5 Reasons Why Hedge Funds Aren’t Trading Confirmation Price Action Signals

This article is going to be a tad ‘controversial‘ to many developing traders out there. It is not meant to be negative in tone or start arguments.

It is to get you to question what you’ve been told about price action. It is to open up a dialogue, about another way of approaching PA beyond the typical narrative.

The general price action story spun out there goes something like this;

To make any buying/selling decisions and pulling the trigger, it ultimately comes down to one final piece of the puzzle.

This final piece comes in the form of a ‘confirmation price action signal‘. And said ‘signals’ only arise in the form of a 1 or 2 bar combination.

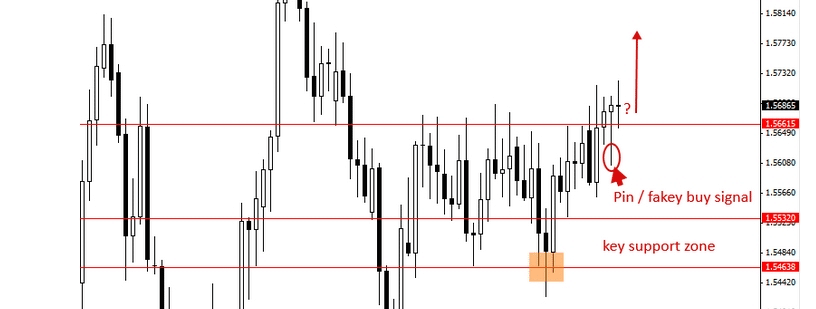

They come in many names, such as pin bars, inside bars, fakey/false break setups, or engulfing bars.

And the follow up to this magical fakey pin bar signal…

Regardless of the name, the idea is the same. You should not enter the market till you see one of these famed 1-2 bar price action patterns.

Thus far, everyone spinning this narrative are derivatives. What do I mean by this?

Those who preach confirmation price action signals, copied all they knew (with minor adjustments) from someone else.

Many of them were students of one individual (Nial Fuller). A little investigation will reveal Nial Fuller’s price action strategies are also derivatives.

He was a member of J16 and copied all he knew from there, again with only minor adjustments.

If you look at most of the price action mentors, you’ll see the overwhelming similarity & repetition. Now you know why the narrative around PA sounds the same.

Essentially, they are either a derivative (copy) or a derivative of a derivative (copy of a copy). What you’ll also notice is none (or almost none) of them have institutional experience.

What’s really being sold here is a ‘green light buy/red light sell‘ methodology. It’s targeting easy prey who don’t want to do the work, who want understanding price action to be easy, who want to be lazy traders (in their own words).

Yes, with just three simple setups that are easy to find, you too can make profitable buying and selling decisions! Or so you are told…

The reality is far different from this (especially in institutions and hedge funds). By the end of this article, I’m guessing you’ll start to see why.

Below are my 5 reasons why hedge funds don’t trade confirmation price action signals.

Reason #1: Paying 5-6 figures To Train Their Traders?

photo: smbtraining.com (does it look like he’s sitting there just waiting for daily pin bars to form???)

The skill and time required to identify pin bars, inside bars, fakey’s and engulfing bars is minimal (a few months max). Shoot, you can even build an algo to do this for a few hundred dollars.

Bank traders on average will make 2000-4000 trades before they can trade the bank’s money. Hedge funds will also spend large amounts of money and time either training or finding talented traders.

If trading is as simple as finding these three patterns to enter the market, why spend so much to find/train traders what a $300 algo could do?

There is a reason for this.

Because reading and trading PA goes beyond confirmation price action signals. Because buying and selling decisions aren’t as simple as these 1 and 2 bar patterns.

If they were, there would never be the need for such expensive and exhaustive training programs. Would you ever spend that much training someone to trade daily pin bars?

My guess is no.

Reason #2 Macro + Technical

If a fund is not trading algorithmically, most likely they are incorporating a combo of macro (read fundamental) + technical analysis.

I talked about this in my article Book Review: Cultures of Expertise in the Forex Trading Markets. The author (Leon Wansleben) is a sociologist who followed forex traders at a top-10 German bank desk for over a year.

