What If Your Trading Plan Cost You Money?

I recently got a daily forex trading plan from a new student and eager beaver who asked for some help with their plan. The moment I opened it, I realized it was incomplete and needed work. To be fair, they had gotten this template from another course, so cannot fault the student.

I generally suggest having two trading plans:

- The Day-to-Day Trading Plan which includes your daily procedures

- Your Business Trading Plan

What we’ll be focusing on here is related to #1 above. Below is the general outline of their current forex trade plan, which I’ll go over, show you what needs to be changed, and what is missing.

Their Current Trading Plan

- Introduction

- Price Action Signals to Trade

- Rating a Trade

- Time Frames

- Pairs/Instruments to Trade

- Risk-Reward Ratio

- # of Positions

- Position Sizing

- Stop Loss & Take Profit Rules

- Rules for Entry

- News Events

- Documentation

- Losing Trades

Do you see anything confusing, missing, or out of place here?

What I Would Change

#1: Introduction – I think this was a good start. However, two things in this introduction stood out;

a) the opening statement, ‘The goal of this plan is to avoid emotion-based trading‘

b) ‘the trading plan may be adjusted, and the rules edited‘

Lets start with A – If the goal of the trading plan is to ‘avoid emotion based trading‘, the current plan only helps for that day, but doesn’t get at the root cause of ‘emotion based trading‘.

Where should the real work be done for this? Prior to any trading, and in the ‘training’ phase! How? Proper training, building your sub-conscious skill set, and removing limiting beliefs.

For B – this is fine to allow the trading plan to be adjusted, but how often? The trading plan should be an evolving document as your level develops and grows as a trader. But put a time factor to this and stick with it.

I would have in the introduction why I am trading, what I am trying to achieve and what my daily goals are. More on this later.

#2: Price Action Signals to Trade – A military general doesn’t start their plan with tactics. They take all the information in to get a broad picture – i.e. the ‘context‘. In trading, this relates to understanding the price action context first. So this section needs to be later in the plan.

What would I put here? Pre-trading preparation, i.e. how will you prepare for each trading day (physically, mentally, market analysis, etc).

#3: Rating a Trade – We haven’t even gotten to our price action context first. This comes before rating a trade for quality. So this should be done here, starting with our top down analysis, how we find the correct context, then go from here.

NOTE: In this template from the other course, their highest point rating for a trade was ‘big size‘ for the signal bar.

Now let me get this straight – the size of the 1-2 bar pattern, is given the most importance? One bar out of the 30-50+ bars which comprise the validity of the signal?

Seems like a confusion to me on what price action is about. Yet ‘Trading with the Trend’ is 5th on their list? How does one bar by itself, have greater value than the entire trend and order flow to this point?

Lastly, the 13-pt rating list completely rules out intra-day trading. A trading plan should be flexible enough to incorporate both.

# 4 & 5: Time Frames – by now, we are too far ahead of ourselves with this plan. Once we know the context, only then can we know the tactics (price action strategies) to use. We cover this in more detail with our course members.

One other thing about this is the fallacy that the time frame is more important than the instrument you trade. Should be the other way around.

Pairs/Instruments to Trade – Although this is completely necessary, I think in one section you can have the pairs/time frames you are trading.

