The Best Support and Resistance Levels Part 1

Today I am going to give a lesson on how to find some of the best support and resistance levels in the market. If I had to say – I think there are three types which are the best support and resistance levels you could find. But it would take a long time to go into each type, what are the characteristics of each, what they mean from an order flow perspective, and how to trade each type.

So I am going to cover in today’s lesson, what are some of the most critical variables to look for when evaluating support and resistance levels. If you can learn to spot these levels, read the price action and key variables before the market reaches these levels, you will greatly enhance your trading, by finding better entries, knowing how the market is likely to react off a level, and how to increase the probability of your trades.

By first learning to read these key variables which I will list below, they will provide you with a lot of information in terms of;

-how the order flow is relating to them

-how these levels will improve the probability your trade or rule based price action system

-how you can trade these key levels

Note: I want to hear your feedback on this lesson, like what key points stood out for you, what you found useful, how you can apply this to your trading, or…even if you want to throw tomatoes at me, I want to hear your comments 🙂

I will start this lesson by talking about what are some key things to look for when evaluating support and resistance levels. I will then describe with some details how each variable informs you of the order flow behind the price action. Then I will go over some basic methods of how you can trade them. I will also give examples to demonstrate how these elements work, then end with a brief overview of what we covered.

Key Things To Evaluate Support and Resistance Levels

If I had to list what are the key things I use to evaluate support and resistance levels, it would be the following;

1) How price reacted to this level in the past (held, became a breakout – pullback level, bounced violently or timidly off of it)

2) How significant is it (lower time frame, higher time frame, held for how long?)

3) How is price reacting or responding to it now

4) What is the speed or impulsiveness price is approaching it now

5) What is the price action context prior to this level

All of these things communicate information to me about the uniqueness of this level, how the buyers/sellers reacted towards this level in the past, how likely they will respond to it in the future, and what they are most likely to do at this level.

Zones & Areas

It should be noted that I do not consider support and resistance levels to be lines in the sand, but more of a ‘zone‘ or ‘area‘. That means I do not consider a resistance level to be one price, but likely several pips on either side. This could be due to differences in price feed, server time, what other traders think of that level, and how they would play it.

A scalper will more likely get as tight to the level as possible, but scalping orders rarely are large in volume or market movers. However, a swing trader or large institution will likely be getting in at several levels, and the level you might be spotting may be one of them they are placing a large order at.

Because of this and all the different ways institutional players relate to these levels, support and resistance levels for me are zones or areas which could be anywhere from a few pips wide to 10+, maybe more depending upon the time frame the level relates to.

Obviously a level from a weekly time frame over years would have a little more play then an intraday level on the 1hr chart so take this into consideration.

What Each Variable Communicates

Although I could spend an entire treatise writing about all the things each variable above communicates, I will go over the key points here.

1) How Price Reacted To This Level In The Past – this is a big one as it tells me what the major players thought of this level. Was the pair highly over/under valued here and it produced a violent reaction in the past? If so, then the first time it comes back to this level, we can expect a strong reaction. Why?

If the reaction off a level was fast, that translates into heavy buying/selling with some large player initiating the rejection. This is followed by other players quickly rushing in to get as close to that price as possible, essentially chasing for the best price, but agreeing with the initial rejection. These levels are defended with a lot of money, and if price does not come back for some time because it traveled fast and furious off this level, then the next time it gets there (especially if it’s the first time back), expect a strong reaction.

When gold sold off massively due to huge margin increases by the metals exchanges, it crumbled hard and everyone was wondering where the bottom was. It found it eventually at $1532 where in one day, it opened at $1640, jumped up $23, dropped $130, then bounced $96 from the lows which was quite an amazing rejection inside one day. This is a violent reaction, so traders were definitely taking notice of it the next time it approached this level. Can you guess what happened when it got there again?

As you can see, price held this level with a tiny breach, then bounced the next 4 days in a row, suggesting strong follow up buying on this rejection. The first time back usually is a slightly lesser bounce since many know of the level, and thus less traders are trapped (or surprised) from a violent rejection the first time around. But usually, this level will hold.

Remember, this is one scenario of how price has related to it in the past. All the other types of reactions communicate a different story.

