What’s Inside?

- The 4 stages to becoming a millionaire trader

- What is the most important stage to making money trading?

- What trading and mindset skills you need to become a profitable trader?

Since February of 2018, I’ve been envisioning how I want to build a complete trader training program that will teach you the stages, skills and mindset you’ll need to build to become a highly profitable trader who can pull a million dollars out of the market. I actually started working on this article over 6 months ago, and it has finally come to fruition.

If there was only one trading article you could read on my site, this would be it, so grab the popcorn as it’s a heavy hitter.

The goal of this article is to teach you about the 4 stages to becoming a millionaire trader. It’s designed to be a roadmap and structure for how to get from where you are now (likely struggling) to becoming a professional trader who can make a million dollars trading the markets.

Before I get into the stages and roadmap, I have to explain a fundamental component and basis for this article.

Buddhism And Trading?

For the last 18 years, I’ve been training in Tibetan Buddhism, particularly in the Nyingma tradition. One of the amazing components of training in Buddhism is the ‘structure‘ and ‘stages‘ they clearly lay out for you. And a fundamental aspect of Buddhist practice has to do with the following formula:

Base, Path & Fruit

To explain this simply, the ‘base‘ is the starting point and foundation you build everything else upon.

It’s a fundamental level of direct experience and understanding you need to have to complete a specific aspect of your training. It’s arriving at the base which is what makes any practice, training or method work. Without this, you’re just wasting your time.

Keep in mind, it is not something you can arrive at ‘conceptually‘. What I mean by this is, it’s not something you can just read in a book and understand. You have to have the actual direct experience before you can progress any further.

Think of it like this:

Who would you trust more? Someone who’s lived in Buenos Aires (Argentina) their whole life, and knows the city, streets, traffic patterns, restaurants, various barrios, how ‘corruption’ affects their daily business, local customs, etc? Or someone who’s spent the last several years ‘reading‘ about Buenos Aires, looking things up on google, and watched youtube videos about it?

I’m guessing every time you’ll take the former hands down, which you’ll notice has nothing to do with ‘intelligence’. The person who’s lived in the city has a ‘direct experiential‘ knowledge about Buenos Aires that cannot be read in a book, watched in a video, or learned ‘conceptually’. It has to be a direct experience!

The same goes for the ‘base’ in trading. If it’s not a direct experience, you simply cannot progress any further. This is what I mean by ‘base’.

The ‘Path‘ is the practice, methods and training you use to get you to the direct experience. It needs to be a specific path which takes you from point A to B.

The path needs to be very specific and clearly demonstrated to produce real results.

The ‘Fruit‘ is what you get when you fully complete the ‘path‘ by using those practices, methods and trainings. It’s the ‘result‘ of what you get when you do the work, and it also should be specific.

If you have the base in place, then you can begin the journey. If not, you’ll need to arrive at the base (just like you have to arrive at ‘base camp’ to climb Mount Everest), before you can proceed any further. There is absolutely no way to skip steps here.

This entire training and article is built upon these principles of Base, Path and Fruit. Simply put, if you follow the structure I’m laying out here for you, your progression will naturally follow and you’ll see the results in your trading performance, mental execution and mindset.

Each of the 4 stages to becoming a professional trader has it’s own ‘Base, Path and Fruit’. Before you can progress to the 2nd stage, you’ll have to complete the first. There is no way around this! So if your goal is to make a million dollars trading, you’ll want to go straight for the first stage.

Becoming A Millionaire Trader (Stage 1)

The very first stage to becoming a millionaire trader is what I call the ‘Stage of Discipline‘.

The ‘base’ of this stage is having the direct experience and realization that:

a) your brain is currently not wired to trade successfully

b) you’ve had the experience of how your mind, emotions, and skill-set are currently not sufficient to consistently make money

c) have a real passion for trading, and

d) a mindset focused on growth

If you have those 4 things in place, you have the sufficient ‘base’ to begin the first stage.

By now, you’ve probably witnessed how your emotions affect your trading decisions (FOMO, not pulling the trigger, fear of losing money, risking too much/too little, etc). You’ve probably also noticed how you’re not consistently disciplined in your approach (system hopping, changing instruments, not sticking to your trading plan, etc).

Sound familiar?

If you’ve realized what you’re doing isn’t working, and that you’re lacking certain skills + training, but still have a passion to make money trading + are focused on growth, then congratulations – you’ve arrived at the base of the first stage. You’ve accepted the fact you (by yourself) cannot make this work, that you need a trading mentor + build new habits to succeed.

If you’re here, then you’re ready to actually begin the first stage, which is the stage of discipline.

The only thing you need to pack in your bags from here on out is a commitment to getting past this first stage. You don’t need to have the commitment to become a billionaire trader. Just having the commitment and openness to train is the minimal requirements to begin the first stage. Consider this stage to be your ‘apprenticeship‘ in becoming a successful trader.

The ‘fruit’ of the 1st stage of discipline is ‘consistency‘. If you don’t have consistency, you’ll never a) succeed in trading, and b) make it to the 2nd stage.

I say ‘consistency‘ is the ‘fruit’ of this stage, because it’s what you get when you have a solid level of discipline in place. Without this, there is no progression in trading, and you’ll continue to make the same mistakes over and over and over again.

Does this sound like your current experience?

Thus, discipline is what helps you exit out of that cycle (repeating the same mistakes). It’s the force which allows you to break through your current bad habits around trading. It’s what allows you to execute the same things over and over again, regardless of the emotions you feel, or obstacles you come against.

