What Kind Of Forex Trading Strategies Do You Use?

A question I got today from one of my facebook followers said “Hey Chris, what kind of forex trading strategies do you use and how do you use them?” This was too big a question to dole out over my 2ndskiesforex facebook page, so I decided to write a short post about this.

What Forex Trading Strategies Do I Use?

Although I use the same strategies I do for all markets, these are the ones I use for trading forex as well, which can be grouped into two main classes:

Price Action & Ichimoku Cloud Trading

Regardless of the asset class, I trade price action and ichimoku cloud trading, however I use them both differently to some degree which I’ll clarify.

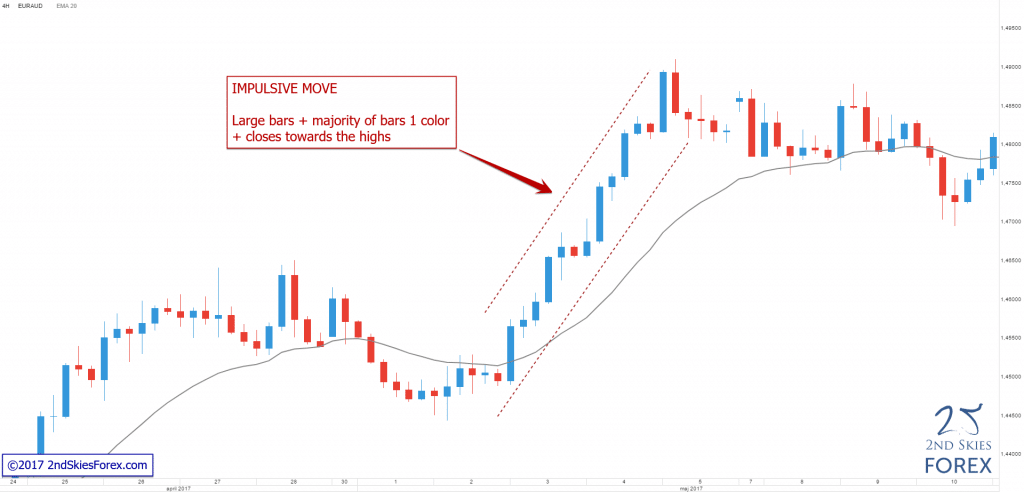

Price Action Trading

As a whole, I’m always using price action because I consider it to be a ‘core’ or fundamental skill. I am always using my price action skills regardless of the instrument, asset class, time frame or environment.

So I can be trading price action strategies on the 1 minute, 3 minute, 5 minute and 1 hour time frames for day trading, or the daily and 4 hour time frames for swing trading. I can be trading price action on forex, futures, stocks, commodities, global indices, CFD’s, forex options – you name it. And I’m always using my price action skills in any environment (trending, ranging, choppy or clean).

It is such a fundamental skill – very much like a good football player is using footwork, that I’m always using it and applying these skills on every chart.

Make sure to notice my use of the word ‘skills‘ here. It’s important you understand why I’m using that (which I’ll elaborate more on later).

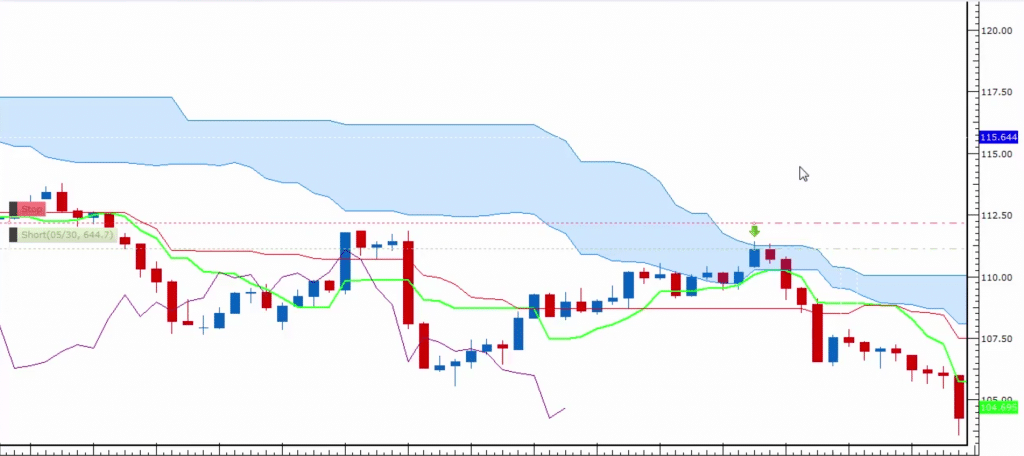

Ichimoku Cloud Trading

Ichimoku cloud trading as a whole is what I consider a more ‘specialized‘ skill, so I’m not using it on every chart, and am applying it in a much more specialized way. I don’t consider ichimoku to be a core skill, but I do consider it to be a powerful one when understood and used properly. Ichimoku will give you a unique perspective on future support and resistance levels, what the underlying momentum is (strong, medium or weak), what the current ichimoku wave structure is like (and will likely look like in the future), where are potential turning points, etc.