Never once are the words ‘pin bar’, ‘engulfing bar’, ‘inside bar’ or ‘fakey’ mentioned in the book.

What you do find is traders working a combination of macro/fundamentals + technical analysis into how they trade.

They also discount the ‘lower time frames are noise‘ meme pretty quickly. Why?

Because most bank traders have to be reading the intra-day price action (due to flow trades, which accounts for about 70% of their trades).

By the end of the book, you realize entering the market goes way beyond pin bars, engulfing bars and inside bars. You realize they aren’t even trading those to make their buying and selling decisions.

Reason #3 Confirmation Decreases Accuracy and Profitability

“I was in (insert derivative name here) price action course and quickly realized how weak it is compared to yours.

I’ve made over 20% in the last few months using your methods. I’m glad you poked giant holes in his price action strategies.

Otherwise I’d still be waiting for pin bars and inside bars, missing hundreds of pips.“

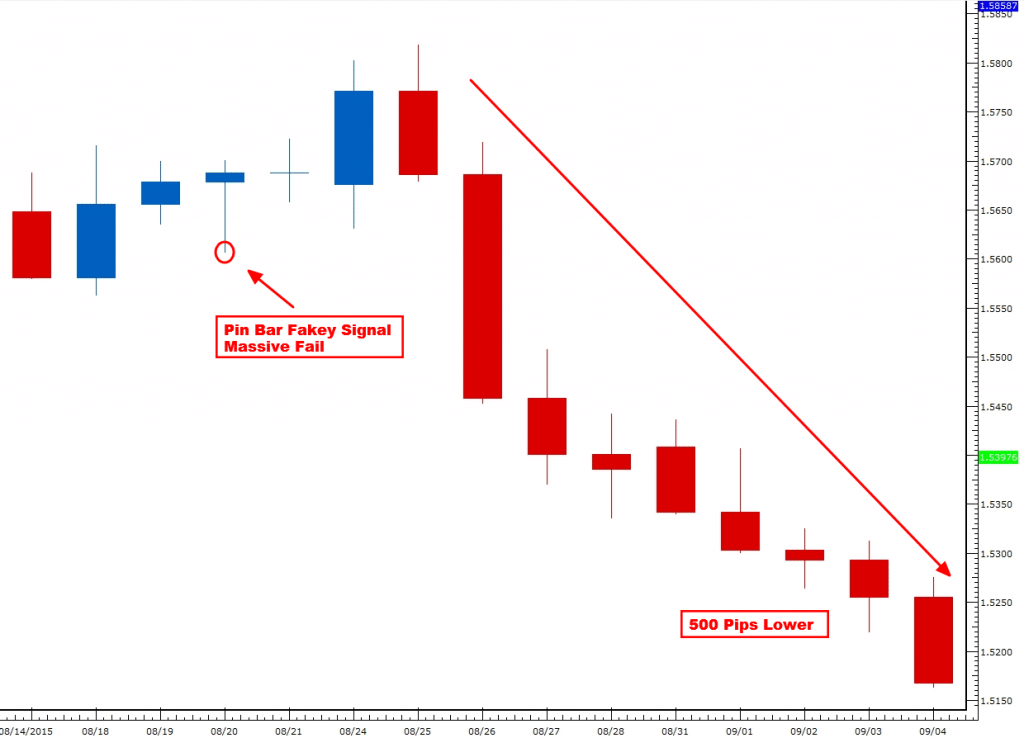

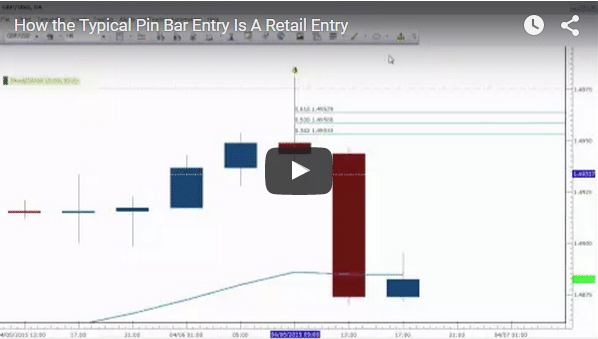

After posting my video How A Typical Pin Bar Entry Is A Retail One, many struggling traders started to see price action differently.