Consider discipline a type of ‘armor‘ against that which will knock you off your horse and derail your progress. Essentially, it protects you against yourself, and is absolutely necessary in trading..

From my experience, both in Buddhism, and in trading, it actually has to get worse before you give up your current approach (which likely isn’t working). You actually have to suffer to the point you realize “I no longer want to suffer like this. I’m open to trying it differently.” This realization creates the first real opening for you to get out of that vicious cycle of repeating the same mistakes over and over again.

The ‘path‘ of the stage of discipline is the most intricate and nuanced part of your trading progression. It’s the hardest part of the mountain to climb, and requires the most effort on your part. This is because you’re going to be fighting against much of what you currently are, which by definition, is insufficient to consistently make money trading. If you were already there, you’d be doing it.

The ‘path’ has to consist of a series of methods and skills (trading and mindset wise) you’ll need to build to get to the ‘fruit’.

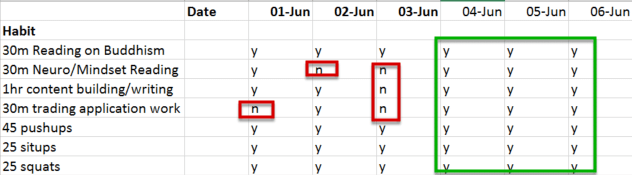

Practices & Methods For the Stage of Discipline

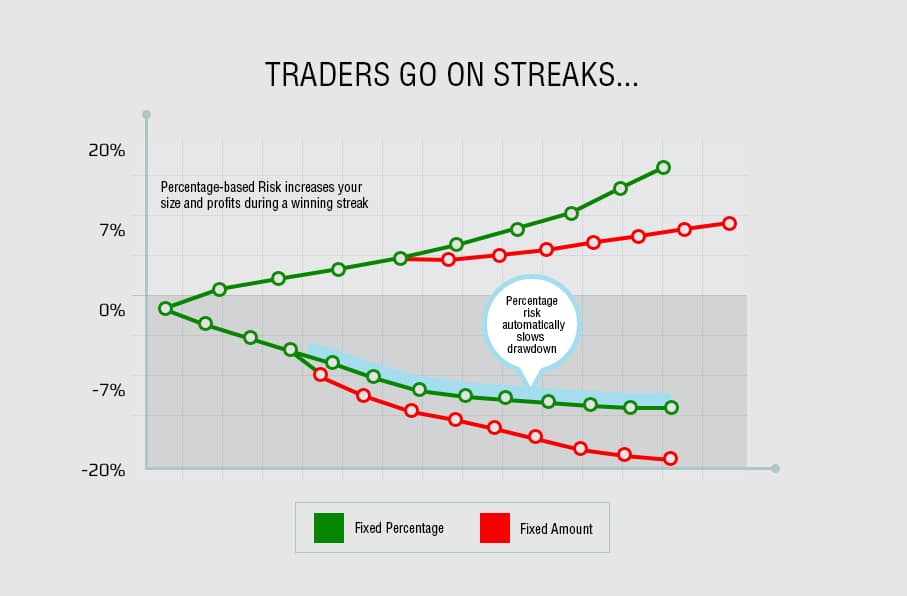

As stated before, the goal or fruit of the stage of discipline is consistency. This means consistency in your execution, decision making process, trading strategies you are using, what instruments you trade, risk management, etc.

Consistency, however, has a ‘root cause‘, meaning the root of what it grows out of. As I’ve stated before, consistency can only come from the mind. If you do not have consistent thoughts, thinking patterns, neurological structures, mindset, (etc) there will be no consistency in your trading. Hence your focus for building ‘consistency’ has to primarily consist of (and begin with) your mind.

If you are currently not experiencing any sort of consistency in your trading, then congratulations, you’ve discovered the root cause of your inconsistency (your mind). Now your initial goal in trading and becoming consistent may seem counter-intuitive, but I’m guessing you’ll find it makes sense when you fully understand it.

Your initial goal in trading should be to become a ‘consistently‘ losing trader. Now many of you are likely thinking “I consistently lose now, why would I want this?” While that may be true in ‘form’, it’s not true in ‘essence’. What I mean by this is, while you may be consistently losing money, there are likely many components of your performance which are not ‘consistent’.

Some of these components can be:

- Risk Management – are you consistently risking the same % per trade? If not, then you’re not ‘losing consistently’.

- Trading Instruments – are you consistently trading the same instruments till you have a sufficient baseline to make a quantifiable decision? If not, then you’re not ‘losing consistently’

- Times of the day – are you consistently trading the same times of the day? If not, then you’re not ‘losing consistently’

- Pre-trade preparation – are you consistently preparing mentally for your trading day with the same routine? If not, you’re not ‘losing consistently’

- Pre-trade analysis – do you have the same consistent routines and methods (price action, ichimoku cloud trading, etc) for finding trading setups? If not, then you’re not ‘losing consistently’

- Post-trade analysis – do you have the same consistent routines and methods for analyzing your completed trades? If not, you’re not ‘losing consistently’

- Reinforcing successful trading habits – do you have the same consistent routines and methods for reinforcing successful trading habits? If not, then you’re not ‘losing consistently’

- Trading plan – do you have a detailed trading plan which has clear instructions for how to trade, how to train, and how to progress in your trading? If not, then you’re not ‘losing consistently’

I could go on as there are many other variables you’ll need to ‘lose consistently’, but my guess is, when you read the above and really take it all in, you’ll realize that you’ve been ‘losing money’ consistently, but not ‘losing consistently’. There a difference.