2) How Significant Is It (lower time frame, higher time frame, etc) – this really has to do with time as all support and resistance levels have what I call a ‘time degradation‘ to them. Simply put, traders have a memory, but they are more inclined to take recent information as more valuable then information a while ago, especially if they are short term traders. Generally, higher time frame levels will dominate and last longer than lower time frame levels. Also, when possible, I’m more interested in drawing levels that are more likely to maintain the trend as that is the more probable scenario. I particularly relate to these when reading the impulsive vs. corrective moves in the market.

For more information about understanding impulsive vs. corrective moves, make sure to watch the video here.

But once you have established the trend according to the impulsive vs. corrective series, look for breakout pullback level where the trend continued, or major swing highs/lows where the trend paused and pulled back to. These will often present great opportunities to get in with trend.

3) How Price is Reacting To It Now – Is price closing on a support level, and just sitting there, with smaller and smaller bounces off it? If so, a breakout through the level is more likely as there is no strong buyers able to push back, and the sellers continue to squeeze them out of the market. Was there a strong pin bar reversal off this level? If so, it could be telling you it will likely hold on a second attempt and start a reversal, hence look for an entry close to the level. How price reacts to the level in the moment can tell you if it’s likely to hold or not, but this analysis should be done before it reaches the level.

Often times the market will demonstrate a price action reversal signal at these levels. Keep in mind, this is the ‘effect‘ of how players responded to the level, not the cause. Order flow was the initial cause, and the level was the location. Everything else was a response to the initial reaction off this level. Hence these price action triggers are often ‘secondary entries’ (or sub-optimal) regarding the level. Sometimes a price action trigger, say a pin bar on a 4hr chart can be an engulfing or piercing bar on a 1hr chart. So sometimes it helps to look at a lower time frame to see what the more micro responses off this level are, or what the price action context was leading up to it.

But no matter what, there will always be clues as to what the major players are doing at this level, and what the more likely scenario is. Look for impulsiveness (strength) off the level, or weakness (corrective price action) off this level for initial clues.

4) What Is The Speed Or Impulsiveness Price Is Approaching The Level – this will really tell you a great deal of information whether a level is likely to hold or not. If you are trading with trend, and with the move when it is approaching a level, how strong the move is heading into it, and what is the underlying characteristics behind the price action (speed, acceleration, etc), will tell you what is more probable.

If a level is an intraday level, or one from only a day ago, a really impulsive move is likely to break through it. If it’s a daily low or high, or a level that held for a week or longer, it will have a better chance of holding. Think of it like a moving object. Consider the size of the object in relationship to what the obstacle in its way is. Normally, force x acceleration (& mass) will tell us whether the obstacle ahead will cave or not. Unfortunately, we do not have exact information about the orders at a level, such as the number and size of them which would equate to mass and volume of the object. Level 2 quotes would help in this fashion, but if you don’t have that, then what?

Why not use the other principles above, such as;

-how did price react there in the past

-how significant is it

-how is price reacting to it on first touch

Weigh those against the force, or impulsiveness of the move, and you’ll be able to get a better idea.

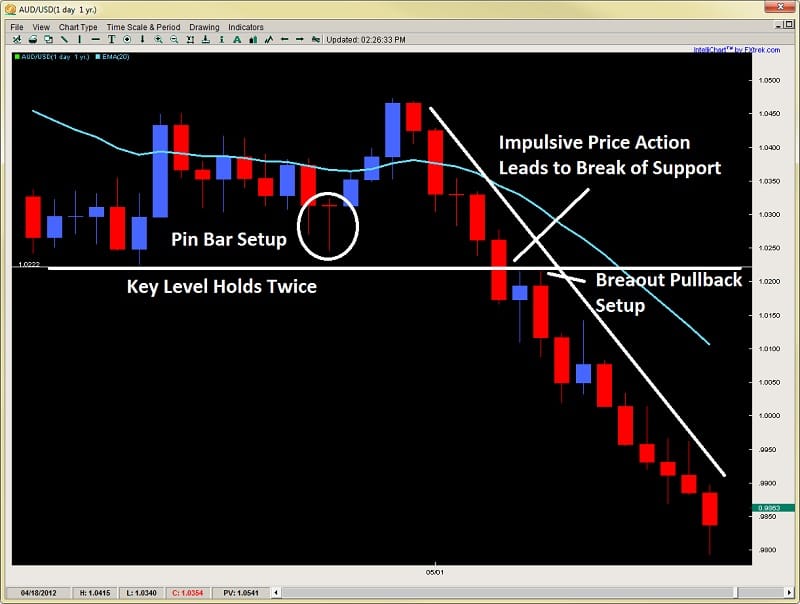

A good example would be the following chart below of the AUD/USD on the daily time frame