They realized how many times they were sitting on the sidelines doing nothing when others were making money. They also realized how waiting for ‘confirmation signals’ decreased their accuracy and profitability.

To learn why this is the case, watch my video below.

Reason #4 Waiting for Confirmation Price Action Signals is Passive Trading

Hedge funds and bank traders are (if anything) passive when it comes to entering the markets.

Institutional traders would not (and could not) be making trading decisions once a daily pin bar has formed.

If they were doing this so consistently, they’d be picked off by HFT’s or predatorial funds who could see their entries a mile away.

This is on top of the fact they’d all be competing for the same liquidity and relative price, which would only mean a worse entry and lesser profits on the same trading idea.

A little investigation into how predictable these entries are will change your perspective on trading.

#5 The Pepsi Challenge

Ok, let’s say you are a devout believer the real way to trade price action is via confirmation price action signals.

Let’s say the above 4 reasons didn’t convince you. We can simplify this through a pretty simple test – The Pepsi Challenge.

Your challenge, should you choose to accept:

Walk into a dozen or two hedge fund offices, bank trading desks and prop trading firms. Then ask them these two simple questions:

1) If you don’t see a daily pin bar, engulfing bar, or inside bar, are you staying out of the market?

2) If you do see a daily pin bar, engulfing bar, or inside bar, are you loading up on your position even more than usual?

I’m willing to bet the answers to the above questions will be a resounding NO.

More likely, you’ll get several laughs, along with someone perhaps escorting you out of the office.

To Date

As it stands right now, nobody has taken me up on this litmus test (let alone proven otherwise). I’m still waiting as I posted this challenge many months ago.

I am confident(while open to being wrong) that after you take this test, you’ll look at price action differently.

Once you let go of the current narrative, you’ll be forced to examine how order flow and the balance/imbalance between buyers and sellers is reflected in the price action. You’ll begin to see how liquidity impacts the PA and volatility.

And you’ll start to trade contextually, meaning through the price action context.

That is when your real training in PA begins, when you let go of the freshman narrative. You’ll also realize trading those 1-2 bar patterns does not build your trading skills.

If trading pin bars really built PA trading skills, then bank traders would be going through thousands of reps on those alone.

It takes no skill to find those signals and spend your time looking for them. And doing so discounts all the other candles in the process.

About All Those Other Candles…

All those other candles is what forms a structure. This ‘structure’ is (by and large) a representation of the order flow.

The order flow gets reflected in the PA, and this PA forms the price action context.

This is where your study should be.

In Conclusion

Looking for 1-2 bar patterns doesn’t make you a price action trader. It makes you candlestick trader, and that is a different approach to the markets.

When you investigate it, hedge funds aren’t trading via confirmation price action signals. And when you stop waiting for confirmation, you’ll find yourself getting better trade locations and higher + R per trade.

Looking at the market contextually will change your mindset. You’ll start trading and thinking in probabilities.

You’ll also discover how waiting for confirmation is a retail traders mindset.

With all that being said, do you agree or disagree with these forex confirmation price action trading misconceptions? Can you see how hedge funds aren’t trading price action signals this way?

Even if you don’t agree, please do comment and share below (in a non-negative tone por favor).

Regardless, I’m hoping you’ll really open up to other ways at trading price action.

Until then – may good health, trading profits and success be with you.

Nice article

I like it how it’s a good summary of it.

Yeah, wanted to summarize vs. having a long extended dialogue on it.

Glad you liked it.

BTW – how is trading in space 🙂

I was that person waiting on the sidelines watching for that pin bar to appear. It wasn’t too long till I gave up as I did notice that the market was trending yet I’m waiting. That was a few years back. Different perspective this course (2nd Skies) gave me on PA and never looked back.

Hola Mark,

Many people were like you sitting on the sidelines as the market moved hundreds and thousands of pips trending, yet you weren’t involved because there was no daily pin bar signal.

Once you let go of this narrative, your perspective on price action changes and the real study begins.

So glad you noticed and thanks for sharing.