It takes discipline and a courage to say “I’m going to focus on consistently losing”, just like it takes discipline and commitment to not hit the target consistently in archery. But that is your initial goal in archery (not just hitting the target), but ‘consistency’ in your technique, process and movements. If there is no consistency in your stance, alignment, breathing, holding of the riser (main bow structure), how you grip the bow string, how far you pull it back, etc…there will be no consistency in where your arrows land.

(Image: Brady Ellison – #1 US Archer – Recurve Bow)

Trading is no different!

Hence in sounding somewhat masochistic, your initial goal in the first stage of discipline is to learn to ‘lose consistently’. By doing this, you’re building the foundation which the entire house you want to build will rest upon. Then you can focus on being a consistently break-even trader. Then you can focus on being a consistently profitable trader.

But before all this, you’ll need to focus on building the prerequisite trading skills, which can be defined as the following:

1) Trading Methodology & Approach

There are only 4 major trading methodologies, or approaches to the markets. They can be any of the following; 1) technical, 2) fundamental, 3) sentiment, 4) flow based.

Now any one of these can fall into broad categories, such as (discretionary, rule-based, hybrid, quantitative).

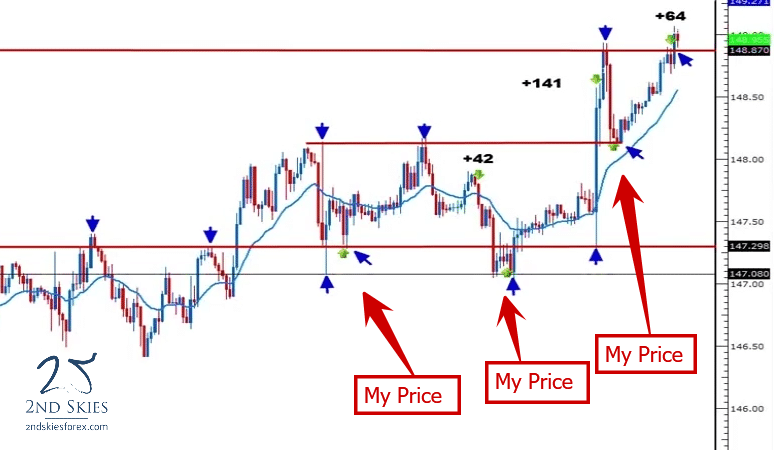

The approach I teach is a ‘technical‘ model based upon understanding price action context and the order flow behind it. I teach this method because it can be applied to any instrument, time frame or environment, and is based upon what all trading decisions are based upon (*information).

Regardless of whether you are a technical, fundamental, sentiment or flow based trader, all trading decisions are derived from ‘information’. Eventually that information has to be converted into an actual trade (and thus order). All ‘activated’ orders become ‘actualized’ order flow. And order flow is the most proximate driver of price action.

This is why I teach price action context and the order flow behind it, because I’m teaching you a ‘root’ method which communicates the footprint of all orders and trading decisions. By understanding these, you can give yourself the highest probability for trading with the dominant order flow in the market, which is what drives all price action. By doing this, you can learn to trade with the larger players who will most likely dominate directional price movements (which is what we want to capitalize on).

Price Action Trading Skills

There are many price action trading skills you’ll need to build, and it is important not to learn these skills out of order. I often find traders trying to learn more advanced skills before they’ve built a solid set of foundational skills. One common example is struggling traders trying to trade counter trend before they’ve learned to trade with trend (with the latter being easier).

Now assuming you understand what candlestick charts are, time frames, and what the basics of price action are, then you’ll need to build your core skills of price action. In price action trading, the first set of ‘core’ skills you’ll need to learn is what I call the 3 pillars of price action context.

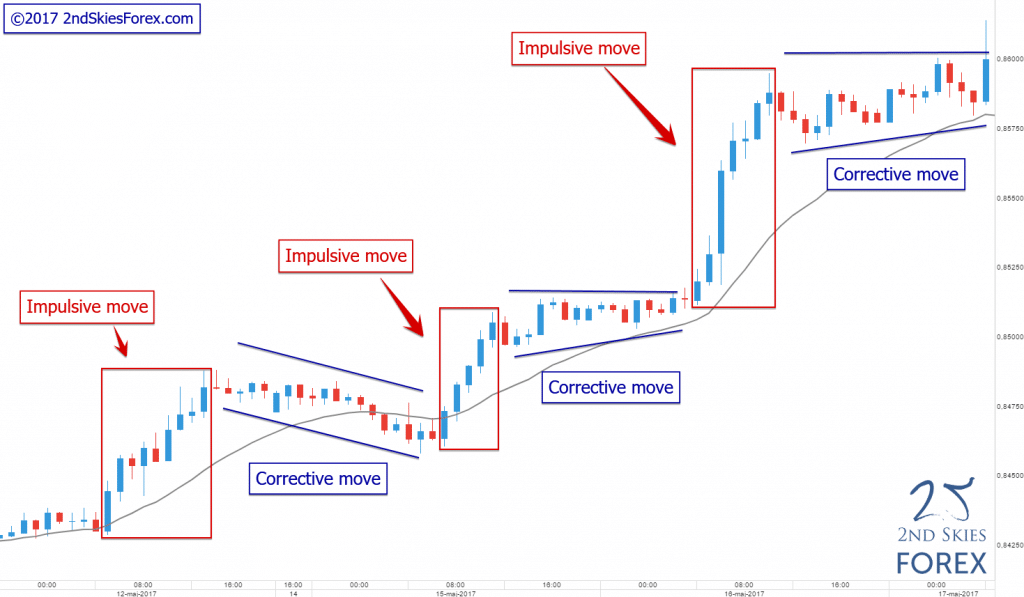

I’ve talked about the first pillar of price action context, which is being able to identify impulsive and corrective moves. The reason why this is the base pillar is it gives you the most amount (and most nuanced) information about the price action and order flow happening right now.

