I know, it seems like we’re well into the new year. But I just completed my Losar, which is the Tibetan new year. The Tibetan Losar is similar to the Chinese New Year as it comes in early February.

However, Losar tends to be slightly different. Leading up to Losar, there are generally 3 main things you focus on. They are:

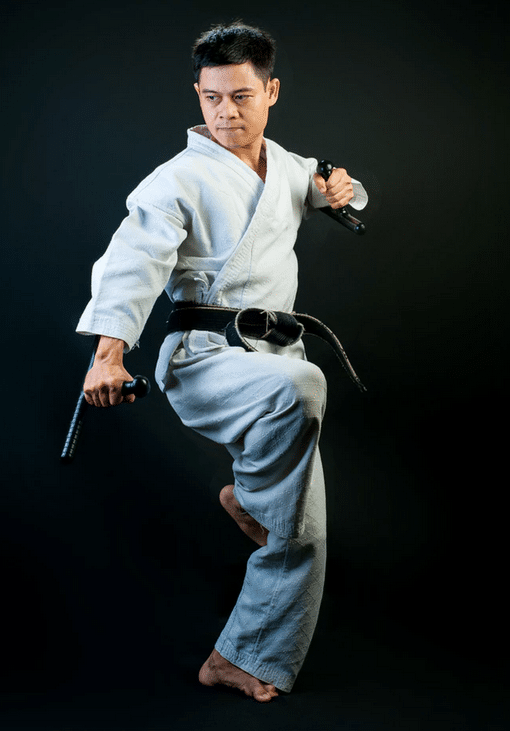

1) Practicing (meditation, yoga, martial arts, etc) + raising your energy (cleaning up your house, working on uncompleted projects)

2) Clearing any debts you’ve accumulated over the last year

3) Reflecting upon the lessons from last year so you can move into the next year clearer and wiser

It is this last experience I’d like to share with the hope that you become more successful in trading (and life as well) for 2019.

Let’s jump in…

Lesson #1: Wisdom and Confusion

Over the last 10 years, I’ve lived in 5 countries, learned 2 new languages, and visited over 40+ countries.

If there is one thing I’ve discovered from all my travels, observing how other cultures live, think, what they value, etc…I’ve seen that every culture, every family, every individual has wisdom and confusion. I’ve yet to meet someone across all my travels which has invalidated this theory. The bottom line is, unless someone is enlightened, they will always be a mixture of wisdom and confusion.

When you realize this, you’ll understand how there is no perfect ‘system’ (politically, economically, socially, etc), and there is no perfect country to live in. All are based on people that have wisdom and confusion, and thus all have their strengths and weaknesses.

This is a very powerful stance to take because it means you can no longer completely discount certain things, like capitalists do to socialists (and vice versa), or republicans do to democrats (and vice versa). Imagine what the various political/cultural/religions divides would be like if both sides of the isle took this stance.

From my experience, generally problems start to occur when you think that one person/system/religion (or yourself) is either all wisdom, or all confusion.

For 2019, try taking this approach to all people, and see how it changes your experience of them. My guess is you’ll find yourself being more open, relaxed and flexible in your thinking.

Lesson #2: “Avoiding Negative People”

Along those lines, I’ve recently seen this phenomena of people saying “I’m avoiding negative people“. This kind of thinking is both helpful, and problematic when you really understand it.

The whole concept of ‘avoiding negative people‘ actually has some wisdom as people can be quite ‘negative’. By and large, most people’s brains are wired so that they will have 5 times more neural cells for noticing the negative vs the positive.

That can be a problem if every 5 out of 6 thoughts you have about yourself/others is negative. How can you build real confidence in yourself if your self-talk is constantly negative? How can you build the traits you want if you hang around a lot of people who 5 out of every 6 statements about you/life/success is ‘negative’?

You can’t. This is where the wisdom of ‘avoiding negative people‘ comes in because you’re trying to rebuild your belief system, self-image, and positive habits.

