6 Trading Statistics Every Forex Trader Should Know

To make money trading forex (or any market for that matter), you’re going to need statistics to improve your trading performance. When it comes to improving your trading performance, 9x out of 10, you should be choosing data over opinions.

I’ve trained thousands of traders, and often times, the difference between winning and losing money came down to one data point or statistic, and at most 2-3.

In today’s trading article, I’m going to share with you 6 trading statistics every forex trader (and all traders) should know. Let’s jump in…

Trading Statistic #1: You Better Have This

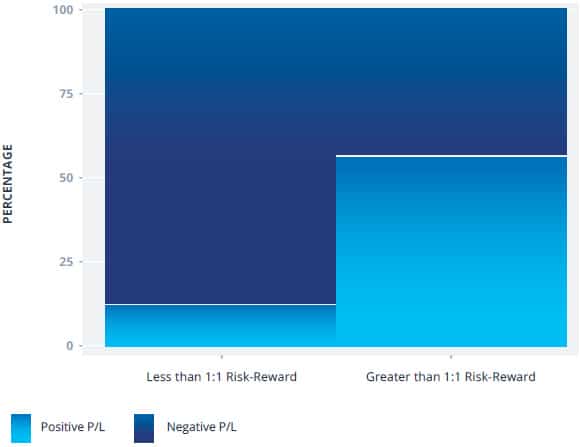

In a highly fascinating study, FXCM did an analysis of traders who had negative risk:reward ratios vs traders who had a 1:1 risk:reward ratio or higher.

For those of you who don’t know what the risk to reward ratio means (risk:reward), it basically measures the money at risk on your trade vs your potential reward. To give a few examples:

- If I’m risking $1000 on my next trade, and my take profit is at $1000, then I have a risk:reward of 1:1

- If I’m risking $1000 on my next trade, and my take profit is <$1000, then I have a negative risk to reward ratio, meaning I’m risking more than my potential reward

- In contrast to that, if I’m risking $1000 and my take profit is $2000, then I have a positive risk:reward ratio of 1:2

Getting back to the FXCM study, they found that trading strategies with a negative risk:reward (i.e. <1:1) had only a 17% chance of making money trading.

Meanwhile, if a trading strategy had a 1:1 risk:reward ratio or higher, they had a 53% of making money (see image below).

Another way to put this is: if your trading strategy has a negative risk to reward ratio, you have a 300%> chance of losing money vs a trader who is using a even or positive risk:reward ratio.

You should now be realizing two important things when it comes to setting profit targets and building a trading strategy:

#1: Make sure you minimally target a 1:1 risk:reward ratio on every trade

#2: DO NOT sacrifice your risk:reward ratio (and take it negative) just to increase your % accuracy

Trading Statistic #2: Risk of Ruin

Originally designed for casino games, the risk of ruin (RoR) is one of the most important trading statistics you need to know. To put it simply, the RoR will mathematically tell you in one statistic whether you are going to make money or blow up your account.

The risk of ruin statistic basically looks at your overall payoff ratio (or Avg.+R per trade), your % accuracy and your % risk per trade. Over a sufficient number of trades (100 or more), you can determine your risk of ruin and know – based on your current trading strategy, whether you will make money, or blow up your trading account.

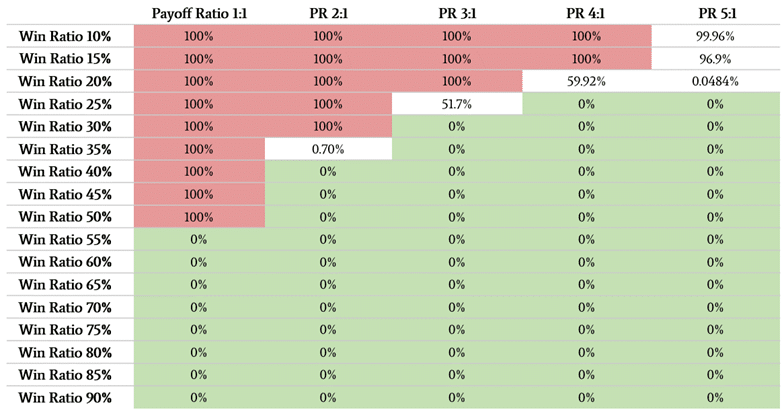

Below is a table showing the risk of ruin statistics using 1% risk per trade, and measuring various payoff ratios and accuracy %’s.

