What is an Inside Bar?

A somewhat common but important price action behavior, and Inside Bar is a candle that is completely inside the previous candles high and low.This is not just referring to the body, but the wicks as well being inside the previous candles price action.Why are inside bars important and how can they lead to trading opportunities.

Before we answer the question above we have to look into the reasons why this price action behavior takes place.There are several reasons for the inside bar forming, many of which we will list below;

- Price is consolidating after a large up/down move in price and is about to start another leg in the same direction

- Price is coming up against a critical support/resistance level which shows some hesitation in the market as to whether it will continue or not

- Price Action and liquidity is dropping before a critical news announcement so with nobody taking new positions, price will not have enough order flow to move consistently in one direction

- Profits are being taken

Regardless of what the reasons are, as traders we are most concerned with which situations are most likely to yield a price action trigger and a trading opportunity.Out of all the reasons listed below (and there are more) the least important is the news announcement as the environment leading up to a news announcement is generally recommended to be avoided due to poor liquidity.

However, all the others are critical for us because they tell us via price action what the market has done and is likely to do next via a price action trigger.

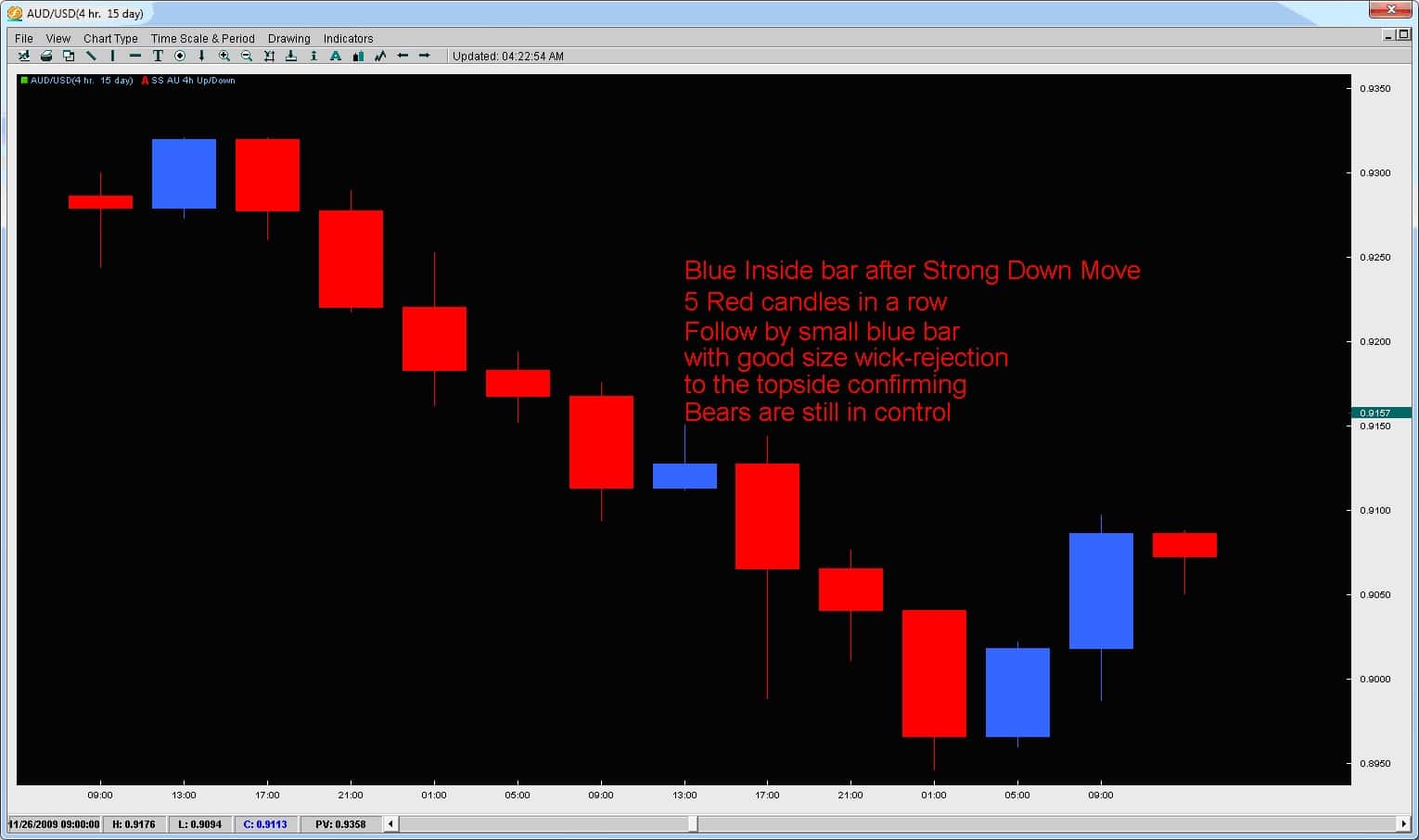

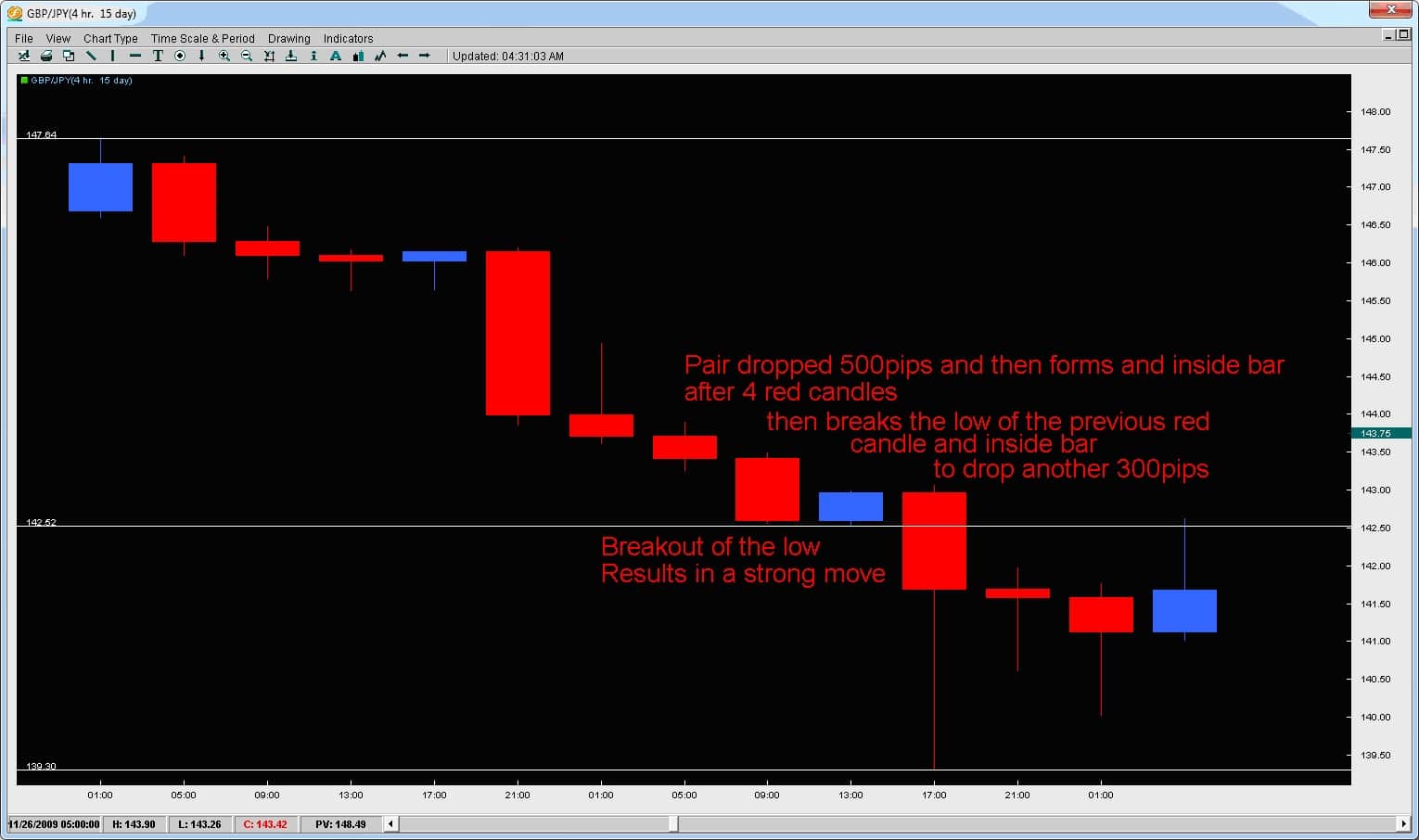

With that being said, lets look at a few inside bars and see how the price action leading up to them revealed information about why they were created and what is the likely next move.

Below is another price action Inside Bar coming at a critical resistance level.See how the rejection on the 2nd attempt as it could not muster a close but only a wick at the previous resistance level? The next candle is an inside bar (not making any higher highs) and closes below the mid-point of the prior blue candle suggesting the bears are starting to wrestle control from the bulls.

Another example of how price started a strong move and then formed a single inside bar. Price then barely made a new high (with the small wick to the upside on the next red candle) and then broke the low dropping another 300+pips. This is a common price action trigger after the formation of an inside bar.

Inside bars form approximately 10% of the time (or are approximately 10% of all candles) and are a unique price action formation. When they occur and critical support / resistance levels (prior highs/lows, Fibonacci retracement levels, outer pivots, larger Kumo formations, etc) they have more impact and can often lead to strong price moves.Also watch out for Inside Bars occurring after a strong price action move. By analyzing the prior move, the wicks of the inside bar, the overall size of it and the price action of the next bar following the inside bar, we can gain an insight into the price action and where the next move is likely to be.

For more information on forex inside bar trading strategies, take a look at the Price Action Course where I share rule based strategies and triggers to trade inside bars.