Over the last two weeks, I wrote on the subjects of ‘Quality vs Quantity – Which is Better For Trading?’ and ‘What is A High Quality Signal‘.

The main theme has been around dispelling some freshman arguments and confusions others have written espousing the quality is better than quantity argument, and what really constitutes a high quality signal.

One question that should have arisen out of this is ‘what is the ideal trading method and frequency‘ based on what I have now explained.

That is what I will focus on today – the ideal trading frequency (or what I think is the ideal trader). In other words, what kinds of trading strategies and frequency would offer you to make the most profits.

I will first talk about time and how that plays a crucial role in trading (and life). Then I will unpack a few trading strategies to give you the maximum punch for your efforts.

Time Is A Currency

I was recently traveling internationally walking down the streets, and I noticed a huge line leading up to this machine. I asked my local friend what all those people were waiting for. They told me if they punch their tickets, they get $.30 off their subway fare.

I then went up to someone in line and asked them how long they wait on average. “About 15 minutes”. I could tell immediately this person misunderstood how valuable time was.

They waited there 5x per week on average of 15 minutes (1.25 hours) all to save $1.50. If they really valued time, they would work an extra 1.25 hours to make more money than the $1.50 they were saving waiting in line.

This extra effort in overtime pay certainly outweighs the $1.50 gained.

Or they could use this extra time to figure out new ways to do what they do, likely leading to a promotion and thus higher pay.

There are plenty of more effective ways to use their time. But the reality is, when you do not have money, you think money is more valuable than time. When you have money, you think time is money and is really more valuable.

Why?

Because you can replace lost money, you can always make more money (an almost unlimited amount), and you can multiply money exponentially.

But…you cannot replace, make or multiple time. Once time is spent, it is gone forever and cannot be replaced, re-done or re-used.

Thus in reality, time is a currency, and often mis-spent.

Using your time well in a highly efficient and intelligent manner will almost always lead to having more time and more money. Find someone really successful and active, and I’ll find you someone who understands time is a currency.

So How Does This Relate To Trading?

The only way one can possibly ‘multiply’ time is to be able to do two things at once.

When it comes to trading, the only way to do this is to trade set and forget strategies on the 4hr and daily time frames. These are strategies where you do not need much time to manage them.

Real set and forget strategies are rule based systems, meaning there are rules for entries, exits, stops, limits, taking profits – everything.

You do not have to make discretionary decisions to use them. All you have to do execute the rules using minimal time and effort to trade them.

While the trade is playing itself out, you are off doing something else (reading a book, learning a new language, training in a brain gym, etc). This allows you to get maximum effect for the least amount of time used.

But I thought you said trading in quantity can be more profitable?

I did, and it is a fact, that if you can take your systems edge, and execute it a few more times a month with similar accuracy, you will make more profit then executing it less.

In fact, in my prior article dispelling the quality is better than quantity argument, I showed that the system with over 15% higher accuracy trading less, was still making far less profits and pips than the system trading more frequently and less accurately.

So quantity does matter.

Thus, trading set and forget strategies is useful because it allows you to do other things while making money. Being able to make money while sleeping is incredibly potent for building financial abundance.

But…and I mean but…trading only a handful of times per month does two negative things to your trading;

- Limited Feedback Loop = Slower Learning Curve

- Not Multiplying Your Edge = Making Less Money

Let me unpack these two briefly.

Limited Feedback Loop = Slower Learning Curve

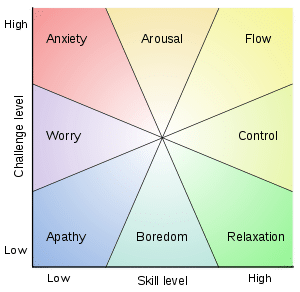

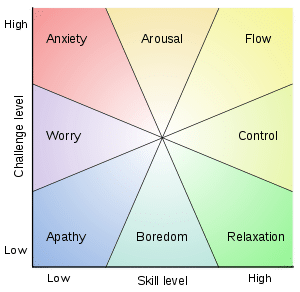

It is a Neuroscientific & Cognitive fact that if you are under-stimulated, or become bored with your trading process, that it will interfere with your learning process. Being bored means you are not challenging yourself enough, nor getting enough feedback from the markets.

Every time you make a trade, it gives you feedback on your abilities, on how you find entries and exits, how you control risk, read price action signals, and make trading decisions.

You don’t become a good golfer or quarterback by sitting on the sidelines most of the time.