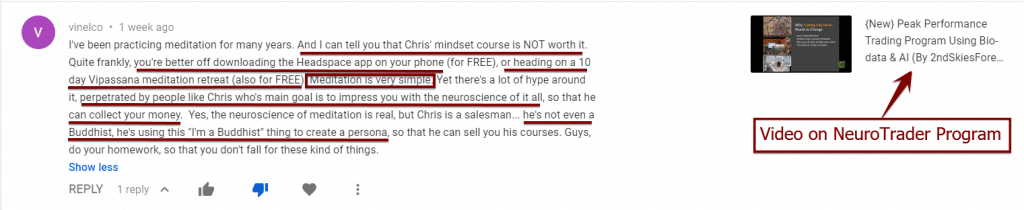

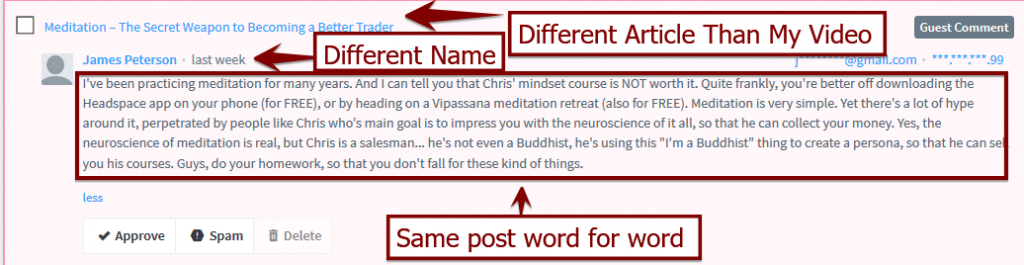

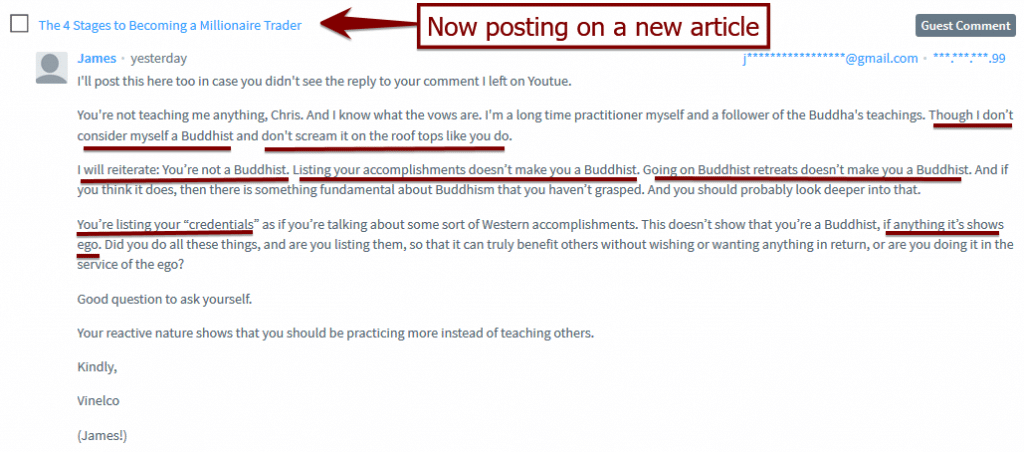

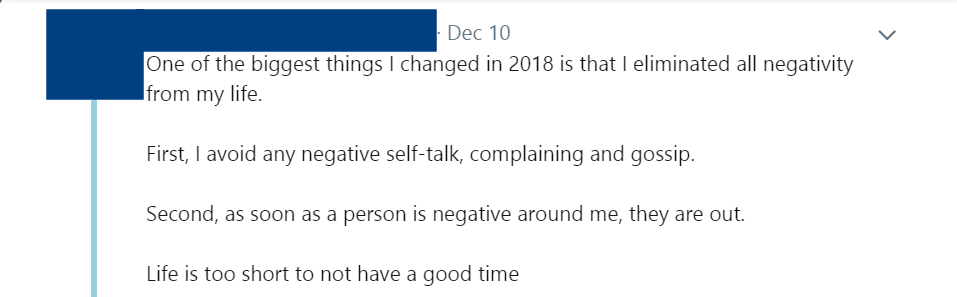

The problem though is thinking this approach of ‘avoiding negative people’ is a be-all-end-all approach. I recently read a tweet from a trader friend (whom I like and appreciate). Here is what they posted:

Akin to point #1, (IMO) this tweet has a mixture of wisdom and confusion. Why?

First off, you cannot avoid all negativity in life. It’s unavoidable! People (including you) at some point will go negative. If you tried to avoid all things negative in your life, you’d be living in a bubble and never interact with anyone. And I’m not sure how you can be a mentor to anyone if you hold fast to this approach.

The whole basis of any teacher-student relationship is taking the student from confusion/negativity to wisdom.

With that being said, how can you be a trading mentor if you’re cutting out all your students who go negative one time? If you did that, you’d likely have no students. So this approach really lacks vision.

Along those lines, ask yourself about those in the military who went to fight the Nazi’s. What would the world be like if they all avoided negativity? Who would take on those battles, make those hard choices, sacrifice their lives for a better good?

Another major problem with this approach is it assumes that you are the ‘wise‘ person, and others (who are negative) are ‘confused’. IMO, this is a pretty arrogant position to take when you really think about it. Maybe your level of wisdom is another person’s level of negativity. Maybe someone much wiser than you would view your beliefs as ‘negative’. So what then? Should they avoid you?

When you really examine this approach, you realize it has its limitations. It has both wisdom and confusion. Can you see how this is helpful and hurtful as an approach?

Lesson #3: Understand Principle & Function

This brings me to my third lesson – understanding principle and function. Principle relates to the basis/fundamental understanding of something and what its founded upon. They explain the how/why things work.

The method of ‘avoiding negative people‘ is based upon the principle that you/others will often lean towards a more ‘negative’ way of seeing things, especially if your brain is wired that way.

Function is having a clear insight as to when this approach/method/practice is useful, and when its not. My guess is the author of this tweet at some point in their life (at least before this tweet) was ‘negative’. What if someone much wiser than them wanted to help them, but decided to ‘cut them out of their life the moment they went negative‘? How functional would that be? How would people ever really grow, or get help from others?

When you realize principle and function, the idea of ‘avoiding negative people‘ or any other method becomes more appropriate in specific situations/times, and completely misunderstood in others.

Hence learn to see the principle and function in your training, growth and development (in all things you do) and you’ll find yourself using the right tools for any situation. Using the wrong tools at the wrong time often creates more problems.