It tells you who’s in control of the market (buyers/sellers), and who’s not. It tells you how to read momentum in the price action without any indicators. It tells you when are optimal times to take profit, and not take profit. It tells you when you’ll need to be patient, and when you need to make a quick decision. It tells you when trading breakouts are more likely (or more probable) to occur, and when they are less likely to succeed.

There is a lot more impulsive and corrective moves can tell you about price action, but by learning these, you start to learn how to think like a price action trader, and see the dominant order flow behind it. This is why it’s the first pillar. If you want to learn about the other two pillars of price action context and the order flow behind it, then check out my price action course where we talk about this extensively.

Now before you can even practice these skills and making actual trading decisions, you’ll need to first be able to identify (with 90+% accuracy) these 3 pillars of price action context. My formula for how to build your trading skills (and price action skills) is simple:

Sim, then Demo, then Live

What this means is, after you’ve watched videos and understood (conceptually) the components of an impulsive and corrective move, you’ll want to start building your pattern recognition skills in the charts. You build these pattern recognition skills so you can identify them automatically, and thus, sub-consciously.

If you’ve ever looked at a chart and had the thoughts, “Is this a such and such pattern? I’m not sure, how do I know? I know it said it has to have x, y and z, but is this part the same, or is it different…“

Have you had this experience before? If so, then your skills are not ‘sub-conscious‘. The reason why this is important is you want to use your cognitive thinking, analysis and bandwidth for finding profitable trade setups. If you have all those thoughts going through your mind, then congratulations – you’ve now realized your skills are not sub-conscious, so that should be your next goal.

By starting with a trading simulator, you can have the opportunity to watch the price action unfold, pause it, take time to read it correctly, then resume the historical price action on the chart unfold.

This is why sim is the best place to start, because on demo, the charts just keep moving on whether you got the analysis correct or not. Just like pilots start off in a flight simulator to make sure they have the basic functional skills to fly a plane, you also need to start off on a simulator.

By looking over thousands of candles and charts in a short period of time via a trading simulator, you can increase your learning curve, and accelerate your pattern recognition skills, particularly being able to identify impulsive and corrective price action.

Once you’ve seen enough impulsive and corrective moves, your brain will eventually assimilate these patterns into its database, and be able to identify them on any instrument, time frame or environment with ease (and without doubt).

After you’ve mastered all 3 pillars individually, the next step is to assimilate them together into one cohesive picture (or gestalt). The goal here is to be able to easily identify all three of the pillars of price action context, then be able to come up with a ‘most probable’ direction of the market.

I say ‘most probable’ because this is a mindset you’ll need to develop to make it out of the first stage of trading. Beginners try to use ‘confirmation price action signals‘ because they think they ‘confirm’ the trade and direction. But 1, 2 or 3 candles is a small amount of price action + order flow, and rarely ever dictates the next move (~1% of the time).

Hence you have to shift your mindset from ‘confirming‘ (because there is no certainty in the market) to ‘probabilities‘, because probabilities is all you are ever dealing with. There is no certainty, and never will be when it comes to price action and the next direction. This is why I say confirmation price action signals will crush your account. If these so called ‘confirmation price action signals’ actually ‘confirmed’ anything, there would be ample statistics and data to back that up. Yet nobody to date has been able to provide this (which should tell you everything you need to know about them).

Now while you’re building your core price action trading skills, you’ll also need to build your mindset skills. To succeed in trading, you’ll need a successful mindset which will keep you on track when things are challenging, and help you execute what you need to when your trades and emotions are really affecting your thoughts and trading decisions.

Mindset Skills to Build Consistency In Your Mind

If you’re working towards consistency in your mind, there are several core mind/mindset skills you’ll need to build. For the purposes of brevity and not turning this into a long novel, we’ll talk about the 3 most important mindset skills you’ll need to build consistency in your mind and make money trading.

The first mindset skill you’ll want to build is understanding how the brain works. By understanding how your brain and mind work, you can accelerate your learning process by working with how your brain functions, not against it.

