How Many Patterns Do You See Here? A Forex Trading Quiz

I have been working really hard lately on my upcoming book ‘Trading Price Action‘ which I am seriously looking forward to finish and deliver to the world at large. Currently I am dissecting a chapter on pattern recognition and came across this interesting chart. In trading, we often look for fixed patterns we are trained to see, such as;

Inside Bars

Pinbars

Outside Bars

etc.

Although this has its benefits to spotting key formations in the market which can lead to good price action setups, we can actually get stuck into a routine of just looking for patterns with relatively fixed variables. This can actually hinder our overall pattern recognition skills to spot newer patterns and this is one of the most important skill sets of a trader – pattern recognition.

I have talked about methods to build this pattern recognition ability, such as brain gyms, like Lumosity as a way to build up the neural connections and spot patterns more easily in the market as one method. Another is going back and looking at historical price action, and in I thought this would be a good exercise for you to work on a particular chart I am writing about in my book.

The Exercise

First off, you will need a watch or a something that keeps track of time as you will want to time yourself on this. If your phone has it, set the stopwatch feature whereby you hit go, and it starts counting the time. For this forex pattern recognition quiz you will also need either a sheet of paper and pen, or a word document open to type your answers.

What you are going to do is for the next several minutes (as much as you need) look at the chart below and tell me what patterns you see in the market. Not what kind of bars you see, (pinbar, inside bar, etc.) as that does not take too much skill and is something that can be easily learned. Practicing something that is easily learned does not breed new neural connections which is what we want to do here.

What you are looking for is patterns in the price action behavior, what do you notice about the price action, what patterns are you seeing that repeat themselves. There are actual behaviors in this chart you are about to see that repeat themselves. This is what you are looking for – patterns in the behavior. They can be of any kind, but ideally, the ones you find that are most useful for trading.

Remember, if something happens once – its an occurrence. If it happens twice – its a pattern. If it happens three times, its a program derived from minimally one pattern. So what you are looking for is anything that repeats itself 2x or more. Thus, take as much time as you need.

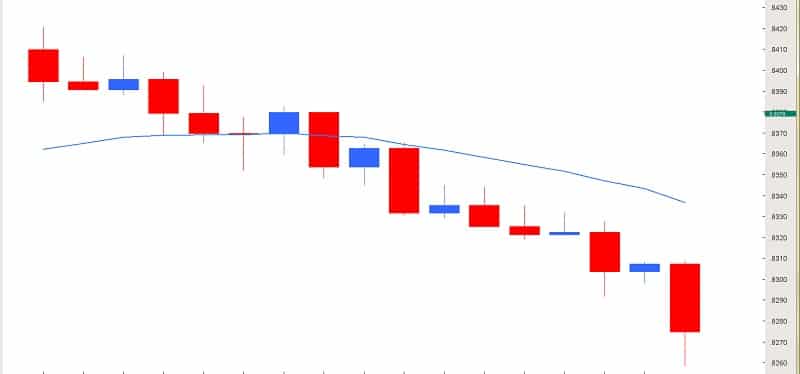

Write down or type all the patterns you can find in this chart. I am going to cover up the name of the pair, and the dates, but I will tell you what the time frame (1hr chart). There is one line on the chart which is a 20ema which can be used if you so wish in your discoveries.

Keep in mind, I have gone back anytime in the last 30yrs to find this chart, so even though the prices may seem like they offer a hint, there are a lot more possibilities of pairs that had these prices so try not to think about the pair. You are just looking for patterns in the price action behavior.

With that being said, get your stopwatch, pen/paper or word document open. As soon as you begin, start your stopwatch and begin to write or type as many patterns as you can see. Once you are done, then mark down the time as you will need this later.

Ready? Begin with the chart below.

Ok, now that you are done, make sure to write down the time and how long it took you to find all the patterns that you did.

The next step is to look at all the patterns and price action behaviors, then come up with a few strategies based on what you noticed. This is because I am going to show you the very next candle in the chart, and if you really did a good job at isolating some key patterns, you probably have at least one strategy for the next candle (regardless of what it is).

