3 Tips for Trading Breakouts

With the holiday coming tomorrow, I wanted to write a short price action article with 3 quick, but highly useful tips for using a breakout trading strategy. If you can add these forex breakout strategy tips to your price action toolbox, you can significantly increase your success rate when trading.

1) Time of the Day

One of the key components to a successful breakout is volatility. When you have greater volatility, you have more orders/players behind the market and therefore increase the probability the breakout bar will have more force behind it. This helps the breakout bar to take out more stops and push the market further in the breakout direction.

But, volatility fluctuates tremendously throughout the day. Statistical analysis has pointed out to how breakout strategies actually function far better during the London and NY session while tend to fail during Asian market hours. This is simply to do with volatility, so the time of the day you take the breakout trade will have an impact on the success of your trade.

Ideally, breakout trades are taken during the following times;

-1st three hours of London session

-30mins before NY open up to 30mins before London close

A great example of this is in the chart below how price consolidated for a day and a half, then broke out massively during the 2nd hour of the London session.

Image 1.1 EURJPY 1hr Chart

Outside of these times, the probabilities decrease for your breakout trade (variably depending upon hour) as volatility is either low or in a declining phase and may not have the order flow behind it to break through the key levels. Also avoid taking breakout trades several hours prior to major economic announcements, or going into major holidays where trading and liquidity will be subdued.

2) Use Options Data to Aid Your Timing

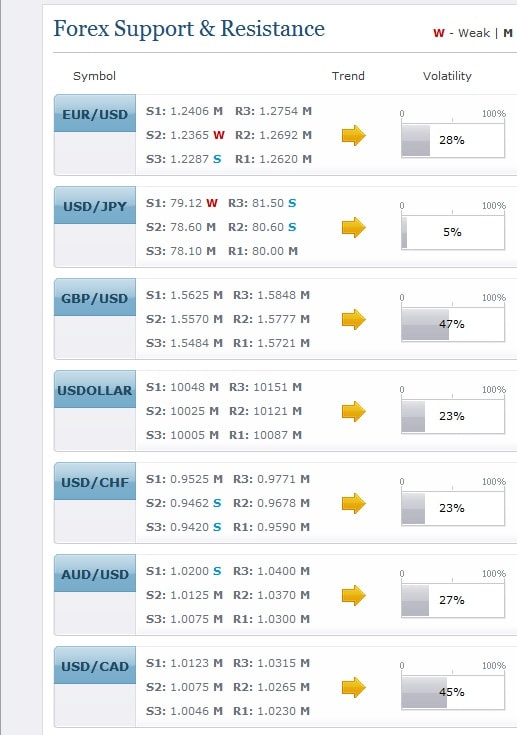

Daily FX has a useful piece of data in their technical analysis page whereby they publish a Volatility Percentile feature. This is derived from options prices with a higher number communicating options traders are expecting greater volatility, while a lower figure suggests more range bound/reversion to the mean type play.

Image 1.2 Volatility Percentile Data

You can simply check the data at any time (per pair) to see where the volatility percentile figure is at. When you are thinking of taking a breakout trade, ideal is to have the Volatility Percentile figure above 70% or greater, suggesting options traders are expecting a greater amount of volatility in the market and thus increasing the probability of your breakout trade working out. If several of the pairs are above these percentages, then there is broad market participation which will likely create strong impulsive moves in the market which are ideal for breakout trading.

3) The Longer the Compression, the Better

Usually breakouts give you several warning signals ahead of time a breakout is happening, either via a squeeze in the price action to one side of the market, a tightly coiled range or higher low/lower high forming inside the range. Regardless of what the clues are, the longer the compression in the price action, the better.

Why?

Markets, traders (and brokers) do not like tightly bound up price action. Smaller ranges and markets mean less continuation and directional follow through. If markets turn around quickly, they offer us less profit in the direction we have chose. But a long compression in the price action will build up a pressure and friction which eventually needs to be released. The longer this builds, the better, for when it breaks out, the market can often go for a large move in the breakout direction as seen in the chart below.

Image 1.3 NZDUSD Daily Chart

You will notice in the chart above how the price action was consolidated in a tight 200pip range for almost two months. But when it broke out, forming the breakout bar, it sold off for the next 5 days in a row, 11 out of 12 days and 13 of 15 days, selling off for over 700pips.

In Conclusion

Breakout trades can offer some really profitable opportunities, but can be maximized by adding these three forex breakout strategy tips above which are;

1) Time of the Day

2) Using Options Volatility Data

3) Looking for long compression periods prior to the breakout

If you can learn how to spot these, along with other various price action clues, you can increase the profitability and success rate to your breakout trading.

For more info on how to trade price action and breakouts, along with lifetime membership, getting access to the traders forum & a lot more, make sure to visit my price action course page here.

Other Related Articles:

Key Price Action Elements to Breakouts

The Best Support & Resistance Levels

Breakout Role Reversal Setups

Hi Chris,

Do you have another way to measure volatility of a pair?

more empirical i assume.

Thank you

Hello Nikos,

Besides that, you’d have to use pure price action, or you can use bollinger bands, but my preference is to do it without indicators if you are not using this.

Hope that helps

Kind regards

Chris

Chris, thanks for the article.

As part III of article suggests under long extended ranges, what’s your take on the EUR/CHF pair? The range on that sucker seems like it will go on forever, at least three months from my count. I hear this is due to the SNB intervention. In your opinion..how much longer can the SNB reasonably hold this up? What kind of purchases would the SNB be making to keep this pair up?

Hello Gabriel,

I think I commented on this, but it is an artificially held range so I don’t give it any credence. The SNB is holding that in the tight range and therefore artificially manipulating the price action, which is not natural, so i don’t really pay attention to it until the SNB relents or steps up the intervention and levels.

As to how long can they hold it? No idea, but these things never really work out in the long run.

Eventually, it will break.

Kind Regards,

Chris

hi,

i am a price action trader,whenever a setup is evovled in daily chart after newtork close,if the pair get breakout in asian session,its 90% tends to a losing trade,if the same setup get breakout in london session ot newyork session,its flows very well.

is there any reason for most fail in asian session?

Hello Vasu,

Its hard for me to comment on your breakout trades during the Asian session because I do not know your system or what kind of breakout you are trading.

As a whole, liquidity is lower during the Asian session, so breakout type trades have to be qualified differently.

Whereas in the NY session, there is more volatility for the push a breakout generally needs.

But these can be mitigated once you learn how to properly qualify breakouts.

Hope this helps.

Kind Regards,

Chris Capre

really great article thanks sir. now my hopes again began after finding your site you are really master mind and great personality person.

Hello Chris,

it’s a great Article.Can you send me a Link to the Tool of the Volatility percentile Date.I can’t find it on the Daily FX Website.

Many Thanks

Bissek

Hello Bissek,

As stated in the article, if you go to the dailyfx ‘technical analysis’ section, you will find it. Just go to dailyfx.com, click on technical analysis and you’ll see the volatility data’s just like in the article.

Hope this helps and glad you liked the article.

Kind Regards,

Chris Capre

Thanks Chris,

I went to the dailyfx.com.hk and I didn’t see it.But I find it now on dailyfx.com..This is a really useful Article.

Kind Regards

Bissek

Hi Chris. I’ve just stumbled upon your website and it’s given me a whole new perspective on forex trading. Now I’m beginning to understand why I’ve been struggling all these tears. Please how can I be a regular recipient of your articles, blogs and the like. Your insights are beginning to open my eyes to issues I didn’t know existed