NOTE: this is not something I created – the concept of understanding principle and function. It’s a particularly buddhist approach to training and teaching. It’s just been a major lesson I’ve had to really work with this year.

4) Find Somebody Wiser/Kinder/Clearer Than You

I think we can all agree there is someone out there in the world who is much wiser, clearer and kinder than we are. I also think if you are going to be any kind of teacher/mentor to others, you also need to be a student as well. Not only does being a student help you fully understand the teacher/student relationship, but it always means you’re no longer taking your mind/thoughts/ideas as gospel. It means continually exposing yourself to someone whom you trust to give you a less biased view of yourself, and point out any confusions you are missing.

I feel very lucky. 19 years ago I met my current buddhist teacher, and have been with her since I made a commitment to be her student. Yes, I’ve taken teachings/trainings from other buddhist Lamas and masters, but she will always be my ‘root‘ teacher. I’ve seen her continually grow and evolve at a pace and magnitude I’ve never seen anyone else do in my life, and have thus committed to being her student my whole life.

In essence, we are all students in life, and there are people out there who can help us become a better version of ourselves right now, while also helping us see our own confusions we are currently missing (trust me, they are there).

Hence, find that person who a) embodies something better than you are now, b) communicates in a way that makes intuitive sense to you, and c) is someone you want to train with (and wants to train you). My guess is when you do this, you’ll find yourself constantly growing, and being challenged to become a stronger, clearer, wiser version of yourself.

5) Building Bridges

The one thing I love about trading is it’s apolitical, non-religious, and doesn’t care about gender. I love the fact that I have students from every religion, across 60+ countries with diverse political beliefs. When people come together for a common goal, our differences aren’t the focus, nor what divides us.

Now with the current buddhist school I’m a part of, we have what you’d call a ‘senior student’ group that you have to complete practices and trainings for.

We recently had a student from Iran who grew up in a Muslim faith join our group. We have no judgments about him, his Muslim practices, faith, or traditions. We appreciate him for who he is and how he relates to us, not what we agree or don’t agree on.

By doing that, we’ve built a bridge between our religions, regardless of our differences. Imagine what the various political or religious conflicts would be like if people didn’t use those differences to see what’s ‘wrong’ with others beliefs?

Imagine what kind of personal, cultural and societal bridges we could build when we stop dividing ourselves from others simply because they hold a different belief system? What if we simply appreciated their good qualities and then looked for common ground?

Over this last year, I learned that when you do this, you build bridges in ways that allow us to work together for common goals, which tends to make us stronger as people.

6) Discipline Has A Momentum. So Does Its Opposite

As a whole, I generally consider myself to be a disciplined person. When I was 11 years old, I got my first job as a paper boy. Keep in mind, this is a job that has no days off. Papers are always being delivered every day, regardless of the weather, health or holiday.

I grew up in Chicago, and we can have some harsh winters. My job consisted of getting up at 5:30am before school started, so I could roll the papers, rubber band them, and put them in a plastic sleeve (if the weather was wet or snowy).

I can remember many days being sick with 100+ degree fevers, and yet still going out there on my bike. And if there was too much snow, I’d have to venture out on foot carrying over 35+ papers around my neighborhood to deliver them on time.

This was hard as a kid, especially getting all this done before I went to school, but I learned the power of discipline. I learned in those early years that what I thought were my limits, were just illusions in my mind. This has become a valuable resource and wisdom for me when I often think about not practicing, quitting, or taking the easy path out.

In trading, you will be tested, particularly in the first stage of trading to see how strong your discipline and level of commitment is. Just like the space shuttle spends the majority of its fuel trying to build enough momentum to leave the Earth’s gravity, so too will you spend a lot of energy trying to leave the gravity of your current habits, conditioning and limiting beliefs.

Hence cultivate discipline, and accumulate it over a long period of time. My guess is you’ll find yourself becoming more confident day by day that you can reach your goals in trading, and life as well.

7) What Habits Are You Perfecting?

I want you to think about the most important precept of neuroplasticity: neurons that fire together, wire together.

In essence, what you continually think about, and wire together, becomes a habit in your brain, and thus tends to dominate your life.

If you think about what revenge trading is, it’s simply you taking revenge on yourself for making a mistake. If you continually do it again and again, you’re simply perfecting the habit of revenge trading, anger, and punishing yourself for making a mistake. Your creating the very problem you’re trying to stop (anger, frustration, revenge trading) by simply making those experiences become habit. Hence you’re using neuroplasticity to become a losing trader.

People often think the actions they take is the basis for the habits they create, but I think traders and people also forget that what we continually think, and say (out loud, or internally) also creates habits, beliefs and neurological networks we’re vulnerable to repeat.

So examine your self-talk in trading, and notice the ‘quality’ of it. Notice your speech (internal or external) about yourself and others.

