Ode To The 4hr Charts…

I want to share with you some results and tell me if you think these would be considered professional grade, or highly impressive to say the least;

110% gain for 2011

124 Trades, 74 winners, 50 Losses

59.67% Accuracy Rate

Largest Win: $14,360

Largest Loss: $8,180

Max Win = 43% larger than Max Loss

Max Consec. Wins: 16

Max Consec. Losses: 6

Max Consec. Win Streak 2.66x Larger Than Max. Consec. Loss Streak

Largest Trading Position: 1M

Overall, this could make the grade for a professional trader. In fact, I know many that did worse (a lot worse) then him and would be happy with his results.

The 4hr Charts

There has been a lot of talk and garbage being spoken about trading off the 4hr charts, how its trading as a hobby, how you’ll only be an amateur, how if you want to be a professional trader, you need to trade off the 1m, 5min, 15m, smaller time frames. Ridiculous, but we are going to demonstrate why.

I’ve been wanting to show people the power of trading the 4hr time frames for a while. Although I have many students doing it, nobody is solely trading off the 4hr. They usually add the daily, or 1hr and have a mix of time frames and systems. In comes Tony.

Do you remember Tony? I wrote about him in the Pyramid of Trading article whereby I talked about him back in early Oct. At that time he was up 76%, and ended the year up 110%. Meaning, he gained another 34% in the last three months – impressive to say the least.

Tony had one thing going for him which was the best edge one could have – discipline. Tony had very little experience, no business/finance degree, just a desire to learn, patience and discipline. He came to me in late 2009 wanting to take some private mentoring sessions.

I taught him less than a handful of systems which he learned well and practiced on in 2010. By the end of the year, he settled on his two favorites:

Price Action

& my Shadow System.

He learned his risk parameters, his style, how he wanted to trade, what was the best pair for him, then went for it. He settled on trading the AUDUSD only on the 4hr time frames using those two (Price Action & the Shadow System).

