Let’s face it – not everyone has the ability to sit down for hours a day building their trading skills. Many of you have full time jobs, families, etc., yet still want to participate in the market.

If this is you, I generally recommend using forex set and forget trading strategies to trade the market. This is done by using rule based systems for to find your entries, exits, stops, & take profit levels. The ‘rules’ save you time as you just have to spot the conditions for a legitimate setup, then put in your order.

The problem is, the more popularized version of this ‘set it and forget it‘ investing style is to set your trades and then ‘walk away’. Perhaps you go read a book, golfing, or hang out on the beach. This is a completely ridiculous idea which actually harms your learning curve.

In this article, I’m going to share the major flaw in set it and forget it forex investing, then explain how you can accelerate your learning curve.

Walking Away – The Major Flaw

Let’s say you only have 2 hours per day to analyze & trade the market. According to the more popularized version of ‘walking away’, you spend say 30 mins to find your setups, put your trades in, then do something else.

Why does this harm your learning curve? Because you already have two hours set aside for trading. If you walk away after 30 minutes, you are missing out on 1.5 hours of screen time and an opportunity to build your skills.

I know what you are thinking – if you have no more trade setups, why sit at the charts?

Wow – great idea. So if I’m not actually in a golf tournament – I shouldn’t practice my golf swing? If I’m not playing a live baseball game, I shouldn’t go to the batting cage, or work on drills, or throws? Ridiculous – and I hope you can see this as well.

What You Can Do Differently

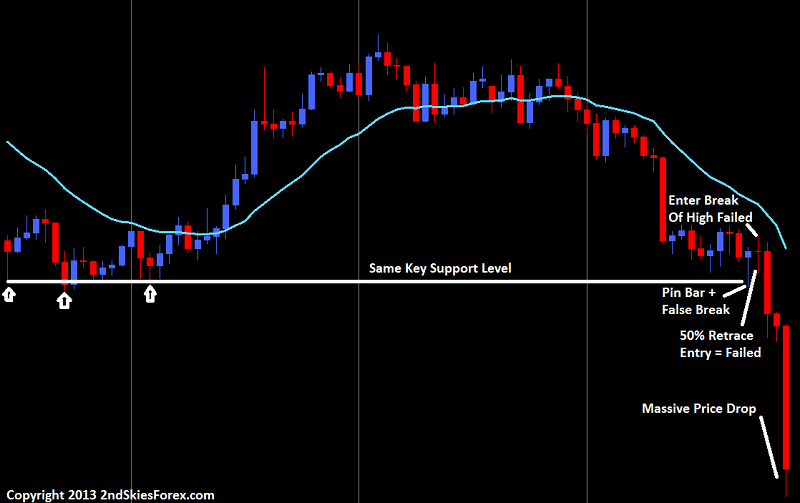

Perhaps your strategy trading pin bars with trend. You have no more setups for the day as you’ve put in your one trade. Does that mean you cannot increase your screen time or learning process? No, have two hours, so USE IT. How so?

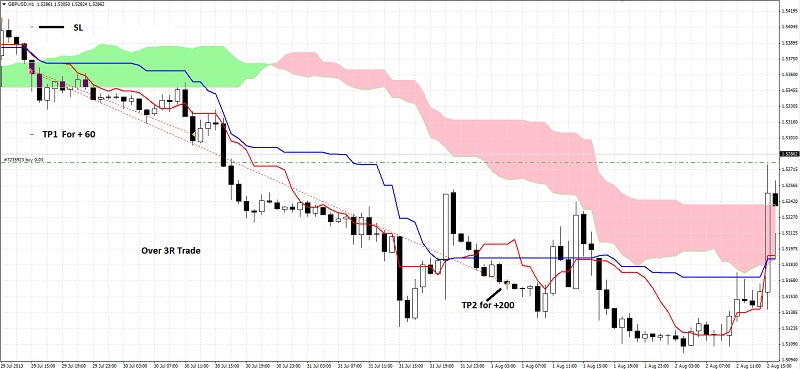

Get Trade Interceptor or Forex Tester 2 where you can go back historically to any point in time & trade price action doing live forward simulation testing. Trading pin bars with trend, open up a daily chart several years back on your favorite or weakest pair. In testing mode, it will move the actual bars at a speed workable for you & of your choice.

Anytime you have a pin bar setup that meets your qualifications – trade it the way you normally would your real system. This will give you both increased reps and screen time – both of which will enhance your learning curve. In an hour of live forward simulation trading, you could actually trade 30-50+ pin bars.

What will this do? It will;

a) Enhance your pattern recognition skills

b) Build neural networks in your brain to recognize high probability setups using your strategy

c) Give you more practice and execution using your method, which will

d) When it comes to live trading, increase the chance you just pull the trigger with less emotions or analysis paralysis

By Comparison

What does the person who ‘walks away’ from their computer, gain during their remaining time? Nothing! They build no screen time, have weaker neural circuits for making trading decisions or pulling the trigger, let alone pattern recognition skills.

Yet the trader who practices that extra 1.5 hours doing live forward simulation trading will improve at a much faster rate.

A Top Professional

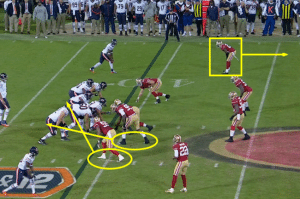

Just recently, I got a perfect reinforcement of this from a top professional. Peyton Manning is one of the best quarterbacks in this generation – perhaps top 10 of all time. He’s 37 and is still playing at a top level.

Yesterday he was in a high intensity back and forth game that went down to the last two minutes to decide the winner. He’d score – then the other team would score, quarter after quarter, both taking the lead at some point. He just scored the 4th touchdown of the day to take an 11 point lead. What was he doing right after this? Take a look at the photo below.

Is he ‘walking away‘ watching the time go by till his next drive? Nope. What is he doing?

Looking at the plays they just made on the winning drive. He’s looking at the formation of the opposing defense, analyzing what he could exploit, what mistakes they are making, etc. This is maximizing your time.

He’s one of the best ever, yet he’s not ‘walking away‘ from the game. He’s engaging in it every moment he can, looking for patterns, reviewing plays, looking to spot what he missed earlier.

This is what you should be doing if you are trading set and forget strategies – using every moment you have. Each practice trade you do on Forex Tester 2 is like an extra lap on the track. Who do you think gets faster and more conditioned? The person who does 2-3 laps per week, or the runner who does 30+ a day? Rhetorical question – but had to ask.

So don’t be a ‘lazy trader’ and just ‘walk away’ as you’re just losing valuable screen time to do more laps. Utilize your time to the max. Trading, is just like any skill as you need practice, lots of screen time, & a successful mindset.

By doing using your time doing live simulation testing and reviewing trades, you are accelerating your learning curve, creating stronger neural networks for trading, and building screen time which is critical to trading success.