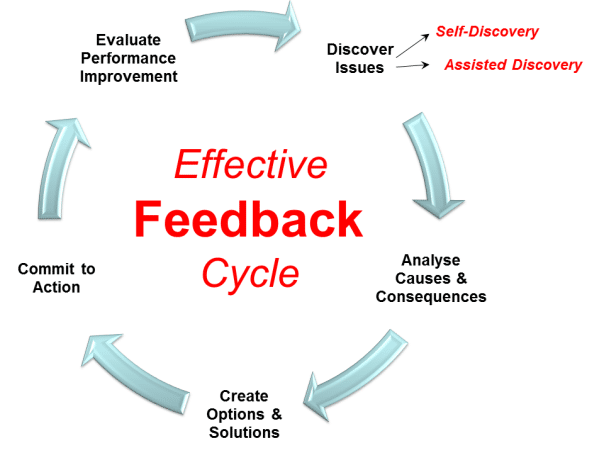

Hence take some time to reflect upon what habits you have created around trading. Just look to what you’ve been repeating the most. Whatever you repeat the most is what you’ve been perfecting. When you do this, my guess is you’ll find you’ve been much more responsible for your current struggles than you realize.

But not to worry, this is a good place to be at, and often is the starting point to making real change in your habits, skills and trading mindset.

8) Being Stuck Often Means You Have to Go To The Next Level

In the early summer of 2000, I was living out of my car – a black 2 seater Miata (man I loved that car). But this was not a happy time. I had less than $3 to my name, no home, no job, and had lost most of my friends to some dark circumstances.

I was stuck in a bad place. And on one of those cold late nights, trying to sleep in my car, I eventually had enough. I threw in the towel to the way I was living, and made a commitment to really change my habits.

I vowed to stop drinking/doing drugs, eat healthy, get a job, and start some sort of mind-body training (I first found yoga). I was tired of suffering in the way I was, and made a commitment to never put myself in a situation like this.

Lo and behold, a few days later, after showering in the local free gyms, I got a job. In a strange twist of irony and humor, it was at a brewery, but I didn’t drink while I worked there as I kept that commitment.

I eventually saved up enough to get a 1bdrm apartment in a shitty neighborhood where resident on the building spoke another language, and some of those ‘residents’ were cockroaches. However, I felt that was my cross to bear for getting myself in that situation.

Less than a month after I made this commitment, I was introduced to my current partner who had just started a teacher training program in yoga and meditation. In the blink of an eye, everything changed.

When I look back in that period of my life, I failed to (at that time) realize how stuck I was in some really bad habits (which landed me where I did). The dark/stuck place I was in, was really the universe’s way of saying “hey, you need to evolve, you need to go to the next level.“

Since then, every time I find myself stuck in a particularly situation I can’t seem to break the cycle of, or get out of, I look at my current life and see where I haven’t evolved. Sometimes just evolving in one area of your life helps to unlock the next door. And even if it doesn’t solve your current problem, you’ve raised your energy, and that tends to lead to better situations, connections and growth in your life.

So the next time you find yourself stuck (in trading, work, life, etc), take a step back and reflect upon the areas of your life you aren’t evolving, and see where it leads.

9) Breaking Big Goals Into Small Steps

How many new years resolutions have you failed to accomplish over the last 20 years? My guess is many. Did you know that those who sign up for a gym membership in January from a New Years resolution will more often than not stop attending the gym within 3 months?

New Years resolutions fail for so many reasons, particularly because you’re making big goals that are too far from your current level of skill, habit and mindset. Yes, it’s important to have big goals, but none of them matter if a) you don’t achieve them, and b) break them down into smaller steps.

Nobody sets out to climb Mount Everest in a year without ever climbing smaller mountains first. The same goes for trading.

So if you really have the goal to become a profitable trader, start with some smaller goals first. Start with the first stage of successful trading – consistency, and break that down into the small steps you’ll need to take to get there. Only when you’ve climbed one mountain can you make goals and aspirations to climb to the next peak.

Hence ditch the fruitless New Year’s resolution. The numbers are against you. If you want to meditate every day, try meditating for 2 days in a row, then 3, then 4, then 5, until you can get to 7. Then try for two weeks, a month, and several months.

Do this enough, and in no time, you’ll have built the habits to accomplish your goals.

10) Big Journey’s Are Rarely Ever A Straight Line

Most likely, you’ve never heard the name Massimo Bottura, or Osteria Francescana. Osteria Francescana was rated the best restaurant in the world for 2018 and Massimo is the chef/brainchild behind Osteria Francescana.

If you watch the Netflix series Chef’s Table (which I highly recommend), Massimo was episode 1. You learn about his success, about his 3 star Michelin rating, and about how many chefs and peers worldwide consider him to be one of the greats. If you were to learn about all his accomplishments, it would be hard to miss the most important part of his story – his struggles, failures, and journey along the way.

Even after finding his passion in cooking early on, Massimo had a long road to becoming one of the best chefs in the world. He had to apprentice for a long time, working long 10-14 hours per day for years on end. He had to study with many mentors and endured a lot of challenges before he could even open his first restaurant in Modena, Italy.

However, even after training for years on end with all the experience in the world, his restaurant struggled immensely. His style of cooking wasn’t well received, and he was going bankrupt trying to keep the restaurant open.

Just when Massimo was about to give in, his partner (and now wife) said “give it 1 more year. If it doesn’t work, we’ll close.” Keep in mind, Massimo had already sold everything he owned just to open his restaurant!

About a few months later, there was a really bad accident on the Italian highways near the Northern part of Italy. After being stuck in traffic for hours, a man decided to take a side route, and ended up in a small Italian town.

Hungry after a long trip, he decided to eat at ta small restaurant he’d never heard of before. It just so happened to be that this hungry man was also a food critic for a major food magazine. By the time he was done, he was completely blown away by the chef’s style of cooking, which was night and day different from most Italian cuisine.