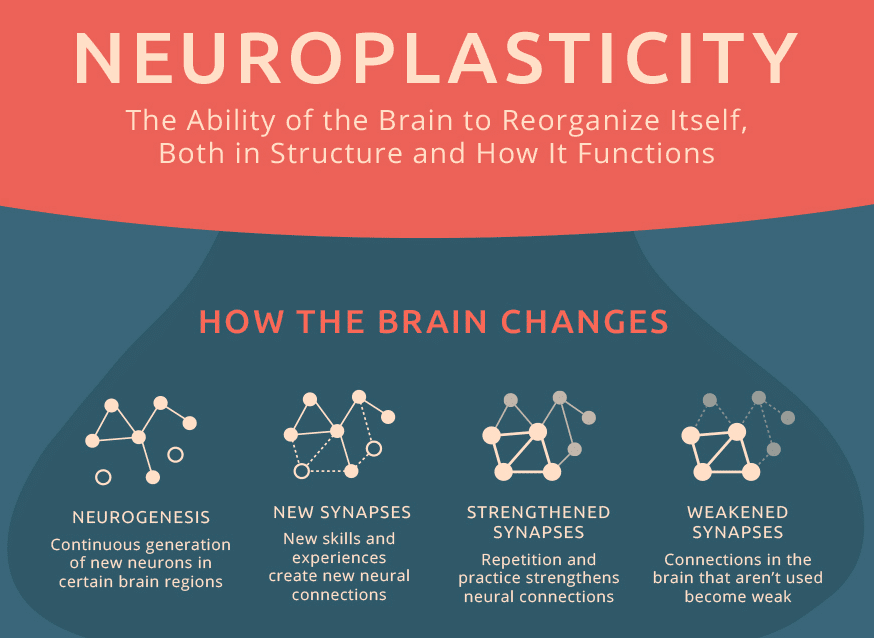

One of the most fundamental aspects of the brain is its ability to re-wire itself. This principle is called neuroplasticity.

Neuroplasticity can be summed up by the following phrase:

“Neurons that fire together, wire together”

Neurons are the basic neural cells you have in your brain. They connect to each other through axons and dendrites. By connecting to each other, they can pass information via electrical signals.

If you want to wire in a new trading habit, you’ll have to activate neural circuits which do this over and over again. By doing this over and over again, they strengthen those connections till they become ‘dominantly wired‘. Another term for ‘dominantly wired’ is ‘habit‘. Anything you have dominantly wired in your brain is a habit. So by firing the same neurons together, they wire together and form specific habits you’ll want and need to build a successful mindset.

This is where understanding how the brain works helps.

There are 7 components to neuroplasticity, but there is one fundamental ‘root‘ component behind all neurological wiring: Repetition.

By repeating the same thing (and thinking pattern) over and over again, you can wire in the trading habits you’re looking for.

It’s why basketball players will shoot free throws every day in practice. It’s why quarterbacks (American football) will practice throwing the football over and over again, so that their mechanics are automatic and sub-conscious. It’s why Bruce Lee said “I fear the man who practices one kick 10,000 times“, because such a person has that has practiced a kick 10,000x likely can throw it with speed, precision and power.

Repetition is the most fundamental building block to wiring new trading habits. Thus, understanding how the brain works is a fundamental mindset skill you’ll need to develop.

