Chris Capre’s 18 Trading Lessons From 18 years Of Trading

This year will mark my 18th year of trading the forex and financial markets. I’ve learned some incredibly valuable trading lessons I wish I had been taught when I first started out. These are lessons which have cost me probably north of $2-3 million dollars in losses, missed opportunities, and making mistakes which took years to figure out (and unwind).

If you’re a struggling trader who’s making the same mistakes over and over again, take heed of these lessons as they’ll save you years in your trading process, and likely well over 6 figures in unnecessary losses.

Hence if you want the fast track to becoming a successful forex trader, learn everything there is to know about these 18 trading lessons. Do this and you’ll find yourself making more money and having greater trading success than before.

Let’s jump in.

1) Invert the Equations Of What Most Are Doing

I have a general formula which I apply to trading and life. That formula is to invert the equation (or process) of what most people are doing.

The bottom line is most people are not successful at trading. In fact, with almost all things in life, most are not in the top 10% of anything they do (job, profession, sports, martial arts, etc).

If that is true (it is btw :-), then most of them are likely following similar patterns and equations for their job, profession, sport, etc, and its NOT WORKING!

What’s the most common pattern you see with struggling traders? Most are not following their trading plan. Most don’t have a proper risk management profile. Most are spending their time on the charts and strategy, not their skills.

Hence, whatever the majority of people are doing – you’ll have to invert that process & equation. Follow this formula and my guess is you’ll find out how well it works in trading, and life as well.

2) Good Trading Requires Good Trading Skills

Trading is a skill based endeavor. There is no way around it. If you want to make money trading, you’ll have to build the skills necessary to do that month in, month out.

Most traders spend between 75-90% of their time looking for ‘the’ strategy, focusing on the charts, focusing on the next trade and how their going to make money. And most are losing money!

Look, it’s quite simple. If you want to play like Mozart, do you start off with the focus of playing like Mozart, or do you focus first on learning the keys, building coordination your fingers, learn to read sheet music, learn how to play chords?

The answer is obvious. You focus on the latter. Those are the core skills of playing piano. Do that, and in no time, you’ll be playing Mozart. Trading is no different.

3) Sim, Then Demo, Then Live

I have a framework for how you should build your trading skills to make money trading. The process is simple.

First, you practice on a trading simulator, focusing on the core skills of price action context. Second, you practice synthesizing those skills on sim, and then start practicing on a free demo account, first finding potential trading opportunities, then trading them on demo. Third, after you’ve built some consistency there, it’s time to go live (starting with a small amount first, then building your acct as you progress).

The formula is simple: Sim, then Demo, then Live.

Do that and you’ll shorten your learning process.

4) Treat Demo Trading Just Like Live Trading

Ever thought to yourself “I can’t get excited about trading demo as there’s no money on the line“? Anytime a struggling trader tells me that, I know that they (right now) don’t have the mindset to make money trading.

Think demo trading is something not to be treated seriously? Think practice is over-rated?

Watch the following video of Michael Jordan on practice and how he related to it. See how intense he is about practice. See how seriously he’s taking it, then compare that to how you’re relating to practice.

As Michael said, “Every day in practice was like a competition to me. So when the game comes, there’s nothing I haven’t practiced before. It’s like a routine. I never feared about my skills because I put in the work. Work ethic eliminates fear.“

After watching this video, tell me if you can still justify treating demo as ‘not-important‘. My guess is after watching this video, you can’t.

5) In The Beginning, Use Bigger Stop Losses, Then Decrease Them Over Time

75% of my students who do a ‘Trading Analytics‘ session with me (where I use 20+ metrics to analyze their performance and help them reduce their leaks while increasing profits), have one thing in common. Their stops are too tight.

