Day trading can be a highly lucrative form of trading because of the sheer volume of trades you are taking. Very much like the online poker player, who plays as many tables as possible to maximize their edge and profit, day trading works under the same vein.

Trade a lot more for smaller profits, and they all add up.

Now there may be people who claim “day trading doesn’t work” and “you won’t make money day trading”, but these statements are completely inaccurate.

Case in point, Stefano Serafini, who won the 2017 World Cup of Futures Trading with an impressive 217% return, is a day trader! Many people in this contest who placed very high, were also day traders.

Hence, it’s important to forget the falsely imported narratives about how day trading doesn’t work. There are a lot of people who make a lot of money day trading. The key is whether you can make it work.

How Do We Define Day Trading?

Before we dig deeper into the world of day-trading, let’s start by defining what day trading is and is not.

Day trading refers to the buying and selling of an instrument/security within a single trading day or session depending on the type of market you’re trading. Day traders close out all of their positions at the end of the day/session.

Day trading is common across many markets, such as forex, futures, commodities, stocks and global indices.

There are professional day traders, trading for large financial institutions and there are individual day traders trading their own money, or managed funds from investors and clients.

Now that we have a basic definition of day trading, let’s have a look at the pros and cons of day trading.

Day Trading Advantages vs. Challenges

Day trading offers advantages compared to trading on the higher time frames, but those advantages also come at the cost of added challenges which you have to be aware of.

One of the major advantages with trading on the lower time frames is the increased trade frequency because markets are moving faster and presenting more structures on lower time frames than higher ones.

If you’ve already established you have a trading edge, then like a casino, you want to execute that edge as many times as possible.

Another benefit to day trading is you eliminate your overnight risk – a risk that major events can happen (while you are sleeping) which may affect your trades.

By day trading, you are closing all your positions before the end of each day/session. This mitigates your ‘event risk’ by not having a position open long enough to be exposed to such risk.

On the other hand, day trading has its challenges. Trading intraday means faster price movements, which means you have to make your trading decisions much faster, while increasing your cognitive load (CL).

We will talk about trade frequency, cognitive load and transaction cost in more detail later. For now, just be aware day trading has its advantages and challenges, both of which you need to be fully aware of.

Is Day Trading Something For You?

First off, if you’re completely new to trading, I’d suggest not day trading in the beginning until you have learned the core skills of trading price action context, so much so that they are wired into your brain.

Why do I recommend this?

Day trading requires you to put all the focus and attention you can muster into reading price action context in real time. When the markets are moving fast, you can’t afford to spend more time than absolutely necessary on basic skills such as position sizing, order execution, etc. They have to be automatic and wired in so you can keep your mind free to find the best trades on the quick.

Hence, it’s important to ask yourself, are you someone who likes to take time to analyze charts, re-think scenarios multiple times before making a decision or easily get stressed?

Are you someone who has a full time job and only 1-2 hours available to trade each day?

If your answer to one of these questions (or both) is yes, you’d likely want to re-consider if day-trading is something for you.

However, are you someone who can make a decision very quickly and act on it?

Do you have several uninterrupted hours to find trades at your computer?

If you answered yes to the above two questions, then you might want to take a serious look at day trading.

The key point here is to understand yourself and how you naturally think/act.

If you can do that, you can align your trading as much as possible with your personality and lifestyle, which is one of the most important factors to determining your success in trading.

Day Trading Time Frames

Generally, the time frames for day trading you want to use are the 1H, M30, M15, M5, M3 and M1 charts. Any time frame above 1H won’t likely be of any use for a day trader since any significant moves on those time frames take longer than a session or a day to play out.

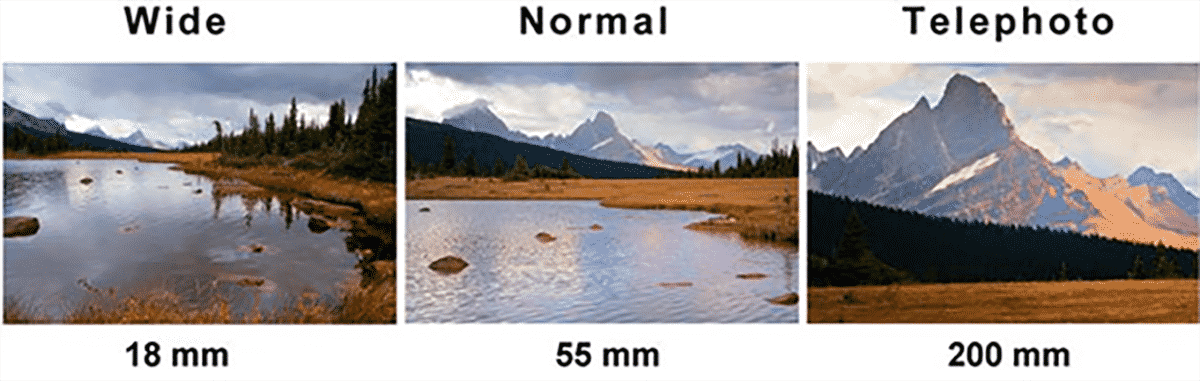

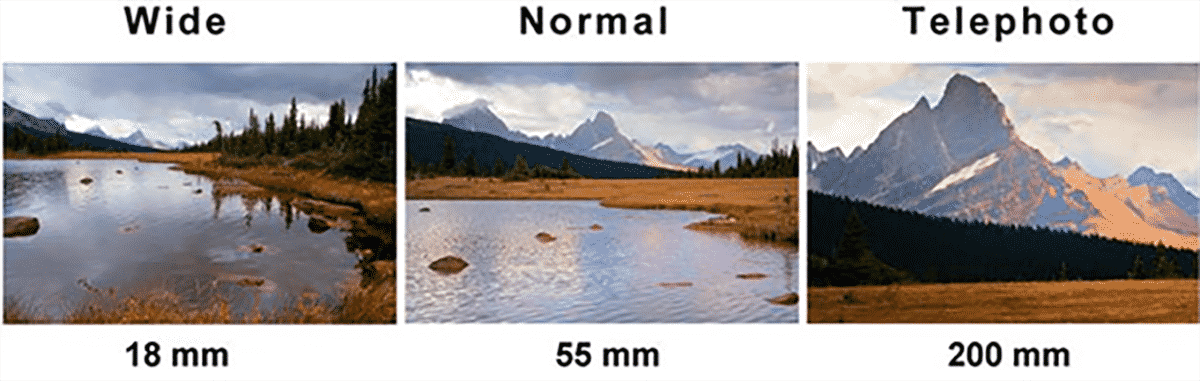

If you hear someone say “One-minute or five-minute charts are just noise” don’t take advice from that person. Time frames just give you a different perspective into the markets and price action.

Shorter time frame charts reveal more detail, but less historical context, while longer-term charts show less detail, but greater historical context.

One of the most important ways to look at time frames is to see them as ‘lenses’ into the price action and information on the chart.

This is clearly demonstrated by the three images below.

After looking at the above 3 shots, what do you see?

Starting on the left, we have the wide lens (18mm) which shows this shore/side of the lake, trees on both sides, and a couple peaks near the top left. In the middle, we have a 55m wide lens which only shows the shore on the other side of the lake. It also shows a 3rd peak which is more easily seen to the upper right.

On the right side, we don’t see any lake, only one major peak, with a well-defined white strip of snow and lattice structure on the mountain.

3 lenses, same piece of land.

Now let me ask you this question: Which one is ‘right’? Which one is the ‘most accurate‘? The answer is neither, or better yet, ‘whichever is most important to what you’re trying to see.’

