2 Tips for Placing Highly Effective Stops

One of the more difficult aspects for traders is placing highly effective stops. Either most beginning traders place stops too tight or too far away. Place stops too close to your entry and they are likely to get hit. Too loose and they unbalance your risk/reward ratios.

In today’s article, I’m going to share 2 tips for placing highly effective stops and how these can help you increase your accuracy and profit potential.

1) The Reason You Entered the Market

You should always have a reason to enter the market. Ideally it based on a price action pattern that has repeated itself in the past, and will likely do so again. All patterns have variables that repeat themselves, and it is this ‘repeating‘ we want to happen again, thus allowing us to profit from a predictable event.

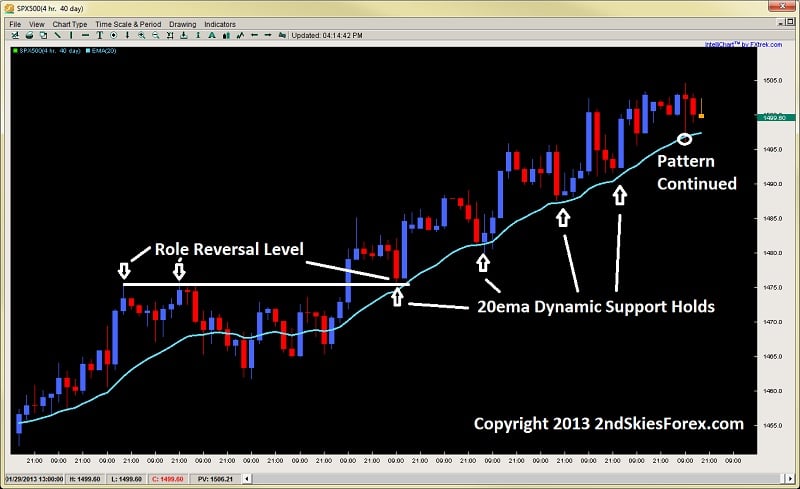

If the reason you bought a pair was because the dynamic support and 20ema was holding on the 4hr chart several times, then your reason to exit should be a violation of this.

I recently wrote in my market commentary how the S&P 500 bounced 4x off the 20ema. If the reason for buying was the anticipation price would bounce off the 20ema again, then my reason for exiting would be the opposite of this happening. Today this is exactly how it played out, bouncing for a 5th time, and offering a trader to profit from it greatly (see chart below).

Now if the price action breaks and closes below the 20ema (something it has not done in 11 days), then the pattern has broken down, and it is no longer a tradable event.

But in terms of placing a stop with this trade setup, we could have looked for the largest breach below the 20ema over the last 11 days, and placed our stop just below this upon entry. Had you done so, you could have easily grabbed a 3x reward play on the last 20ema touch.

2) Stops Are Best Placed Above/Below Support & Resistance Levels

Institutional traders place their orders around levels more than anything else. When many orders from a lot of players with a lot of money, occur at a particular price, it often creates a strong reaction at a level. And when price ‘reacts‘ to this level more than once, it often becomes a key support or resistance level.

Thus, stops are best placed above or below key support and resistance levels. It is here that the larger players are placing their orders, and thus likely to defend your entry and stop.

If you do, then in following the logic of rule #1, we should be getting out of the trade if the level is clearly breached.

Lets take both sides of a potential trade below and see how we could have placed our stops effectively buying or selling.

EURUSD 4HR Chart

Starting with the left side of the chart above, we have a strong impulsive price action bull run, that finds sellers just below 1.3400 , or point 1. This selling pulls back to A where it finds support around 1.3250, and then re-attacks the sellers just below 1.3400 again at point 2. Now if you were a seller, and had seen price hold just below 1.3400 2x, and sold at pt 2, the logical place would be to put it about 10 pips above the round number, while targeting the buyers around 1.3250.

Why 10 pips above 1.3400?

Because this is a round number, statistics show typical stops for selling orders placed at round numbers are often within the first 9 pips above (so 1.3400-1.3409). Of course, always make sure price action confirms this, but this is a general rule you can use.

Now if you want to be a buyer in this case – taking a with trend continuation play, then buying at B or C, with a stop 10-15 pips below 1.3250 would have also worked out, targeting the resistance at 1.3400.

Now trades will not always be this clean in terms of support and resistance levels, which leaves you two options;

1) Only trade when the price action is really clean

or

2) Learn to place really efficient stops

I understand the latter may be more difficult to do, but you can find more high probability setups by adding a key component.

Impulsive Moves

One way to increase your chance of having a profitable trade, and placing an efficient stop, is to trade with trend more than counter-trend. When trading with trend, the majority of the order flow is already on your side, so look to consistently trade with impulsive price action moves, not corrective ones. If you can do this, then you will build your confidence in placing efficient stops, because you are getting in with the larger players.

A great example of impulsive and corrective moves is in the chart below.

You will clearly see how much more profitable one would be selling the impulsive moves (white boxes), and not the corrective moves (green ones). When you can learn to spot and trade with these moves, you will find your stops tend to get hit less, and your full profit targets achieved.

One Final Note

It should always be noted, when a beginning trader looks at a trade, they see profit first, and risk second. A professional on the other hand, looks at controlling risk first, then profit second. So once you have a trade idea and potential entry, figure out your stop – which should be placed where the market should not go if you are correct.

From here, calculate your risk in pips, and then find a target which can be easily achieved with consistency. If the math works, then pull the trigger, and let the trade play out.

In Summary

Placing stops tends to be one of the more confusing things for beginning traders, as they are often placed too far or too close to your entry. By learning to place stops close to key support and resistance levels, you will find they are more well defended than it no-mans land.

Also, by placing stops based on what the market should not do if you are correct, then you will find your stops get hit a lot less.

Lastly, when trading with impulsive moves, you increase the probability your trade will be profitable since you are trading with the flow of the larger players.

To learn rule based systems for placing effective stops, limits, entries and exits – make sure to check out my Price Action Course.

Kind Regards,

Chris Capre

Excellent… and just what I needed. As usual Chris, you write with exceptional clarity. Thanks.

Alan

Hello Alan,

Thanks Alan – glad you liked it.

Kind Regards,

Chris Capre

So what about during ranges? Can impulsive moves exist in ranges? And if so, is it a good idea to trade them?

Hello Lola,

Yes, just on smaller time frames.

But the general rule with ranges is, when its in a range – trade it like a range.

Hope this helps

Kind Regards,

Chris Capre

” But in terms of placing a stop with this trade setup, we could have looked for the largest breach below the 20ema over the last 11 days, and placed our stop just below this upon entry. Had you done so, you could have easily grabbed a 3x reward play on the last 20ema touch.”

l think l must be reading this wrongly Chris.If l am seeing it correctly the chart is a 4hr one so that would mean having your stop below the lowest breach of the last 66 candles, which would be massive of course! So l am presuming the meaning to be that l should measure the biggest breach over the last 11 days and use that distance as my stop distance. If so, l think that’s a cool stop placement technique! Any reason for 11 days, is it a quant thing or just something which is a tad more conservative than say the last ten days, a more commonly seen number for look back periods etc?

Thanks for another great article!

Hello Michael,

Yes, a slight misinterpretation.

If you look at any of the other breaches, they were about 1-1.5 pts below the 20ema, so this is the largest breach

thus we’d look to place our stop just outside of that, say 1.75pts below

does this make sense?

Kind Regards,

Chris Capre