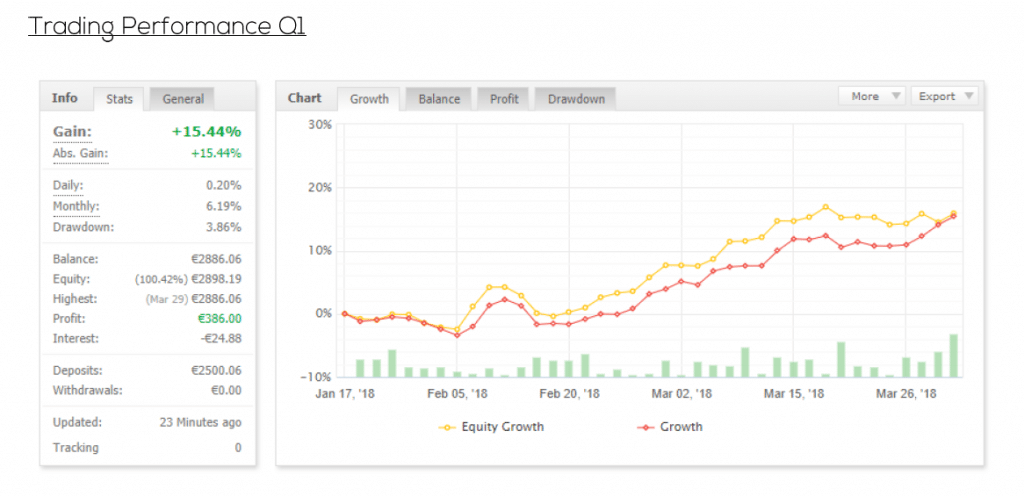

In the beginning, your goal should be accuracy and consistency. Tight stops in the beginning requires precision. Do you really think you have precision in your trading skills right now? If the answer is no, try widening your stops a bit and see if your accuracy increases. If it does, you’re on the right track, like my student below.

However you cannot always have bigger stops as it will decrease your profitability over time. You’ll be leaving money on the table. So focus on consistency first, then precision later.

6) Preparation is Highly Underrated By Most Struggling Traders

How much do you prepare (mentally) for your trading day? 10 mins? 15 mins? I’m willing to bet 75% of the traders struggling out there spend 15 mins or less preparing for their trading day. Are you one of them?

What’s the most important tools for a Football player? His body and his mind. What’s the most important tool for you as a trader? Your mind (for the most part).

Hence you need that tool (your mind) to be sharp and prepared for your trading day. Treat preparing for your trading day like a professional athlete, then see if your performance (and mindset) increases.

7) Whatever You Don’t Measure, You Won’t Improve On

How many metrics of your trading performance are you measuring right now consistently? My guess is 90+% of you struggling traders out there measure 3 things at most:

#1 – % accuracy for your trading

#2 – account balance at the end of the week/month/year

#3 – how much your account is negative from your original starting balance (or how much you need to get back to break even)

Does this sound accurate?

How many metrics do I measure about my trading performance? About 20, and I can measure them so quickly, it takes me < 15 mins to measure.

Bottom line is, whatever metrics regarding your trading performance you are not aware of, you cannot fix. You have to be aware of your trading mistakes before you can fix them.

But even then, if you don’t take the next step (measuring them), you won’t know what your baseline is, and how you can improve.

And if you don’t know what your baseline is, and what you need to improve on, how do you plan on getting better?

8) Consistency Comes From The Mind

“I’m close, but can’t seem to break through. All I’m really needing is a consistent trading strategy and trading plan.” Ever thought that to yourself?

Where do all your trading decisions come from? They come from your mind.

How many times have you written out a trading plan, and not followed it? How many times have you not followed your trading strategy? How many times have you not pulled the trigger when your trading setup comes?

Consistency in trading doesn’t come from the strategy or your trading plan. You won’t experience consistency in your trading till you have consistency in your mind.

Hence if you want to experience more ‘consistency‘ in your trading, you’ll have to wire consistency in your mind.

9) Information Does Not = A Good Trader

How many trading books have you read? How many trading videos have you watched? Probably a lot, yes? Yet you’re still struggling to make money trading. Why is that?

If watching videos, reading books (i.e. taking in information) made good traders, you’d likely be there by now. But you’re not. And that reason is simple.

Information does not = successful habits.

Trading is a skill based endeavor. I’ll take the trader who’s read only one trading book, and watched one trading video, but has practiced the core skills of price action context vs. the trader who’s read 100’s of books, watched 100’s of videos, but doesn’t practice their trading skills.

10) Successful Trading Requires A Successful Mindset

To make money trading, you’re going to have to build a successful mindset. This is a mindset which focuses on getting better every single day, regardless if they made money that day or not. This is a mindset which embraces the challenges trading provides.

There is a mindset you’ll need to make money trading. While that mindset is not fixed, there are certain habits and patterns of thinking you’ll need to make money trading. You’ll see these patterns in the best traders of our time.

Hence if you want to make money trading, you’ll need to build the mindset to get you there, and keep you there.

11) Trading Can Be A Lonely Venture. Join A Trading Community!

Ever feel lonely in your trading quest? NEWS FLASH: You’re not the only one who feels this. Most traders do.

Anytime I visit traders and students in other cities, they all tell me how relieved they are to realize they’re not the only one having these experiences. There is no university degree in trading. Very few people will ever work at institutions with other traders. Plan on not being that person.

Once you realize this, and that you’re not alone, you also realize how beneficial it is to join a trading community.