Kind Regards,

Chris Capre

Hello Chris,

I just read your recent article, and I was amused the way you “called out” Nial Fuller, and further destroyed my belief in traditional technical analysis and yes, confirmation patterns. I have dumped 99% of what I was doing and using, and will now make a commitment to learn and apply your materials.

Have a great day.

Charles

Hola Charles,

Yes, the goal of this article was to challenge the common narrative around price action confirmation signals.

Once someone really investigates it, they see this is a false narrative and start to really investigate price action, so glad you caught on.

Kind Regards,

Chris Capre

Thanks Chris, I do like the way you look at the markets! You give new hope to all of those (myself included) who lost lots of money trading “the common way” (such as waiting for confirmations, false secure). Now that I’m looking at smaller intraday time frames and reading price action actively and differently (the way you teach for example), I’m starting to make money. PS: I don’t trade pin bars but I love inside bars: as they are more complex to trade and ambiguous (can be traded in both directions actually), they catch all my attention. Best regards, Olivier

Bonjour Olivier,

Ca va bien?

Am glad you found hope in this as many others like you tried the other way and lost money, along with a lot of time not developing their PA skills.

You’ve made a big shift and are seeing price action differently now which is good.

Inside bars can be quite interesting when you start to understand them on multiple time frames and look at the price action inside them, so very good intuition there.

Kind Regards,

Chris Capre

Hi Chris

Nice article. I like the way you think.

I do have some comments for discussion though.

1- I think that most people trade the pinbars, engulfing bars etc, particularly on the daily time frames because it suits there current situation. There easy to find, only require 30min to go through the charts once a day and when traded with the current trend, they are quite reliable.

Most retail traders work a 9-5 job and don’t have the time to watch intraday charts, even when you’re not working most people don’t have hours to spare every day. At least I don’t anyway. So although I agree with what you have said, to me it seems that unless you’re getting paid by a bank or fund to watch price action all day long, the above theory doesn’t seem relevant to the average mom and dad.

2- so how would you address relevance to the average working person and how can someone utilise the above mentioned when they are time restricted?

Hope this makes sense Chris,

Looking forward to your favourable response

Cheers

Hello Christopher,

Great name 🙂

Most of my students have 9-5 jobs just like you and manage just fine without having to spend hours in front of the charts.

I’ve condensed how to read price action context into three simple models. Once this skill is wired in (doesn’t take too long), you can analyze and get all the context for multiple instruments in 30 mins as well.

So what you mention about the pin bars/inside bars/engulfing bars really doesn’t apply.

Yes, they are ‘easy’ to find, and that is part of what’s being sold. But it doesn’t really matter if what you find doesn’t work, reduces your profitability or accuracy now does it?

FYI – I’m happy to put my top students numbers against anyone else from the pin bar + inside bar + engulfing bar camp and see who wins that one. I’m confident my top student (who also works a 9-5 job) will trump the top student from any of those other camps.

Food for thought and thanks for sharing as your questions were some good ones.

Kind Regards,

Chris Capre

Good article, it has lots of info. for some one like me a newbie, thanks.

Hello Sohail,

Yes, newbies can learn a ton from this by not getting mis-directed about trading price action.

This is exactly why I chose to go with Chris, to understand and trade Price Action, the Pin strategy articles that the other guy sold did not make common sense as big institutions surely do not wait for a pin all day. My trading improved just by reading articles on here but I’ve gained more in the course that I have not one single regret as I’m learning how institutions trade.

Good article Chris, salud!

Hello Itayi,

Yeah, the pin bar strategies taught by ‘the derivatives’ don’t make sense. Institutions aren’t sitting around all day saying ‘sorry, I can’t get in because there is no daily pin bar’

So nice observation amigo.

Awesome deconstruction of much of the price action material out there.

Context is always king, and delving into the markets on a deeper level than the “fakey” will enable you to spot market inefficiencies you would never have known existed. Its something everyone should strive towards.

Indeed – context is king and trading only pin bars and fakey’s does not build your price action skills, nor teach you much about PA.