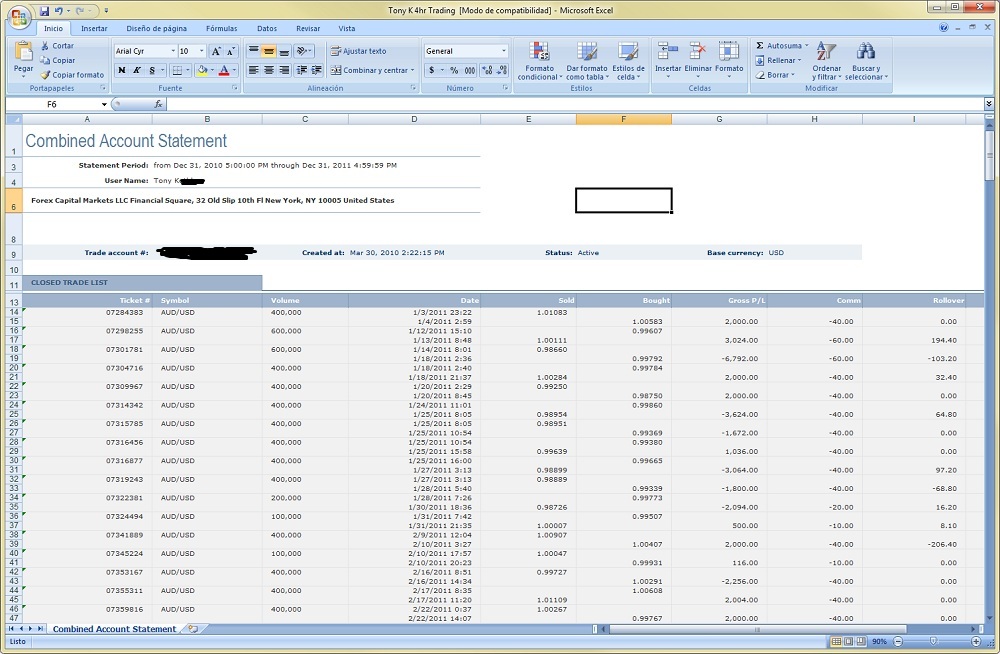

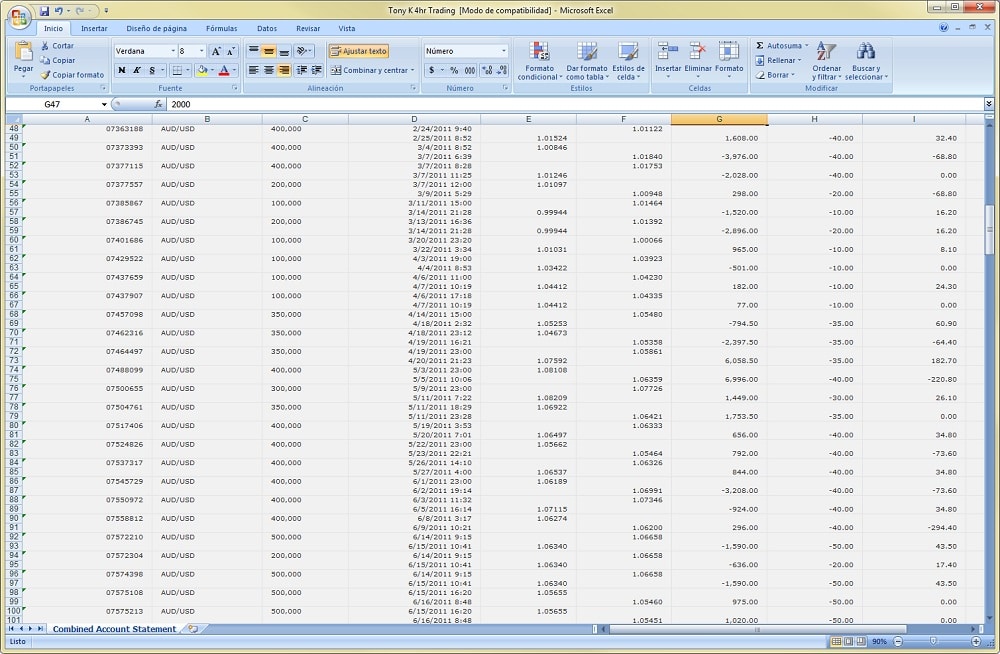

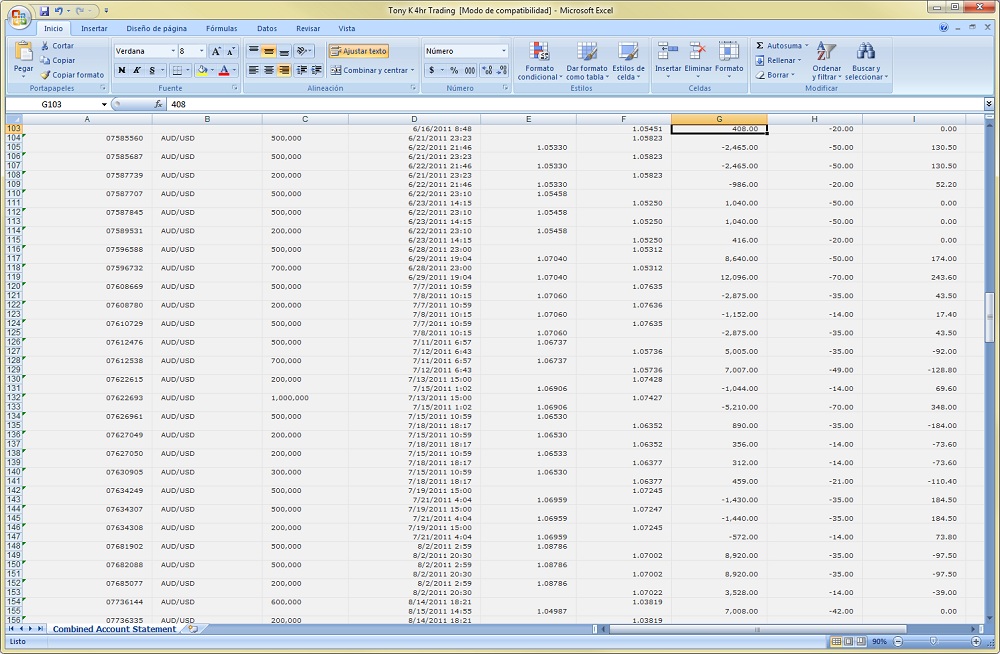

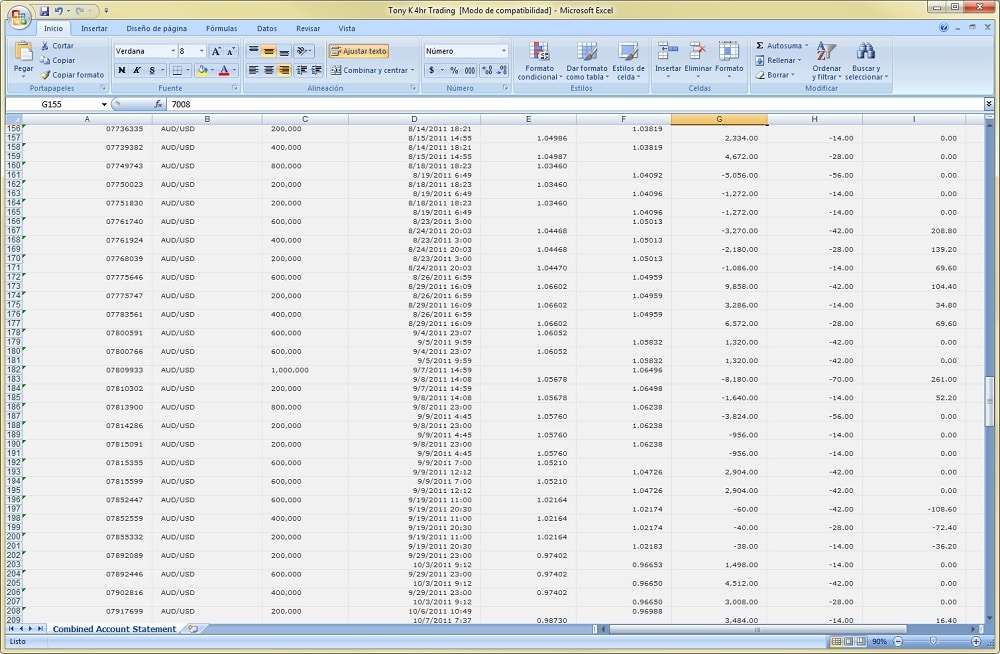

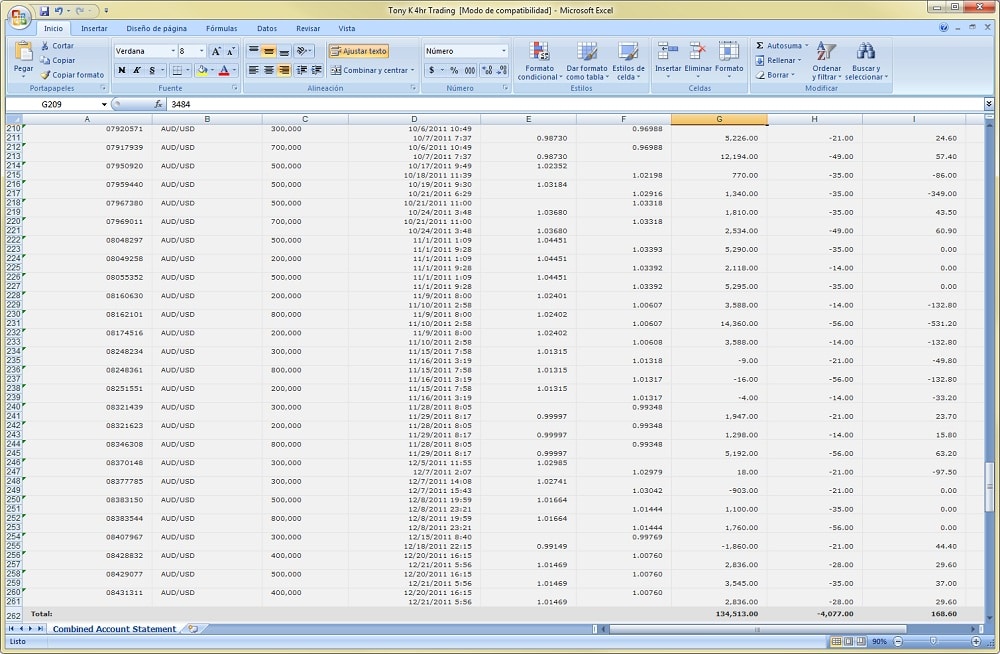

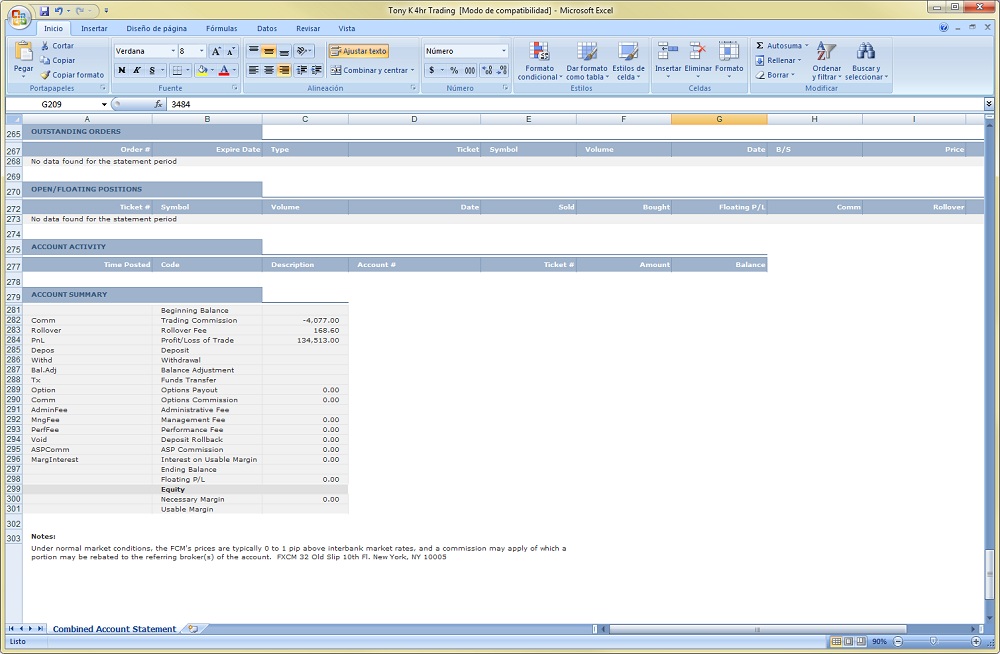

I am going to show you his entire trading report, which averages about 10-12 trades a month with the max being 16 and the least being about 8. You already have the stats above so lets show you the entire trade history for 2011. I have covered his personal details and acct number to protect his privacy, but all the trading is there which you can see below.

Screenshot 1

Screenshot 2

Screenshot 3

Screenshot 4

Screenshot 5

Screenshot 6

So there you have it, an entire year of trading. To recap his performance;

110% gain for 2011

124 Trades, 74 winners, 50 Losses

59.67% Accuracy Rate

Largest Win: $14,360

Largest Loss: $8,180

Max Win = 43% larger than Max Loss

Max Consec. Wins: 16

Max Consec. Losses: 6

Largest Trading Position: 1M

This should finally put to rest the ridiculous talk and idea you only have to trade one time frame or smaller time frames to be a professional or highly successful trader.

