Options Trading 101

What is Options Trading?

When you are trading stocks or currency pairs in the forex market, your trading is very straight forward. In stocks, you are either buying or selling a stock. If you buy a stock and it doesn’t go anywhere, you make no money (assuming there is no dividend on the stock).

When trading options, you can make money if the stock goes up, down or goes absolutely nowhere. Options also allow you to hedge or decrease risk on stocks in your portfolio.

This is just one of the many ways options are a totally different animal vs traditional stock buying/selling.

When you buy or sell an option, you are not trading the underlying directly. You are not actually buying the stock itself, so you are not owning the shares directly. However you are trading their price, direction and value very much the same.

In addition to this unique form of trading, if you buy a stock, you want that stock to go up in value or down in value if you have shorted the stock. However, with options, you can make money if the stock goes up, down or doesn’t move at all which is a very unique property of options.

Contract Between Two Parties

When you’re buying or selling options, you’re essentially buying or selling a contract between two parties (the buyer and the seller).

Let’s go through an analogy which will make it easier to understand.

If you own a car in the US, you legally have to have insurance on that car. The insurance policy protects you with certain accidents, liabilities, etc. When you buy insurance, you are buying it from an insurance company who is authorized to sell that insurance policy.

You pay them a monthly ‘premium’ and they offer you coverage. In case you didn’t know it, insurance companies are highly profitable businesses because they are typically selling you insurance at a greater cost than the actual value they most often provide.

Hence the ‘premium’ (i.e. insurance policy) they are selling you is more expensive than it should be.

With options trading, the ‘buyer’ of the option is like the car owner wanting insurance. The ‘seller’ is like the insurance company. Except the only difference is, with options trading, you don’t need to be an insurance company to sell an option, you just need the necessary capital to cover that option.

Thus, if you buy an option, you pay a ‘premium’ (like you do with your car insurance). If you sell an option, you collect that premium from the moment you enter the trade, which is called a ‘credit’ that you receive for selling the option contract.

Now this sounds great as you can (like the insurance company) collect that premium, and thus collect a regular income by selling options. However, you must be able to honor those obligations in the option contract if the counterpart (the buyer) ‘exercises’ the option.

We’ll cover later the process of ‘exercising’ and ‘assigning’ which is a more advanced concept. For now, just make sure to understand that you can now (with options trading) take both sides of the transaction, but you do so as a buyer (payer of premium) or seller (collector of premium) for said option contracts.

Advantages to Trading Options

Below are what I consider to be the main advantages to trading options:

Leverage & Margin – when you trade options, you get more leverage than if you traded the underlying directly because every single option contract controls 100 shares of the stock.

Market Neutral Strategies – if you buy a stock or forex pair, you want that stock/pair to go up in value. You make no money if it goes nowhere in price, and lose money if it goes down.

However when trading options, you can actually make money if the stock or pair goes absolutely nowhere in value. These are called ‘market neutral’ strategies, meaning they make money if the price of the stock/pair goes nowhere.

Pretty cool eh?

Neutralizing Risk – how many times have you bought a stock, the price goes against you, but you still want to hold your position? Probably many…

But what if you wanted to ‘hedge’ your position (i.e. neutralize or reduce) the risk in your trade?

Options are one of the best ways to do that because you can be long a stock and yet buy (or sell) an option which will either a) reduce your downside risk if your trade goes against you, or b) give you money for selling an option against your trade.

Collecting Premium – as mentioned before, if you buy a stock, you do not get ‘paid’ to enter that position. However, with options (particularly selling option contracts) you collect a premium, and thus get ‘paid’ to enter the trade.

Unlimited Upside – there are many options contracts where the upside potential for profit is unlimited. This requires a greater understanding of options contracts, pricing, etc., but there are situations where your potential upside is unlimited.

Fixed Risk/Profit – along with the point above, there are also option contracts you can trade that have fixed risk, along with a fixed amount of profit you can make, no matter how much the stock or pair moves for or against you.