This is a useful article. Those of us who can write trading algorithms know your argument to be true because we have verified it over many years of historical data. A trading algorithm that shows historical profitability based on these patterns is almost certainly over optimized and won’t work outside of the historical period it was tested on.

Hello Ian,

Yes, a very good point and something programmers would have figured out long ago, so thanks for sharing.

Kind Regards,

Chris

ANOTHER…Great article Chris! Thank you for this! But, I am a bit thrown. I thought your lessons in the PA course were about recognizing, detecting, ambushing and trading pin bars, shaved bars, multi-bar set-ups, impulsiveness, correctiveness and behaviors, no?

So, if this article changes the game, or opens our eyes, where do we start? Do we go back through the course still learning about pin bars, shaved bars, etc? Please help me further understand my friend…

Hello FXRecon,

Good questions.

First off, nowhere in the course do we say a pin bar or shaved bar is a confirmation price action signal.

Second, I’d suggest going through the course again as our first and most important lessons are on price action context.

So perhaps starting there, then working your way forward.

Hope this helps.

Kind Regards,

Chris

“Chris Capre – September 8, 2015 5:46 am

Yeah, wanted to summarize vs. having a long extended dialogue on it.

Glad you liked it.

BTW – how is trading in space :-)”

Chris, what do you mean by that? 😀

the institutions do not avoid the noise of lower timeframes because they are the noise. shouldnt we try to avoid the noise so we can lower our chance of being stopped out by the noise by trading higher timeframes eg 1 hour up.

Hello Jennifer,

It’s irrelevant who or what is the ‘noise’. They (institutions) play down there (as they do on any time frame) which means it’s playable.

FYI once you build up your PA skills, it doesn’t matter what time frame you are trading as you can trade them all.

We are not trading 1-2 bar patterns. We are looking for exploitable edges regardless of the time frame that exits.

Very much like a professional poker player takes the hands that will give them an edge, whether its pocket Aces, the big slick, suited J-10 or a pair of 6’s.

If it has an edge and the probabilities are in their favor, they play it because that edge provides over time.

Same goes for trading lower TF’s.

Food for thought.

Chris,

Nail fuller publishes his price action strategies which for me are total rubbish. But your articles are caked with your own repudiation of nial fuller’s strategies. It’s a repetitive theme in your writing which makes you come off over competitive and angry. Being a Buddha you should know better.

Sell your product.

Michael.

Hello Michael,

First time commenting on my site, and yet this article brought out a voice?

Perhaps you could explain how being a ‘buddhist’ is related to changing the meme, dialogue, or questioning a typical narrative.

FYI – A search of ‘Nial Fuller’ on my site reveals 3 articles, with two being from this this year and one last year back in Jan. IMO, it seems like 3 articles (across 75+) would not = a ‘repetitive’ theme.

Perhaps you perceive me as ‘angry’ challenging the current narrative. But I don’t feel ‘angry’ about it. I am happy to challenge it, but being ‘angry’ about it isn’t my general IMO.

And I’m not ‘selling my product’…I’m having a dialogue and challenging an existing narrative.

I do thank you for sharing your perspective and your comments.

Kind Regards,

Chris Capre

Very insightful article Chris! When you write about the fact that prop firms spend thousands of dollars and several months to a few years training their traders – it really hits home! whats your opinion of currency futures and trading using a depth of market ladder?

Hello Gloria,

Yes prop firms, bank desks and hedge funds spend a ton of money training for something more complicated then pin bars.

RE: FX Futures

I think its a valuable tool and a workable way to approach the fx market.

Kind Regards,

Chris Capre

Hey Chris, first off thank you for all of your hard work putting the advanced price action course together. Secondly, and this is for everyone else out there reading this, I’m a member of 2nd Skies Ichimoku and Pro Forex courses along with the Advanced Price Action course. These two courses alone can turn your trading around. Price action through 2nd skies is certainly beyond the candlestick patterns I learned from some bloke down under.

Hola Ivan,

I appreciate the positive sentiments.

And yes, the price action we teach here is beyond any candlestick patterns taught in other PA courses. Glad you joined this side and good to have you aboard.

Kind Regards,

Chris Capre

Thank you very much for this post.What about Johnthon Fox’s PA course?maybe same as Fuller’s course.I far I know they make good pips as I am a student of Johnathon Fox.