Once you see the following chart with the next candle in this series, the go back to your list of strategies, and decide what you think is the most appropriate for the new candle. Make sure you have written all the rules for the strategy, such as your entry, stop and limit. Position sizing is not important – just that you can isolate a pattern, make a trading strategy off this, then apply it on the next candle.

Ok, so you should have all your strategies and rules in place for taking (or not taking) a trade on the next candle, which you will see in the chart below.

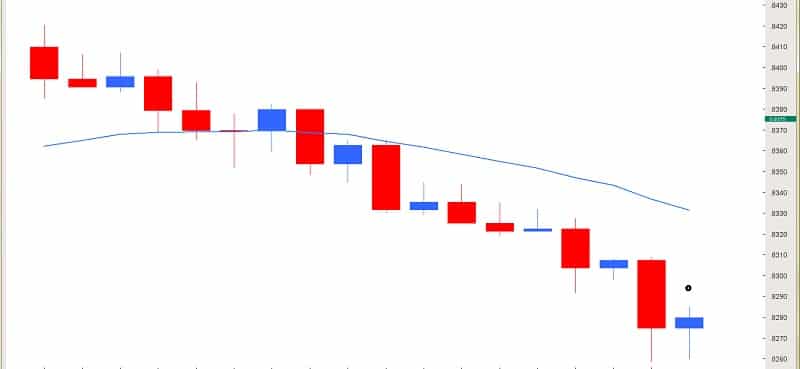

So this is the chart one bar later. To make it a little easier for you to make a decision, I have decided to provide the data on the last blue candle with the black dot above it which has the following pieces of data;

Open: .8275

High: .8285

Low: .8260

Close: .8280

One more piece of data, the low on the red candle prior was .8259.

So armed with all that data, along with all the patterns you recognized in the price action, and with the strategies you came up with, take a moment to figure out what is the best strategy to trade this blue candle. You can either decide to;

a) trade this blue candle

or

b) not trade this blue candle

If you decide to do A and trade this blue candle, then what you are going to do is decide what is the best strategy to trade it. This means having all the rules for entry, along with placing your stop and limit. Now here is the kicker;

Whatever strategy you use, has to be out of the position in 3 candles.

Why?

Because these are the last 3 candles for the week, and the market will close for the weekend which is also a holiday weekend and there is a G20 meeting which will have a major impact on the market.

So, that is the challenge. Come up with a strategy that you think is best to trade this pair now that the blue candle is closed. You have to be out of it in three candles so you can be out for the holiday weekend, hopefully in profit with a smile on your face.

With that being said, I am going to post the next three candles tomorrow on the following page around this same time;

https://2ndskiestrading.com/strategies-for-forex-trading/forex-signals/

You will want to look for the post which will be called ‘Forex Trade Signals and Setups Feb. 21st‘

In this post I will provide the chart with the next three candles, and then you can compare how your strategy did and share with me what your strategy was, rules for entry, stop and limit, and what the final result was.

What I am going to do is share with you my strategy, what patterns I isolated to come up with it, and how it played out. I will give you a few details ahead of time, but want to explain the background to this challenge:

I came to this chart as I was doing some practice through my charting program, which will take any pair, hide the dates, the actual pair, change the numbers on the prices, but will correlate them to the real historical price at that point in time.

Then what it does is challenge you to trade that chart in that point in time bar by bar. If you want to trade at the end of the bar, you do, if not, you don’t. It does a very good job at giving you real practice in reading price action because you are trading bars as they come in real time, just like real trading.

Sure, its not real money, but the point is to learn to find patterns in the price action which is a great exercise to do, especially when the market is closed on the weekends.

Now here are some points I’d like to share;

1) When I started looking at this chart, in < 1 min, I was able to isolate 4 key patterns, even though there were many more

2) from these 4 key patterns, in < 1 min, I was able to come up with a trading strategy for the next bar if it had certain characteristics

3) with this new blue bar, I was able to trade it having a R:R ratio of 3:1 based on the strategy I came up with

And I will leave you with that for now. So make sure to come back tomorrow to the link I shared above, to see the next 3 bars, and how your strategy did. Then make sure to leave a comment how your strategy did, what was the entry, stop and limit, or if you didn’t trade at all.