Put/Call Ratio – one of the great things about options is your options broker should give you access to the put/call ratio. This is the ratio of traders buying calls (bullish option trades) vs puts (bearish option trades). This in essence gives you an insight into the order flow and sentiment of a particular stock by seeing the ratio and how those options were traded on that stock.

Making Money With The Price Not Hitting Your Target – yep, you heard that right. Because of a unique feature about options pricing, you can actually make money without the stock price hitting your target on your option (called the ‘strike price’).

Implied Volatility – a concept you will learn about in options is ‘implied volatility’ which is a measurement which reflects the markets ‘view’ that stock XYZ will change over time. Essentially implied volatility is the market’s projection or forecast of a likely movement in the stock price.

Implied volatility usually increases in bearish markets and decreases in bullish ones, but this is not fixed. This gives you an advantage because it gives you a relative ‘insight’ into how much the overall market thinks stock XYZ will move over the life of that option.

Disadvantages to Trading Options

Don’t get to own the actual shares – when you are trading options, you don’t actually own the shares as you’re trading a contract on the shares. Hence any dividend or shareholder access you get by owning the shares are not available when trading options.

Can have unlimited risk – while we mentioned the possibility of having unlimited upside, there are some options that expose you to unlimited risk.

Lesser liquidity – unlike stocks, options trading is definitely less liquid. For the larger and mid cap stocks, you most likely won’t have any issues of finding a buyer or seller for your option trade. However not all stocks have options on them, and some that do have much less options to trade than actual shares.

Spreads – because stocks have greater liquidity, they more often have tighter spreads due to the increased liquidity. Options (having lesser liquidity) thus often have wider spreads.

This is not always the case, but it’s definitely a potential out there for option bid/ask spreads to be wider than the actual stock itself.

Time decay – if I own a stock, and the stock hasn’t hit my stock price, if it takes a day, a week or a month to hit my profit target, I still make the same profit.

However, with options there are times where the longer it takes to hit your profit target, the less money you make. This is called ‘time decay’ which we’ll explore later. Time decay can actually work to your advantage, but it can also be a negative.

Complicated – and lastly, as you might have guessed, because of the increased complexity in trading options, the learning curve can be steeper. Options inherently are more complicated than simply buying/selling stocks or forex pairs.

Buying & Selling Options

You can be an option buyer or an option seller. What this means is you can be a call buyer (bullish on stock XYZ) or a call seller (neutral to bearish on stock XYZ). You can also be a put buyer (bearish on stock XYZ) or a put seller (neutral to bullish on stock XYZ).

You can always be an option buyer or seller of option contracts depending upon your view of XYZ stock and where you see the stock going in the future.

Option Premium

All option contracts have a ‘premium’ for those who want to buy it. Just like if you want to buy your car or fire insurance, you are a buyer of car/fire insurance and have to pay the ‘premium’ of the contract to the seller of the insurance. Options are exactly the same as the insurance analogy.

If you want to buy a call on XYZ stock (e.g. you are bullish) then you will have to pay a premium. In essence, you have to pay a cost to buy that call option and contract.

If you are an option seller of the call on XYZ stock (e.g. you are bearish or neutral) then you collect the premium the option buyer will pay for the call option.

Option premiums are paid up front, so if you buy a call or put, you pay up front to enter the trade. The option seller collects the premium up front once they sell the option contract to the option buyer.

Premiums are calculated based upon price of the stock (or underlying), price in relation to strike price (we’ll explain strike prices shortly), length of time for the option contract and volatility.

You don’t have to calculate premium as all brokers will do this for you.

Premiums are priced based on dollars and cents. So if the premium you have to pay to buy XYZ stock is $2.10, then you will have to pay $2.10 x 100 shares (as all option contracts control 100 shares of the stock) which = $210.

If the premium is priced at $.45, then you will pay $.45 x 100 = $45.

If you sell a contract at $2.10, you will receive $210 credit (per option contract). If you sell an option contract for $.45c, then you will receive $45 (per option contract). Hence this is how you understand option pricing and premiums.