Hello Shehab,

It’s virtually the same course as Jonathan Fox was a student of Nial Fuller and copied virtually everything with very small differences.

Hence it doesn’t matter – if you trade confirmation price action signals, it will reduce your profitability, accuracy and edge.

You state they ‘make good pips’ but there has yet to be one person who’s shown a good myfxbook acct. And even if they could, I’d be willing to put my top student vs. theirs anytime and see who has a greater edge.

Kind Regards,

Chris Capre

Hi Chris,

From the tone in this article… it seems you are dismissing the validity of pinbars and engulfing patterns?

Mike

Hello Mike,

Hmmmm, it seems you misunderstood the article. The main thrust of the article is dismissing the idea hedge funds enter the market via ‘confirmation price action signals‘ such as pin bars, engulfing bars, etc. What I’m saying in the article is hedge funds are not sitting passively on the sidelines saying ‘sorry, I’m not getting into this trend because there is no pin bar or engulfing bar‘.

Now that isn’t ‘dismissing’ pin bars and engulfing bars outright – they are simply information (that is all).

But to state ‘hedge funds’ and bank traders enter the market via pin bars/engulfing bars, etc. as their confirmation price action signal (and without them, they don’t enter) is what is being dismissed here with the 5 reasons above.

Hopefully that clarifies it.

Very nice article and some interesting insights into how the big players think and trade. In regards to how or where we learn price action, I’ve always felt that this is more of of an art/skill set that’s developed rather than some mindless or magical fakey pin bar set up. So, thanks Chris for taking interest into devoloping our skills as traders and really helping us change the way we think and approach the markets.

Hola Ray,

Yes, it’s definitely an art and skill which is developed – not some mindless hunt for magical pin bars or fakey’s.

Good to hear someone noticed.

Kind Regards,

Chris Capre

Hi Chris,

If you took a closer look Nial Fuller’s site, you must have noticed that the teaching evolves around these major concepts:

1. Trading confluence of trend, level & signal… not the signal alone.

2. Money management focused on risk units representing an absolute amount trader is comfortable risking

3. Adequate psychology of trading, and, of course

4. Concept of probability i.e. all of the above is highly probable to give profit on a large (>20) series of trades

It has been stressed throughout Nial’s website that trading this way is simple but not easy… and that is so true. The signals section may be incomplete but , hey, aren’t all teaching methods… Munehisa Homma’s to begin with.

Your statements may be in place, but it feels that you were way too quick to choose your counter example of Nial Fuller.

Best of luck…

Hello Milutin,

Other than your comments being a commercial, nothing in what you say here refutes the main thrust of my article. In fact it actually amplifies it.

How so?

Regardless of pt 1 and the TLS method, the ‘signal’ is still what is needed to pull the trigger. This makes all the other things before it invalid without a signal. That negates price action context, and also reconfirms the entry method being a ‘confirmation price action signal’.

And to dive into Nial Fuller’s trend analysis, being based on an 8/21 ema crossover, that has nothing to do with price action, nor builds one’s price action skills.

Hence again, a very weak approach and definition of price action (especially within the context of a trend).

RE: PT2 is meaningless regarding this discussion. But to address is briefly – how about you take the pepsi challenge and ask the same hedge funds if they are risking ‘an absolute amount (in $) per trade’ and let me know how that goes.

You cannot even do a risk of ruin calculation using the dollar amount. You cannot even get this figure without knowing the % risk per trade, so this MM method is useless and you won’t find institutionals using this method.

RE: PT3 – not really relevant to this article

RE: PT4 – if your concept of probability (or Nial Fuller’s), starts a series of trades 21 or higher, then you have an incredibly low baseline to measure with. You’ll need hundreds (more like several hundred) to have any real measure of probability. 20 wouldn’t do for any measure of expectancy or probability in trading, regardless of the method.

I could flip a coin 20x in a row and get mostly tails in a series of 10,000. That mini-series of 20 is meaningless in regards to the overall probability. So a pretty weak point here IMO.

