Trading In The Summer – Tips For Trading Forex, Stocks, Commodities and CFD’s

What You’ll Learn In This Article:

-Trading in the summer

-What are two unique factors affecting trading this summer

-What preferred strategies and instruments I’m watching this summer

As traders, our job is to constantly adapt to an ever changing environment of price action, liquidity and volatility. Trading markets in the summer often experience a decrease in volatility and liquidity whereby many professional traders go on vacation, spend time with their kids, thus affecting market liquidity and volatility.

In today’s trading article, I’m going to talk about how this summer is different for two reasons you need to understand, along with how you can profit during the summer months, adjust your trading strategies, and maximize your time + profitability behind the charts.

How Trading This Summer Is Different (Trading Insight #1)

This summer has an additional element contributing to the typical summer trading conditions.

It has the World Cup, which is only hosted every 4 years. Because of this, and being such an international event, there is extra impetus for traders to be less active and order flows to change drastically as 3-4 billion people globally are watching the games (myself included :-).

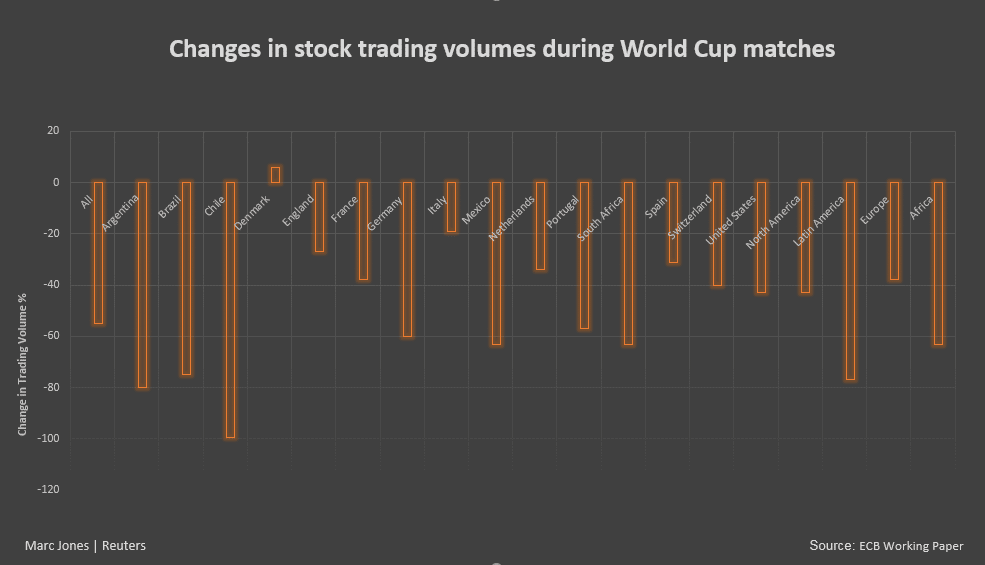

When there is a World Cup, the stats are very clear. In a research paper by Ehrmann & Jansen, during the 2014 World Cup, when a country played during normal trading hours, volumes dropped by as much as 48% in that country’s stock market. On top of it, prices tended to ‘decouple‘ from what’s happening in the global markets.

Below is a good image to show how volumes during the world cup drop (source: reuters).

Hence, when your team is playing, local stock market volumes will drop.

On top of it, when your country (or your opponent) scores a goal in your game, the number of trades goes down by 10% and will often take 30-60 mins after the game before trading volumes resume to their pre-game levels.

In this year, more than 2/3’s of the games will be during European or New York trading hours. So expect forex, stocks, futures and bond markets in both Europe and the US to be subdued (less in the US since their team didn’t make it).

And another interesting fact – your country getting knocked out of the World Cup can knock off almost 50 bps from your national index that day, while your country winning the World Cup translates into your country’s index outperforming the global benchmark by 3.5% on average, so some potential trading opportunities on both sides there.

How Trading This Summer Is Different (Trading Insight #2)

Unlike many previous summers, trading has taken on a different tone because of the events happening globally. A trade war between China & the US has spooked global markets (i.e. risk off), and the emerging market space (EM) has been quite volatile while the DM space (developed markets) has been much more muted.