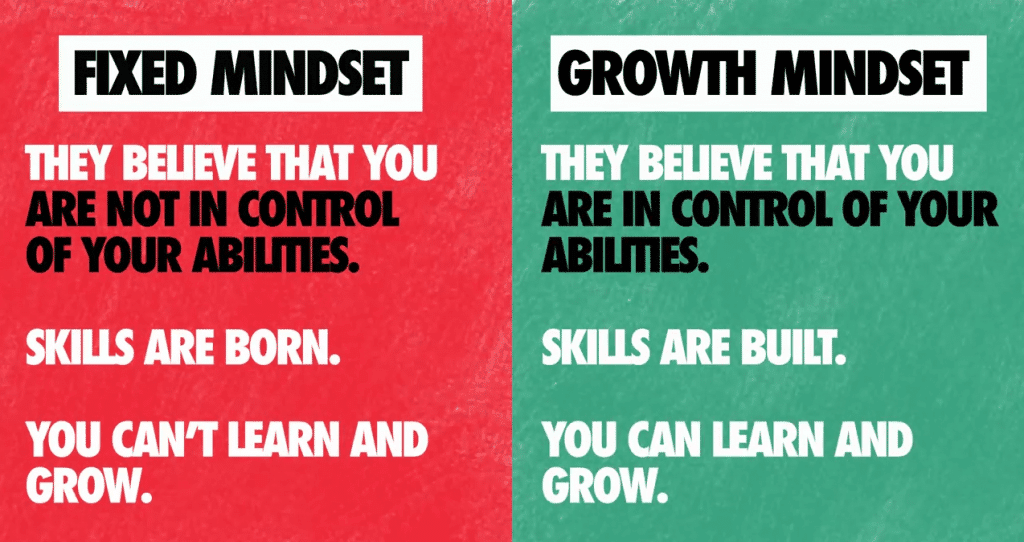

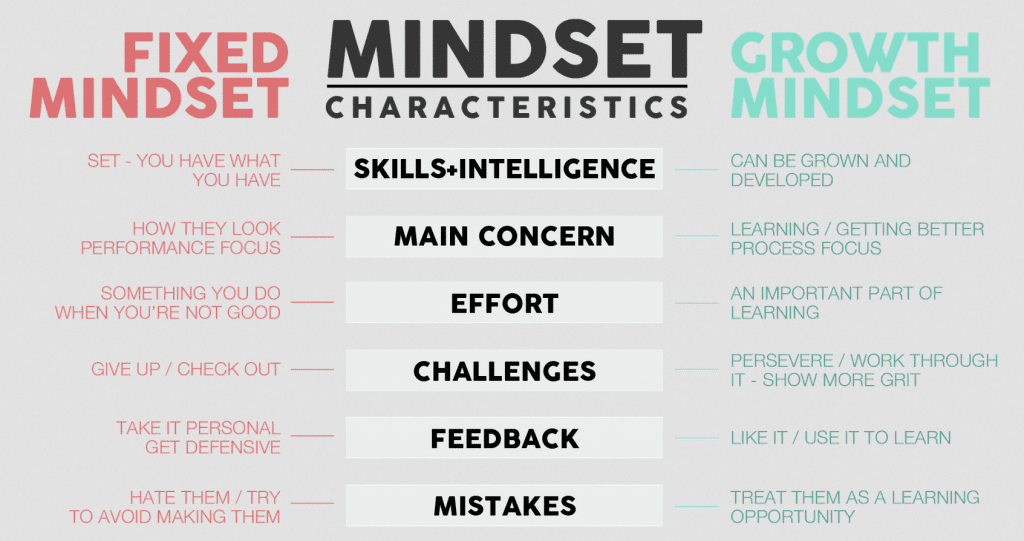

The second mindset skill you’ll need to build is what I call the GBT mindset. GBT = getting better today (also known as a ‘growth’ mindset).

Notice the focus here isn’t ‘profitable trading now‘. It’s a trading mindset that works every single day to get better. By getting better today at your skills, you eventually build enough skills and competence to make money trading.

The GBT mindset is one that is focused on the process, and has a well designed process + skills + goals they are focused on. The process aspect is the methods and plan of action you engage to build your skills, which allow you to reach your goals.

If you’re just focusing on the results “dang, I’m still not profitable yet“, then you’re jumping too far ahead and not focused on what you need to succeed (skills: 1) technical, 2) risk management and 3) mindset). Hence your ‘goal’ right now if you’re not a profitable trader should be to build the skills to make money trading.

This is why you need the GBT mindset, and an approach which focuses on building your skills step by step, and getting better today at your current level of skills. Then once these are sub-conscious, you take on the next challenge.

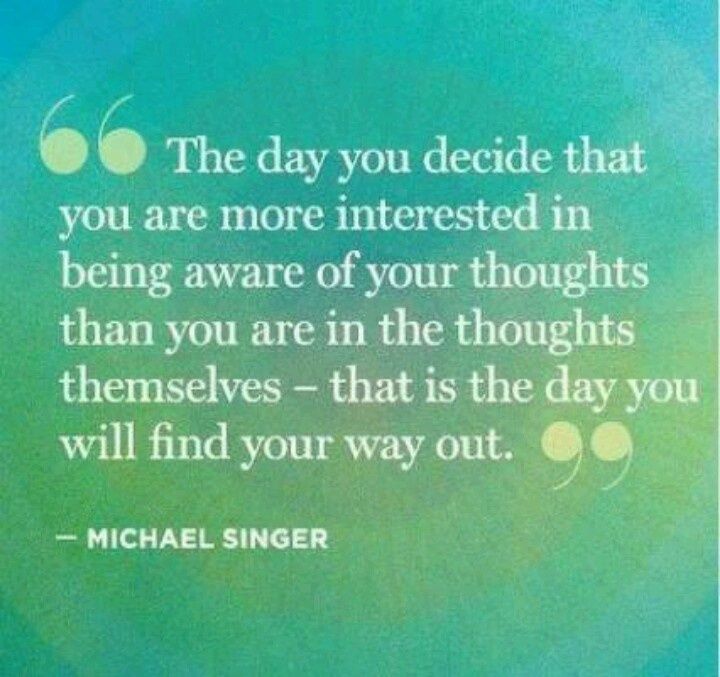

The third mindset skill you’ll need to build to become a consistently profitable trader is ‘self-awareness‘.

Now I’m not saying you have to become a zen monk to become a good trader. But you’ll need to develop a minimum level of self-awareness to make money trading.

Why?

Because if you really understand how the brain works, you’ll realize you are actually fighting your own brain and evolution to build a successful trading mindset.

How so?