RE: Signals Section

No, Homma’s methods are related to candlesticks. The Price Action models I work with go way beyond candlesticks and could be done with a line chart or bar chart. They are based on the underlying order flow behind it, and gauge momentum, imbalance, transitions, and more, all done over dozens of candles, not just 1, 2 or 3, along with understanding price action context (something Homma never mentions, thus completely different ).

So again – a major misunderstanding here.

But to sum it up, nothing of what you said here challenges in any way what we stated in this article. In fact it further amplifies it. To state that hedge funds trade using confirmation price action signals such as pin bars, and are staying absent from trends without said pin bars is incredibly inaccurate.

And as we’ve addressed, the approach to price action trends, and PA context also shows to be incredibly lacking.

Hopefully this clarifies it further, but thank you for sharing your comments.

Kind Regards,

Chris Capre

Excellent Chris! Many insights in here for me and really changed my perspective. I used to think those pin bars meant the world and I’ve even taken a course in the past where their relevance was wayyy overemphasized. Thank you friend!

nice article . want to buy your course but it is very expensive for an Asian guy 🙁 if there is any promotion ever, please let me know. thanks from Thailand

Thank you Chris, the more I read your articles the more I’m realising why I’m not successful yet I have been trading for about 2.5 yrs only last 8 months on live account, Nial fuller is my mentor and everything seems to be different with pin bars , inside bars , and fakeys, and with time frames nothing lower then H1 , I like the way you take trades with 20-30-50 pip stop loss and still get 3-4 R-R I seem to need always a larger S-L and every time you get hit it takes a while to recuperate. thanks again Chris and keep up the good work , I love reading your articles they give me more hope , I know it is within my grasp , but I guess it takes time , I spend lots of hours every day figuring out how the patterns develop and how they play out , major levels, and all other Price action that present themselves. Cheers

Hi Chris,

I have to admit that as I am reading this article, my ideas are shifting.

I have always had trouble thinking in probabilities and tend to want to wait, get a signal, do a mechanical enrtry and a target and walk away.

This is trading while avoiding trading….

But then I only have a couple of hours in the morning to trade, so I liked that idea. Not sure I can sit all day and follow order flow like full time traders in institutions.

But you make so much sense though! Can your approach help, with a schedule like mine?

Thanks.

If your ideas are shifting, that is a good sign.

Having trouble thinking in probabilities is a hurdle to trading that one must overcome, very much like a poker player must always think in terms of odds.

RE: Your Question

You don’t have to be sitting around for hours each day ‘watching order flow’.

Learning to read price action context is a skill. In the beginning, I could only trade 4 instruments. Now, I watch 18. How can I handle that much more?

Because the skill of learning to read and trade price action context + order flow in real time has been wired in subconsciously, which is something you can learn to do.

And when you build this skill, it doesn’t matter if you only have a few hours to trade or 10, because you can do it quickly, just like a professional guitarist doesn’t need 2hrs of warmup just before they can play chords or a good tune.

Hope this helps.

Kind Regards,

Chris Capre

It does make sense,why hedge fund make billions dollars with trading probabilities,but not trading by confirmation and pinbar is effect of institutional trader already get in.

Thanks for you article,really an eye opening.

Hello Xperiaone,

Yes, the pin bar is created by the institutional flow already in the market, so any later entry is reactive and most likely a worse entry.

Kind Regards,

Chris Capre

Hi Chris

Thanks for all the info on the site. I don’t see a problem with questioning approaches or trying to evaluate which is better.

You say in a comment (that i’m unable to reply to), “You state they ‘make good pips’ but there has yet to be one person who’s shown a good myfxbook acct.” I agree, and find this a little troubling, but does this mean you have one?

Hola Rico,

Questioning other approaches is healthy IMO.

RE: Myfxbook

None of my platforms connect with it (Saxo, Active Trader, GTX) so not an option for me. Am considering Darwinex – (atm) they got a long way to go before worth considering.

But many of my students in the course have posted myfxbook accts which I’ve shared in webinars – one of them being up 70+%.

Kind Regards,

Chris Capre

Hi Chris,

Firstly, thanks for exposing false teachings that rather prevalent in the net these days.

However, I am quite curious about some things.