If the box is red, you have a 100% of blowing up your acct. If the box is green, you’re going to make money trading. The number inside the boxes tells you the % chance you will blow up your account.

What you’re looking for in your RoR is 0, meaning you have a 0% chance of blowing up your account. Hence, if you want to make money trading, you’ll need to know your risk of ruin.

NOTE: We have a FREE risk of ruin calculator which you can use by clicking on the link

Trading Statistic #3: Trading Strategy Durability

The durability of your trading strategy is critical. This is because the markets are always in flux, which also means your accuracy %, and thus your performance will always be in flux.

Most profitable trading strategies operate within a range. So if your trading strategy is 60% accurate (on avg.), due to winning and losing streaks, you’re trading strategy is likely to fluctuate in terms of accuracy (~between 50% and 70% accurate).

Hence it’s important to have a strategy that can under-perform, yet still have enough margin of error to make money trading.

Now using the risk of ruin table from above, do you notice any patterns when it comes to profitability? When you go further to the right on the top/horizontal axis increasing your payoff ratio (or Avg.+R per trade), you’ll notice the number of ways you can blow up your account decreases, while the number of ways you can make money trading increases.

Another way of stating this is:

You have more ways to lose money at lower payoff ratios, and significantly less ways to make money trading.

The obvious correlate to this is:

The greater your payoff ratio, the more ways you can make money trading, and thus have a smaller window to lose money.

In short: try to build a trading strategy with a payoff ratio > 1:1. You’ll have a much easier time handling draw-owns and recover faster when you get back on track. And that = more durability.

Trading Statistic #4: Most Beginning Traders Are Poor Learners

Being that we have over 10,000+ students in our trading courses, we’ve been able to collect a lot of statistics on our students, particularly when it comes to trading performance, and how they train.

In deciding to conduct an internal study on how our students train and learn in our online trading courses, we found dozens of fascinating statistics. But one pattern we noticed is that most beginning traders are poor learners and have bad learning habits.

Why do I say this?

When students buy one of our online trading courses, one of the first things they receive is a welcome email. In this welcome email, we explicitly instruct them to watch the welcome video 1st because it contains key information on how the course works, what training models we find best and how to best use our trading methods.

How many students actually watch the welcome video? <20%. And how many students actually watch the lessons in order? 27%. From this, I think we can make the conclusion that most beginning/struggling traders are poor learners.

Now ask yourself this: do you normally just read books out of order in terms of chapters? Do you try to skip belts and skills when training in martial arts or learning to play an instrument? No, so why do you do this when it comes to learning how to trade?

There are many likely reasons, but the lesson should be clear: don’t sacrifice your learning process by letting your impatience win the day. Doing so decreases the chances of you making money trading.