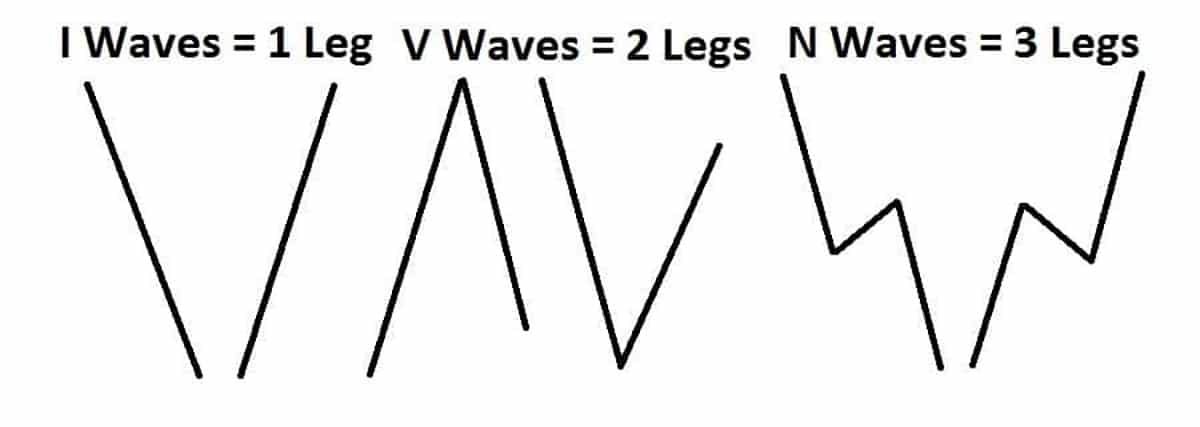

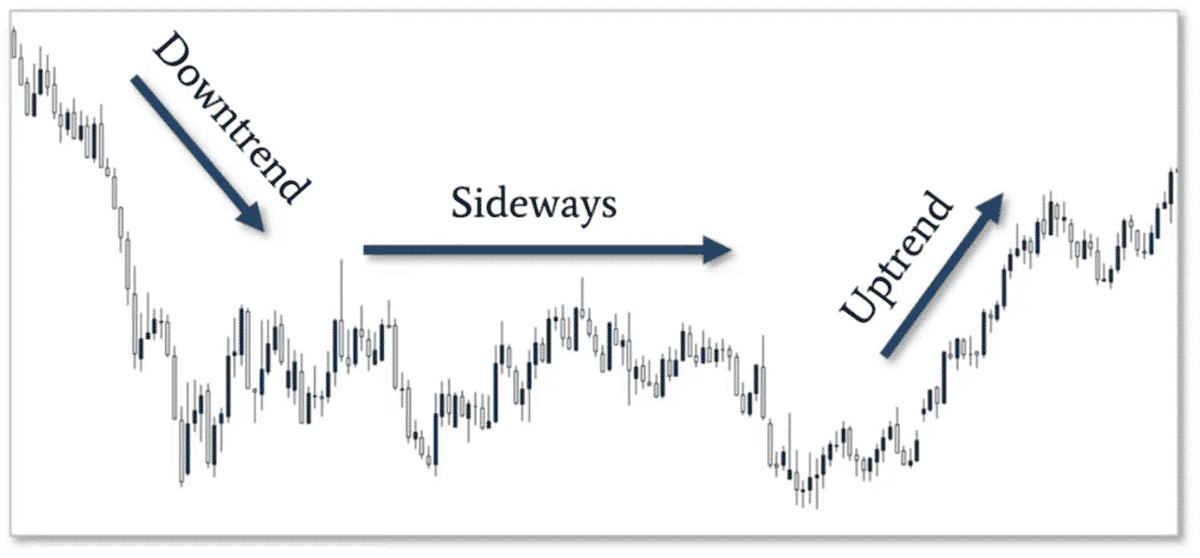

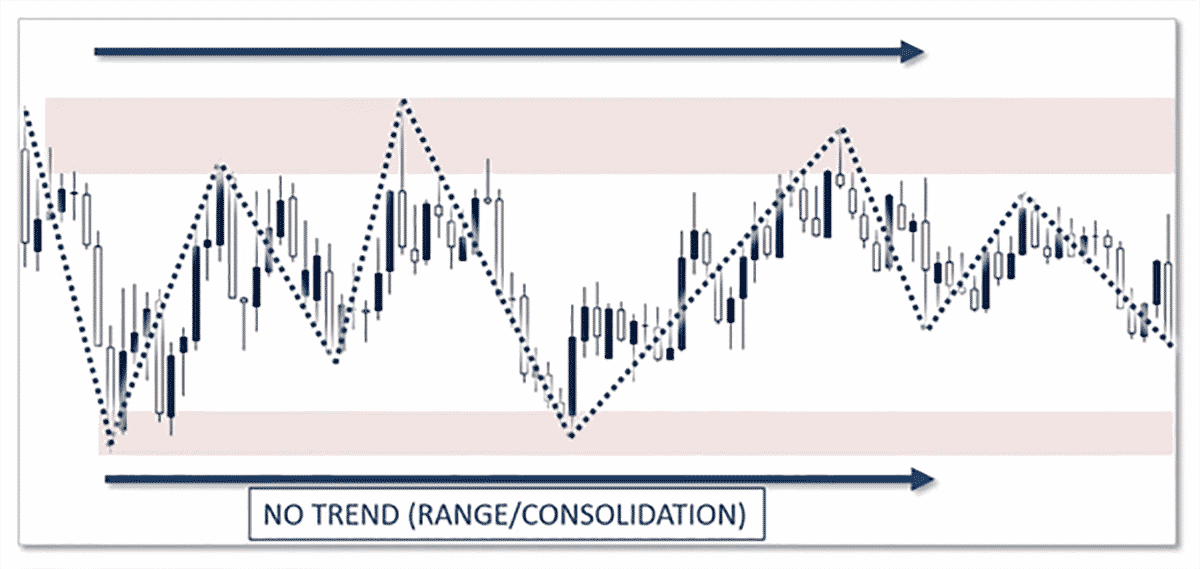

And that is how you need to think of price action on the lower time frames. Each time frame is its own ‘lens‘ (perspective) about the price action and order flow. Hence each time frame has its own trend.

The key is to pay attention to the time frames most relevant to how you’ll trade.

Expectancy vs. Frequency

As we’ve talked about before, day trading takes advantage of the premise that volume of trades (over smaller profits) is your trading edge (how you make your money).

This section will be dedicated to understanding what is a trading edge, trade frequency, expectancy, and how this ties into your performance and profitability.

It’s very easy with all the literature out there, to look at risk in a very two-dimensional perspective of accuracy and risk to reward, but there’s a lot more to your profits and performance than just risk to reward + accuracy. You have to look at your performance 3-dimensionally!

The bottom line is that our profits and performance are determined by 3 things:

- Accuracy (% winners/losers)

- Avg +R per trade

- Trade Frequency

All of the above create your trading edge and ‘expectancy’, which is what we can expect to make over time through hundreds and hundreds of trades.

Hence, it’s critical to understand how these 3 relate to each other, particularly in relationship to day trading.

To get an idea of how these numbers all affect your performance and edge, let’s take System A with 60% accuracy, trading 5x a month, risking $100 and targeting $200, assuming a 1% risk per trade.

Below is how the math works out:

5 trades over 12 months = 60 trades per year

60 trades x 60% accuracy = 36 winners/24 losers

36 winners at +$2,000/trade = $7,200 profit

24 losers at -$1,000/trade = $2,400 loss

Total Profit = +48% profit/+$4,800

Now, let’s take System B, which is the same as System A, but lets reduce the accuracy by 10% (assuming you will be less accurate trading the same system on a lower time frame) while increasing trade frequency.

Trading 20 times a month (~5x per week), risking $100/trade and targeting $200/trade.

Below is how the math plays out:

20 trades a month = 240 trades per year

240 trades at 50% accuracy = 120 winners/120 losers

120 winners at +$200/trade = +$24,000 profit

120 losers at -$100/trade = -$12,000 loss

Total Profit = +120% Profit/+$12,000

Comparing the two systems, the day trader made an impressive +120% profit vs +48% for the swing trader. Same system, same risk to reward ratio, yet more profit for the day trader.

Even if I make System A 70% accurate (a very low probability), here is how the math plays out risking the same 1% per trade:

5 trades over 12 months = 60 trades per year

60 trades at 70% accuracy = 42 winners/18 losers

42 winners at +$200/trade = +$8,400 profit

18 losers at -$100/trade = -$1,800 loss

Total Profit = +66% Profit/+$6,600

As you can see, even being 20% more accurate (highly unlikely), the day trader still makes more profit than the swing trader.

The bottom line is, if you have an edge, the more times you can apply it with a relative level of accuracy, the more the edge will play out in your favor. And that leads to more profits!

The prior examples are of course overly simplistic, but in our Trading Masterclass, we teach you how to calculate trade expectancy based on your current performance, and how you can improve your performance by improving your expectancy and trade frequency.