I feel really proud on the trading community we have at 2ndSkiesForex as they’re all open, friendly, and really helpful towards others, especially the senior students. We’re all here for the same goal, and we realize how important it is to communicate and interact with others on this journey.

Why should you try to tackle such a challenging profession as trading alone? Why not join an active trading community that supports your growth as a trader, where you can see others succeeding?

12) Focus on the How vs Focusing on the When

One of the most important mindset shifts you can make in trading is spending more time focusing on the ‘How‘ vs. the ‘When‘. I can always tell where a traders mindset is when they ask the question “how long will it take for me to make money trading?“

Would you ever walk into a martial arts studio and ask “how long before I can beat up a black belt?” Would you ever walk into a piano school and ask “how long before I can play Mozart really well?” No, of course not. Not only is there no fixed answer for this, you’re focused on the wrong variable.

The reason why this is such an important mindset shift, is it gets you actively focusing on and directing your energy to the ‘how‘ and ‘what‘ that will get you from point A to B.

The ‘when‘ won’t get you from point A to B. But the ‘how‘ will.

13) Risk Management is the Most Underestimated Skill in Trading

90% of all struggling students who start my trading course have one variable in common. They don’t take risk management seriously and have inconsistent risk on each trade.

Now ask yourself, “How good are you at predicting whether your next trade will win or not?“

Most likely, you’re not that good. If you were, you wouldn’t be taking so many losing trades that you ‘knew’ were going to lose now, would you?

There are 2 key points here:

1) you’re likely not that good at predicting your winners and losers (less winners)

2) trading is a game of probabilities and your trading distribution will be mostly random

Hence risk a fixed % per trade so each loss is always the same % of your account.

14) There Is A Difference Between Planting Seeds & Watering Seeds

In April this year, my father passed away. I left within a day of hearing upon the news to spend time with my family and say my goodbyes to my dad.

The day I got back home, I realized how much we all were in the same vision, or spirit regarding our family. I realized this was a ‘window’ for us to make real changes, just like all big moments in one’s life are.

I talked with my family about how this moment was a window, and a great opportunity for us to plant new seeds for our family. But planting seeds is not enough if you want them to fully grow. You have to water them, provide sunlight, and give them proper soil. Do that, and the seeds (which are pure potential) will grow and manifest that potential.

So ask yourself, are you just planting seeds (watching videos, reading books, but not making any real changes)? Or are you actually watering those seeds, taking real actions, working hard every day to get better?

Which trader do you want to be?

15) If You’re Continually Making the Same Mistakes, Seek Training From A Forex Mentor

I could not imagine trying to learn more about becoming a Buddhist and do the meditation practices without a mentor or teacher. I actually did try (back in college) and for the most part, failed.

The same went for my trading. I knew at some point I needed training. I needed someone to provide feedback to me and help me see what I wasn’t seeing. This is something every professional athlete has (a coach or mentor). Why do you think trading would be any different?

If you’re continually making the same mistakes over and over again, you’ll need a mindset and path outside your current one. If your current path, skills and mindset was working, you wouldn’t be repeating the same mistakes over and over again now, would you?

Hence, if the above description sounds like you, get training from a forex mentor (or trading mentor), one that is a verified profitable trader.

If they cannot (at a minimum) provide one year of verified profitable trading results, then most likely they aren’t a good trader, and most likely aren’t a good trading mentor.

16) To Make Money Long Term, You’ll Have to Get Comfortable With Uncertainty

How do most people make their money? Via a job, yes? A job which pays you a fixed salary on fixed dates. A job which requires you to work fixed hours, wear fixed clothes, and has a lot of fixed rules.

What’s the common denominator there? Everything (by and large) is ‘fixed’ or ‘solid’. You can rely upon that, which has its benefits.

Trading by default completely up-ends that process. The markets aren’t fixed, but ‘fluid‘, constantly changing. Bull trends one day become ranges, pullbacks, or bear trends the next day. You can make $25,000 one month, and lose $2K the next.

What’s the common denominator here? Most things are not ‘solid‘ or fixed in the markets. And that will totally mess with your brain, and sense of security.

Bottom line is, you’re going to have to get comfortable with ‘uncertainty’ when it comes to trading.

However by becoming a successful profitable trader, you can put the ball back in your court. And that + financial freedom will most likely eliminate about 75% of the every day stresses you experience in your life.