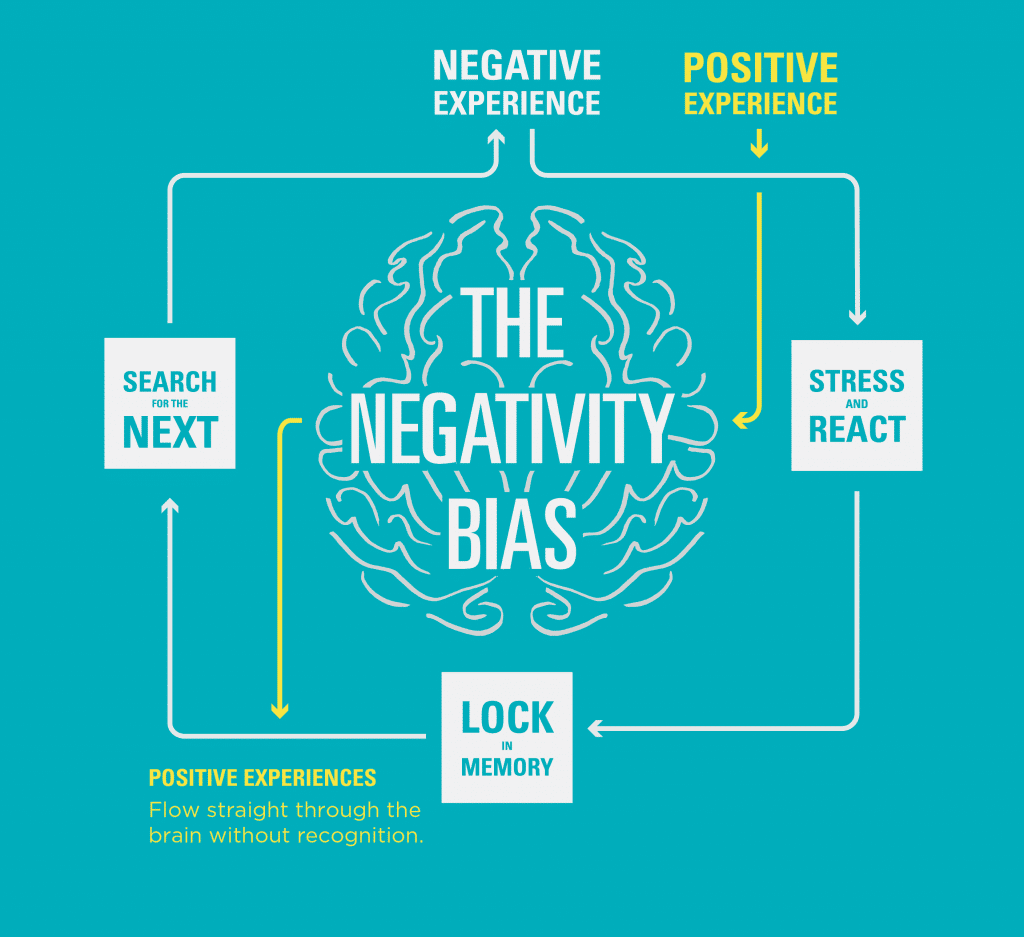

Let me demonstrate this with a few key brain facts:

- You have about 500% more neurons for finding the negative vs the positive

- You are more likely to choose an immediate reward (even if it is a lesser reward) than delay gratification (for a larger reward)

- Your emotions heavily influence how you interpret (and code) an experience, memory or event

Now lets examine these 3 brain facts.

The first one should be obvious as to how it can affect your trading. If you are 5x more likely to notice the negative vs the positive, what do you think that means when you make a mistake, or a trade starts to go against you? How do you think that will affect your thinking in real time when you have to make clear, calm trading decisions? Do you think it will help, or hurt your decision making process?

Ever experienced a trade that was a winner but starts to go against you? Were you totally relaxed, or feeling ‘stress’ when it started to pull back? And do you think that stress affected your analysis and decision making? This tendency to notice the negative vs the positive is called the negativity bias.

What about the 2nd brain fact? Ever chose to exit a winning trade too early? This is your brain working against you. If you’re more likely to choose a lesser immediate reward, don’t you think that will become problematic in making decisions which will lead toward long term success and trading habits?

In terms of the 3rd brain fact regarding emotions, just think about the majority of emotions you’ve experienced in trading. Have they been mostly positive or negative? Have they mostly helped or hurt your trading process, thinking and mindset? Do you even know how to use emotions to your advantage in trading? My guess is no.

Hopefully it is becoming clear why self-awareness is key. You can determine if the self-talk that’s going through your mind is accurate (“something doesn’t feel right about this trade“), misleading (FOMO, fear of pulling the trigger, etc), or not important (“I wonder how many people liked my last tweet”).

By building self-awareness, particularly around trading, you can learn to know when you need to stick to your discipline and/or trust your gut instincts. You can also learn how to self-regulate your mind, emotions and psychophysiology so you can make the most optimal trading decisions.

Simply put, if your biology and psychophysiology is off (heart rate, breathing, skin conductance, etc), the chances of you making a bad trading decision go up exponentially! And more often than not, the difference between making money trading and losing money trading comes down to the trading mistakes you make.

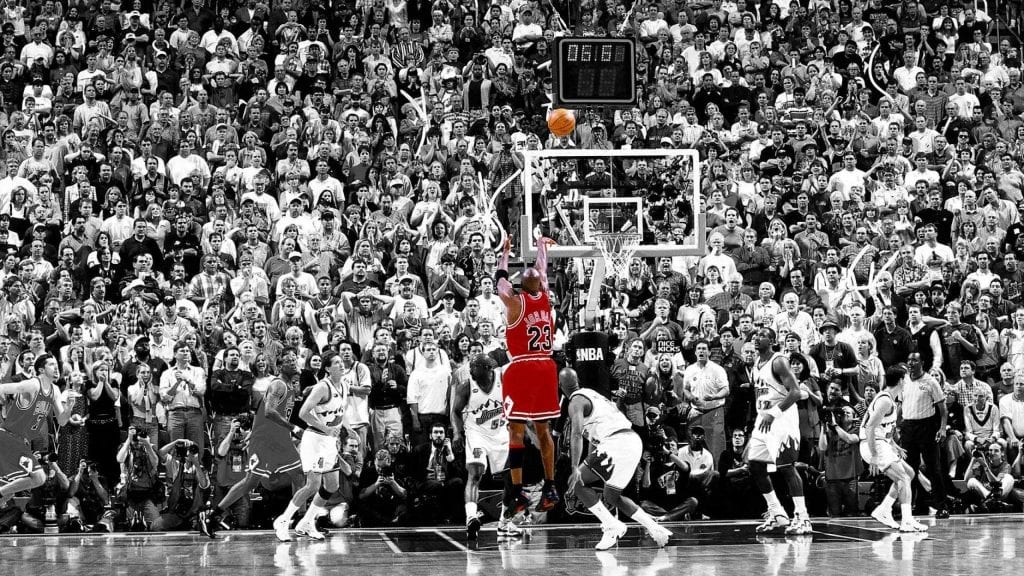

Becoming A Clutch Performer

The term ‘clutch athlete‘ is actually misleading. When the game is on the line, the statistics are clear. The best performers are not performing at their peak, or above their baseline. They’re actually performing below their baseline. The difference is, they make the least amount of mistakes compared to their baseline, while the non-clutch performers make more. This is why specific athletes are clutch, because when the game is on the line, they make the least amount of mistakes, and thus outperform everyone else.