All of this is thanks to Tony for sharing his results with me. He traded only on the 4hr time frame for an entire year. A lot of his trades were done in a day, but many went a few days, with several going 4-6 days holding time. All he traded was Price Action and my Shadow System on one pair for an entire year. Disciplined, patient, and highly profitable.

How many educators show results from their students, especially of this caliber? I believe I am one of the few, and Tony will not be the last. Maybe the next person is you – hopefully it is.

To also separate myself and end the debate, at the end of this year, I’ll show you audited results from an account I opened up just to demonstrate I am not just a good teacher, but a good trader as well. I will publish the audited results from a professional accounting firm, on my site so you can all see I am the real deal.

I have no idea how i’ll end up for the year, but whatever it is, you will see it. Even though my fund has an 8+yr audited track record (which should be proof enough), this will settle it, as it will only be my trading, only me pushing buttons, not anyone from my trading team, or any account from my fund. Just my own individual account opened just for this. This should end the debate. Hopefully then I can stop answering questions about my legitimacy, focus on trading, and teaching people who are serious about learning to trade successfully.

There are 3 things I live and breathe every day and have been for over the last 10yrs;

Yoga

Meditation

Forex Trading

I make my living and have been for almost a decade from trading. I study it every day and every moment I can get a chance. The only thing that is right up there with the three things I listed above is Teaching People to Become Successful Traders. I’ve seen every kind of trader you can imagine (from time frame to profitability), and there is no one person who holds the monopoly on the truth of trading and the learning process.

And to the rest of you with open minds and a serious desire to learn, this demonstrates you can be a profitable and highly successful trader, regardless of your time frame, system or background. With the right effort, discipline, and patience, you can be a profitable and successful trader as well.

Ode to the 4hr Charts and profitable trading.

Kind Regards,

Chris Capre

2ndskiestrading.com

Twitter; 2ndSkiesForex

Chris,

I can’t emphasize how you always seem to hit things out of the park and this writing is no exception.

I’m surprised to hear that folks question your legitimacy. For the past year or so, I’m always thinking “interesting…I never saw it that way” when I read your analysis or listen to your webinars. I guess that’s why your of a professional caliber.