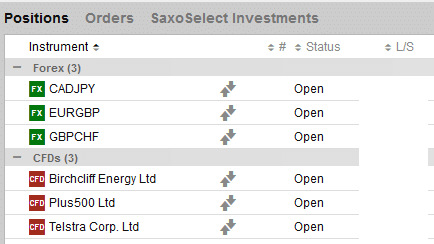

You’ll notice in our members daily trade ideas, we’ve often been holding positions or doing our price action analysis moreso outside the majors simply due to DM volatility being low while EM volatility has been high.

Below you can see my active open positions with none of them being a major.

Hence I’ve been taking advantage of the increased volatility in the EM markets & crosses to capture these large moves and changes in the price action.

With that being said, how can you use this information to help adjust your trading strategies?

Summer Trading Tip #1

With decreased liquidity as a whole, markets tend to move less. Hence you have to expect trades to take more time to play out.

Thus try to be a little more patient with your trading hold times as they may simply take more time to get to your target.

Summer Trading Tip #2

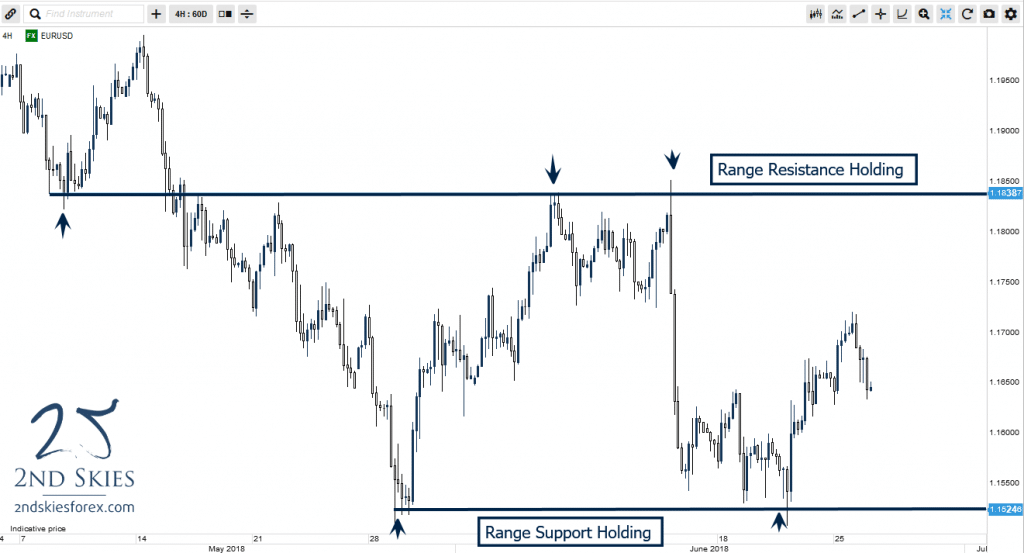

Along with tip #1, expect ranges to hold more, and trading breakouts to work out less during these periods.

When ranges hold, and liquidity is less, I avoid trading breakouts because many will fail.

Instead, I often look for false breaks which become more common during lower liquidity times, so make sure you’re watching for potential false break setups.

NOTE: If you want to learn more about false break setups, watch my video of me doing a live false break trade for +350 pips of profit.

Summer Trading Tip #3

Try expanding some of your instruments to move beyond the forex majors, like looking at the exotics and EM currencies. Some of EM forex pairs I’m watching right now are: EURNOK, USDSEK, USDTRY, USDZAR, USDMXN, USDRUB, and USDPLN.

As for the DM forex pairs, I’m currently most interested in: CAD, AUD, JPY, CHF and NZD pairs (note: 3/5 are commodity currencies).

In terms of the global markets, I’m heavily watching Russian stocks, UST’s (US Treasuries), commodities (gold, Oil), and EM bonds.

If you’d like to learn more about what live trades I’m in at any time, make sure to check in with our members daily trade ideas for updates.

And if you’d like to learn about another summer trading tip, check out another article I did on trading forex in the summer.

Now Your Turn

Did you learn something about trading in the summer? Have new options for finding high quality trading opportunities?

And the toughest question of them all – who do you think is going to win the World Cup?