The Aggregation of Marginal Gains in Forex Trading

The World Cup ended a few days ago with Germany hoisting the trophy. Some are speculating this Germany may be the best national team ever.

Such a statement will be argued across bar tables and countries for years to come. Regardless, below are a few amazing facts about Die Mannschaft winning the World Cup;

1) No European team in 6 prior attempts had won the WC in Latin America

2) Their goal differential (difference between goals scored vs. goals allowed) was tied for the best ever at +14, scoring 18 goals, allowing only 4 in 7 games.

3) They finished the WC with the highest ELO rating for a WC champion ever (source: Nate Silver)

There is more, but they won without having any major superstars like Messi, Ronaldo, or Neymar.

How did they do it?

The answer is a method known as The Aggregation of Marginal Gains. This is a strategy for improving performance in any sport, skill or performance based endeavor (i.e. trading). This method is the offspring of Dave Brailsford, the General Manager for Team Sky (Great Britain’s professional cycling team), who has helped British cycling become dominant since 2010.

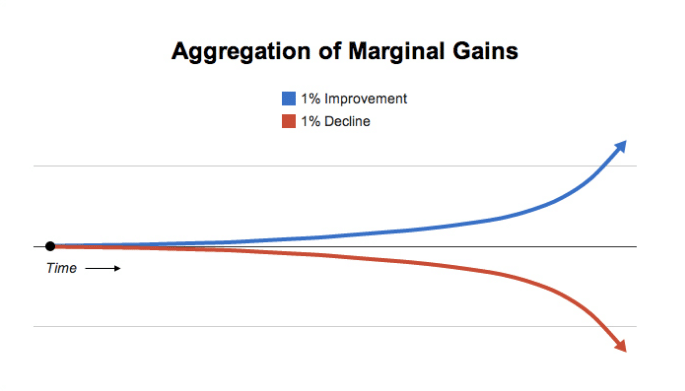

The idea is simple – find and improve as many areas of your discipline as possible by 1%. If you add up those small gains, it will lead to a dramatic improvement in performance.

How did the Germans utilize this method to win the 2014 World Cup? They employed 40 sports scientists to look at every aspect of the game. Their mission was clear – find the smallest advantages wherever they existed. Putting this into context, while they had 40 sport scientists, Brasil had 2. Below are just some of the 1% marginal gains they produced.

1) Climate Trends – they analyzed various tropical climate trends in relationship to player performance and reduce the risk of injuries.

2) Alpine Training – before the WC, they had a 10 day preparation camp in an isolated village in the Italian Alps, 1,000 meters above sea level. Training at this altitude helps to increase the production of oxygen-carrying red blood cells – thus increasing stamina.

3) Base in Porto Seguro – 1 year before the WC started, they build a 60 room base helping them adjust to the tropical conditions more easily. The German climate is far from anything resembling ‘tropical’. Most teams booked hotels in the south of Brasil where it was much cooler, thus making it harder to adapt.

There is more, but you get the key point – they prepared in every way possible giving them the edge available.

If I’m correct, many teams and nations will be studying their methods to improve their respective programs.

An Edge in Trading

In trading, most tend to think of their ‘edge‘ housed only in their strategy. That would be a rookie mistake.

Your trading mindset is an edge, your risk management is an edge, your trade management is an edge, your training method is an edge, your preparation is an edge, your trading plan is an edge, your spreads are an edge, etc. There are certainly more, but create a 1% increase in any or all of these, and the aggregation adds up to a huge shift in performance. That difference could be the gap or cleft between you losing money like you are now, and making money consistently.

The Slightest of Edges

In trading, the difference between losing and being flat is often marginal. Sometimes just a few small shifts in your trading can bridge the gap. The same goes for moving from break-even to profitability. Just increasing your accuracy alone by a few % can mean the difference between having no edge, and making money consistently.

Just even using the fixed % model vs. the fixed dollar amount will improve performance as we’ve demonstrated before. Below is a great chart just showing one of the ways the fixed % model is superior in performance.

Another great example is housed in your risk management. Using the risk of ruin formula, imagine you are a trader who can consistently get a 1:1 reward to risk ratio with your price action strategy. If you are 50% accurate with this R:R ratio, you are losing money. Increase your accuracy to 55%, and now your system makes money (assuming you have a manageable spread).

NOTE: I have a FREE Risk of Ruin Calculator which you can use by clicking on the link.

Edge In the Spread

Coming back to the spread, if your current markup on the GBPUSD pair is 1.5 pips, and you can reduce that to just 1.4 pips, a .1 pip decrease in your spread may not look like much, but take a long view and see what happens.

I have been trading for 14+ years now. Let’s use a low number assuming I make 20 trades per month trading 11 months per year.