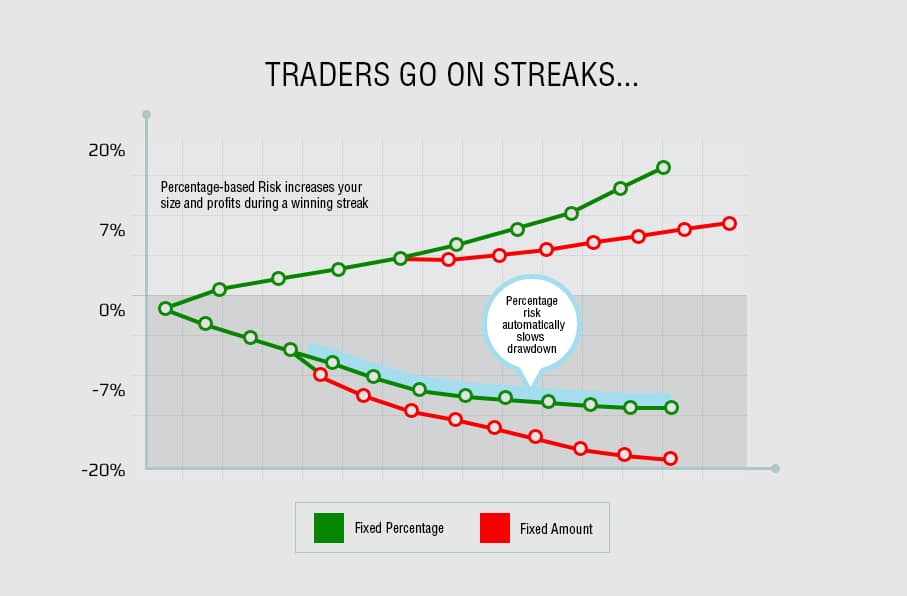

# 6, 7 & 8: Risk-Reward Ratio/# of Positions/Position Sizing – The first one is completely irrelevant by itself without understanding the Risk of Ruin.

You can use my risk of ruin calculator to find yours. For more information on the risk of ruin formula, click on the link above.

Number of Positions – kind of irrelevant. Although you may have a fixed % equity risk per trade, what if you start your day, and realize 4-5 high quality setups on deck?

My suggestion is to have a max risk per day, and per trade. If your max risk per day is say 5%, and you spot 5 trade setups, then you can risk 1% per trade. If only 2, then you can risk 2.5% per trade. As long as you keep the risk of ruin at zero, the number of positions should not be limited IMO.

Position Sizing – Can all be addressed under one section, which I’d label ‘Risk Management‘

# 9 & 10 & 13: SL & TP Rules/Rules for Entry – should be addressed in the strategy itself.

#11: News Events – I’d say make this part of the ‘pre-trading preparation‘, under the ‘market analysis‘ preparation.

#12: Documentation/Journal – I agree this needs to be part of your forex trade plan. But there is nothing in here about reviewing your trades, or end of the trading week analysis. Monthly, quarterly and yearly reviews would be recommended.

What About Training?

I generally recommend having a completely separate plan for training, very much like professional athletes have practice/training routines, which are separate from game-day preparation. Trading should be no different.

For those trading higher time frames like daily and 4hr strategies, I’d recommend using your non-trading time for practice/training. This is not just demo trading, reading books, or studying course material. We suggest going beyond this with live forward simulation trading, just like fighter pilots do simulators, or baseball players have batting practice.

Our favorite tool for this is Forex Tester 2, which allows you to go back in time, and then live forward trade it bar by bar as if they were appearing in real time.

You can get a $50 discount on Forex Tester 2 by clicking here.

In Summary

As you can see, the template they were working with was quite confusing, lacking key things, and out of order. Had I been working off that trading plan and not known better, I would be approaching the market incorrectly every day, missing a dearth of things.

It is important to understand a professional trader will see things on a more sophisticated level than your traditional 1-2 bar pattern trader. Professionals, by default, can recognize opportunities beginning traders will not, like a good poker player can make money on more hands than a weaker one. This also goes for one’s daily forex trading plan, so having a more evolved one will give you a greater edge.

Ask yourself, how sophisticated is your trading plan? Does it feel unorganized, confusing and incomplete like the first template? Does it even include pre-trading preparation? What would you recommend adding to this trading plan?

Please make sure to share your answers, along with whether you agree or not, and why you agree/disagree.

Yikes Chris – do you have a camera in my office, I was just working on a trading plan this morning!