Remember, there are no points for cheating, so only honesty here. It really does nothing for your trading process if you are;

a) not honest, and

b) only try to inflate your ego by looking cool on this post

Remember, in a week or two from now, this post will rarely be seen, and nobody will really care how you did so skip the ego part of trying to look cool, and just be honest with what you did and how it played out.

The whole point of this forex pattern recognition quiz is to be an exercise whereby you;

a) test your pattern recognition skills

b) see how quickly you can come up with the patterns

c) see how quickly you can formulate a strategy (or strategies) based on the patterns you noticed in the price action

This is about as close to what you are doing in real trading – spotting patterns, finding opportunities, and trading the right edge of the charts as they come to you, bar by bar. You have to make decisions based on what you see and what you think will happen.

But in reality, nobody knows what will happen with the next bar – and that is the friction we all love (or dislike) in trading. Its the mystery, of what will come next, of not knowing, but seeing if we can find the answer ahead of time by being a detective and looking at all the available clues. Some of us are closer to Sherlock Holmes, and others are closer to Inspector Clouseau.

Regardless of where you are at, the mind has a neuro-plasticity to it which means you can learn to be an expert in spotting patterns and key price action clues from charts just like these. In an article I will write on this Thursday, I will discuss some key things you can do to improve your learning process, so you can enhance your pattern recognition skills, along with tailoring your educational process to help accelerate your learning curve to trade profitably and successfully.

I look forward to your responses tomorrow.

Kind Regards,

Chris Capre

Twitter; 2ndSkiesForex

If you liked this article, make sure to click the ‘Like’ button at the top of this article 🙂

And also check out my latest article called Ode to the 4hr Charts whereby I share an entire years trading report of one my students and how they made 110% in year, just from learning two of my strategies.

A)PATTERNS (3min08seconds)

1.10 out of 17 candles are red, 6 blue and 1 doji.

2.The bodies of red bars are generally larger than blue bars.

3.A bar after the blue bar is always red.

4.20ema acted as support and then resistance.

5.After the price ducked under the 20ema the highs of blue bars never went above the high of the previous red bar.

B)STRATEGIES

I would not trade on the last blue bar. Rather I used this bar to notice that down side rejections prevailed and up side move from next bar is possible which negates the previous pattern saw in this chart.

1.After this last blue bar, if price trades at 8274 I would go short with stop at 8286 and target at 8260.

2. I would go long if the price trades 8286 first with stop at 8274 and target at 8308 (near the open of last red bar?)

Hello Zeffer,

Nice work – some really good pattern recognition there.

you spotted 2 out of 4 of my patterns, and noticed some key info – well done.

I’ll be posting my follow up to this with the patterns I spotted in about 1.5hrs from now so stay tuned but well done overall

solid pattern recognition skills.

Nice Work!

Chris Capre

Hi Chris,

Time: 4:42

Patterns:

1) Majority of candles are bearish

2) After a blue candle we get a strong red candle

3) Price never breaks the high of blue candle on following day

4) After a strong red candle price retraces back to around 50% of the red candle.

5) Strong break of 20 EMA offered retest entry (occurrence only)

Strategy:

Enter at Market on Open of next candle : 0.8280

Stop 5 pips above High of Blue Candle : 0.8285

Target Low of Blue candle : 0.8260

Risk 5 pips reward 20 pips

Possible 1:4 for a 1 hour trade

Interesting to see how this works out???

Regards

Tony

Well done Tony.

Very nice work and pattern recognition.

You got two of the four patterns I spotted (although technically your # 3 is not correct as one broke the prior candle high by 1pip, but without seeing the chart up close, this would be hard to spot so you get full credit).

Overall, very nice work.

I’ll be posting results in the next hour so stay tuned.

Kind Regards,

Chris

Hi chris

did you have an update to the patterns that you saw ?

