Have you ever said this to yourself in trading? Most of us have, present trader included back in the day.

You don’t know it, but this statement is a trap. Unconsciously you believe you are a victim of cause and effect.

What you have to see is that you can ‘cause an effect’, particularly the ones you want.

A better question to ask yourself would be;

“How can I change my thinking, feelings and actions to produce the effect and results I am wanting?”

Doing this keeps you focused on the process first. This is how you accelerate your learning curve in forex trading.

This is employing a successful trading mindset.

I was listening intently to an interview of a professional athlete, talking about playing against one of the best teams in their league. Instead of being intimidated by the prospect of playing such a highly dominant team, they had the following to say;

“These are the games you really look for. They force you to test yourself, to find out what you are doing well, and what you need to work on.”

If there is a mindset or quality I’d like to install in every trader, it would be what this athlete was conveying. They looked forward to the challenge they were up against.

They weren’t worried so much about making mistakes, or not being able to handle the more dominant team.

If they couldn’t, it meant they had things to work on.

Frustration Leads to Learning

Developing traders need to build this type of successful mindset. Losses will happen, you will be frustrated at times, and the market will not always make sense. These experiences can last for hours, days, weeks, perhaps months.

How you respond to each and every trade matters more than you can imagine.

If you as a trader are going through, or have recently gone through a frustrating period – you have to let that ‘feeling’ of frustration be temporary. It is ok to experience stress in trading, but it is not constructive to define yourself by your frustration.

Frustration must lead to learning.

Better to have the approach that any losses, mistakes, or frustrations are learning experiences. That you actively seek out the challenges inherent in the markets.

Approaching every single trade as a learning experience, will help you see the bigger picture and build confidence in your trading.

Opportunities to Learn

Each trade and moment behind the charts is an opportunity to learn.

Are you really trading like a sniper, or just sitting on your hands waiting for some perfect setup? Are you trading to be right, or are you actively focusing on improving your skills? Are you working to accelerate your learning curve, or are you letting your emotions define your experience?

Frustration must lead to learning – in fact all trades must lead to learning. You either win, lose, or learn from each trade. The first two you cannot control entirely, but you can with the last. And which do you think leads to your development as a trader?

The best athletes, professionals, and successful traders learn from each trade, and maximize every chance to learn. This is part of building a successful mindset, which is essential and required for trading successfully.

Ask yourself, how would your trading experience and mindset differ if you looked forward to the challenges, and the frustrating moments, learning from each? How would this change your daily approach and thoughts when engaging the markets each day?

What parts of the above can you work on, and what have you noticed about yourself after reading this article?

Please make sure to comment, share your current experiences, and what you thought about these suggestions.

One of the best things you can do to accelerate your learning curve is to do simulation trading. There will be times the market is slow, or you don’t have setups. If your only training is watching videos, and making trades in the market, then your learning curve comes to a halt when there are no setups. This is where forex simulation trading comes in.

In this video, we discuss how you can use Forex Tester 2 to accelerate your learning curve and build your skill set.

For those wanting to get the $50 forex trade simulator discount, you can get this and order by clicking on the link Forex Tester 2 $50 Discount

In a new series of articles, I will be reviewing books approximately once a month specifically related to trading. I am a fanatic reader, consuming on avg. 1-3 books a week, and often come across some great reads on trading, or building a successful mindset. Today’s forex trading book review is one my most recent reads Cultures of Expertise in Global Currency Markets by Leon Wansleben.

Overview

The book is a solid study of traders and analysts at a top 10 bank in Germany, focusing on the FX desk. The author is a sociologist by trade, spending a lot of time analyzing the interactions between members on the FX desk.

It goes without saying parts of the book are highly ‘academic‘ in nature. This is key, because you will find yourself going through pages and pages of ideas which are aptly named ‘theories’.

We are traders – we deal in the reality of profits and losses, managing our risk models, emotions and mindset. Sociological theories by themselves will have little benefit to us. Regardless, the book has some highly valuable information, so onto the gems inside.

Pros

Want to find out a lot of interesting information on bank professionals? Then you’ll find this book interesting on such things as;

-how bank traders make trading decisions

-interactions with the analysts

-day to day activities

It is clear by the end of the book (if it wasn’t already), bank traders are highly aware of fundamental data/announcements. Sometimes this info is primary. Other times they are strictly concerned with the ‘flow data‘, or order flow and transactions from incoming hedge funds and participants.

Price Action & Intra-day Trading

One thing is clear – desk traders are primarily focused on the price action in real time. They are without a doubt trading intra-day on an active basis, while also building longer term positions in their book.