Day Trading & Price Action Context

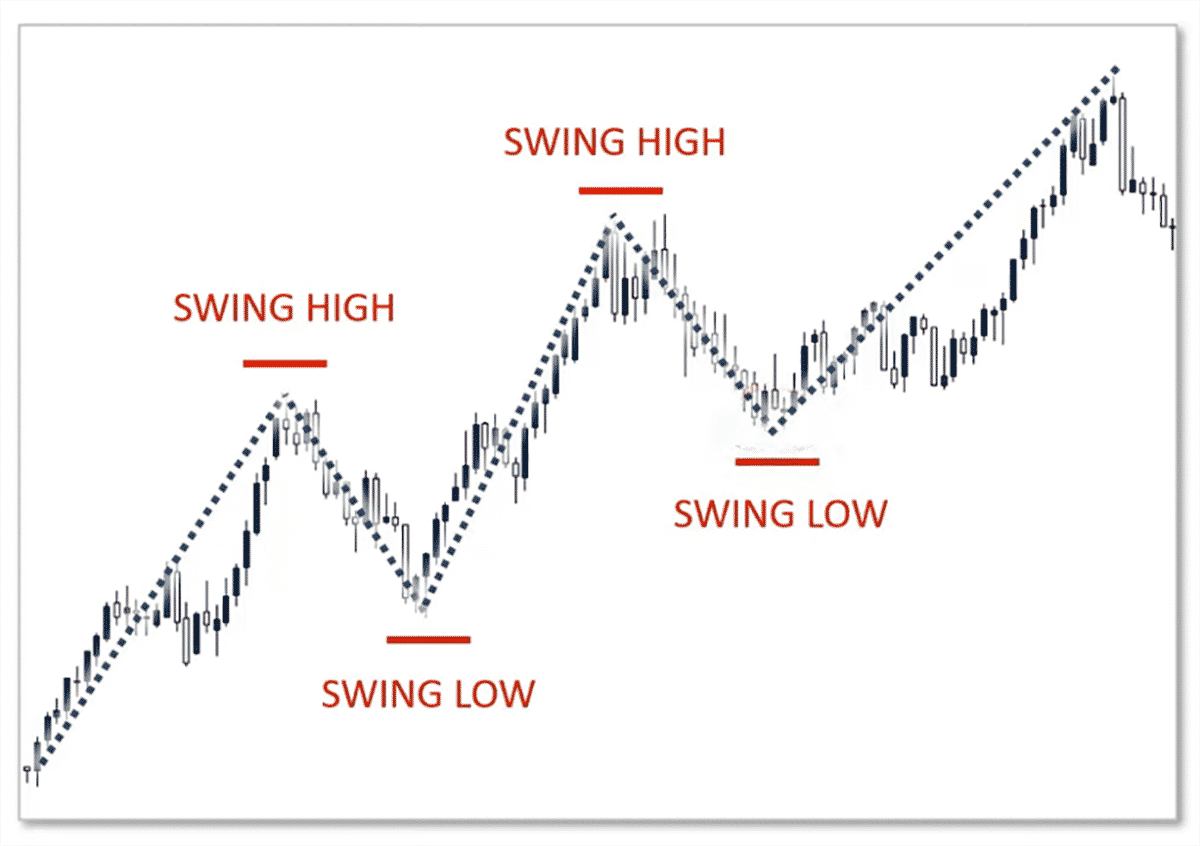

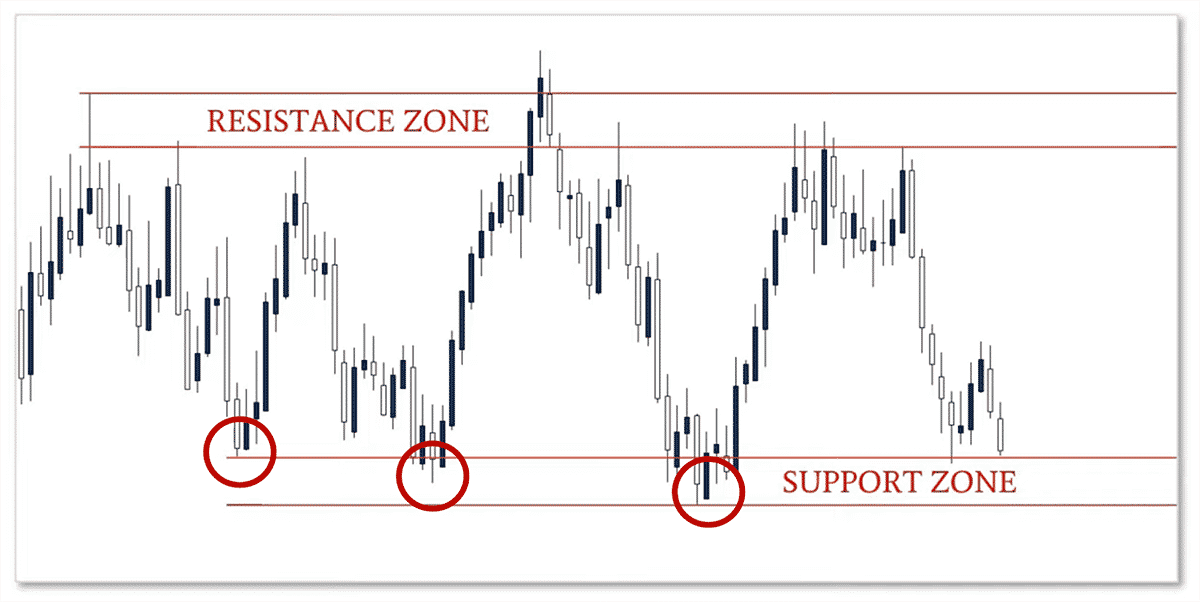

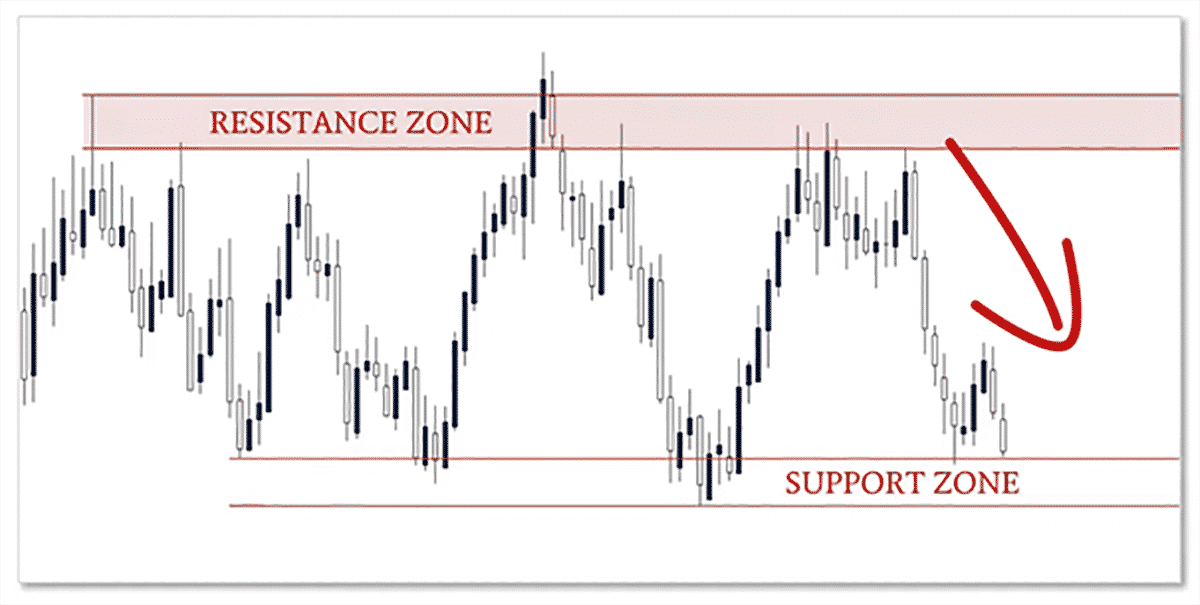

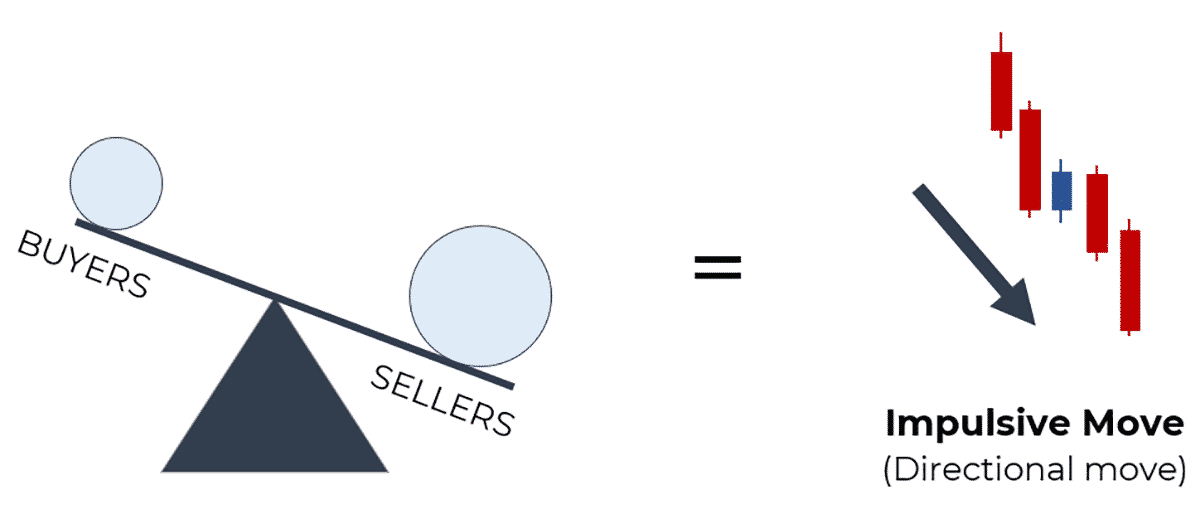

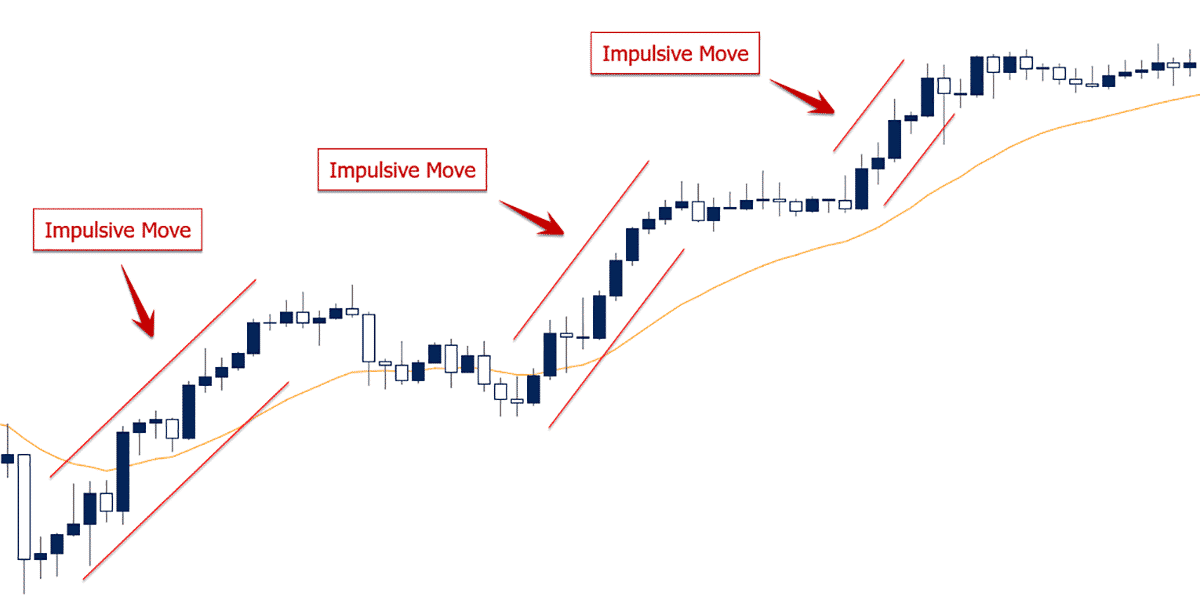

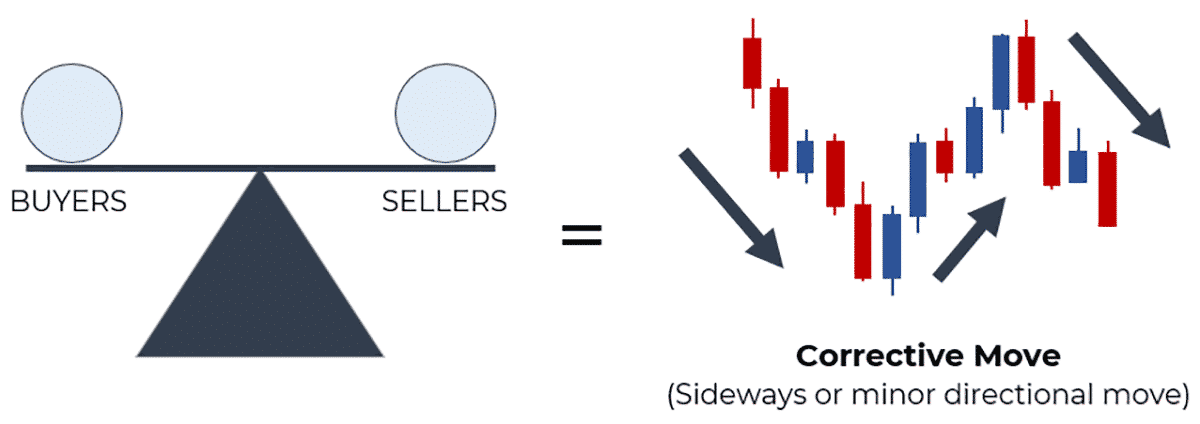

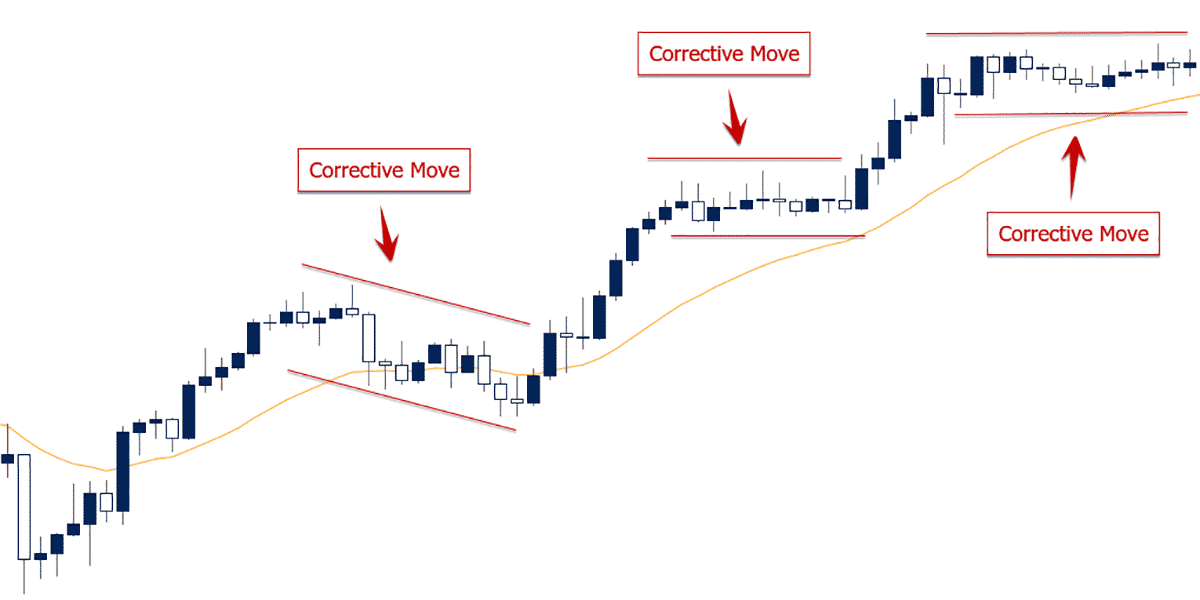

Regardless if you’re swing trading or day trading, you want to make sure that you’re trading in line with the most dominant order flow as this helps to put the probabilities in the favor of your chosen trading direction.

