The 5 Components You Need For Your Forex Trading Plan

What you’ll learn in this forex trade plan article:

-How do you build a successful forex trading plan?

-How do you evaluate whether your trading plan is working?

-Why you need a forex mentor to help with your trading plan

One of the more common questions I get from traders is “how can I build a successful forex trading plan?” If you’ve had this question before, or feel your trading plan is not sufficient, confusing, or not working, then pay attention because this article will answer your questions directly.

From my experience, you will need (at a minimum) these 5 major components to be in any successful forex trading plan you make. Let’s go through them.

#1 Your Why

From my experience, you need a ‘why‘ as to why you’re doing this. It should be the ‘core‘ reason and inspiration behind why you’re trying to become a successful trader.

For most traders, the why is simple:

“To build financial independence while working from home, having more time to spend with your friends, family, while determining your value and income, and having no limit to the upside you can make.”

Would this pretty much encapture the main reasons why you want to become a successful trader?

Now there is certainly a deeper discussion we can have about your ‘why‘ and what you think it will give you, but for now, my guess is almost all of you fall into the above reasons why you’re wanting to become a professional trader.

The reason why I suggest getting really clear about your why is it will remind you (no pun intended) why you are doing this, but more specifically, why you should work hard to achieve your goals. This is helpful when things are going wrong as that is when you need a boost in motivation and connection to your why.

By having a personal and emotional connection to your why, you’re more likely to stay focused and keep going when things are challenging.

#2 Daily Preparation

Ever watch a professional sports game, particularly before the game starts? What do you notice if you turn on a football game a few hours before it starts? You’ll see the same thing across pretty much every sport on the planet.

All professional athletes start hours before the actual game/contest doing one thing: Preparation!

They are preparing their body and mindset to get ready for the game ahead. Take a look at this 30 second video of Odell Beckham Jr. (American Football Player) getting ready before his game.

What do you see him doing? Rehearsing the exact same things he’ll be doing in the game (running routes, making cuts, catching passes). Keep in mind, this is after he’s done his stretching and exercise routine to get his body warmed up for this.

Now I have one simple question for you: “Do you think trading should be any different when it comes to preparation?”

The question is mostly rhetorical, however when I quiz most struggling traders about their pre-trading routine, its usually very minimal at best.

Now I know many of you have full time jobs and lead busy lives, and perhaps only have 1-2 hours per day to trade. If that is the case, then I’d suggest spending at least 15 minutes preparing mentally for your trading day. This should be finely crafted into a very specific routine you execute day in, day out.

What should you be doing during this preparation phase of trading? At a minimum:

1) getting your mind (and ideally body) in an optimal state for trading

2) mentally rehearsing everything you need to do during your trading day

3) after you’ve done the above, then starting your pre-trade routine

The above is what I would call a ‘sufficient‘ and ‘expedient‘ way to prepare for your trading day and get you in a mindset + state to make money trading.

#3 Core Trading Mechanics

Now that you’ve 1) connected with our ‘why‘, and 2) mentally prepared for your trading day, it’s time to sit down in the chair and start trading your edge. However, you need to clearly lay out what you are trading, and how. These are your core trading mechanics and a blueprint of what you’re trading.

In this part of the forex trade plan, you need to cover the following:

1) markets/instruments you are trading (should be fixed in the beginning until you’re at least stable or consistently profitable)

2) what strategies are you trading (these should be very clear what you are trading, along with the parameters/conditions for each strategy and setup, such as entry, SL and TP conditions)

3) what time frames you are analyzing the price action context and making your trading decisions from

In the beginning, I recommend trading no more than 5-10 instruments (less is usually better in the beginning) so you can learn their price action, volatility and order flow patterns by watching the same instruments day in, day out.

Gaining familiarity will allow you to find more trading opportunities in those instruments over time, and thus profit more.

You’ll also need to know exactly what trading strategies you are using day in, day out so you’re very clear about what setups you should be focusing on, and what you should let go of.

Forex Trading Tip: Once you know what strategies you are using, make sure you have screenshots of those setups (ideally you trading them successfully live) so you can imprint these patterns and charts into your brain. This way when that same pattern in the price action shows up, your brain will (sub-consciously) tell you “Hey, that’s a good trade, you need to jump on this.“

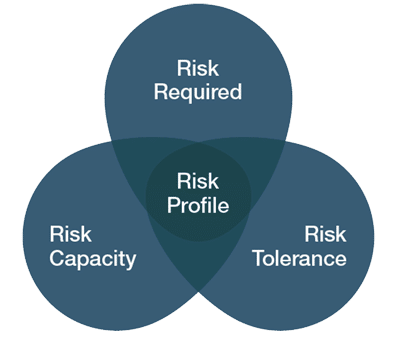

#4 Risk Profile

This part of your trading plan is all about risk, and risk is all about the numbers (mathematics). It’s a confluence of the risk required to make a maximum amount for each trade, your risk tolerance and risk capacity.

There are several things which will help determine your risk profile in your trading plan, such as:

1) % risk per trade

2) max risk per day

3) max risk per month

NOTE: If you want to learn why we recommend a % risk based model, click here.

Regardless, you’ll need to know exactly what you’re risking per trade and it should be consistent. This is because you could be varying your position size, but if you increase size on your losing trades, and decrease size on your winning trades, you’re leaking your edge (losing money where you shouldn’t be).