The Option Strike Price

All option contracts have a strike price. The strike price is the price the option contract can be bought or sold when exercised.

Only option buyers can ‘exercise’ options. When they do, the option is ‘assigned’ to the option seller.

For call options, the strike price is the price the stock/underlying security can be bought at by the option buyer, whereas for put options, the strike price is the price whereby the security or stock can be sold by the put buyer.

For example, if stock XYZ is currently at $40, and you are wanting to buy a $45 call option on XYZ stock, you need the stock to rise above your $45 strike price by expiration to profit. The strike price is what you can buy the stock at even if it rises above your $45 strike price. This means if XYZ stock closes at $50 by your expiration date, you can buy stock XYZ at your $45 strike price, and profit from the difference between your $45 call strike price and the current price of the stock ($50), thus profiting $5.00 per share.

The Option Expiration

All option contracts have expiration dates. This is a major difference from trading spot forex or stocks. When you buy a stock, there is no date you have to exit the trade. As long as it doesn’t hit your stop loss or take profit, you can remain in the trade indefinitely.

With options, all option contracts have an expiry date, so you have to learn to time your trades and where you think they will be (or can be) by the expiration date of the option.

Traditional option contracts are what we call ‘monthly’ options, meaning they expire at a fixed date for the month which is usually the 3rd Friday of each month.

The key thing to understand about the expiration date is that your option has to hit its price by the expiration date to profit from your option.

For example, if you bought a $50 call on XYZ stock to expire September 18th, and on September 18th at the market close, the price is $49.99, your call will expire worthless since it didn’t achieve its target ($50) by the expiration date.

Hence think of the expiration date as the final date your option contract is valid for and can profit from. If you have an option in profit before the expiration date and you were the option buyer, you can exercise the option for profit before the expiration date.

ATM, ITM & OTM Definitions

Now that we’ve covered the expiration date, it’s time to cover the terms ATM, ITM and OTM.

ATM = At The Money, and it essentially means that the current price of the stock is at the money of your strike price.

ITM = In The Money. This means that the current price of the stock is in the money of your strike price.

OTM = Out of The Money which means the current price of the stock is out of the money of your strike price.

For example, if you buy a call on XYZ at $50, and the stock price is currently around $50, the option would be ‘at the money’.

Using the same example, if you buy a call on XYZ stock at $50, and the stock is anywhere above $50, then the option would be considered ITM or ‘in the money’ because it’s a profitable option (hence ‘in’ the money, or profit).

For OTM (out of the money) options with our same example, if you have a $50 call on XYZ stock and the price of the stock is below $50, then the option would be considered ‘out of the money’ because it’s not profitable, therefore ‘out’ of the money (or profit).

Options P&L Charts/Diagrams

The last key component for understanding options is the option P&L chart. It’s what helps you evaluate the option contract and at what prices the option would be in profit (and by how much) or not.

They are simple tools to help you analyze your option strategy or trade.