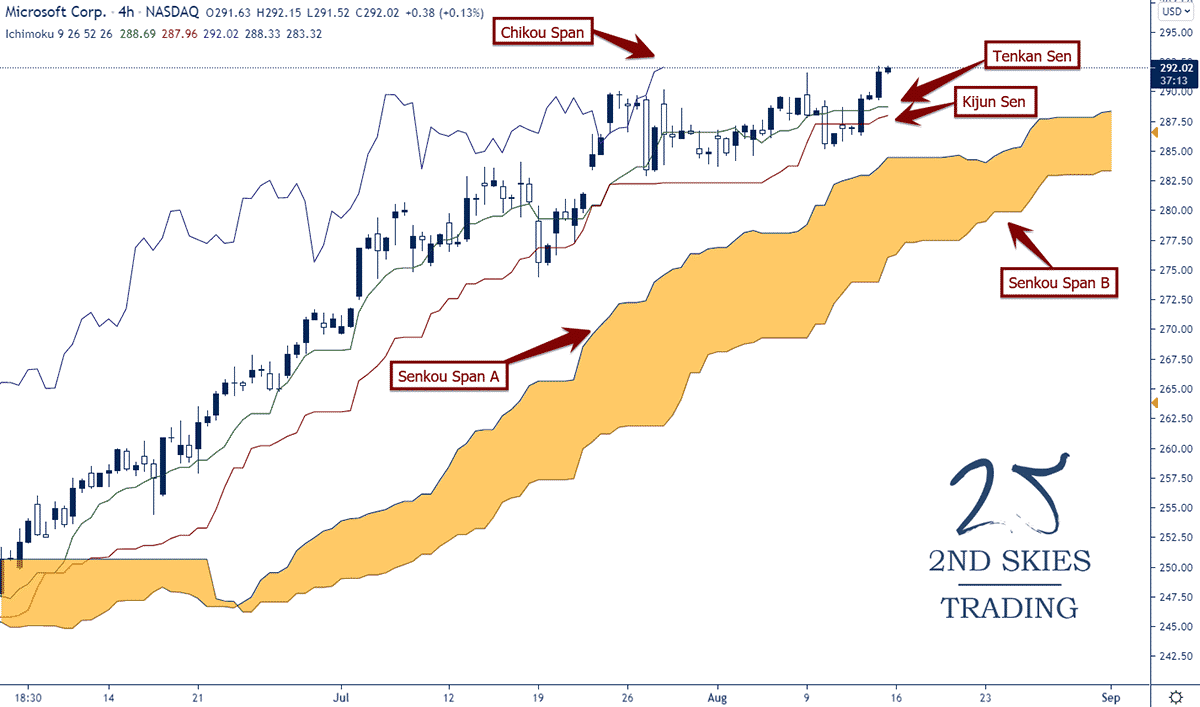

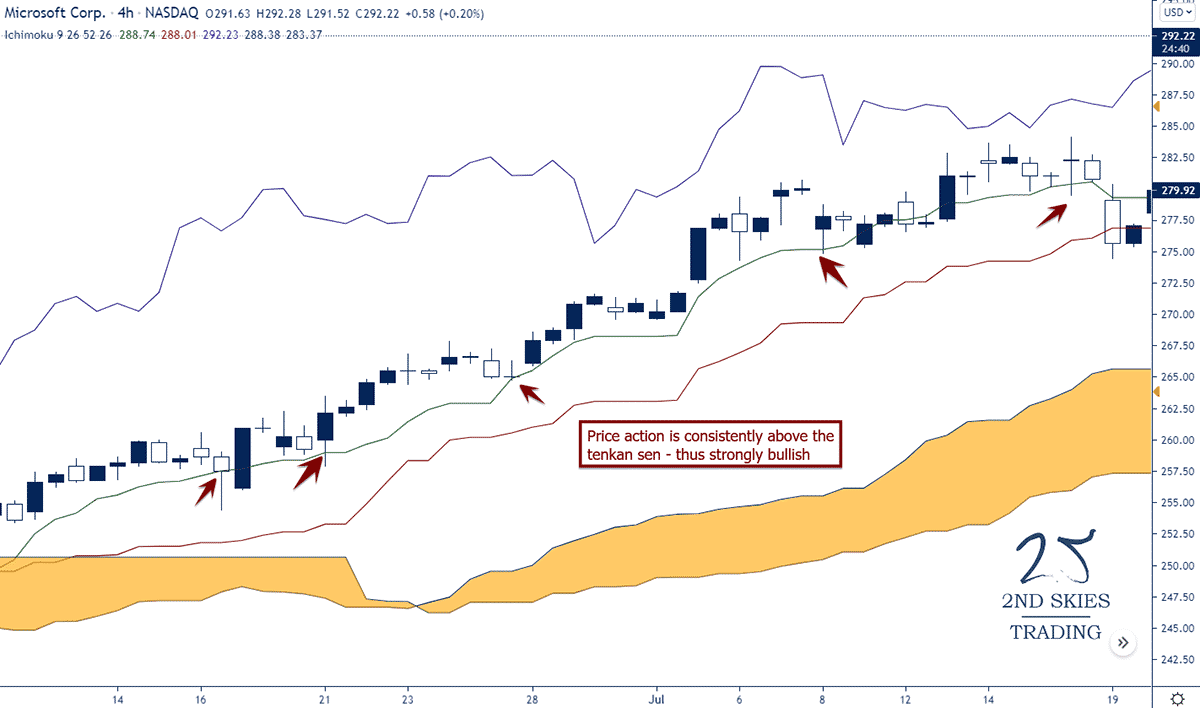

Therefore you’d want to work with at least one higher time frame (HTF) to establish the price action context + trading direction, together with one lower time frame (LTF) which will be your trading time frame on which you make your trading decisions and place your trades.

To give you an idea what this looks like, let’s have a look at some charts.