He decided to write about his experiences at a restaurant called Osteria Francescana. In that moment, lightning had struck, and it changed the course of Massimo’s career forever. While Massimo’s worldwide success happened over a few short months, the journey there was hardly short, nor straight.

When you take a deep look at those who’ve become successful in their careers, you’ll find none of them built success overnight, nor in short order. They’ve all had to work for years at their craft before they had their breakout moment, and that path from start to success was never a straight line.

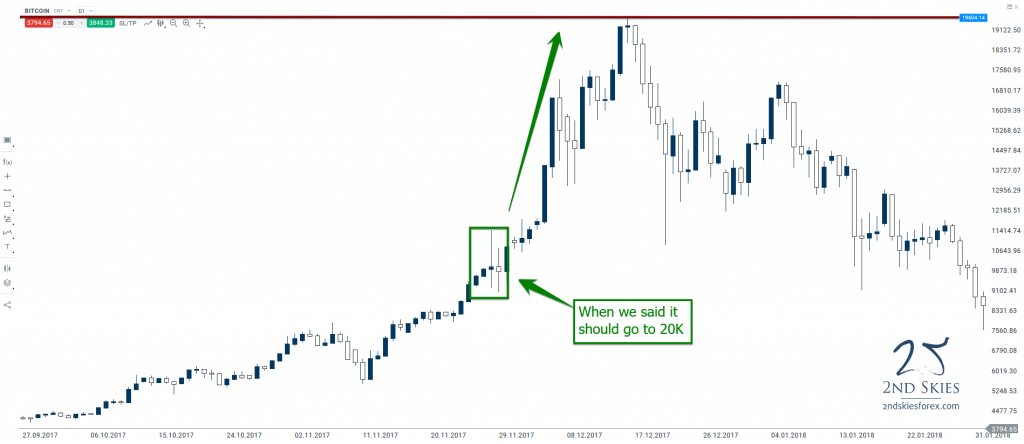

So give up the fantasy of trading and becoming a millionaire over night. This is not something to fear, but to celebrate. It’s what makes the journey, and experience of success even better than you could imagine.

11) The Best ROI Trade Is To Invest In Yourself

If there is one lesson I could go back in time and teach to a younger me, it would be that the best ROI trade out there is to invest in yourself. Everything begins, and ends with you, your health and mindset. Those 3 variables determine what you think, decide and execute every day. It shapes who you surround yourself with, what support they offer you, what beliefs you share, what qualities you enhance them with, and they you.

It was 19 years ago, shortly after living out of my car, that I really invested started to invest in my health and mindset in any meaningful way.

Since then, I’ve:

-Paid for over 150+ weekend retreats

-Taken about 20+ online training courses is various skills that I needed to work on

-Read on average one book per week for the last 7-8 years

-Done about one 7 day pancha karma retreat (healing/detox retreat) per year for the last 8 years

-And continually pay to keep my body healthy through accupuncture, ayurveda, chiropractic adjustments and exercise

I’ve realized the most important thing I could invest in, is me, my health and mindset. I’m not saying you only have to look out for numero uno. Having a positive impact upon others is important. But you won’t be of any help to yourself or others if you don’t care for you health and mindset.

Hence ask yourself “What am I doing this year (activity, or training wise) to invest in me?” What are skills you want to build? What experiences are you embarking on that will enrich your life?

Take a moment after reading this article, and start really thinking about what you want to grow into this year. I’m not talking about the ‘things’ you want to buy. I’m talking about who you want to become as a person. Figure out what those are, then find ways to invest in them.

I’m guessing once you do, you’ll find it to be one of the best investments and trades you’ll ever make.

12) Making Money Doesn’t Make You A Wise Person

There seems to be this major cultural ignorance, that people who have made a lot of money are also ‘wise’. Wise as in they know what’s best for government, know what’s best for the economy, know what’s best for society, technology, your life, etc.

People seem to equate financial/business success with ‘wisdom’. This is a really strange phenomena because its implicitly admitting we value money above all, and that if you make a lot of money, we should listen to you on all kinds of subjects.

Making a lot of money just means one thing: you’ve learned how to make a lot of money. History is heavily littered with people who made vast sums of money, had massive success in their business/craft, but were miserable in life.

This whole problem has also entered the trading space with trading mentors. They seem to get some sort of success in trading, or business, and are now doling out advice on twitter like a life-coach.

Success in business or making money means just that (success in business/making money). It doesn’t make you some wise person who has clarity or insight into the human mind, what makes people happy, or wiser.

Know the difference.