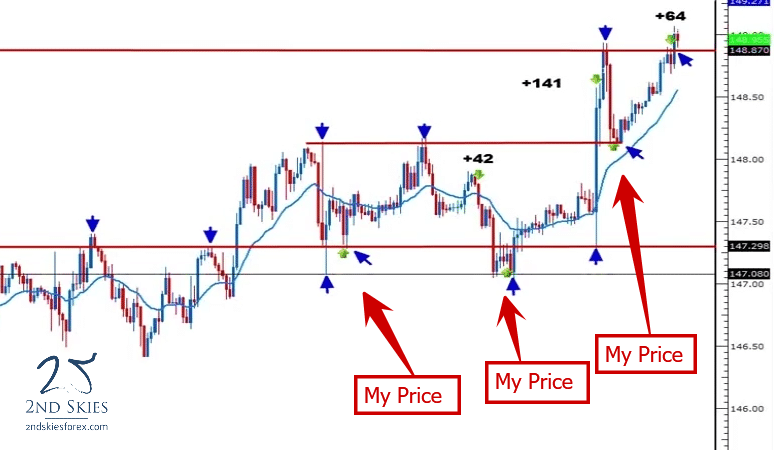

17) Always Wait For Your Price…95% of the time 🙂

If there is a trading lesson I’ve had to learn 100’s of times over, it’s this one. I cannot tell you how many times I got to the charts, noticed a trade setup just happened, and now its moving away from my entry, exactly as I had planned.

Of all the times I chased the trade and price, about 95% of the time, it came back to my price.

This is such an important lesson for 2 main reasons:

1) if the trade does come back to your price, and wins, won’t you be making more money that way? won’t you be losing money if you get in for a worse entry, and it goes against you?

2) what do you think being disciplined, and waiting for your price does to your self-image and trading mindset?

Which one of the above scenarios do you think wins? And more importantly, which one do you want to win with?

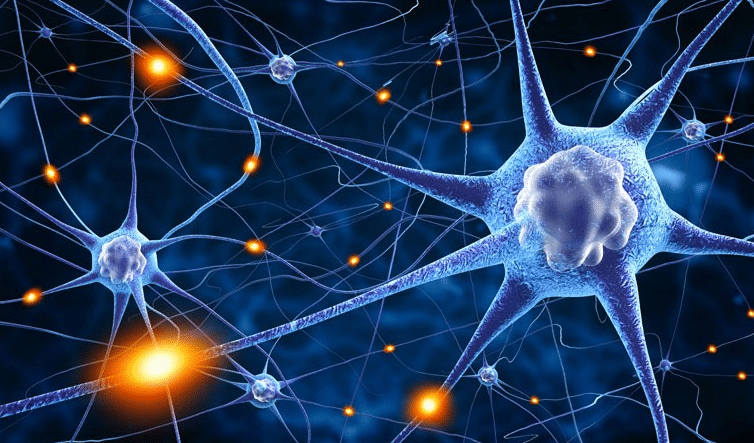

18) Your Brain Has The Tools To Make Money Trading, But You’ll Need to Re-wire It

I’m very serious about learning how the brain and mind works. Of the 50+ books I read every year, about 45+ are on the brain, mindset and meditation.

I’ve been studying neuroscience for over 20 yrs since my university days. I’ve spent the last 18 yrs meditating every day, completing a 1 yr meditation retreat and various practice progressions along the way.

There is one thing I’ve learned through all those years. That the brain, and how its wired, has the tools to help you make money trading. It also has the biases to cause you to lose a lot of money trading. Most likely you’ve already experienced this.

Now I’m guessing you’ve heard about cognitive biases? These are mental and neurological structures in your brain + mindset which cause you to make really bad decisions. A few examples:

1) The negativity bias

2) Confirmation bias

3) Fear of Missing Out

etc…

There are dozens of biases you have which will make it really difficult (if not impossible) to make money trading. Luckily, your brain also has a key feature (like hardware in your computer), that allows you to re-wire your brain to make money trading.

This feature is called Neuroplasticity. It’s how your brain can actually change its cellular and neurological structures to form new habits (i.e. habits that will help you make money trading).

What this means is, you have the ability to re-wire your brain to think and take actions like a successful trader.

The key is, you’ll have to re-wire your brain to do this, and that takes methods, applications and work.

You’ll need real practices, methods and training based upon neuroscience, cognitive psychology and a deep understanding of your brain + mind to make these changes.

Luckily this is a real thing, and my profitable students have proven this.

Hence if you want to start making money trading, you’ll have to re-wire your brain to do this consistently. And that only comes with training, practice and hard work.

Now Your Turn

What did you think of my 18 trading lessons? Did you find something valuable here and learn something new? I take my trading, and my mentoring very seriously, so please make sure to share and comment as I want to hear your feedback on this.