Trading is a peak performance endeavor that is skill based. There is no way around it!

This means you’ll have to learn how to become self-aware when trading gets intense. If you want to make a million dollars trading, you’ll need the 3 mindset skills I’ve listed above when you have 5 or 6 figures on the line.

By becoming more self-aware, you’ll start to build the psychological and mindset skills to become a consistent trader who makes ‘consistent’ trading decisions, regardless of the pressure or challenges you’re experiencing while trading. You’ll be able to direct your cognitive and mental activity in the right direction, while avoiding getting swept up by your emotions, or negative self-talk.

There are many ‘methods’ and practices you can use to build self-awareness. I teach several of these in my traders mindset course. But one method we focus on in our traders mindset course is meditation, which is scientifically proven to help improve your neurological and cognitive performance in a variety of trading activities.

I’ve been practicing meditation since 2000, done over 10,000 hours of meditation practice. I’ve completed a 1 year meditation retreat. I’ve completed 3 one month retreats, about 150+ weekend meditation retreats, and trained with the same meditation teacher since 2001. Needless to say, it seems fair to say I have a ‘solid’ training in meditation.

I recognized early on how important meditation is to my trading mindset, and thus created a 12 lesson meditation series specifically for traders. The goal of this practice is to build self-awareness, increase your emotional IQ, and help you enhance your brain’s functioning, which meditation has been scientifically proven to do. If you want to learn more about how to use meditation to become a better trader, then check out my traders mindset course.

Now there are many techniques you can use to build a successful trading mindset, but these are three most ‘fundamental‘ I’d highly recommend you focus on. There are other mindset skills you’ll need to complete the first stage of trading (discipline) and get to the fruit (consistency), which could take me an entire book to write and flesh out. But I feel I’ve given you a glimpse of the first stage of trading.

Getting Past the Hardest Stage (*And Not Jumping Ahead)

From my experience in working with thousands of traders, helping many traders become profitable, I’ve seen how every trader which has failed to become a profitable trader has never completed the first stage. They’ve either a) never built the mindset skills to become a ‘consistent’ trader, b) never built the core foundational skills, or c) tried to skip various aspects of both.

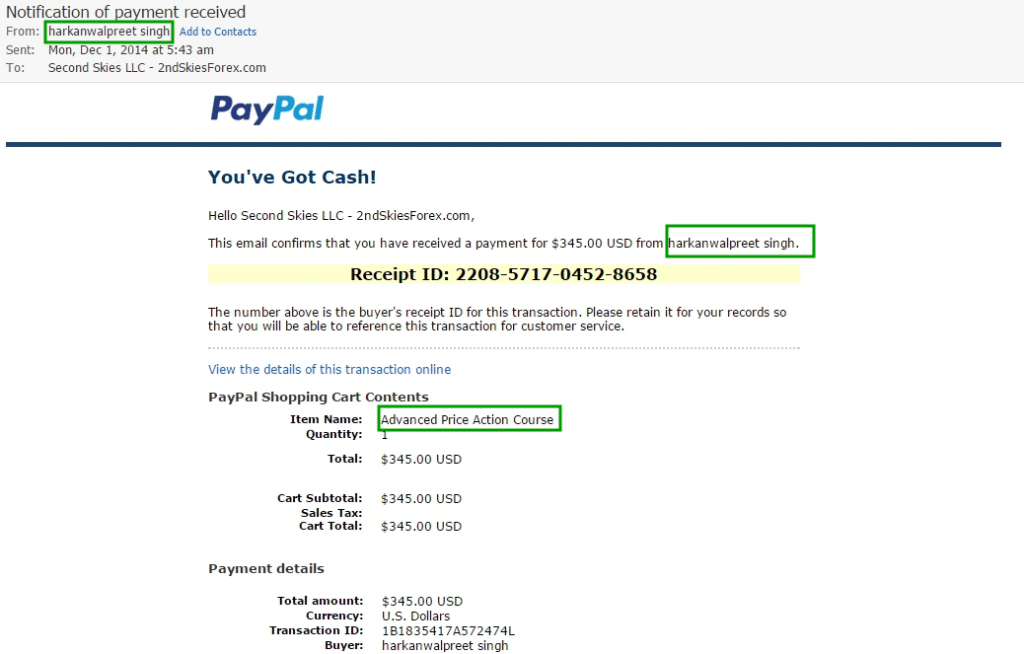

From all the students I’ve trained that have become profitable traders, they’ve all completed the first stage without fail. I’ve yet to meet a profitable trader who is able to make money consistently while skipping the first stage. There is no way around it!

Now if you want to learn about the other 3 stages to becoming a million dollar trader, I’m doing a private member webinar this weekend (Dec. 22nd) for all my course members. After the webinar, I’ll be making this webinar available to all my members so they can follow this road map and become consistent traders.

If you want to learn how to become a member, click here.

Now I hope you’ve gotten a tremendous amount of value out of this article, and use it as a guide and road map to your successful and profitable trading.

Please make sure to leave a comment, and share this with any friends or forums you feel will benefit from learning about the stages to becoming a million dollar trader.

Until then, may you see real growth in your trading and mindset.