13) Concept Is < Direct Experience

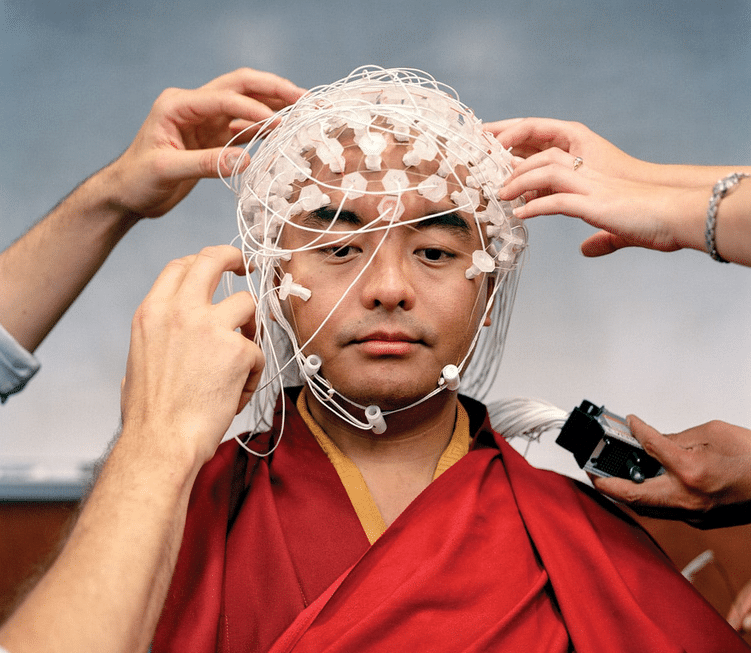

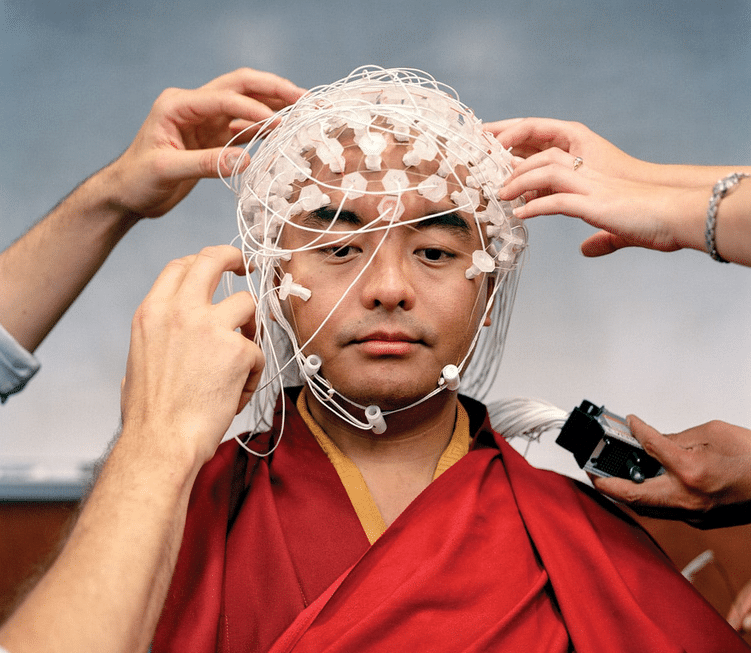

There is a fascinating book ‘Altered Traits: The Science of How Meditation Changes Your Mind, Brain and Body‘ by Goleman and Davidson. They had spent years testing the brains of experienced meditaters from various practices, traditions and experience.

However one particular subject caught their eye. His name is Mingyur Rinpoche, and he’s the one person they tested who has spent spent more hours in meditation practice then any other (62000+). To put that in perspective, that is the equivalent to meditating 8 hours per day over 20 years, without ever missing a day!

Goleman and Davidson tested him during an experiment where he was to spend one minute focusing on compassion, and then rest his concentration and awareness for a short period of time.

His EEG activity (Electroencephalographic) had shown something the scientists had never seen before: high amplitude gamma waves, the strongest, most intense form of neurological activity. Gamma waves are the fastest brain waves, and occur when various regions of the brain are working in sync.

Ever have that sudden ‘aha‘ moment where everything clicked and came together? Most likely you’re experiencing a gamma wave. However for us mere mortals, these last about .5 seconds. Contrast that to Mingyur Rinpoche where they lasted the entire minute (while he was focusing on compassion).

Now keep in mind, these authors (and the other researchers they included) are ‘experts‘ in studying and understanding the brain. And yet, regardless of their high IQ’s, when they had to think about what Mingyur’s state and consciousness was like, this is what they had to say:

“We can only make conjectures about what state of consciousness this reflects. Yogis like Mingyur ‘seem’ (my emphasis) to experience an ongoing state of open, rich awareness during their daily lives, not just during meditation.” Source: Chapter 12, Altered Traits.

Notice how they are openly admitting their own limitations in attempting to understand what Mingyur’s state of awareness, clarity and insight is like during these states?

What they are implicitly admitting is, regardless of how strong your intellect is, to understand something ‘conceptually‘ is nothing compared to having the direct experience. Those ‘experts’ in the brain are completely powerless to fully understand Mingyur’s state of clarity, mindset and awareness.

This should help you come to a very important conclusion and realization:

Concept is < Direct Experience

14) Doing What I Was Trained To Do

On Monday, April 16th last year, around 8am, I had missed a call on my cell. I was in the kitchen making tea and getting read to start work. A few minutes later, at 8.04am, I got a text message. It read: “I need to talk to you asap, please call me.”

It was my sister. I called on the quick and the first words out of her mouth were “Dad’s gone.”

After spending a while on the phone, finding out what happened, and getting a flight, I did what I was trained to do (as a buddhist). I sat in meditation, then did practices for my dad.

I remember the scene very clearly. It was winter with lots of snow outside on the treetops and slightly cloudy. I looked outside my office into the vast space across the nearest mountain top to the east, and…just…sat.