14 years x 11 months = 154 months of trading

At 20 trades per month, I would have executed 3080 trades

A .1 pip increase = a +308 pip gain

At 10 standard lots per trade, we are talking $100 per pip

At $100 per pip, we are talking a difference of $30,800 profit, all from a .1 pip improvement in my spread!

Can you see the power of how one small gain leads to a big increase in performance?

Now imagine making 5, 10 or 100 of such gains. By using the aggregation of marginal gains method, you can create small gains which lead to huge improvements in performance. Such gains can be the difference from losing money, to breaking even. or breaking even to making money month after month.

Below is a fantastic graphic how a 1% increase in performance over time will affect your outcome (source: Jeff Olsen).

Edges To Be Found in Trading

In trading, every edge counts, which is why you have to take time to really dig into your trading system and method. Such analysis can turn a barely profitable trader into a highly successful one. My top students have all dug deep into every aspect of their trading, and this is why many of them would outperform 95% of all traders on the planet.

Below is a list of some possible edges you can find in your trading:

1) Improving your entries – Are you using optimal entries, or sub-optimal?

2) Decreasing Stop Size – Take a trade setup with an 80 pip stop & 120 pip target (1.5 R:R). Now reduce the stop by 10 pips. Your R:R increases from +1.5R to +1.85R (23% increase), all from tightening your stop by 10 pips.

3) Trade Management – is a trailing stop kicking your out too early, or helping you lock in the maximum amount of gains?

4) Time Stops – are you holding your trade for days, maybe weeks on end for a simple 1R gain? Or could your capital, time and mind be used for trades with higher R and a quicker return?

5) The instrument you are trading – Perhaps you can make a little money with one pair, but testing the system on another pair shows a big increase in performance.

6) Reducing your spread – perhaps you can get equal performance in terms of accuracy and R:R ratios in a lower spread instrument.

7) Time of Day – Are you trading intra-day? Perhaps trading during more ideal times for your system could increase profitability.

8) Risk of Ruin – do you even know your risk of ruin, or the mathematical probability you will make (or lose) money? Knowing your RoR can mean the difference between losing and making money every month.

9) Your Trading Mindset – maybe your strategy makes money consistently, but you use it improperly, or don’t pull the trigger when you get a prime setup. Your trading mindset could either keep you focused on process, or constantly worrying about that big loss you just took. Ask yourself what edge do you have in your mindset, and how do you work to improve this.

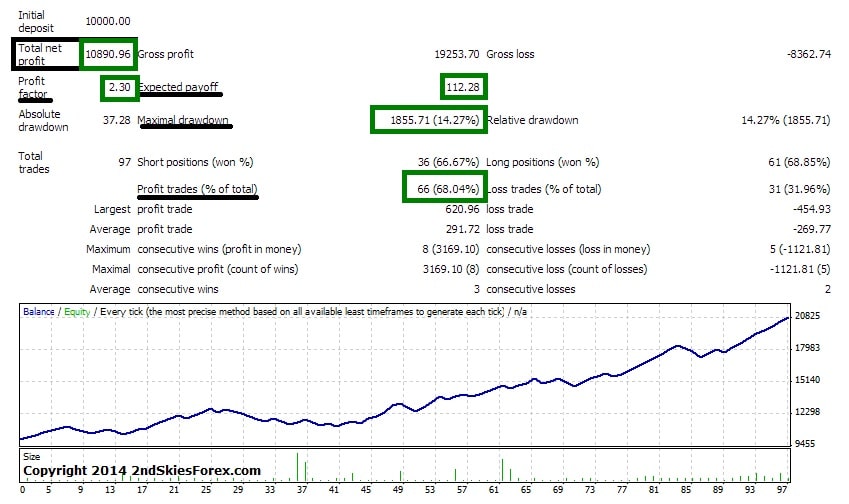

10) Trading Strategy – does your trading strategy have an edge? Below is a strategy from our Price Action Course on just one pair and one time frame, including the performance data gaining +108% over 97 trades risking only 2% per trade.

In Closing

The aggregation of marginal gains is a powerful method that can be applied to trading, sport or any skill based endeavor. The training in the alps did not win Germany the World Cup. Nor did the base they built in Porto Seguro. Nor did the analysis on climate trends and player performance. But adding them all together, alongside with their futbol system, training, teamwork, and a focus on the details, it all added up to a winning advantage, setting records and making history.

Now that you’ve seen the power of making small gains in your trading and how it can affect performance, ask yourself what can you look at to give yourself a better edge? Where can you make small gains, and what details are you missing?

Along those lines, what other edges do you think could be useful to improve trader performance?