Hence, any ‘guru’ or ‘authority’ out there touting how ‘higher time frames‘ are the way the institutions trade, has no idea what they are talking about and spouting a complete fiction.

Interactions

The author does a really good job providing insights between the traders, analysts, salespeople and how they interact daily. He shows several diagrams of the layout, seating positions & conversations during specific meetings for an inside look into FX trading desks at large banks.

Traits of Top Traders

Another key point you quickly realize, is how the top traders manage risk, are incredibly disciplined, and have emotional courage to perform at the top levels.

Also you’ll begin to understand how critical intensive screen time is to developing a high level of trading skill. For those trading daily and 4hr strategies only, you won’t build a solid base of skill trading just 30 mins to 1 hr per day. Hence, you’ll need to augment this by accelerating your learning process, which I’ll describe how in a future article for those with full time jobs.

The Cons

Being written by a research fellow at a University, the book has a certain academic feel, which unless you are into academic theories, you will likely find these parts uninteresting.

My suggestion is anytime the author launches into a discussion about such theories, you can skip forward till they start engaging how the traders, analysts or salespeople act on a daily basis. This is where the real juice is for you IMO.

Another con is the price. Being over $100 – compared to most trading books, it’s on the upper end. You can ‘rent’ it for 1/4th the price, which would be my suggestion if you just want the nuggets inside.

In Summary

For those wanting an insight into the FX institutional world and how bank professionals trade, this will be an informative book. Most likely, it will change how you trade and approach the markets. That in and of itself means the book has value.

For those feeling like they should ignore fundamentals, you’ll probably find yourself re-evaluating this position. Minimally you’ll want to be aware of such events, and consider studying them a little bit further (without diving too intensely into them).

Along those lines, how do you relate to fundamental/economic events? Do you study them, just know of them, or trade through them? And for those trading only daily and 4hr strategies, what do you do to accelerate your learning curve?

Last week in a free private webinar for my course members, I asked a key question about what builds confidence in trading.

Trading is without a doubt, an endeavor you need confidence in. Having a confidence that you can do this will be a fuel when you need it, clear obstacles when you face them, and provide a focus on what is essential. Confidence will accelerate your learning curve.

On the flip side, lacking confidence can be one of the most destructive traits for a traders mindset. When losses come, how will you re-bound and focus? What happens if you start your day with two, three, or four losses? Will you doubt your system, trading plan or skill set?

All eyes can see, lacking confidence is destructive, while having confidence gives us a greater chance for success. Although we know this conceptually, or intellectually, often times our actions tell a different story.

So how do we build confidence in trading? What can we do create an unshakable belief in our abilities? If we engage specific things, will they help us form a foundation to profit consistently?

The answer is yes, you can, without a doubt build confidence in yourself and your abilities. In this article, I am going to share a method to help you build confidence. Will it be enough? I don’t know, but it’s a great place to start.

Successful Endeavors

I am very proactive in protecting my mental capital and self-image. Having a strong self-image and a healthy reserve of mental capital will lead to increased performance.

With that being said, what do you think it does to remember your past successful endeavors? Do you think it builds up your confidence, or brings it down? The question is rhetorical, but I want you to begin thinking about this more deeply.

I’ve worked with thousands of traders over the years, and one common trait among most of them, is they are all good at something. Chess, poker, math, sports, finance – you name it, they are likely good at something.

In our courses, we have well over 50 doctors, many of them surgeons. We have poker pro’s and tournament champions who are wanting to transition into trading. I have a few traders on the NYSE or for some large prop desk while others are high profile trial lawyers. Engineers, programmers, IT specialists….we have them all and the list goes on.

As a whole, most students who want to learn forex trading are intelligent, probably successful in their current field, and likely good at some skill. So how do we leverage this to build confidence?

A Method

One simple method you can use is to think about what you are already good at. Think about what you went through to get there, the obstacles you overcame, the doubts you faced, the hurdles you passed, how many times you weren’t sure you could be good at it. Yet in spite of all that, you became highly skilled at it.

Notice the confidence you feel to perform that skill or endeavor. Did you always feel that same way as you did now, particularly in the beginning? Unlikely. But you got there, and now have a competent level of skill in it, whether it be a skill, sport, job, martial art, musical instrument, work or endeavor. This current experience and skill can (and should) be used for our trading process.

Hence, take some time to think about deeply what skills or traits you can do well. Think about it till it brings up a feeling of confidence to engage that activity and do it well. Remember this feeling and apply this towards trading.