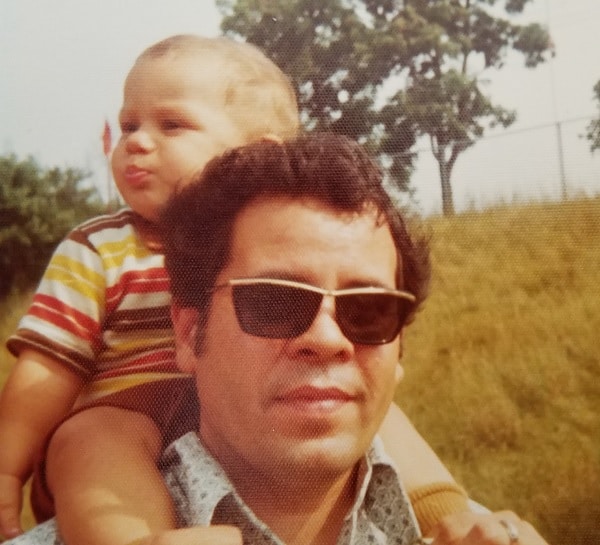

My dad and I had a ‘complicated‘ relationship. I eventually made my peace with it, realizing our relationship would never be what I had envisioned between a father and son (does it ever???). But I had accepted it, and him for what he was…a mixture of wisdom and confusion, with definitely a lot of confusion.

I hadn’t seen my dad in months, and his last text msg to me was “uh rtrbnot, biilb, hybrid yy, we isthat, we.” When I got this, I thought he had just accidentally butt-texted me, so didn’t pay any attention to it. Who would think that was an actual message?

But when I sat there in meditation, I started to experience some regret for not texting back. Maybe he was trying to contact me, but was losing his faculties? Maybe he was reaching out, but couldn’t use text well?

When I sat there, a whole range of emotions and thoughts came up, including many, many tears. But instead of getting into the emotions specifically, I just sat there in the raw energy of them. It felt like I was on fire. It was both painful, and highly energizing to sit in such intensity, without making them mean anything about me, my dad, or our relationship.

I did what I was trained to do, and I’m glad I did, because I could have easily fallen into a deep cavern of regret, frustration, anger, or whatever about his passing, me missing his last text, or not seeing him before he left.

A few days later, there I was, standing in front of my dad, in his casket, the life gone from him. He looked like him, and yet not like him. It was kinda surreal. When I said my goodbyes, I left him one of my main malas, which I had chanted 100’s of thousands of mantras with over the years. I said my prayers for him, and shortly after, he was buried.

When I came back home after the funeral, I felt a big vacuum. My dad was there for the 40+ years I’ve had on this planet. Now he was gone, and there was nothing I could do about it.

But while feeling this giant hole and vacuum, which felt very raw and open, I also felt the world, there in every moment, trying to fill up this hole…with life.

Life is pain and joy. It’s loss, gain, and everything in between. There are many ‘initiations‘ we go through in life (love, relationships, success, failures, death). It is during these moments, some of the most intense ones you’ll ever experience, that your training and mindset will be tested.

That which you are most trained to do (or most wired to do), will in most cases, be your dominant response.

Hence ask yourself, when the really intense moments in trading manifest, how strong is your training? What thoughts/actions do you default to? Is it something you can rely upon, or will it hurt you in such moments?

15) People Are More Complex Than You Think

One of the really interesting moments for me after my dad died was spending time with my family, and all the things we talked about regarding his life. I’m not sure why families do this, but often times, people reserve certain ‘details’ about others until after they die. And to no surprise, my family did just that.

I had known my dad was taking medications for years due to his declining health, but I didn’t know the extent to which he was. I also learned that from 60 yrs on, he was taking a steroid daily. Now if you know anything about steroids of any kind, they’re super intense, and are basically a last resort to stimulate some functioning in your body you can’t do naturally.

Sometimes they can be helpful, sometimes not. But one thing they are for sure is ‘mood altering’. So for the last 20+ years of my life, my dad was on a drug that likely affected his thinking, moods and mindset.

Which made me ask the question:

“How much of my dad was I really relating to these last two decades?”

I’ll never know, but the very question created a space for how I felt about my dad. Maybe all those times I felt he was being unconscious, highly moody, angry, loud, blurting out, etc. were actually caused (in part, or wholly) because of his medications.

Maybe if he wasn’t on them, he’d be a different person. I’m not sure I’ll ever know, but I know people who’ve been on meds, and who they are without them can be a completely different person.

I also learned many things about my dad in terms of how he dealt with tragedy, and losing a son who died on X-mas eve. I never got to meet this sibling of mine as he was before my time, but in learning how my dad responded to it, I can see a lot clearer why he was the way he was.

One thing I learned in 2018 is that people are often more complex than you think, and rarely are they ever ‘black and white‘ when it comes to their emotions, personality, and mindset.

And by understanding people are more complex than you often perceive, maybe, just maybe we can hold a little more space for them. Most likely, people are more complex than you think they are. And that accounts for what you’re perceiving about them as well.

16) Generosity Is A Wisdom

As I said before, there are traits and behaviors I learned from my dad, many of them being negative, but also some really positive ones as well. There is one thing my dad had down pat, and that was generosity.