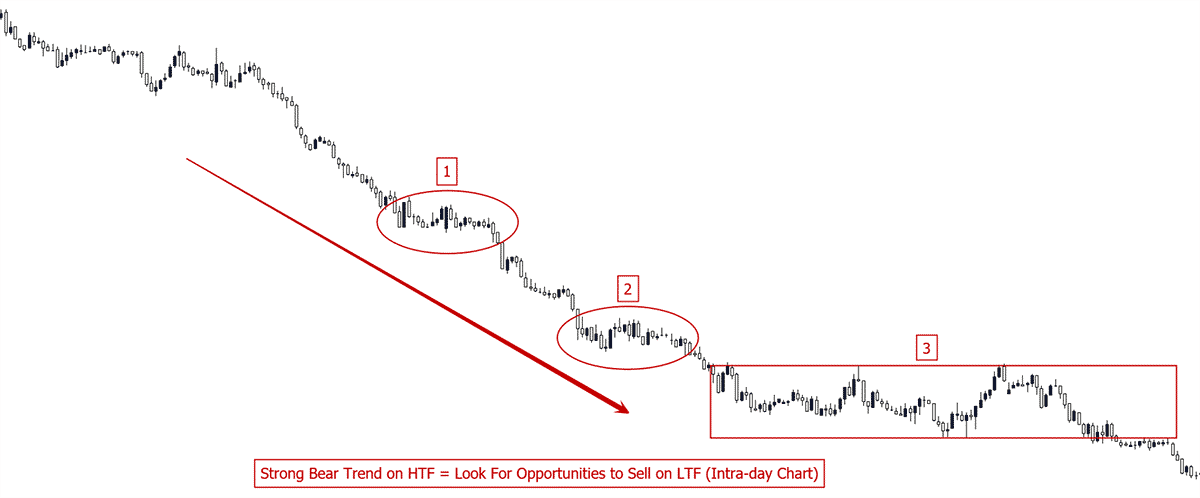

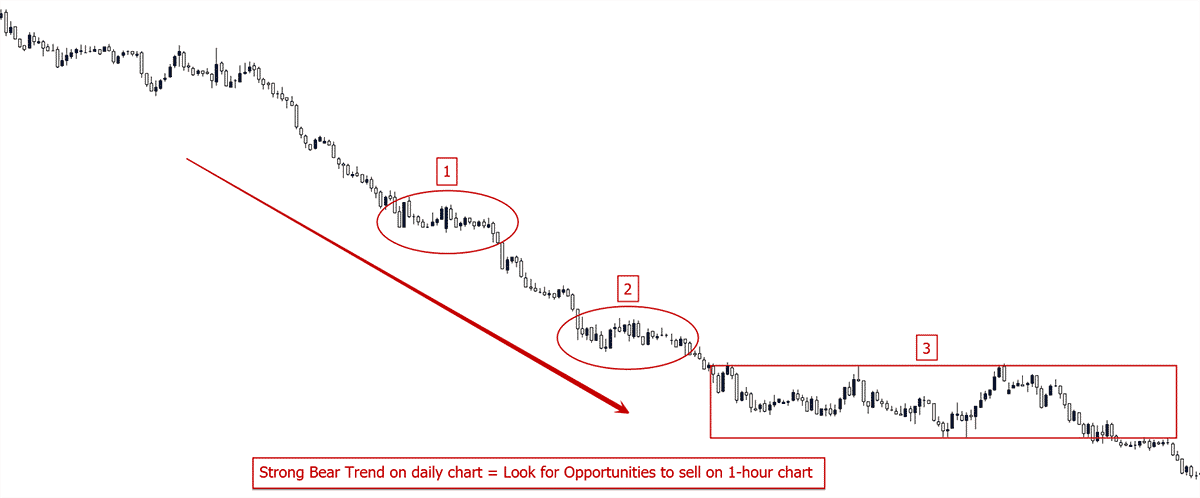

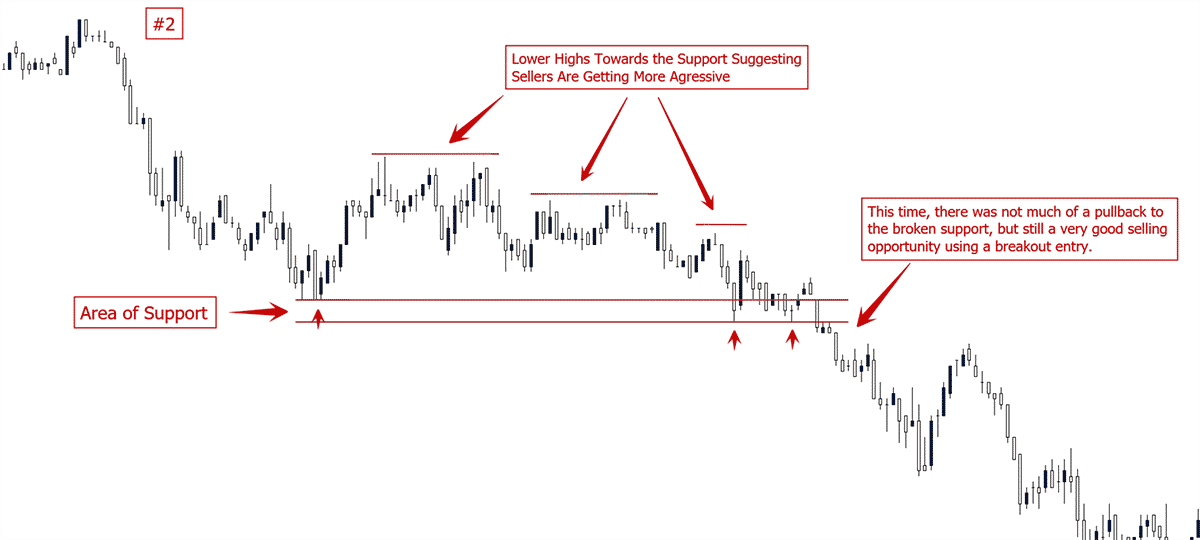

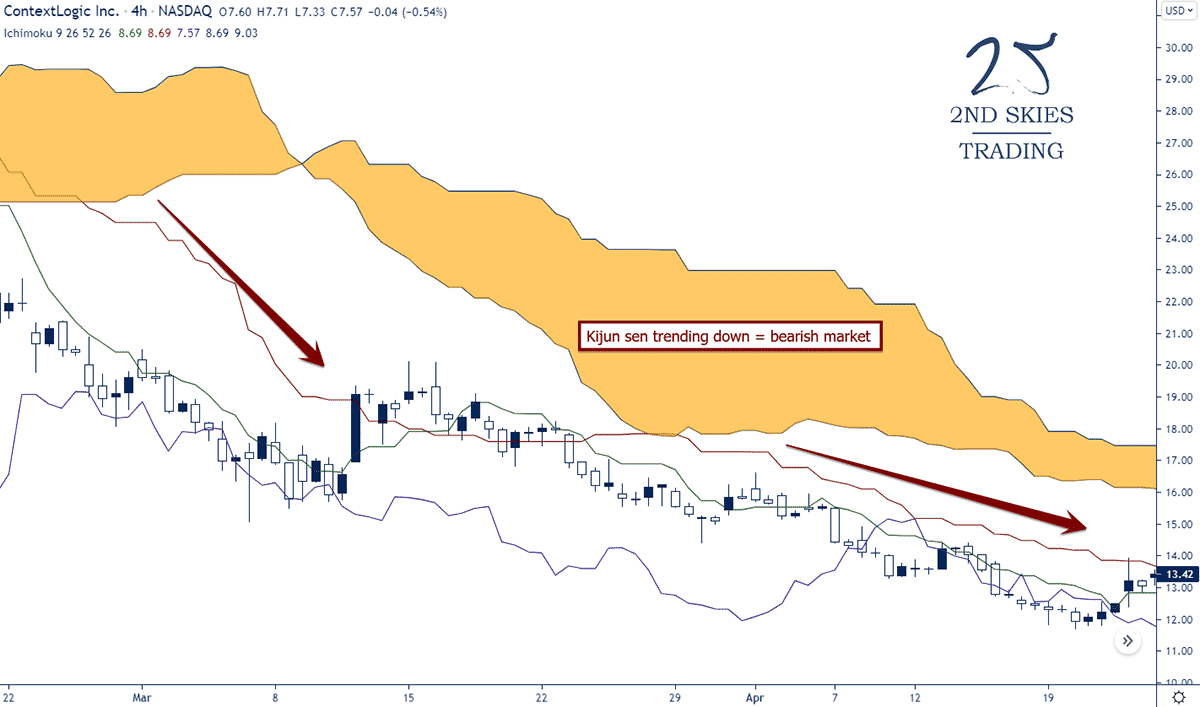

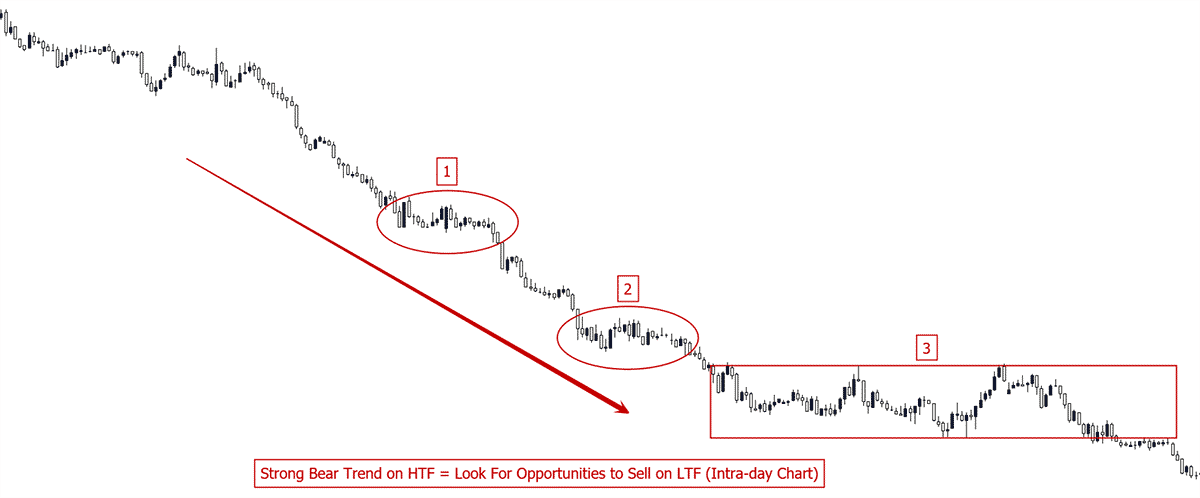

Below is a 1 hour chart which shows a very clear bearish trend.

Using this view as our HTF (Higher Time Frame) context we can clearly establish the most dominant order flow is distributed towards the sell side and we should only be looking for opportunities to sell this instrument on our trading time frame (Lower Time Frame).