Price approaches the level with some volatility, as there are solid moves on both sides of the fence with bears maintaining control on the way down. Price bounces off the level with a piercing pattern and then a second attempt forming a pin bar reversal. But then after a small retrace, price attacks the level with vigor, selling off 4 days in a row, taking out the last 13 days gains. Does this resonate strength to you? Do you think it will break? See the chart below

As you can see, price was exhibiting a lot of strength and impulsiveness heading into the support level. There were definitely some clues ahead of time this was going to break. Such as how price barely lifted off the level each time, and attacked it twice without ever gaining much ground to the upside.

Keep in mind, the trend was already down leading up to it, so with trend traders used these pullbacks to get back in the trend. The last time they said enough is enough, and went to take out the barriers at this level. The buyers at the support level likely exhausted themselves on the first two rejections which failed to gain traction.

Putting all these components together would have communicated a breakout was likely, which would have helped your current short, or give you a second opportunity to get back in on a textbook breakout pullback setup for a high probability-low risk trade.

In Summary

So there you have a few key variables to look for in finding the best support and resistance levels. Remember, price action patterns form at these levels and are the ‘effect‘, not the cause of the move. They do communicate information to us as traders, what we are looking for is the price action context before we reach these key support and resistance levels. Hence, it is these key levels where orders are being placed first.

Thus, by learning how to read the price action and the key variables I listed above, you can greatly improve your ability to spot good setups, improve your entries, placing trades where weak players are getting in, and the stronger players are looking to enter.

Please make sure to comment below, and click on the like buttons to share this article 🙂

For those wanting to learn to trade price action, get access to the traders forum, lifetime membership & more, visit my price action course page here.

A lot of good information which clears up the small questions

Thanks for the insite

Excellent article thanks Chris, clear and concise.

So, l can now use my tomatoes in a healthy salad!

Excellent article that clarifies the relevance of multiple parameters of price action at important levels.Your articles are always clear and convey many important points which come into play evey day in a traders life. Thank you.

precisely what to look for in the market. looking at trading the market, not a pair specifically, – looking at momentum with newtons principles. as always informative thanks chris

Many thanks, very excellent article, as a trying to learn price action student we tend to see the immediate on the charts, the candlesticks bars , the Emma’s, the support and resistaance as a level and not a zone , the 4 points you mention reminds me that iwe need to look need to look at the background, the history and the intensity of the price action.

Hello PC,

Yes, its important to look at the whole situation as context for what is going on not just things in a static fashion which is why I went through all this material in the article.

Im working on the follow up to this article so should take it to the next level but glad you liked the article.

Kind Regards,

Chris

Great article! Thank you.

Hello l3rmini,

Glad you liked it

Kind Regards

Chris

Hi Chris,

I thought I had already commented on this and apologise that I haven’t,

this article really does communicate the common sense approach

on how to understand approaching price reaction to support/resistance

levels and is something I incorporate into my daily trading. Well done

yet again Chris on bringing common sense and safety to our daily

trades, which we all so desperately want!

Hi Chris

Superb article as always. I’m following your Webinars on FXstreet, actually I have only six to go and I’m already transformed in every turn.

Thank you for all your efforts and kindness.

Hello Baback,

Good thinking to combine the study of the forex strategies articles with the webinars – definitely helps with the learning process.

Anyways, glad you liked the article.

Kind Regards,

Chris

I usually look for divergence once price has reached a major support or resistance price

Hello Ayo,

Divergence is in relation to indicators, but there are plenty of ways to read price action and understand when the levels will hold or be broken.

I find price action to be much more reliable than divergence as a whole.

Anyways, thanks for sharing.

Kind Regards,

Chris

Hello, Chris, a perfect article, thank you very much. I could not find the part 2, have you written it already?

Thanks a lot, Pavel.

