How To Trade For A Living Without Much Capital

What’s inside:

-How can you trade for a living without much capital?

-I want to make 6-7 figures trading professionally, but I don’t have much capital. What options do I have?

-How can I get funded as a trader with a small trading account and little experience?

I recently got a really good question from ‘Bill‘ asking about this important topic. Bill asked the following:

“Here’s the short version: I’ve been working hard. I’m super stoked because I’m on the right side of break even after 9 months and hundreds of trades in demo account. If things keep progressing which I am confident they will how will I make real money with no serious capital to trade and the important question is where do I get it? How do I get it? Who’s capital can I trade? What are the options for a guy like me who can make 50% on his 5000 dollar account if he devotes a lot of his time and effort to watching charts etc? I guess the idea of building capital over many years from crumbs seems quite daunting. Any help and info would be much appreciated……… Thank you, Bill”

I hear ya Bill. These are all very good questions many struggling traders have asked. How can you make a living if you only have $500, or $5000 to start with? You’re certainly not going to pay off a mortgage with a 50% gain on your $500 or $5K acct. So how do you get around this, and why start trading if you only have a small amount to start with?

Before I answer these questions, I need to take one step back and clarify an important part of making money trading for a living.

My model for trading and making a living from your trading starts with a simple model:

Sim, then Demo, then Live

It basically means you start building your skills on a trading simulator. Then you start applying them to a demo acct. Then after stabilizing in sim and demo, you move to live trading with a small amount. The key focus for this last part being on ‘consistency in execution and process‘.

Once you have done that, and have a steady baseline of performance, then you’re ready to start increasing your acct size. This can either be through personal capital, or the capital of other investors.

From what it sounds like for you Bill, you’re at the 2nd stage of this process. Hence before you even get to worrying about making a living off your $5K capital, you need to stabilize in live trading first.

But let’s assume you’re there. Let’s assume you’ve been trading a small account for 6mos – 1 year and are consistent in your execution, process and discipline.

How can you trade a large enough account to make a real living from this? How can you trade professionally for a living by starting with a small account?

There are several components you’ll need to start getting capital which I’m going to list below.

#1 – Get Your Trading Results Verified

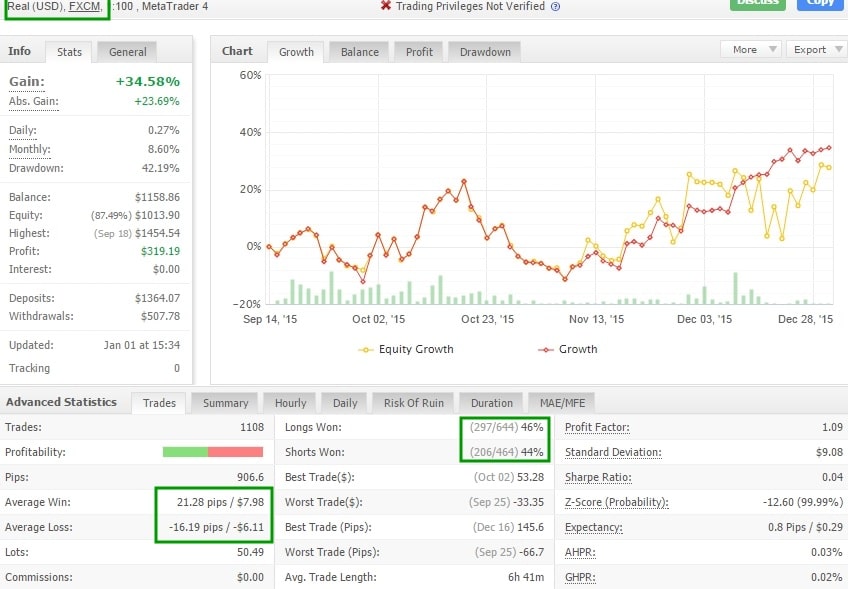

For your live account trading, you’ll want to get your trading results verified. I shared my verified profitable trading results here.

For you, there are many ways to verify your performance, such as:

1) Have your accounting firm audit your results and give you a document that is stamped/dated by them, the accountant who performed the audit, and the results of your performance listed on this document.

Not all accountants are trained to do this, so you might want to seek one of the big accounting firms for this (PWC, Deloitte, E&Y, KPMG, etc).

NOTE: Getting an audit can be quite expensive, sometimes up to $50K depending upon how much trading activity you’ve done. If you’re a day trader, expect it to be more expensive since you have more trades that need to be accounted for.

I’d recommended this if you have a) a large account, b) are looking for serious capital ($1MM+), and c) are courting serious/accredited investors.

If that’s not you, then you can use the cheaper (free) and simpler option #2 such as myfxbook or fxblue. Assuming your platform works with those services, you can connect your trading acct to them and they’ll analyze the data and verify it for you.

This is what most traders with small accounts (under $100K USD) should be considering, and other than your time, it’s free.

#2 After Verifying Your Results, It’s Time to Get Capital

Luckily there are many services and sites that have capital and are looking for traders. In this current investment climate, people are looking for traders with consistent risk management, a risk of ruin at zero, and solid returns.

Here are a few sites/services below that offer various methods to get you capital:

#1) Fundseeder (started by Jack Schwager)

Summary: Jack has great industry connections and a decent platform/services to help you get investors to invest in your trading and track record (which you’ll have to establish first with a live trading account).

You get connected into their system, trade away, and the platform will start to expose your trading to investors that are interested in investing with you.

Image: Jack Schwager (Author: Market Wizards)

#2) Etoro

Summary: A social trading platform that allows traders to trade demo or live, and have their trades copied by other traders. You get a % of the fees for each ‘copier/investor’ that signs up and follows your trading.

Keep in mind, no really good trader would choose this long term, because it means investors with large accounts can invest a very small amount in ‘copying’ your trades, then mirror/copy those same trades in a larger account. So you’re missing a huge portion of the pie by taking this route, but it’s a good place to start.

#3) Join A Funded Trading Program

There are many programs out there that have capital and training resources to help you become a profitable trader. They generally offer a suite of products, platform and training resources, and once you prove yourself to them, they’ll fund you.

In Closing

The most important thing is not to focus on the problem (“I don’t have much capital to start with”), but instead – focus on solutions. This is what a successful mindset does.

You not having a lot of capital to start with isn’t an issue. If you can trade, and you can manage risk, you can get capital. Capital is always looking for places to park and generate a return. There’s more than enough capital out there for you to trade. You just need to find the right outfit, program and investors for you.

I hope I answered your questions ‘Bill’, and to you all as well reading this who’ve wondered what Bill emailed me about.

This is a very important topic, but one that has many options and solutions for traders like yourself looking needing capital to trade for a living.

Any questions? Message me directly via my contact form here.

Until then, all the best and may you find real confidence and progress in your trading.