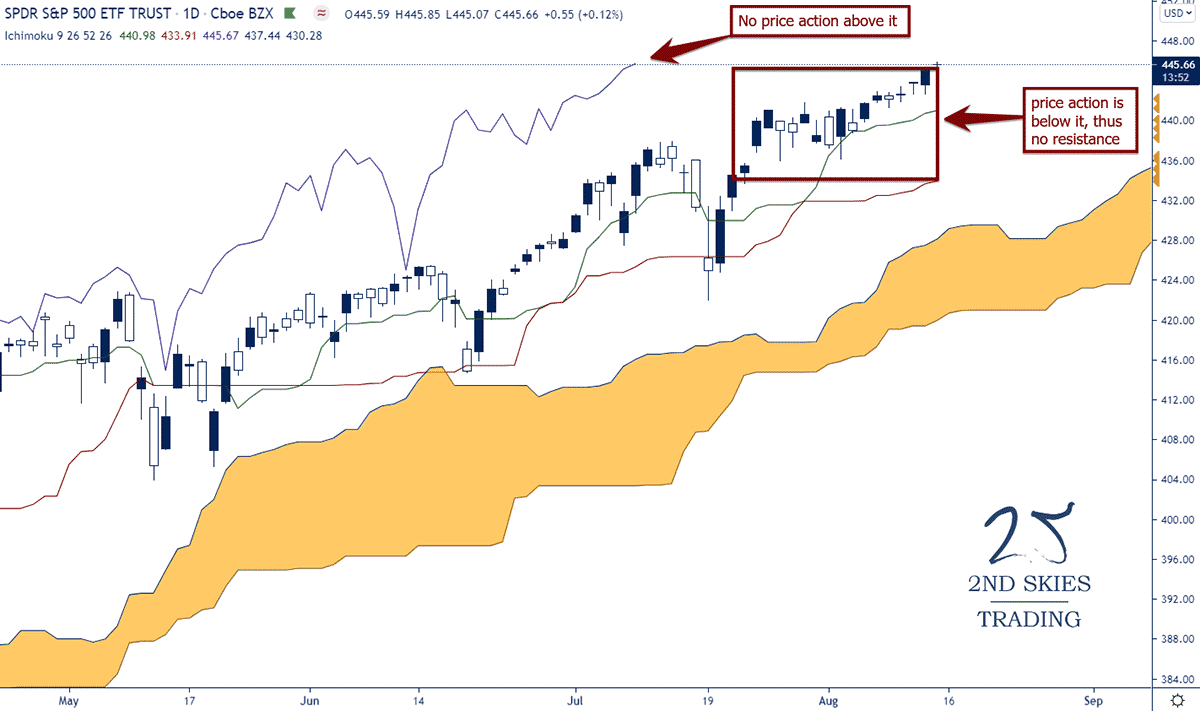

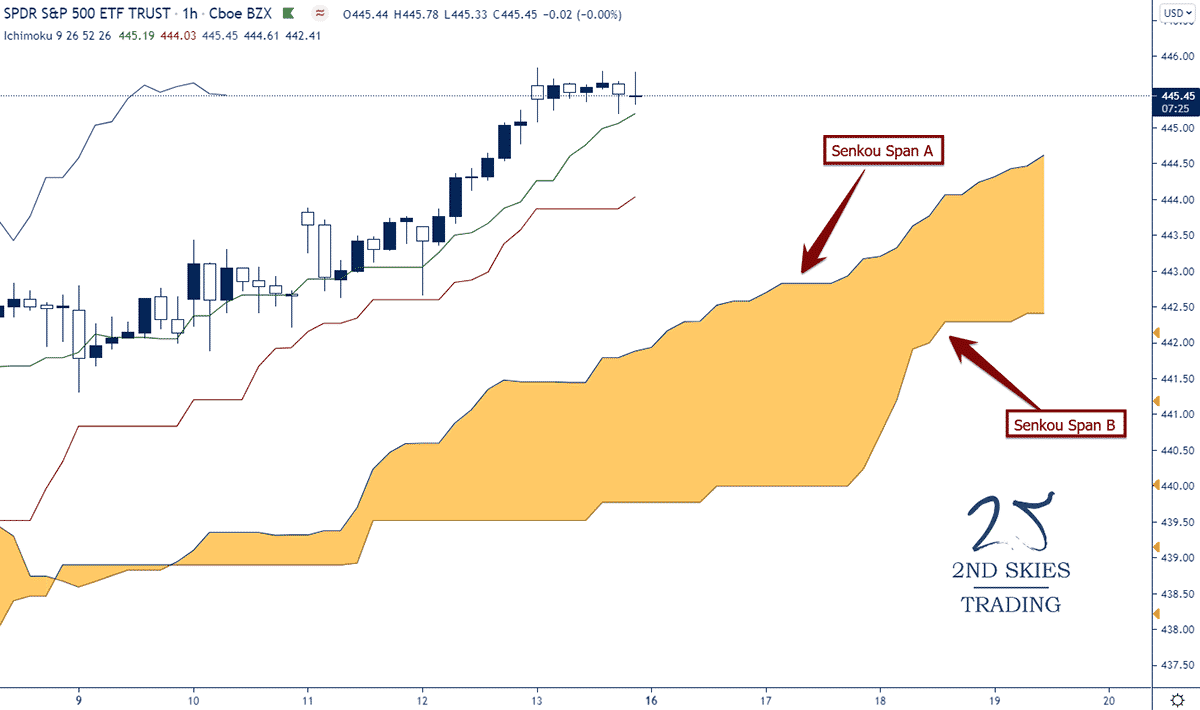

Now, let’s have a look at each of the highlighted areas (1-3) on the LTF (Lower Time Frame) or Trading Time Frame (TTF), showing us the price action in greater detail.

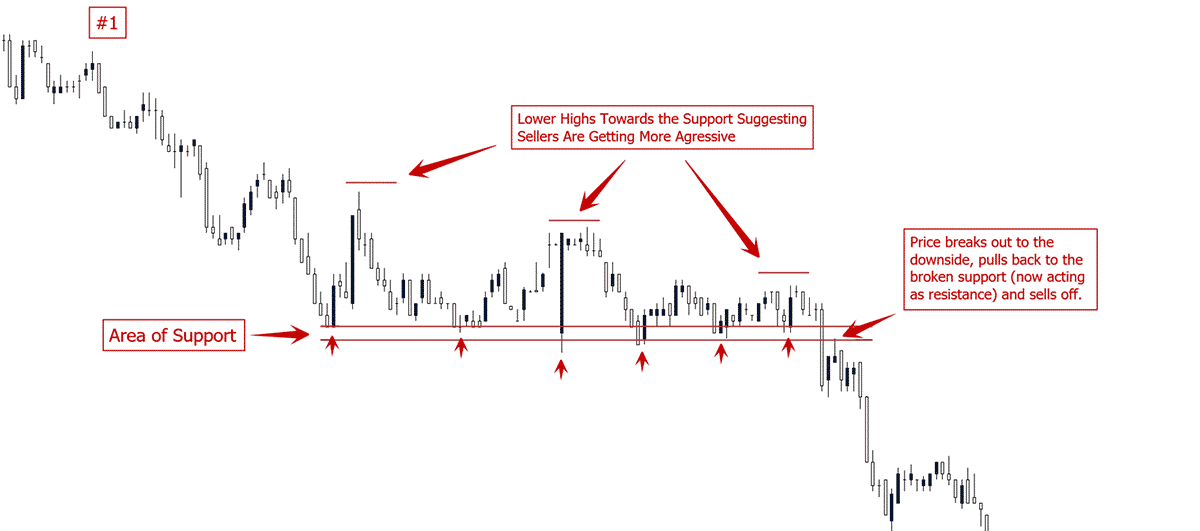

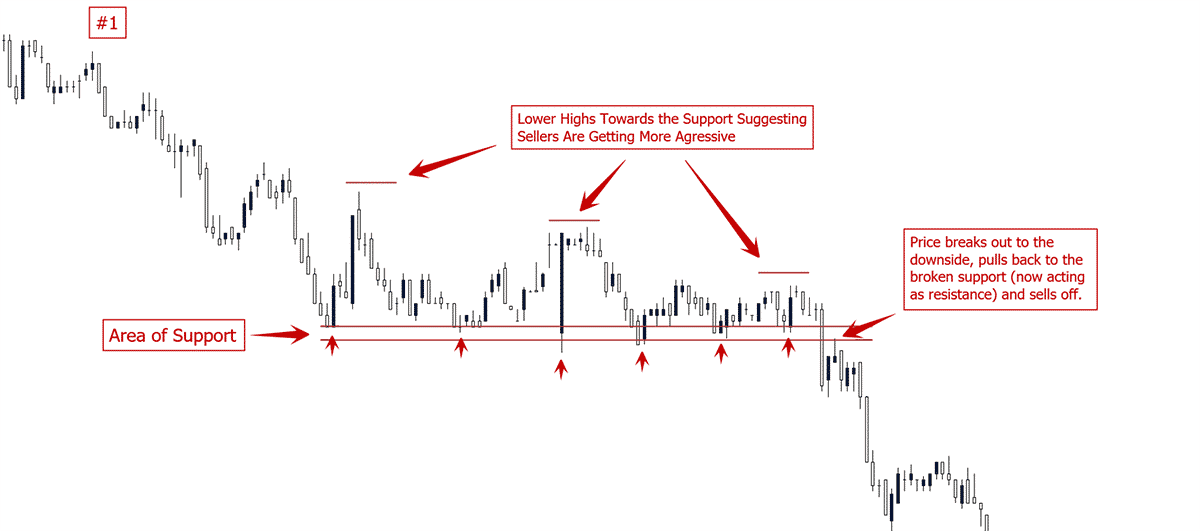

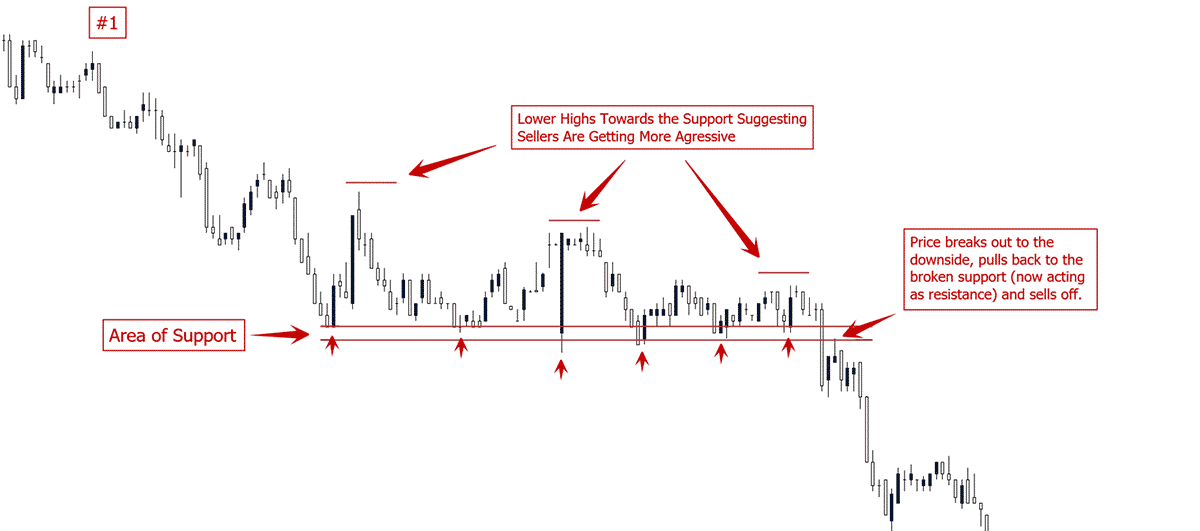

Highlighted Area #1:

Using the M15 chart enables us to view the bearish trend on our HTF in greater detail, enabling us to find high probability entry locations.

In this first example, we can see how price did build an area of ST support which later was broken and offered a good trading location on the pullback.