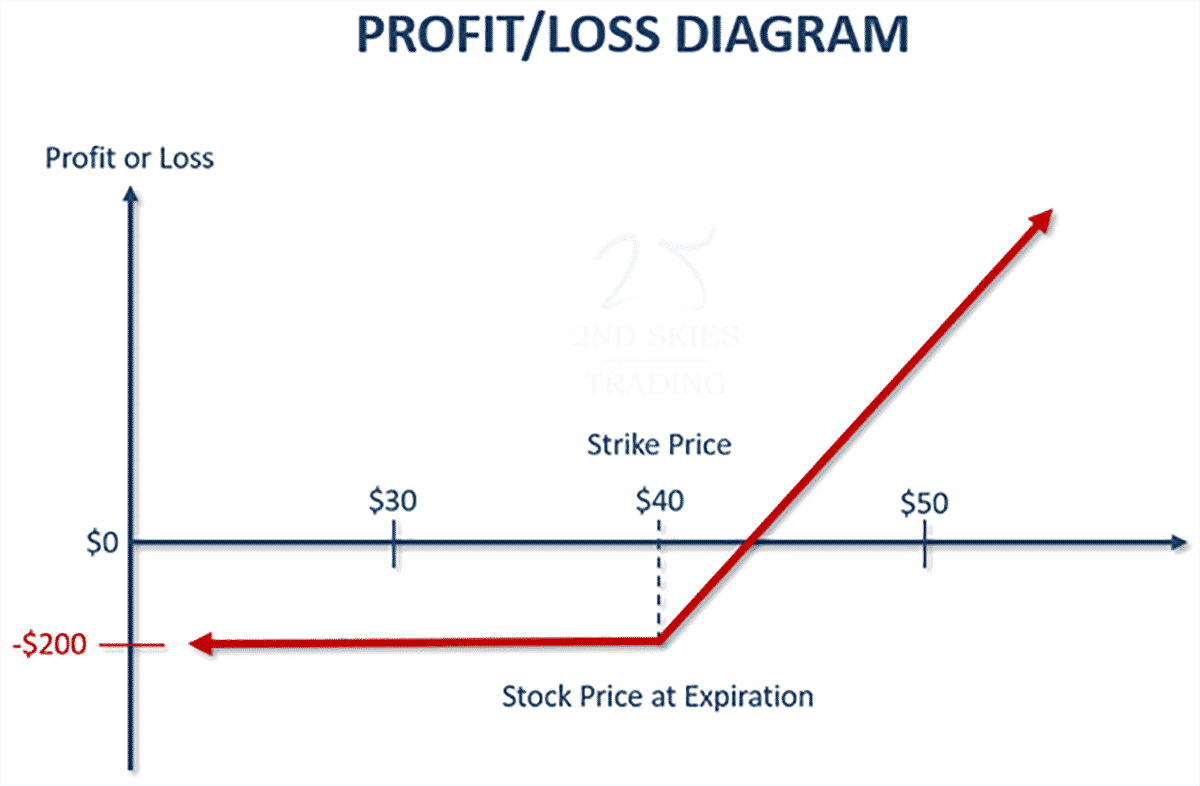

Let’s look at the following P&L diagram below and analyze it in detail.

Looking at the chart above, you’ll see an x-axis/line which represents the stock price at expiration. You can see the $30 strike price, $40 strike price, and $50 strike price.

The y-axis/line represents the profit and loss of your option. So anything above the x-axis will be in profit and anything below the x-axis will be in a loss.

Now this chart is what a call option looks like in terms of P&L.

Since the line starts at -$200, it means that you bought the call option on XYZ stock at $40 for $2.00 per contract. In this case, you bought one option contract since your option cost you $200 ($2.00 x 1 contract).

Since you bought the option contract, you’re max loss is what you paid for the option (i.e. $200). No matter what happens to the stock price from here, you cannot lose more than $200.

Now if you notice the red/orange line starts to ascend and crosses the x-axis at $42. This is because you bought the $40 call for $2.00, so you need the price of the stock to climb above $42 to make a profit. The call is at $40 and the cost of the option is $2.00, hence the stock has to climb $2.00 above your $40 call strike price to profit.

The line also ascends up towards infinity, because technically, that is what you can make in terms of profit as the stock rises above $42. Whatever price the stock closes above $42 at expiration is what you will profit.

So if the stock closes at $45, you will profit $5.00 from your $40 strike price minus the cost of the option ($2.00). This means you will profit $3.00 per contract x 100 shares.

For one option contract, that will = $3.00 x 1 contract x 100 shares = $300 profit.

The key points to understand about the option P&L diagrams is the x-axis will always represent the strike price at expiration and the y-axis will represent the profit (if above the x-axis) or loss (if below the x-axis).

In Closing

Make sure to review everything in this article in detail. How well you understand these components will determine how well you can trade options, as these are the primary pieces of the puzzle you need to understand to quantify and fully understand for your option trades.

Be sure to read our article on Calls & Puts next.