I apply ichimoku pretty much on any instrument, however one main difference is I don’t really trade it on lower time frames, so any time frame below the 1 hour chart. That is because my testing really hasn’t found it to be stable enough on lower time frames.

Is it possible you can use on those lower TF’s? Yes, but I haven’t found a consistent skillful way to do it over time. The time frames I trade ichimoku on are the 1 hour, 4 hour, daily, weekly and monthly.

So in essence, I’m using it for more short term swing trading, medium term swing trading, and for some long term trend changes to capture some really large moves, moves that may take months to fully deliver, but could often be in the 500-1000+ pip plus range. The longer moves often add a second income through the carry trade, so an opportunity for two incomes on the trade.

Getting Back To Skills

If there is one thing I’ve learned which has separated me from most trading mentors, is that, just like great athletes focus on continually building their skills, I focus heavily on building trading skills.

I’ve seen some forex trading mentors churn out trading strategy after trading strategy, sometimes 20+ over the years. However if you notice, the strategies they came up with 5+ years ago they are not using today. Meanwhile, I am still using many of the same strategies from the last 5 years, and they’re still effective as I’m a verified profitable trader.

What’s the difference between me and the strategy churners?

My core focus is on trading skills because trading is a skill based endeavor. It’s not a ‘strategy’ based endeavor, but a skill-based endeavor. When you realize this, you’ll see a major change in your mindset. You’ll start thinking like a millionaire trader.

If you have solid trading skills, you’ll be able to adapt to any market, and the market is always changing. This is why so many struggling traders fail to make money. They think short term. They think they only need a trading strategy to make money in the markets.

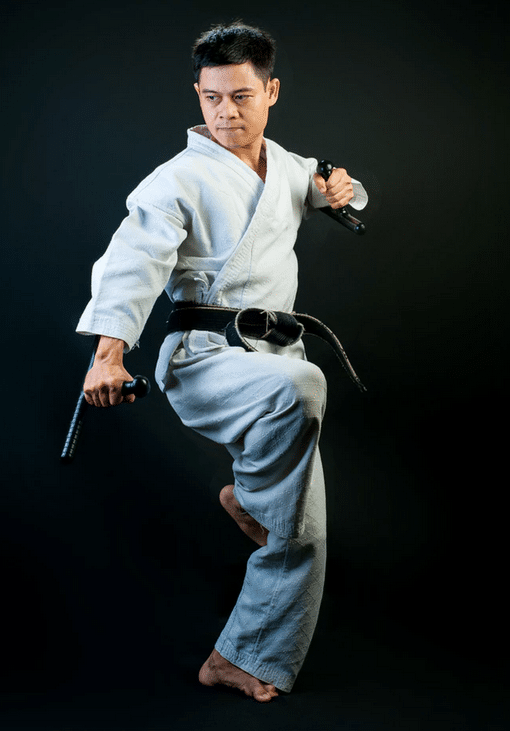

Think about it like this: would you ever walk into a martial arts school, and ask them “Can you give me a martial arts strategy for beating up someone 6’3″ tall?” Of course not, because there would be no one strategy for that person, and even if the sifu could give you one, without the proper skills to execute that strategy (stance, footwork, punching/kicking technique, muscle memory, strength, speed, accuracy, etc.), it would be completely useless.

The path to becoming a black belt in any martial arts is paved through building skills.

Hence, if you’re just thinking you need a winning strategy to make money trading – you’re using the wrong approach. What you need are trading skills that work on at least one instrument or asset class across multiple environments, and ideally across all time frames. If you have that, then you’re adaptable and have a set of skills which allows you to handle all the environments you will encounter.

Hopefully you can now see why a profitable trading strategy alone is insufficient to make money trading long term.

So there you have it – those are the two forex trading strategies I use every day when I’m trading the forex market (along with trading stocks, futures, options, commodities, global indices and CFD’s).

I didn’t get into any specific price action or ichimoku strategies. If you want to learn more about my specific trading strategies, you can check out my price action course, or my ichimoku course where you will learn exactly how I trade those strategies day in – day out.

I hope you enjoyed this trading article. Don’t forget to leave a comment sharing your thoughts below.

Until next time, may you find real progress in your trading performance and mindset.