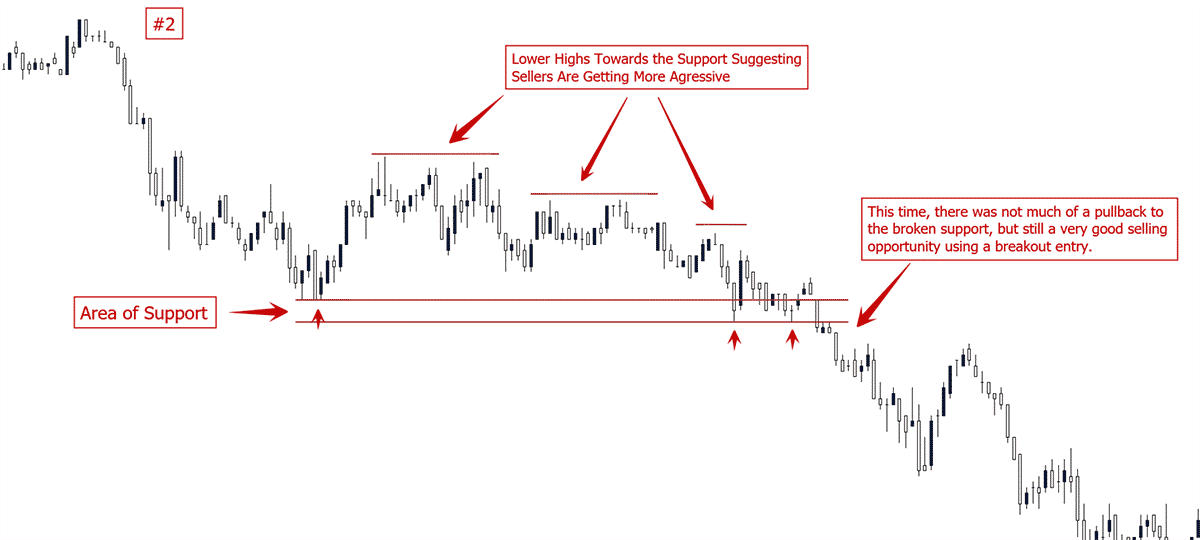

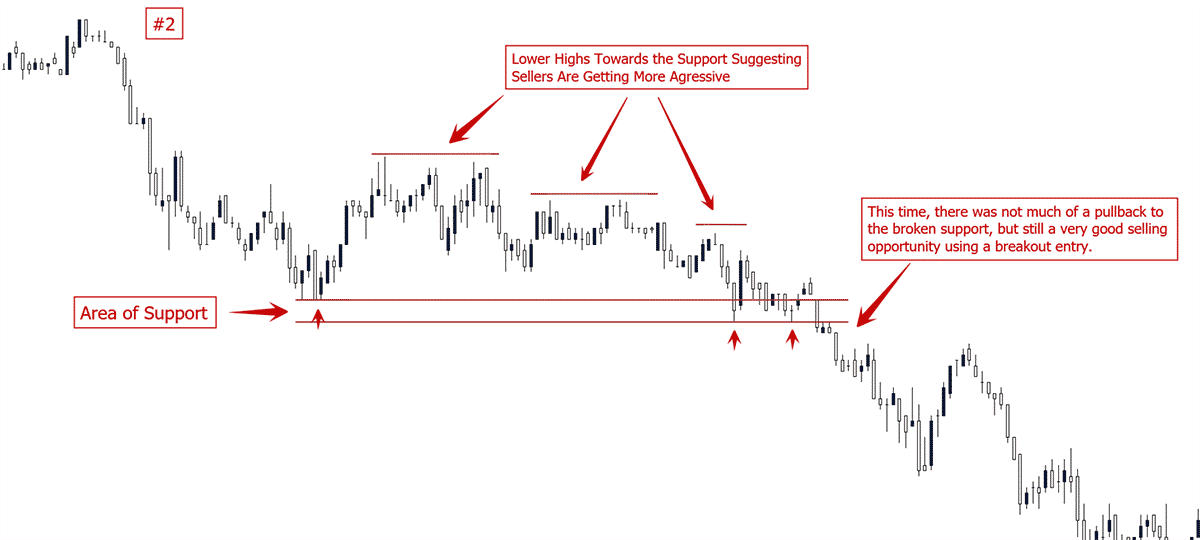

Highlighted Area #2:

The exact same structure/pattern repeated itself further down in the same trend.

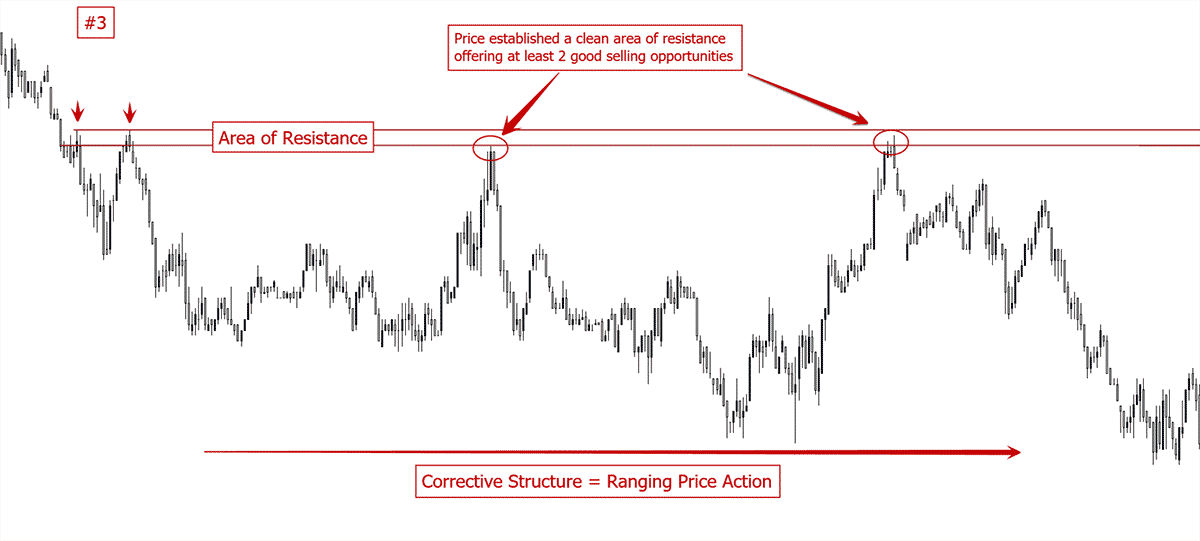

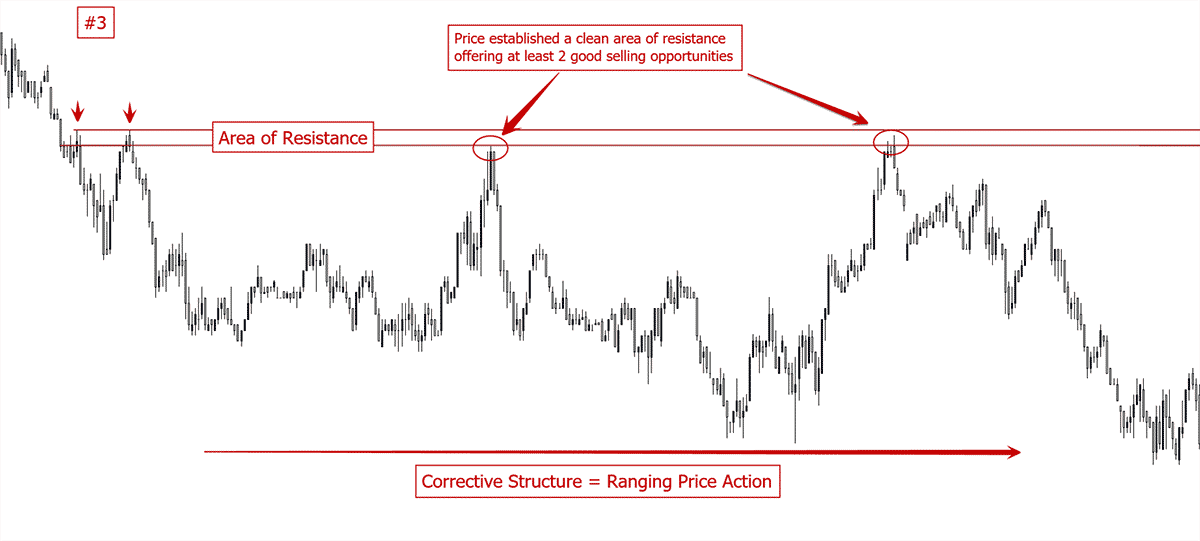

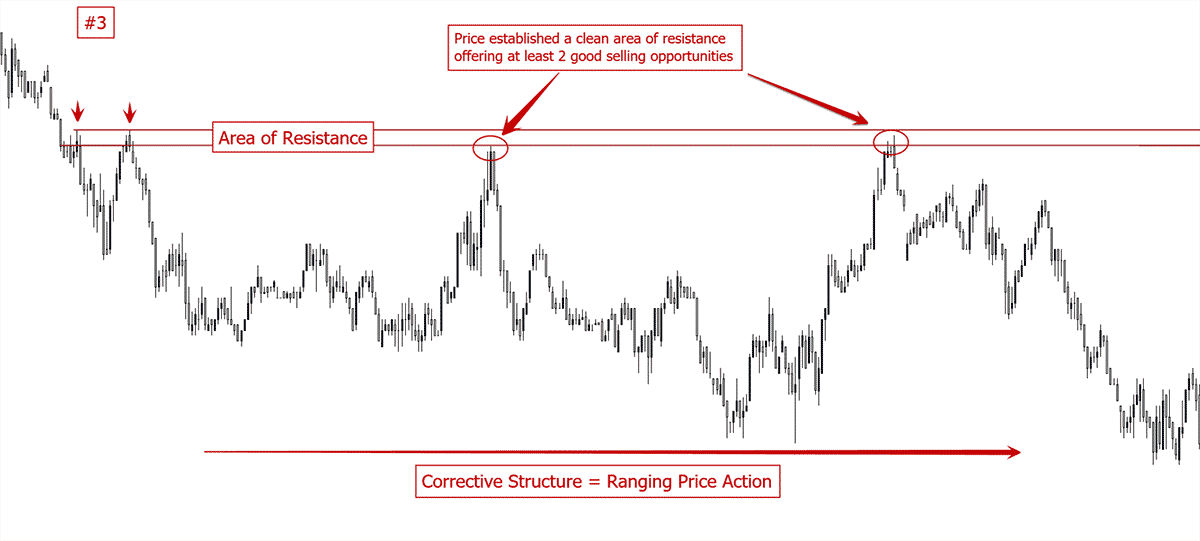

Highlighted Area #3:

Once the trend started slowing down, price started ranging within a small corrective structure, providing multiple shorting opportunities from the top of the structure.

I hope this example clarifies why it is important to trade in line with the HTF price action context/order flow and how you can utilize the lower time frames to view the HTF price action in greater detail, enabling you to spot high probability entry locations.

Anyone trying to buy in this trend would have gotten crushed.

These are only a few examples of how to use the LTF to enter trades within a HTF trend.

Increased Cognitive Load (CL) When Day Trading

As already mentioned, intraday trading means faster moving prices/charts and requires you to make many important decisions in a fraction of the time that you’d have at your disposal when trading on a higher time frame like the 4 hour or daily chart. This significantly increases the cognitive load on a trader.

What is cognitive load you ask? Cognitive load refers to the total amount of mental effort being used in the working memory, similar to the working memory of a computer and refers to how much information an individual can consume/process in a given period.

A greater cognitive load means that you’ll exhaust your energy at a much faster rate which in turn can have an effect on your decision making.

Aspiring traders often are attracted to trading the lower time frames because they offer more ‘action’. But since they are not experienced enough, they are often unable to cope with the increased cognitive load, which renders them paralyzed at times or leads to very bad trading decisions.

The additional stress caused by suboptimal trading decisions further increases the cognitive load and a trader can end up in a very vicious negative spiral.

Now, there are a few key things we can do to:

- Reduce cognitive load and

- Handle the increased cognitive load correctly

First of all, one of the most important factors to reduce cognitive load is skill. The better you are at something and the deeper a skill has been wired and made subconscious, the less effort is required to perform a task.

A good example is driving a car. When you just have gotten your driver’s license, driving a car in heavy traffic can be exhausting, simply because all the skills necessary for driving a car have not yet become a sub-conscious skill and therefore requires a lot of focus/concentration, whereas a few years later, we are able to drive a car effortlessly, almost on auto-pilot.