Nonetheless, i’m glad for all the work you do that is readily available that doesn’t cost anyone a dime, just merely the time and attention. I figure if someone has a problem with you, they should simply leave. I’ve seen a post or two where someone was trying to almost antagonize you and/or your methods. I don’t get what their problem is nor appreciate their motives.

Chris you do a wonderful job of sharing your gifts and talents when you really don’t have to. Thank you for all that you do.

Hello Gabe,

Thanks for the kind words on this article and am glad it hit home.

I can understand some people’s skepticism as there are people in the fx educational space who taint the business with manipulative marketing practices.

I know one other person who every month has on their site, ‘This month, i’m offering a special discount on my course. Click on the link to learn more’. The thing is, they are offering this every month, so its not only dishonest, but manipulative. Obviously they do not care about being either and only care about sales. This type of behavior is what stains the business and detracts from people who genuinely want to educate others to become successful traders. I understand their marketing tactic – that if someone buys the course, its unlikely they’ll return to the course page and see they were duped into thinking they got a special discount. But this drives home the point on how manipulative and dishonest.

Since there are people like that, I can understand skepticism. But being skeptical with an open mind is far different than being skeptical with a closed mind. The whole point of being skeptical is to question, but do so with an open mind as one is unsure of the truth. I implore all people to read my work, follow my free articles/webinars, do their research, and then decide. If they like it and want to continue with it, great. If not, no worries, but to continually bash me with a fixed perspective shows its more ego based and comes from a lack of awareness – not a perception of what is.

Anyways, I am glad you are finding benefit from the articles and they will continue to come so hopefully they can be a part of you trading successfully and having a long and profitable career trading.

Kind Regards,

Chris

Hi Chris,

Con Sinceras Gracias to yourself and Tony for sharing his trading record here in this post.

One can imagine the type of ‘difficult’ enquires you would get regarding your education methods and strategies and whether or not they were legitimate or not.

Speaking as someone who has only been using your price action methods for a little over 2 months I can humbly say that if one diligently follows the set up rules and as you said act with discipline in regards to controlling risk like Tony obviously does,

it is more than just a dream to be consistently profitable week in week out.

I wish you and Tony continued success and also hope to emulate Tony’s success by diligently and patiently using the methods you have taught me.

Regards

Tony (Not THE Tony!) lol

Hello Tony, hopefully you can repeat the success of your twin trader 🙂

Yes, if one has diligence to follow the systems and methods, anyone could be a successful trader – its a real thing, just like Tony

is and anyone else can become successful like he did.

Keep at it, stay focused, disciplined and patient – this is recipe for profitable trading.

Kind Regards,

Chris

Hi Chris,

Wow! There are people out there bashing you, huh? Well that just goes to show the fear and deceit in their hearts anyway. As you know, I have followed all of your Ichimoku training and advise for quite some time now. I have searched and search for everything Ichimoku. I must say that I have yet to come across anyone with as much professionalism and in-depth teaching on the subject matter as you.

You have always been honest and you have never just given me the answers that you thought I was looking to hear. I appreaciate that about you. I have always looked at you as THE AUTHORITY on Ichimoku and Price Action trading. Keep up the good work that you do. No one else is out there providing as much detailed and quanitatively back-tested information as you.

I receive so much garbage in my emails from several other companies that claim their FOREX system is the best thing just short of the Holy Grail. They always have deceptive marketing tactics; and what amazes me is how they push one course and then come out a month later with their latest and greatest course of all time! Ridiculous!

I appreciate what you do Chris and I follow your training faithfully and I really look forward to your thoughts and perspective on a daily basis. The competition will always fear and bash a legitimate player and you Sir are definately the Real Deal.

I Thank You!

Kindest Regards,

Gary-

Hi Chris

Just reading from another comment above, I was wondering is it necessary to have access to intellicharts to trade your systems or mt4 will do the job? If yes could you please tell me what it is that makes intellicharts necessary? Thanks for your time.

Btw I am looking to get the price action course so want to know specifically about PA course, whether or not intellicharts is a must. Thanks

Hello Jimmy,

Good question, intellicharts is not a must and MT4 works fine. In fact, for our main systems in the PA Course, we have actually tested them across three different server times for MT4 so no issues using MT4.