:-)))

So, to clarify, your trading plan is (in essence) a checklist, starting with pre-trading preparation, followed by a top down analysis to determine what the trading environment is and then drilling down to choose the right “weapons” for the environment and then stepping back out to post trade analysis/documentation and weekly reviews?

Yes, I love this article! everyone confuses strategies for a trading plan

The two plans are completely different, the writer of the plan above may not even trade or at best has a convoluted and confused thought process.

The trading plan IS the big picture, why your doing it/ how much of my portfolio am I willing to risk in speculation/ goals/ targets/ risk management/ what strategies/ what are the tested results?/ what is realistic?

The business plan is very very different and I am glad you pointed it out! i.e. what business structure, tax planning (bahamas? – jokes), record keeping, account management, website development?, training?, future plan – work for self, manage money for others? build managed portfolio to sell? exit strategy?

The guy who wrote the outline at the top focusses on the strategy only, and not even in the right order!

Great Article, love it!

Hello Dion,

Yes, I am really glad you pointed this out as many seem to miss this.

Many confuse strategy for a plan, and it shows the level of the mentor giving such a trading plan template. The differences are night and day, and a confusing/weak plan can totally change how a trader effectively, or ineffectively approaches the market, so some well points raised here mate.

Kind Regards,

Chris Capre

Great article Chris! Articles like this will definitely help many new aspiring traders to put their plan together since finding any good advice on how to build a solid trading plan are rare on the internet. Most websites and/or forums focus mainly on strategies and or/selling their own product and just on the sideline mention some kind of plan. Great stuff!

Hello Sascha,

Yes, most of the advice around building a trading plan are all the same vanilla methods. You’ll never hear anyone talking about pre-trading preparation, or post trading review work, outside of filling in your trading journal. And yes, almost all just focus on the strategies, so we wanted to write something more nuanced, unique and professional, hence glad you liked it.

Kind Regards,

Chris Capre

Thanks for this topic Chris. I will adjust my plan based on your input.

Hello Jobi,

Good to hear amigo.

Kind Regards,

Chris

Grreat articule…great ideas…great plan… the point is beginning to put in practice and have a great dose of discipline and pacience….in my personal opinion two basic principles to maintain and conserve in this trouble market

Hello Jorge,

Yes, patience and discipline are required to survive this market, but glad you liked the article.

Kind Regards,

Chris

Chris, You made some great points about building a trading plan. Thanks for sharing the forex tester resource, I have been looking for a good backtesting software. I am going to try it out on your recommendations

If more traders focused on creating a better plan I believe there would be a much lower rate of starting traders who fail.

Hello Casey from WinnersEdgeTrading.com,

Good to hear from you. Yes, its very common for traders to build a plan purely around the strategy, which to me, falls completely short. A better plan would definitely lower the rate of starting traders who fail, because it would mean they are managing the correct things, not just their strategy.

Also glad you found the Forex Tester 2 resource, as its been quite valuable for back testing, and simulation trading.

Kind Regards,

Chris Capre

Hi Chris, thank you for the article. I agree with you that traders need to have two types of plan – the business plan, and the day to day operation plan or what I call as a trading process.

Hi Chris

I’m Back !!! 😀 great article, as always.

Just today I was gonna revise my trading plan and create monthly goals and a review procedure. I’m gonna use the above mentioned guidelines, but do you have an article specifically about how to build a trading plan from scratch ?

Thanks

Does the trading strategy belong in the trading plan?

Hola Steve,

It most certainly does.

Kind Regards,

Chris Capre

Hello Chris

Thanks for this very good info. I am still thinking about getting involved in forex, at some point I will need you help to get me started, thanks again.

Hello Sohail – glad you liked it.

When you are ready to begin – I’ll be here.

discipline… discipline… focus…focus…. maybe the most dificult moment is to stay just watching the screen

Hello Ismael,

There are always challenging decisions to make in trading. The key is to build the neural networks and mindset which makes these skills and discipline your baseline so it’s relatively automatic. This will become easier over time with the right training.