Hello Pavel,

I have not written part 2 yet as I’m considering saving it for my book so to be continued.

But glad you liked it.

Kind Regards,

Chris

I like how you talk about the “Zone”, not a particular price, as we often overlook the problem of different server times, brokers ect. This is definitely a good point which I got out of this article!

Thanks Chris

Johnny Logan

Hi, joined you on twitter and keep learning a lot from your aticles. This is very informative. Thanks

Hello Tony,

Glad you liked it. Make sure to check out all the free articles and videos as there is a lot good information in there.

Kind Regards,

Chris

This is one of my alltime favorite posts from 2nd Skies. Excellent job of teaching a trader to “recognize” support and resistance using candles and not just moving averages or trend lines. Glad you highlighted it again this week. With your permission, would like to include it in our next newsletter.

Hello Kos,

Glad you liked it.

What newsletter are you referring to so I can get an idea of what you are thinking?

Let me know

Kind Regards,

Chris Capre

Here was our January retrospect bitly12aKogT however our thought is what was lacking was a focus on technical analysis to better assist newcomers the market. To that end, we’d like to kick off that addition with your article; of course with backlink and full attribute.

Hello Kos,

Ok, email me via the Contact Page and we can discuss further details as there may be a possibility of working together here.

Kind Regards,

Chris Capre

Hi, Chris,

A great article as always. Thanks!

very good … thanks Chris. This article helped me a lot.

One of the best article I like because if its clarity and importance .Thx Chris

Chris,

This is an excellent article!

Hello Robert,

Glad you liked this one.

Kind Regards,

Chris

Hello Chris. Is there a Part 2? Thank you.

This is a great article Mr CC. I really like the way you’ve articulated the way price ‘tests’ a support level and the examples you’ve shown really emphasise your points. Thanks for sharing this – learnt a lot from this!

Hello Pipinblu,

I am glad you found this article useful as its a critical subject for trading. To succeed, one must understand how to relate to and trade key support and resistance levels.

Kind Regards,

Chris Capre

A very great and insightful article about support and resistance levels. Thank you a lot for sharing your expertise freely with us. Just one question: what is the best way to draw support and resitance lines on a price chart? Using the high/low prices (top/bottom of wicks) or closing prices?

Hello Janet,

Glad you liked the article and found it useful.

In terms of which method to draw them, generally I include the wicks, but this may include passing through a wick if it creates a more harmonious line.

Hope this helps.

Kind Regards,

Chris Capre

I have been using your methods for some time now, and they are really starting to improve my trading. Keep doing what you are doing.

Awesome info and straight to the point. Always enjoy reading your forex trading articles. Thank you and saving up for your course asap.

Rattling good instructive stuff here mate. Keep it up.

I’ve spent hours today looking through various support & resistance material, and this one definitely is much more detailed, unique and informative than the others.

Really appreciate ur help in understanding key support and resistance levels better.

You are the professor of PA

This post was really fascinating, particularly since I have not found high quality price action material like this. Keep up the great work prof

Although I’ve been studying with another mentor of price action, I would have to say this is a much more sophisticated way of looking at support and resistance.

I appreciate all the good work you do, and also you responding to our comments, which shows a personal care in your work.

Beauty. I followed many great traders on net and their articles, but you are the exceptional and unique, a true genius.

this is really a great stuff, it shows you are a master of price action. Honestly, no one has never talked about support and resistant area price action this way since i have started carrier in Forex trading over ten years ago

Hello Samson,

Thanks for the positive comments.

Yes, not many people talk about support and resistance like this, yet is such a critical skill for trading price action, so glad you noticed.

Kind Regards,

Chris Capre

hhmm are the points here related to supply and demand trading system?

Have you ever really heard me use those terms?

Your articles are always thought provoking, that is why i am saving towards enrolling in your advance price action course, I cannot wait to get more insights because i have never seen this concept explained like this by anyone

Hello Elijah,

I’m hoping to provide some provocative material that challenges one’s understanding of price action. There is a lot more in the APA course so looking forward to working with you soon.

Hi Chris, still doing my demo account, thank you for simplifying certain aspects that I am still struggling with.

Hello James,

In the beginning stay simple and compact. Focus on learning a few things well like the material in this article and it will pay dividends over time.