3 Ways Archery Helps My Trading

Last week was the first time I had gone back to my archery school in over a year. Approximately 2mins into the class, I realized how much I had missed formal archery classes, but also how archery helps my trading.

Now I am not suggesting you need to grab an Olympic bow and start taking archery classes to take your trading to the next level. But, it often helps to acquire a second skill or practice to assist your main endeavor – i.e. trading.

For example, Joe Namath was constantly reminded by his coaches he needed to work on his footwork. So he did what every quarterback does…he took up dancing! Footwork was critical to his position, and dancing helped him improve his footwork dramatically.

In almost all skill based endeavors, an additional practice can really improve one’s core skill. I’m going to share with you three ways Archery helps my trading.

1) Focus on the Complete Process

In archery, to hit the target consistently, you have to repeat a specific motion with the precision of a Swiss watch. But to do this, you have to be completely present and focused on the moment and process.

I had developed a habit of pulling my back shoulder towards my head. As my teacher corrected me on this, my concentration naturally became more focused on my pulling shoulder. But, in the process, I wasn’t rotating my front elbow properly.

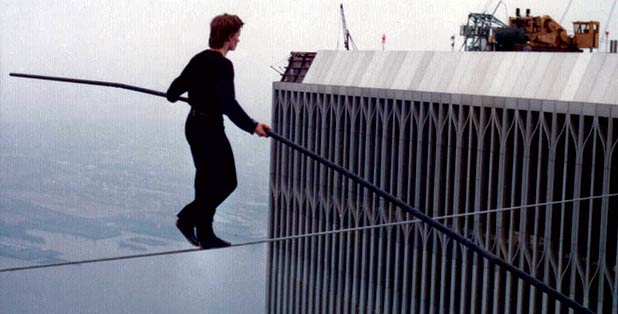

I quickly realized too much concentration on one area meant less on another. Now just imagine if I was a tightrope walker and had this problem 😮

I find this to be the same with developing traders – they focus too much on strategy (particularly the system and entry) but not enough on controlling risk. Managing risk is a game of pure mathematics, and with most traders, they take profits too early, but get hit for their full stops.

Does this sound familiar?

This is a mathematical disaster waiting to happen, and unless you understand your risk of ruin tables, along with how your system performs over time, you may be 60% accurate or better, but mathematically doomed to lose money.

To be a successful trader, you have to focus on the complete process and every aspect of trading. This means just as much attention to proper risk management, building a successful trading psychology, AND a winning system. If any one is lacking, you will unlikely make money over time.

2) It’s All In the Mind

My last session before returning home was the advanced practice focused solely on shooting at longer distances. Normally, I train at 18m, but for this class it was at 30m.

Obviously, some adjustments had to be made, like changing the sight, getting used to holding the bow higher, etc.

After a few rounds, I was shooting close (but not quite) to what I normally would at 18m.

At the very end though, things got interesting.

We ended by shooting three rounds back at 18m, and it ‘felt‘ incredibly easier. Yes, precision becomes more critical at longer distances, but it also felt easier as a whole. Something changed in my mind, and I definitely felt more confident about shooting at 18m.

But what I noticed is with the top shooters in the school, they almost shot identical to what they did at 18m. Why were they able to shoot the same at 18m as they did at 30m?

The difference was in the mind. To them, their mind was just as focused on the task at 12m as it was at 30m, and they were also just as confident. That difference in the ‘thinking it was harder’ for me, definitely translated into my experience of it, particularly my confidence.

Just like archery, so much of trading is in what goes on between your two ears. Take a look at your last 20-30 losing trades in your journal, and see how many of them are related to mental errors, as opposed to you executing everything perfectly, but the trade just not working out?

Now do the math and see what you would have done if you had executed the strategy perfectly. Try the same for your last 20-30 wins, particularly the ones whereby you exited too early, and do the math again. Take a look at the results, and I’m willing to be with over 90% of you, your performance would have improved (if not been highly profitable) if you had used the strategy according to its rules.

Numbers are the best sirens for traders, so see the financial impact your mind has on your results. Now imagine that every month for the next 5 years and see what the difference would be. You are likely talking about two different trading careers.

So ask yourself how many errors do you make simply because of your mind & emotions, then see what you can do to make less errors. For traders more often than not – it’s in the mind.

3) Repetition is Key

Nobody will become a professional golfer swinging the club only 5-7x a month. The same goes for throwing a baseball, playing piano, and trading as well. There is no way you are going to really understand trading, patterns, price action, or the markets if you are only pulling the trigger less than 7x a month.

If you are currently doing this, you are not getting enough feedback from the market, and almost certainly not finding good setups, because there are plenty that happen per day.

Just like in archery, repetition is key to getting the process and technique down. This does not mean you will become a better archer shooting an arrow every 10 seconds as opposed to every 20. There has to be deliberate practice and you have to be able to concentrate on each trade, just like each arrow.

Thus, repeating the process more often will generally lead to better development, so make sure you are trading every day unless there is absolutely no signal with your system. But if that is the case, consider getting another system. Trading is like a feedback loop which communicates information on you, what you see in the markets, and how you are doing. Any lack of feedback usually means a missed opportunity to both profit and learning more about yourself and where you need to develop.

In Summary

Often times, when learning any skill based endeavor (like trading), finding another practice to engage in will often help augment your development as a trader. Many things come to mind, such as playing chess, learning an instrument, training in a brain gym, playing poker :-), and also archery. All of them have aspects which develop key skills highly useful for trading, and could provide the necessary tools to take your trading to the next level.

In terms of trading though, make sure to realize how a lot of it is in the mind (confidence, emotions, etc), to focus on the complete process (risk management, trading psychology, strategy), and how repetition helps develop your skills as a trader.