Please make sure to share your ideas, comments and suggestions, and what you have used to increase your performance.

Fantastic article Chris. Thanks for sharing.

Hola Eric,

Glad you liked the article amigo. Being a huge World Cup/Futbol fan, this was a fun one, and quite fascinating.

Kind Regards,

Chris Capre

Hi Chris, You seem to find examples everywhere! Great article and fun reading. Since I joined your PA course I am not only learning how to become profitable, but it also reflects on my everyday life.Thanks!

Hola Victoria,

That is how I approach trading and life – find reflections of what I learned and see to use towards my growth, and helping students.

This article was definitely fun, so glad you enjoyed it.

Also great to have you in the course as you’ve been a great addition and your learning process is really developing.

Kind Regards,

Chris Capre

Excellent piece Chris,

I have been wondering all this time what my edge is. I have been asking myself if I have any edge in the first place.

To be honest, I do not have the proper answer to the question “what is your trading edge”?

After reading this article I have fully grasped the real meaning of “edge”.

I am sure that the knowledge that I got from this article will bring in positive results to my equity curve.

Wishing you all the best in your new home in Canada.

Rey

Awesome article Chris…And I totally agree with Victoria , you not only helps us to grow in trading but also our personal life . Thanks again.

P.S: Did you know how Germany won Brazil in semis. Fun video only one team is playing

https://www.youtube.com/watch?v=z6nPL7qi4Xg

Hello Raja,

Well I hope to help inspire growth, not just in trading, but in life in any way I can.

Kind Regards,

Chris Capre

Fantastic and well written article Chris! Very inspirational as always!

Beeing born and raised in Germany myself i can confirm that mostly everything in Germany is approached the same way, especially within the bigger companies. I was suprised when i moved to Sweden at the agen of 17 to see how unplanned and unorganized all the companies i worked for in Sweden were compared to the ones i worked for in Germany. Just an observation i made myself many years ago but it resonates with what you mention in your article.

Hola Sascha,

I am not surprised what you are saying about how the Germans approach many things like this. I had a good German friend here with me during the first three weeks of the WC, and we talked a lot about their system, culture, etc. Seems quite common there and how well they are organized, plan things, and use a system for everything.

So glad you noticed this as well as I find it a useful wisdom to apply to trading.

Kind Regards,

Chris Capre

Great Article Chris ..Thanks for posting

Few of my doubts solved by this article..Thanks for the help

Hola Jobi,

Glad to hear you have found a few doubts solved from this article as it brings up some crucial points for traders.

Kind Regards,

Chris Capre

Yes great article Chris,you are a great teacher and i have learnt so much from your Price Action course.Being a keen cyclist living in the U.K very familiar with what Dave Brailsford has achieved through the small gains in all areas principle.He even advises taking your own pillow when traveling to hotels for better sleep Lol ! I like the way you’ve used this principle with gains in trading.

I’ll always disagree the Germans are the best team ever.Unfortunately i’m old enough just to remember the Brazilian side of 1970…they were a truly great team.

Hola Rob,

Glad to hear you are learning a ton from the Price Action Course.

I’d imagine Dave is quite popular in the UK and well studied. Also heard about the pillow idea to improve sleep. That is really looking at all the details.

Definitely a tricky question if they are the best team ever, but they are definitely in the contention.

Kind Regards,

Chris Capre

Hi Chris,

Another Fantastic & timely article. All of those pieces of the puzzle or process add up to the whole & as you say each improvement to each little edge makes the whole stronger! Thanks!!

Hola Stan,

Yeah – each piece of the puzzle means something, just like it did with the German team. They played well as a whole, not just in parts. And each little edge added up to a winning advantage.

Hopefully you can do the same with trading, and find little areas where you can increase things 1% for your performance as well.

Kind Regards,

Chris Capre

Hi Chris

Thank you for your articles,i always appreciate to hear from you !

I realized your point changing instrument from EUR JPY to USD RUB

to improve my patience holding positions longer .As long the open position is not in profit,i gain a nice swap every day wich reduces the loss every day a little bit.When the price changes in my favour i make double gain only waiting.

I always had the opinion its necessary to trade a pair with a certain vola.

Trying this fits very nice with my dayjob.

Had to change the broker to try this and check out if the demo and the real conditions are the same for Swap-payments.

But the experience was really worth it.

Hi Chris

Excellent article and very informative.

Thank you for your time you always give us traders

regards

prem/Sahaj

Hola Premnathj,

Am glad to hear it was informative and shared something useful for forex traders.

Kind Regards,

Chris Capre

Like this aggregate of marginal gains idea. makes me want to improve bit by bit till i hit success.

Thank you for such a great article.