You become better at trading, by trading and making trading decisions – win or lose. Each trade is a feedback loop from the markets which offers you information that can bring you closer towards your goal, re-enforcing good habits while negating bad ones.

But if you don’t trade often or enough, you are missing out from seeing how much you really understand. There is a reason bank traders often have to make 4,000 trades before the bank lets them trade money. Without being challenged enough in relationship to your skill level, being bored or under-stimulated will not induce development, and it will actually hurt the learning process.

Thus, if you are only trading around 4-5x a month, you are hurting your learning process and curve, as you are missing plenty of high quality signals every day.

Not Multiplying Your Edge = Making Less Money

Although I’ve already demonstrated this in my prior article on quality vs quantity, the bottom line is your system should have an edge and expectancy.

If you are trading at 60% accuracy, making on average 2:1 reward to risk per trade, ask yourself who makes more money;

Trader A using that system 5x a month?

or

Trader B using that system 10x a month?

The answer is obvious – it’s a mathematical fact that if you can multiply the amount of times your edge plays out, you will make more money.

So in summary, trading more often while keeping your edge, will not only challenge you and stimulate you more, but will also help you make more money and profits.

What About Set and Forget Strategies?

The downside with set and forget strategies on the 4hr and daily time frames, is they do not come as often as intraday trading setups will.

Ask yourself how many signals offering 100 pip targets and 50 pips stops come in relationship to 60 pip targets and 30 pip stops?

Obviously more of the latter. And since daily signals only come once per day per pair, mathematically there are less of them than signals on the 4hr, 1hr or smaller time frames.

Although you may think only high quality signals come on the 4hr and daily time frames, you simply have not been trained to see them, as there are plenty of them coming daily on lower time frames.

A quality signal has nothing to do with time frame, but having three things;

- Is a pattern that repeats itself with consistency and accuracy

- Is a signal that offers low risk and high reward potential

- Is a pattern that offers itself a clear entry and exit pattern

That is all a signal needs to be high quality, and this is not time frame dependent. If someone tells you otherwise, they do not understand trading and you should run away from them.

Although set and forget strategies can allow you to use your time efficiently, they do not allow you to multiply your account at the same pace as trading intraday will offer you more signals, and plenty of high quality ones. The one downside in trading intraday is you usually have to be there and manage the trade.

With training, this is not stressful, and becomes quite enjoyable. It also offers you a greater opportunity to learn, as you are observing more candles and price action formations, thus seeing more patterns and gaining more chart time. The latter two will without a doubt increase your learning curve, but only spending a few hours per week will take you a long time to log your 10,000 hours or really master reading price action patterns.

Thus, trading intraday signals and setups allows you to generate more opportunities for profit.

Which Is Better Then, and What Is The Ideal Trader?

In reality, the best combination is to trade both set and forget strategies, along with trading intraday setups. This is the ideal way to generate the most profits in the least amount of time.

You really get the best of both worlds as you can make money sleeping, also finding great intraday price action setups each day, and I have students doing exactly that, week in-week out.

Now I do not recommend sitting at your computer for 8hrs per day just trading intraday, then spending another 1-2 hours per day finding your set and forget setups.

The brain really can only achieve maximum concentration for short periods of time, often less than a few hours. Luckily, the best intraday trading setups are during peak times of volatility, so you only need to be around for a few segments of the trading day to capture some serious pips and profits.

I recently did a live intraday price action trade banking +1415 pips of profit in about 4 hours with over a 4.75x reward to risk play. How many days will it take you to make +1415 pips of profit, or 4.75x your risk trading daily price action setups? Food for thought, but i’m pretty sure you won’t do that in a day, or even a week for that matter.

In Summary

The bottom line is, the ideal trader can trade a few hours of the day highly concentrated, finding a few high quality intraday price action setups, while also making some set and forget plays. This allows them to multiply their profits and edge from the intraday trading, in concert with making money while sleeping.

This really is the ideal trader and offers you the most opportunities – not just for making profits, but for accelerating your learning process as you are constantly in the feedback loop from the markets, and learning at a faster pace.

Now there are other critical factors for helping the learning process, along with finding what is ideal for you, and what is the ideal trader mentality. These things I will discuss in the next article which will be coming soon so stay tuned.

Until then, no matter what religion you are, or wherever you are in the world, I wish you all the best of holidays, and that good health, abundance and a ocean of good things come to you, and those you care about.

Kind Regards,

Chris Capre