Climbing Mountains

It is important to remember, all of you at some point in your lives have broken through obstacles, difficulties, and gone past your doubts. Maybe these were small, or maybe they were mountains, but every one of them we’ve climbed reminds us of how far we’ve come, and what we’ve overcome along the way.

As I said, before, ‘Overcoming is the Currency of Success.‘

Remembering this, and having contact with our past successful experiences will help you build confidence in yourself. This is another method for protecting your mental capital and keeping a strong self-image.

Hence, take some time to remember all the obstacles you’ve overcome along the way. This should give you a feeling that you can overcome your inner obstacles to trading successfully.

In Summary

Having confidence and a strong self-image are two of the most essential weapons for a successful trading mindset. Most, if not all of you, have had to overcome something in your life. And equally most are already good at some skill, sport or work.

Think about your developed skill set in any particular field, and what you can do with those skills. Think about what obstacles you had to overcome throughout your life. Notice how it makes you feel about yourself when you think of what you can do, and what you’ve grown past along the way.

Sometimes, we need to just remember our strengths, inner resources, and wisdom we’ve acquired along the way. Sometimes just noticing those things will remind us of our capacity, and our potential. This is just one method you can use to build up confidence in trading.

It should be noted, there are other crucial methods you can be engaging daily to build an unbreakable bedrock of confidence. Take some time to ask yourself what builds confidence in trading for you.

Please make sure to share your ideas on this, how it helps, and any comments you have regarding this article.

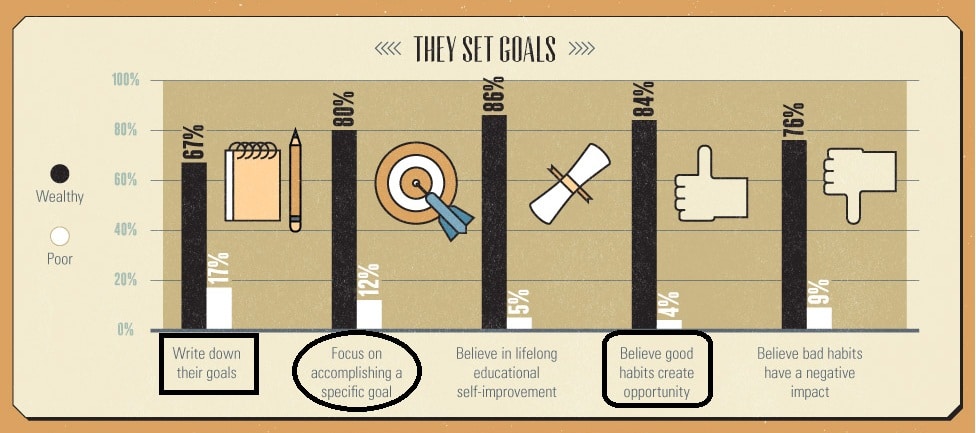

In a great study by Thomas Corley on the daily habits of successful wealthy business people vs. the poor, some fascinating statistics were unearthed. Here are several below:

- 76% of wealthy people exercise aerobically at least 4 days a week vs. 23% for the poor

- Those same wealthy people eat over 30% less junk food

- 65% watch less than 1hr of TV a day, and almost never watch reality TV

- 88% of those same wealthy people read 30 minutes or more each day vs 2% of the poor

- and lastly, 67% of those successful business people write down their goals vs. 11%

It should be noted almost 70% of these now successful people started off in poverty.

One statistic this study really dug into was that of setting goals, and the discrepancy was overwhelming across the board. Here they are below:

- 67% of successful business people write down their goals vs. 17% of the unsuccessful

- 80% focus on accomplishing a specific goal vs. 12% for those struggling

- 86% believe in continual self-improvement and education vs 5%

- 84% believe good habits create opportunities vs. 4% for the poor people

- 76% believe bad habits have a negative impact vs. 9%

Hence, highly successful people write down their goals, focus intensely on accomplishing a specific goal, continually train and work on themselves, are super confident good habits create more opportunities, and avoid negative habits and limiting beliefs.

Now ask yourself, have you written down your trading goals, or are they just in your head?

When you are training, are you working on a specific skill, and doing deliberate practice?

Or are you just going through the motions waiting till the market opens?

Do you just think between your two ears you should write in your trading journal, or are you writing in it each day you trade and train?

Where are you at in this spectrum of habits and in setting goals?

It’s one thing to say, ‘I want to make 10% a month‘, or ‘I want to be a professional trader’.

But do you follow it up with action?

Do you set goals, build a specific plan of action to accomplish that goal, and then put hours into that plan of action every day?

If so, then you have a key piece in place towards trading successfully.