Trading Statistic #5: Proper Risk Management

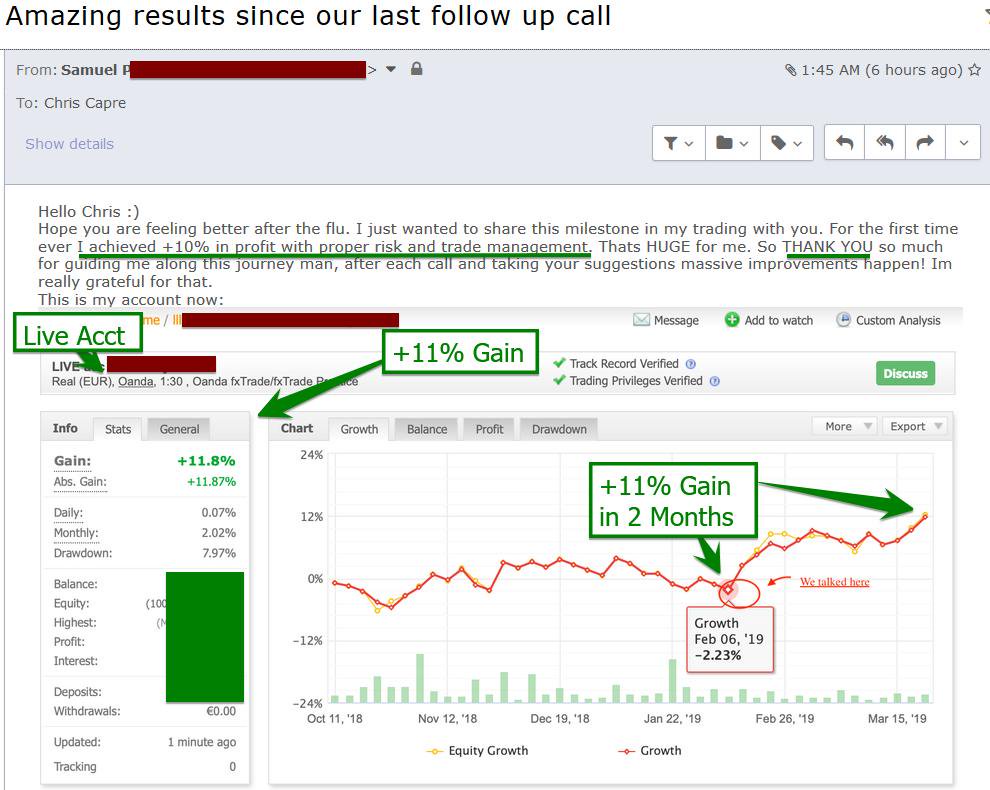

For my price action course members, they get a free skype analytics session with me whereby I analyze their trading performance over a number of trades, and help them find ways to make more money trading.

Many times, after 1-2 sessions, the student turns profitable. I recently shared an example of this on my twitter account with the student making +11% profit in 2 months.

Now out of the 1000’s of trading accounts I’ve analyzed from my students, how many of them are using consistent risk management on our first call? <30%! What I mean by ‘consistent risk management‘ is risking the same % equity per trade.

NOTE: To learn why we recommend a fixed % risk management system, hit that link.

To put it simply: if you’re not risking the same % equity per trade, then you could be risking more on your losses (and thus losing more), while risking less on your wins (and thus winning less).

That is outright masochistic. If you want a surefire way to blow up your account, constantly change the risk % per trade and just do what you want. However, if you want to bypass this avoidable pain and suffering, make sure you have a consistent risk management system and fixed % risk per trade.

Trading Statistic #6: How to Absolutely Fail At Trading

Over the last 12 years, I’ve gotten to review thousands and thousands of my students accounts, statistics and trading performance. I’ve taught many students to make money trading and become consistently profitable traders.

How many of my students were able to make money trading without proper risk and money management? ZERO! No explanation needed.

Hence, if you absolutely want to fail at trading, then just risk what you want without any data, math or statistics to support your decision.

In Closing

If you want to make money trading, you’ll need to know your stats and understand what the data is communicating about your trading performance. There are many ways to get sufficient data and statistics about your trading performance. Two free services you can use are myfxbook and fxblue.

I’d suggest getting your account connected to one of those services and looking at your data to see where you’re at. This will help give you a partial roadmap of how to become a profitable trader.

But beyond getting the stats, most likely you’ll need an experienced trader and trading mentor to evaluate your performance, and give you quantified feedback on how to improve your trading. That + the feedback and guidance they can give you to correct your trading mistakes can often be the difference between winning money, and losing money trading.

If you’d like to get actionable guidance on how to become a better trader, click here to join my price action course, giving you access to me, the members trade setups forum, and over 60 hours of trading lessons to improve your performance.

With that being said, por favor make sure to share your feedback with a comment below.

Until then, may you find real progress in your trading performance and mindset.