Since you don’t know whether your next trade will be a win or a loss, you need to be risking a fixed % per trade.

I also recommend having a max risk per day so you can shut things down if you’re off for that day. This will minimize your downside when not on your game.

In terms of your max risk per month, this is the same concept as above.

Trading Tip: If you want to avoid having major draw-downs you’re unlikely to recover from, we recommend having a max risk per month <10%. For every month you have a 10%+ drawdown, you decrease your chances exponentially you won’t recover your losses by year end.

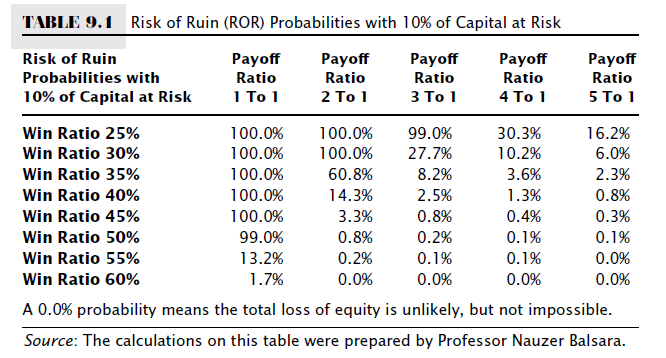

Also in your risk profile, you should be aware of your risk of ruin, which tells you mathematically a) whether your account will blow up, or b) whether you’ll mathematically make money. So critical you understand your risk of ruin.

If you want to learn more about the risk of ruin for trading, click here.

#5 Analytics & Review

Every successful trader reviews their trading for the day. Just like an athlete reviews film from their past games to see what they could improve upon, you have to have a process for reviewing your trades each day/week/month.

A simple way to relate to this is:

“You cannot change what you cannot measure.”

(Pro football players reviewing film below)

If you don’t measure and review your trading performance in detail, you’ll continue making the same mistakes over and over again. Have you had this experience? If so, most likely you’re not reviewing and analyzing your trades and trading performance properly.

I recommend the following:

1) spend at least 15mins each day reviewing your trades for the day

2) spend at least 1hr per week reviewing your performance and execution for the week

3) spend at least 1hr per month reviewing your overall stats

What should you be reviewing?

1) charts for each and every trade, showing the price action context before the trade, along with your trades entry, SL, TP, & the result

2) how well did you execute your trading plan (were you over-trading?)

3) what was your performance (stats) for the month and how does that compare to your baseline?

By having a time to analyze and review your performance, you’re teaching your brain to spot the habits and actions which led to making successful trades, which further reinforces good trading habits.

In Closing

These are the 5 major components you’ll need for any trading plan you create. There is a lot more that could be said on the subject, but this should give you a solid framework to build your own trading plan.

In the beginning, you’ll need to do some experimenting to tease out what feels more natural for you. I recommend doing this in 3 month chunks so you don’t change your plan too often, and give it enough time to play out.

Eventually, you’ll likely need some feedback on fine tuning your forex trading business plan. This is where a forex mentor really helps, because they can see things you’ll likely be missing, and can give you actionable insights on how to increase your profits, accuracy and performance.

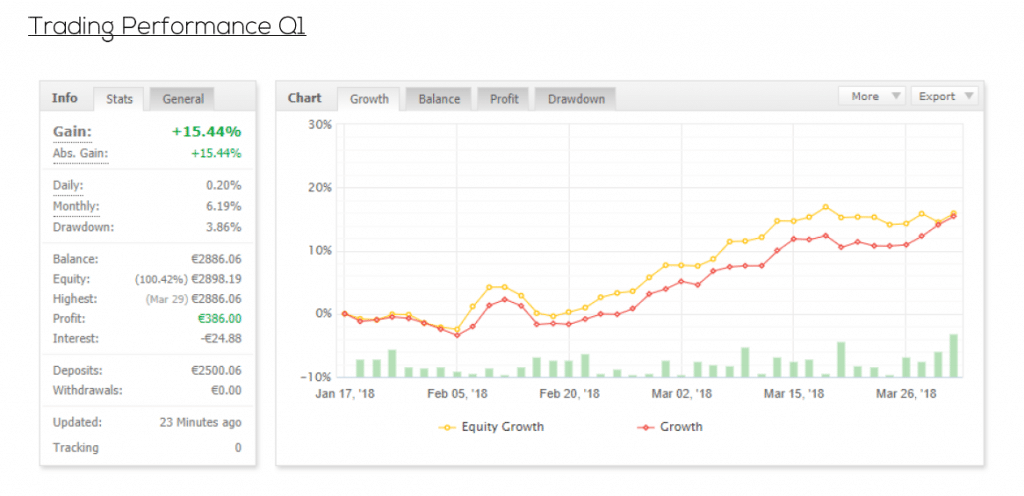

Below is one of my students first quarter performance for this year whom I’m constantly helping with their trading plan.

If you’d like to learn more about our Trading Masterclass course and how we can help you build a successful trading plan, click here.

Now Your Turn

Did you learn something from this trading plan article? Notice anything lacking in your current forex trading business plan? Feel like you have a more clear idea how to build a successful forex trading plan?

Make sure to leave a comment below, and share this article on social media.

Until then, I’ll look forward to hearing from you.

Additional Resources: What if your trading plan is costing you money?