It’s the same with trading. Before you take on one of the most challenging trading environments (intra-day trading), you’d want to make sure that many of your core trading skills have been repeated enough for them to be subconscious skills.

Another key factor to help reduce cognitive load is having the right mindset and being able to handle emotions. Having an incorrect mindset while letting emotions take control of you will multiply the already high cognitive load experienced during day trading.

In our Advanced Traders Mindset Course, we provide the tools, strategies and training to build a successful trading mindset, including day trading.

Increased Trading Costs

It is important to note, if you are trading the lower time frames intraday, trading costs will become a greater factor compared to someone trading the higher time frames. Even though trading costs may seem small in isolation, those differences in trading costs can add up pretty fast.

As a simplified example, let’s say a swing trader and intraday trader go long the stock of Apple at the same time. The swing trader naturally will have a bigger profit target and stop loss compared to the intraday trader since he/she only trades larger moves/swings.

Thus, for the sake of this example, let’s say that the swing trader has a target of $10 whilst the intraday trader a target of only $2 and both have an average spread of $0.20.

Now, for the intraday trader, this means that the spread (cost) for this trade is 10% of their potential profit whilst for the swing trader, the spread will only be 2%, meaning the swing trader can keep 98% of their potential profit whilst the day trader only can keep 90%.

Whilst this might not sound like a lot, over time (and hundreds of trades), this difference can add up fast and ‘eat up’ a big portion of your profits.

Now this example is overly simplified as there can also be commissions and swap rates involved, but the bottom line is that intraday trading is more ‘expensive’ than swing or position trading when it comes to transaction costs.

The higher trade frequency of an intraday trader will likely cover some of the costs, but in the end, as an intraday trader you need to be more precise in your trading to reduce the impact of the spread in relation to your overall profit.

Risk & Money Management

Taking risks is an essential part of trading. In order to make money trading, a trader has to take on risk. But this risk has to be calculated and controlled at all times as poor risk management can lead to disaster, and in the worst case blow up your account (losing your entire trading capital).

Thus, proper risk, money management and capital preservation should be the #1 priority of any trader.

For the members of my Trading Masterclass, I recommend having three to four risk thresholds as part of their trading plan.

These thresholds are:

- A max risk per trade

- A max risk per day

- A max risk per week

- A max risk per month

A max risk per trade should be based upon your risk of ruin. If you have a risk of ruin that is zero, mathematically you cannot blow up your account and you will make money. A max risk per day should be a daily risk limit to avoid losing too much on any given day. The max risk per week and month are also based upon the same concepts.

If any one of the above is ‘optional‘ in my book, it is the max risk per week. Keep in mind, none of the above defines how many trades you should (or should not) take in a day to avoid over-trading, a topic we’ll talk about later.

Also I’d suggest no more than a 1% risk per trade, although for day traders, I’d suggest less in the beginning (<1%).

Preparation

Preparation, in my opinion, begins with the mental game, and that has to start before you actually put your butt in your chair.

You’ll see this in professional athletes who are getting themselves mentally ready before they even get to the stadium.

Aaron Rogers (quarterback for the Green Bay Packers, 1x Super Bowl Champion & holder of several Quarterback records) spends a lot of time the night before thinking about the game and what he is going to do.

Trading has to be approached in a similar way, and the successful traders I communicate with regularly, employ the same tactic.

Hence, you have to include mental preparation in this part of the trading process.

Many times I talk to my private course students and ask them what they do to prepare for the day’s trading.

These are the general responses I get:

- Drink a cup of coffee, maybe two.

- Check out what announcements are coming out.

- Look at the markets and then get ready to trade.

And it ends there…

To me, this is somewhat shocking. Perhaps because I trained in martial arts, played semi-professional futbol or competed in archery, I have a habit of preparing for anything I am doing seriously. This is the same for trading – preparation is key.

Case in point, think about what you are doing when you are going to trade for the day.

You are going to do many of the following tasks each day:

- Make critical decisions and calculations on risk

- Access long-term memory and use your pattern recognition skills to find trades

- Come up against your psychological issues around money and Equity Threshold

- Sit down for hours meaning your bodies energy will be less active and more stagnant

- Use the reptilian part of your brain (limbic brain) which thinks more of near term rewards instead of long term benefits

Do you notice a pattern here?

Other than the fourth one on the list, all the others have to do specifically with your mind. The most important tool you are going to be using while trading is your mind, so preparing this is the most critical thing you could do before trading.

Ask yourself the following questions:

- Would a professional football player not warm up their muscles before a game?

- Would a football coach not watch video of their team or the opposing team before a game?

- Would a professional archer not take a few shots with the bow before starting a competition?

No – and there is a reason for this. All professionals know one thing for sure – they all prepare for whatever their task, skill or thing they have to execute. And why shouldn’t you?

Why shouldn’t you be preparing your mind before you start your day of trading?

While the questions are rhetorical, there are several things you can do to get yourself mentally prepared to make money trading. My first recommendation is to get up early and take a shower before you start your day.

Your central nervous system actually needs certain things to get in sync with your body biologically. Getting up around the time the sun does activates a protein sequence in your brain which helps it get chemically prepared for an intense day of critical thinking.

Showering helps to stimulate your nervous system and wake up your body and mind so you are more fresh for the day.

Another recommendation is to get some exercise, whether it be physically, mentally, or ideally both.

Each day, before I do anything, before I make any critical decisions or start work, I practice yoga and meditation every day.

Yoga helps calm my breathing which allows me to control my emotions and thoughts while having a body physically healthy to sit for long hours in the day.

Meditation sharpens my mind to help develop awareness of my thoughts and emotions which could influence my trading. It also helps me think clearly while making critical decisions.

I then spend the last 10-20mins visualizing what I am going to accomplish for the day, how I am going to trade, and what I will do successfully.

At a minimum, if you start trading in the morning, I’d suggest doing a few stretches since you are sitting all day and at least do some visualizations to program your mind for success. Remember, sitting is the new smoking, so make sure to augment this by getting some exercise.

If you are trading after work, make sure to take a break from your work mode, unwind a bit, clear the mind, and then sit down at your computer.

Day trading & Overtrading

Regardless of whether you are day trading or swing trading, over-trading is something many traders struggle with. The reason why you over-trade has two major underlying reasons.

Before we dive into those, I’d like to point out some key things most struggling traders mention when it comes to over-trading.

They are:

- “Feeling the need to be in the market” or “Fear of missing out (FOMO)”

- “I get impatient sometimes”

Note those two statements down for now as they are critical.

But before we get into the reasons why you over-trade, we need a working definition of ‘over-trading’. My definition of over-trading is as follows.

Assuming you are working with a trading plan, I define over-trading as the following:

Over-trading is taking any trades outside of your trading plan.

If you take any trade outside your trading plan (either going over your risk limits, or something not in your trading plan), then you are ‘over-trading’. Everything inside your trading plan (whether it be 10 trades or 100 trades for the month) is not over-trading, just trading and taking advantage of opportunities.

You can over-trade on any time frame. The time frame is not the root cause of over-trading. A lack of discipline is.

If you have not wired your brain to mentally execute your trading plan, the time frame will make no difference.

Just like if you have the habit of overeating, you will do so whether you are at a restaurant or your own kitchen. The habit is within you and doesn’t just disappear when you change environments.

If you want to dissolve the underlying root of over-trading (discipline & mental execution), you have to rewire your brain. Before we get into how you can do that, I’d like to address a few points about my definition of over-trading.

If a basketball player is on a hot streak, you keep feeding him the ball as those streaks are critical to winning. Professional poker players know this as well – when hot, keep putting your chips down.

The same goes for trading. Not pulling the trigger when you have a setup (with all conditions in place) simply limits your upside. Why would you ever do that? If the price action context is prime for you to make a ton of money that day, you should be attacking the markets.

On the other side of the coin, I’ve had days where I started out with 6, 7, maybe even 9 losses in a row. But I’m not fazed by this. As long as I haven’t hit my risk limit per day, I’ll keep attacking the markets, sometimes buying and selling in the same day.

Ironically, on many of those days, one or two big winners either brought me back to break-even, or helped me end up in profit for the day. Had I succumbed to some notion about ‘over-trading = x trades‘, every one of those days would have ended in a loss. On top of that, each one would have ended with a much greater negative impression in my mind.

Yet how much confidence do you think I get from losing 9+ trades in a row, yet still ended the day in profit? Just like a quarterback doesn’t stop throwing the ball because he’s had a couple interceptions and bad passes, the same goes for trading.

Your goal should be to win each and every day while maintaining your trading plan, risk limits and mental execution.

The time frames you are trading doesn’t determine whether you over-trade or not.

And the proof is in the pudding! Many traders are already trading the higher time frames, and still have issues with over-trading. The underlying root cause is discipline and mental execution in trading, and that comes down to how your brain is currently wired.

If you haven’t wired it into your brain yet, you won’t be able to execute discipline while trading. It’s as simple as that, regardless of the time frame. If you fear something will happen, you create psychological tension around this fear. This only increases your negativity bias, which further perpetuates this behavior.

In conclusion, we have to adopt a different working definition of ‘over-trading’. We have to get beyond the time frames that cause overtrading notion.

Your goal should be to execute your trading plan as is (and nothing more). And that needs to include your risk limits while pulling the trigger when you need to.

Review Your Work for the Day

Did you know professional football coaches after each game will spend anywhere from 20-40hrs a week reviewing tape of their last game, how things went, and then look at tape of their upcoming opponents?

Sometimes they are spending as many hours as people work in a week, just preparing for the next game. They will make notes, look at several different angles of the games, then prepare some tapes for their players to review to see what mistakes they made and learn from their mistakes.

There are actual poker players who have rooms full of journals with notes they took on players, how they played, what decisions they made, and how the hand played out.

- What do you do to review your trading and correct your mistakes?

- Do you have a trading journal which you actually fill out religiously?

- Do you screen record your trading and make comments of what you were seeing so you can see your mistakes and what you did correctly?

Do you review your systems performance monthly, quarterly or yearly? Trading is not just sitting in front of the computer when the markets are open, pushing a few buttons on the mouse, buying, selling and putting in stops or limits.

Trading, like all professional endeavors, is about preparing yourself for the challenge ahead. Trading is having a framework and a clear trading plan so there is no confusion about what you need to do each day.

Trading is about preparation + reviewing your performance. Simply put, you cannot change that which you do not review and measure.

Ask yourself what you are currently doing to review your trading process and how you are fixing your trading mistakes and plugging your leaks.