My dad’s parents were super poor, and came from very hard conditions. My dad grew up in the streets of New York in a rough neighborhood. He saw very well how hard the poor people worked to get out of their situation. He also noticed how they struggled just to survive.

Because of this, I have probably a 1000+ memories of growing up in Chicago, and us pulling up to a stop light, and seeing someone on the side of road in -20F weather. Before we’d even get to the stoplight, my dad was reaching into his pocket to grab what few dollars he had. He’d open the window, call to the person, all while traffic is waiting behind him, and give them whatever money he had, suggesting they get some food and stay warm. He’d wish them well, and then we’d continue on our travels.

Often times, after this, my dad would say something like, “my god, it’s so cold out there, how are they surviving?” or “how can a country so wealthy leave people like this?” To my dad, it confounded him how we could call ourselves the ‘richest country in history‘, yet not take care of our own people. I too have pondered this question for decades, and only have partial answers.

I learned very early on from my dad that generosity is a wisdom. It’s a moment in time where we are not thinking about me/myself/mine. It’s a moment we’re letting go of that obsession, and thinking about the well being of others, and actually caring for their condition.

It seems we could use a little more of that spirit in the world today (generosity/thinking of others). It doesn’t have to be money, but could be time, energy, or just listening to someone who needs someone to talk to.

Hence, try the practice of being generous to someone (in any fashion) 1x per day for the next week (even if it’s only for a moment), and see how it feels.

17) Trading May Not Be Your End Game

I’ve been trading for over 19+ years. I’ve had 2ndSkiesForex for over 11 years, been practicing buddhism for 19 years, and only one of those can I confidently say I’ll be doing until the day I die (any guesses?).

Why am I saying this? I’ve taken on big projects that have succeeded well over a decade, and there are two things I’ve really experienced over these last two decades:

1) I’ve evolved as a person

2) With that evolution comes changes in what I’d like for my life

As I’ve gone through my physically unstoppable 20’s, worked like a madman and started several successful ventures in my 30’s, now that I’m in my 40’s, I’m much more aware of my mortality, and how my values are changing.

I’ve had periods over the last two decades where I’m not trading for a month or longer. And most of that time, I felt like I was missing something. Not an addiction, but a skill and challenge. When I’m not involved in the markets, something feels off.

However, I cannot imagine feeling the same in my 70’s, or 80’s. At some point, trading will not be there, and most likely won’t in my end game. I also don’t imagine being a trading mentor in my last days.

What I’m trying to say is, while right now, you may be uber-passionate about trading, and want to trade full time for years on end, who you are in 10 years from now ‘hopefully’ will be different. And along with becoming different, your values change. How you value trading now might not be what it is in 10 years.

Trading may not be your end game. It may be simply a stepping stone to something bigger, some future which you cannot imagine right now. Be open to that possibility, and avoid looking at any failures in trading as life or death. Maybe you’re on a path to a higher peak.

18) The Training Never Stops

I was recently wacthing the Tom vs Time series, which is about one of the greatest competitors of the last 100 years, Tom Brady. Whether you like him or not, you cannot deny his accomplishments and competitive fire. Tom is now 41 years of age, and has just won his 6th super bowl!

He’s an elite athlete in his own sport and position, and yet, after all the skill, knowledge and accolades he’s acquired, he still does something fundamental every day for 8+ months a year. He trains!

I think many struggling traders have this delusion that training and practice isn’t important, that once you are successful, you won’t have to practice or train any more. But any long term athlete, musician or trader will tell you, the training never stops.

There is no athlete that is playing competitively at a high level and is not training. There is no musician who is playing at a world class level who is not practicing their instrument week in, week out. And there is no profitable trader who isn’t doing their homework, reviewing their trades, and constantly looking for an edge in everything they do.

Training never stops. There is no arrival point where we no longer have to practice. Hence ditch the idea that at some point when you’re making money trading, that you won’t have to do any more work.

The work never stops.

19) Try To See People’s Goodness

There is one astounding fact about your brain (including mine) which continues to baffle me, yet explain a lot of world around us. It’s the fact that you/me/others have about 500% more neural real estate towards perceiving the negative vs the positive.

Chalk this up to evolution and our desire to survive as a species, but this trait of ours has run its course and isn’t really applicable in today’s world.

Regardless, if our brains are primed to see the negative more than the positive, then what does such a fact mean for how we perceive others? It means we’re most likely to notice, observe or pay attention to their negative qualities vs their positive ones with 5x’s the regularity.

This creates a myriad of problems in how we perceive others, along with what we reinforce in ourselves.

I think this 5x effect is why news organizations are more likely to publish stories which activate these neural networks. It makes them more money because it triggers more neural real estate in us, thus more likely to prompt a reaction.

I also think if we want a healthier society, we have to learn to balance these qualities out, so we’re able to perceive both the negative and positive qualities with equal skill and regularity.

Try doing this for a week, picking a few people, and notice how it affects your perception and experience with those people. It would be interesting to hear what you find.

In Closing

I sincerely hope you found some wisdom, insight and helpful pieces out of this article. As I reflected upon 2018, I see a year of growth, of great personal challenge, and laying the foundations for an amazing 2019. There were a lot of tough lessons to learn in 2018, and I hope to make less of these mistakes in 2019.

Please make sure to leave your comments, feedback and thoughts on my musings above.

Until then, may this article be of benefit to you in your trading, and life as well.