Hopefully this answers your questions and should you have more, email me via the Contact Page

Kind Regards,

Chris

Hey Chris,

Thanks for the really quick reply. Yes, that helps a lot. And its also quite easy to find a MT4 platform that matches the intellicharts timezone. The main concern I had was that intellicharts probably has something special that’s not available elsewhere that’s important to trade the methods. But its good to know other platforms will work too.Thanks once again

Hello Jimmy,

Glad it helped. Anything that the intellicharts do, we actually provide for MT4 so there is no need and one can work simply from MT4.

Hope to be working with you soon.

Kind Regards,

Chris

Hi Chris

I have been with other companies and have paid quite a large sum attending their courses. I started in nov 2010 with a group. It cost me 5000 aud. I went to a demo and then did not make it. They asked me for another 20000aud for a professional course which i did not go as i still havent got the demo right with the 5000 strategy.

Then i went and paid 300 for 5 months for another forex course which gave me signals to trade.

That too did not go well.

Then i bumped into ichmoku.

I decided to take up your offer in nov 2011.

In the mean time my trading platform MFGlobal went bust.

So i started to use MT4 and then MT5

Later i found that i have to use Intellicharts to get the correct setup in the classes you offered.

Since dec 2011 i have been just making profit on my demo.

I joined the 2nd course you offered in dec.

As far as i know your system works on each trade i put.

I have to follow exactly the stategy and not try to be a extra smart person.

I can tell you that your system works and you are dedicated to help other traders be sucessfull.

forget about the others that try to crucify you .

keep on your road that is simple and true. There will be others who have nothing else to do but spread hatred and jealousy.

Keep it simple just follow to the letter at least one of the strategy that you have and everyone will make it

thanks again chris for the fast reply to emails

your student

prem

Hi Chris,

Just read your article and the comments.

Its very inspiring to read of Tony’s success and l am only sorry you felt the need to have to defend your work.

Anyone with half a brain should be able to see from the amount and quality of the teaching you provide for free on this site and FXStreet etc that you are genuinely the “real deal” when it comes to trading.

l, for one, am just very glad you still enjoy teaching so much that you put up with all the hassles when you obviously don’t need to, and l get to benefit hugely.

As you so wisely say,scepticism is good as long as its open minded and the sceptic is ready to accept the truth if he sees it!

l have bought your Price Action course but really with all the free stuff you put out,which creates a positive feedback loop, l feel l have really bought two great courses or even more!

Muchas gracias por todo y “Viva El Cielo Segundo!”

Michael.

Hi Chris,

After viewing todays webinar, I got a little inquisitive about the shadow system. Could you give me a brief description about what its all about? Also is the shadow system the one that Tony solely concentrated on? And, is the shadow system included in the price action class?

Hello Krisrikant,

I’ll send you an email with all the answers to your questions about the shadow systems.

Kind Regards,

Chris

Thank You Chris, Ill wait for your email :p

Hi Chris, Just read your e-mail. The shadow system really appeals to me because you can focus on just 1-2 pairs and at the same time have quite a lot trades every week/month on the 4hr.

Thanks for the e-mail 🙂 and I look forward to taking the course!

Hello Krisrikant,

Yes, it is definitely an appealing strategy and one of my favorites.

Looking forward to working with you as well.

Kind Regards,

Chris

Chris,

Would you happen to know the risk percentage Tony applied for himself?

Thank you,

charlie

Hello Charlie,

Not sure exactly as I did not ask him but around 5% is my guess.

Hope that helps

Kind Regards,

Chris

Hi Chris

Does the shadow system that tony used use some sort of trailing stops? I ask because his losses seem to be quite different and not always around the same figure. So I was guessing maybe the system moves the stop up with price.

Hello Jim,

Do you mean his wins seem to be quite different? His losses are relatively stable, but his wins are quite varied.

If that is what you were referring to, yes, it has a a special trailing stop based on certain parameters.

Kind Regards,

Chris

“He learned his risk parameters, his style, how he wanted to trade, what was the best pair for him, then went for it. ”

Hello!

how to find what is the best pair for me?

Hello Rene,

This is really a question you have to ask yourself, in relation to;

1) what are you comfortable trading based on how they behave, pip ranges, volatility levels, etc.

2) which moves more naturally with the times you are available

3) what pair do you perform best on

When you answer these questions, you will find the pair best for you.

Hope this helps.

Kind Regards,

Chris Capre

Chris, when you say 110% return is that return on capital e.g c. $120k on trading account to make c. $134k profit on that or how is the 110% metric calculated? I’m really trying to understand what level of capital a guy like that is carrying on his trading account to make that kind of profit.

Hello Ross,

11% return is on initial capital Tony started the year with.

Hope this helps.

Kind Regards,

Chris Capre