Tnx

jeremy

Hello Jeremy,

If you read the article, it talks about where I will share the answer. I give a link and mention to look for the answer in the next day’s post.

So go to the link in the post and the date I mentioned I would give the answer, then you will find it there.

Kind Regards

Chris

Got it now – Thanks Chris.

Hey Chris,

This is a great exercise btw, I find I really need this kind of scenario practice to help me understand price action better. So this is what I would do:

The pattern that stuck out most for me was that no blue candle was ever followed by another blue candle. And this happened 100% of the time giving us a high probability that the next candle after the blue candle would be red. I would have sold at the open, set my stop at the previos red candle open, and either closed my position at the end of the day or waited until the next candle had reached the same size as the previos red candle (open to close). It took me about 5 minutes to spot this one pattern.

Thanks,

Mark

Hello Mark,

Very good – this is a good start for spotting patterns and you spotted a key one so you got the essence of the exercise. Now try and expand this practice into your day to day analysis

with pairs in real time and this skill set will definitely build up to where you start to find new opportunities.

But well done overall

Kind Regards

Chris

Hi Chris!!! 🙂

could not resist this challange!!

1. patterns (13.51 and tricky):

a. impulse bars to the down

b. after up candle follows a down day

c. trend is currently down ie price broken the ema-20 (or a down trend channel for that matter)

d. light support broken at 8300

e. long wicks changed from pointing up to down

2. strategies:

a. continuation (or with trend); sell 0.8271

stop 0.8290

target 0.8233

b. retrace (or against trend); buy 0.8291

stop 0.8265

target 0.8340

3. psychology:

which one do I favour? Should one take the recent price action plus trend for granted (ie that price patterns repeat themself indefinatly) I would go for the sell option. However I personally have a tendency to read a bit more in to this, like time of day. That is the last 3 h before weekend holliday and G20 meeting news. Giving clues to that institutions may not currently be active in the market, giving room to retail shortsellers in this enviroment of uncertanty. Price is also far from the ema-20 (Chris favourite as I understand it 🙂 forcing you to consider a retrace possibility. The last candles the red and including the blue are the largest in some time and it broke the small support at 8300 however not in a “heavy” way ie the red candle did not close near its low and combined with the blue candle that is an inside bar giving them a tweezer look (ie identical long wicks down one pip away indicating a new support level) closing in its the upper 1/3. All this taken together gives that I personally would favour the retrace since it “feels” as the market consisting of retailers shorting might be scared to close their positions before the bell and not to carry any risk over the weekend as the G20 is approching…. But I could be wrong and hence the use of stop-loss!!!!

best alrik3

Hi Chris

Interesting exercise 🙂

Patterns seen:

Bearish Engulfing X 6

Evening star X2

Hammer X2

Took 6 mins.

Decided not to take a trade until the following the final candle was revealed.

Reasoning:

17 hrs in a downtrend with no real breathers e.g consolidation/reversal/bounce present

last two bear candles starting to show potential signs of exhaustion

When last candle revealed it is an inside pair and the candle looks like an evening star. Inside pair means the instrument could go either way. Evening star means a higher probability for going long. Therefore to trade this I would take 2 limit orders one to the buy side one to the sell side on one cancels the other basis.

Entry points:

Buy 8290 with SL at 8255

Sell 8260 with SL at 8290

Not looked at the link yet to see what actually happens. Will do so after this post. 😀

Great exercise Chris!

Time around 2m.

This is how I see it.

1. Bears are in control, taking on momentum to downside.

2. Broke through 20 EMA, went for a retest and sold of again with a big red impulsive candle,

no wicks hardly.

3. Last red candle showing signs of exhaustion, is the bear run coming to an end?

4. With only 3 hours left and bank holiday, there is a good chance a lot of sellers will start

to take profit and become buyers, blue candle.

5. I would put a pending order: buy stop 2 lots @ 8290

stop @ 8255

TP1 1lot @ 8360

TP2 1lot just before closing in 3 hours.

Regards Hugo.