You seem to know James16’s, Niall Fuller’s and Jonathan Fox’s trading methods inside and out. You are even aware about how they are related, e.g. Niall was a former student of James16 and Jonathan was a former student of Niall (Thanks for exposing this by the way.)

How do you know all these things?

Were you once a partner with them? How do you know so much about them?

Hoping to hear from you soon.

Cheers,

Enner

Hello Enner,

No, I was never a partner with any of them. Nial Fuller asked to partner with 2ndSkiesForex back in 2008, but I turned him down. As to knowing about their trading methods, I’ve done my research, but you are welcome to do yours. Shoot you can even ask them yourself.

Kind Regards,

Chris Capre

Hi Chris,

great article and hopefully people will one day stop believing the “experts” who claim this

i’m happy to say for fun i took you up on The Pepsi Challenge, i asked a few people i know who do this and the responses are as followed:

1) If you don’t see a daily pin bar, engulfing bar, or inside bar, are you staying out of the market?

the response was laughing and said that if any believes this to send your money straight to them and save yourself the stress and go and find some other to occupy your time.

2) If you do see a daily pin bar, engulfing bar, or inside bar, are you loading up on your position even more than usual?

with this one more laughs, and a big NO. if they are loading up more than usual on these bars it was a coincident and the bars were not the reason for them to do, they had other reasons.

P.S even though i asked this i didn’t believe either of the questions i did this for fun and to help to prove the big myth, i explained where and what the reasons for the questions were.

Hi

Thanks Chris

I believe we are pointed in the wrong direction from the get go and we aren’t told the true story of trading, simply because it’s too scary and definitely not an attractive career from the outside if you are only beginning it. If they told us how much work we had to do in order to change our way of thinking, dealing with stress and so on, my guess is, not many people would be enrolling in those courses !! Therefore, a lot of us don’t really have an understanding of what trading truly is and we cannot move toward what we aren’t able to imagine.

I liked it when you said we must move from this freshman way of seeing things.

“More likely, you’ll get several laughs, along with someone perhaps escorting you out of the office.” Hahaha I read this at work, Chris man you killed me with this one, thanks for this wonderful lesson, you have sharped my Price Actions a lot, my trading is not the same i am making profit since i found out about 2ndskiestrading.com

Hello Nkululeko – I am glad your price action skills are getting better through our free PA material.

Hello Chris, your thoughts make complete sense to me. I took your course about 3 years ago, but lost my interest in trading. A couple of weeks ago I recalled that I had lifetime access, so logged in and was astonished to see how much the course material had improved. There is so much of market sentiment to understand from the charts and I am trying to ‘unlearn’ (those concepts that seem to make everyone think they can trade successfully quickly) so that I can fully absorb what Price Action (PA) really means and how to understand properly the story that the charts are really telling.

From what I have seen, you actually trade the way you teach. That alone is refreshing. Your understanding of PA is way above any other mentor (I have experience with a few). I have to admit that although the concepts are simple, it is kind of complex at the same time. Becoming a successful and profitable trader will require a lot of patience, diligence and practice. But you have provided all the training that anyone would require as long as they have the passion, dedication and perseverance to keep learning and improving their skills.

Thank you for sharing your knowledge and skills with anyone who wants to be successful at trading.

Regards

Hello Ravi,

How good to see you again. Yes, you have life-time access to any of my courses, and can come and go as you please or whatever works for your circumstances.

Yes, the course has changed a lot. We’ve completely revamped the Advanced Price Action Course, added tons of new lessons, changed the format, structure, and more to optimize your learning experience.

I’m glad you are noticing this as you’ve come back.

And thank you for saying ‘my PA understanding is way above other mentors’. I feel the narrative that all you need to do is trade these 3 candlestick patterns has totally derailed the study of price action. Hopefully I can change this.

And yes, I trade exactly the way I teach. That is why I’ve created a lot of videos showing me trading live with my own money using the exact same price action strategies as I teach in the course. So am glad you’ve noticed this.

Trading definitely requires patience, diligence and practice. Seems like you’re coming to that realization which is a good thing.

Glad to have you back and I’ll see you in the course.

Kind Regards,

Chris