But if not, spend about 1 minute asking yourself why you haven’t set any trading goals, then the next 30 minutes discovering what those goals are, and what you need to do to accomplish them. From there, you have to take action.

In reality, the largest portion behind your success is the choice to think successfully. What you think and do has the greatest impact on your success or failure. I meet a ton of people who were highly successful (at something) before they came to trading. Yet they get stumped on how to trade successfully and become frustrated.

That frustration is a type of amnesia. It’s forgetting you weren’t always successful at what you are now. It took time, likely hundreds of hours, you made an ocean of mistakes, worked hard when it wasn’t convenient, and kept going when problems hit you for a loop.

Where is that wisdom now? Where is that experience now when you are experiencing your frustration? Rely upon that, and use it to keep moving forward. Tune your mind to what you want to accomplish, understand what it takes to achieve that, continually work on building a successful mindset, and then get to work.

Nothing about this will be easy, but nothing great ever is.

By now many of you are in full swing with the new year, and at least 6 days removed from creating your new year resolutions. Below are some interesting statistics about new years resolutions, some of which I think will not shock you.

1) About 8% of people are successful in achieving their new years resolutions (not far off from trading)

2) 25% of those who make them don’t even make it past the first week

3) 34% of those resolutions are related to money

Source: Betterment.com

Do these numbers above surprise you? My guess is if I surveyed 1000 people, the majority would not be surprised.

We’ve all made resolutions and failed to keep them (including yours truly).

Have you ever asked yourself why is that? I certainly did.

Why do so many people consistently make new years resolutions, yet fail to really nail them? Made a resolution to always fill out your trading journal each day without fail, only to a few weeks/months later finding yourself not filling it out? Why?

The reason you did not fill out your journal, or consistently risk a fixed % of equity per trade, or whatever resolution you made is the same underpinning reason all resolutions fail.

In this article, I will briefly share a far better method for making consistent change, then ask the critical question as to why most fail.

A Far Better Model For Consistent Change

One of my yoga students Mark Gonzales eventually went on to become a great yoga teacher himself. In 2012 he was given the Yoga Journal’s Talent Search Winner Award, and has one of the most influential power yoga channels on youtube. He still humors me in letting me know my classes were some of his hardest ever. I appreciate that sentiment as I wanted him to push his body and mind to become more than what he thought he could do.

One brilliant insight Mark recently shared captures a far better model to consistent change. Here is what he said below;

“New Years Resolutions are for those who didn’t work hard enough or look after themselves the year before. Self improvement can start now, all year round, from this moment forward.”

Indeed, for those who are constantly working on themselves all year round, there is no need for a new year resolution. It is far easier to work on yourself month-in-month-out then to rev up the change engine once a year. If you have not been working on removing your limiting beliefs throughout the year, then a new year’s resolution is most likely to fail.

It is like not running all year, then all of sudden taking yourself out for a long run when your lungs and legs are not ready for the task. You are most likely to fail, and then imprint negatively on your self-image ‘it is not like me to make the changes I need/want to‘.

This only hinders your confidence and decreases your likelihood of making lasting change in the future. Every negative imprint from failing to keep a commitment or resolution only adds on to the difficulty of changing your trading mindset in the future.

Daily affirmations by themselves will not make lasting change, especially since most are done improperly. Their is an underlying flaw in daily affirmations most fail to see. Also making those trading resolutions at the beginning of the year creates the idea you can only change once a year. This is also a fateful idea.

It is far easier to work on smaller goals throughout the year, that eventually build up your self-image and confidence to make the big changes. When you have seen yourself do the work earlier, it becomes more ‘like you‘ to do the work later. This is a far superior model for consistent improvement and hitting your target.

Why Do Most Resolutions Fail?

Understanding this one thing would help unlock many of the critical reasons why you make the same trading mistakes, why you have a streak of winners and lose them all in one trade. It is the same reason why you follow your trading plan for a few weeks/months, but then go off the reservation.

The reason why a trader fails to make consistent change and build a successful trading mindset is the same reason why most resolutions fail.

With that being said, before I share the answer – why do you think most traders make the same mistakes over and over again? Why do you think you fail to keep your risk management? Why do you think you succumb to the same emotions you know are toxic to your trading?

Many of you are smart people and can certainly figure out most of what you are doing isn’t helpful. Yet you still do it anyways. Why do you think you continue to do things which you know will only hurt your trading performance?

Please make sure to share and comment below. Your answers will be incredibly revealing as to where you are in your trading process, how much you understand about the trading mindset, and what you have to build mentally to become a successful trader.

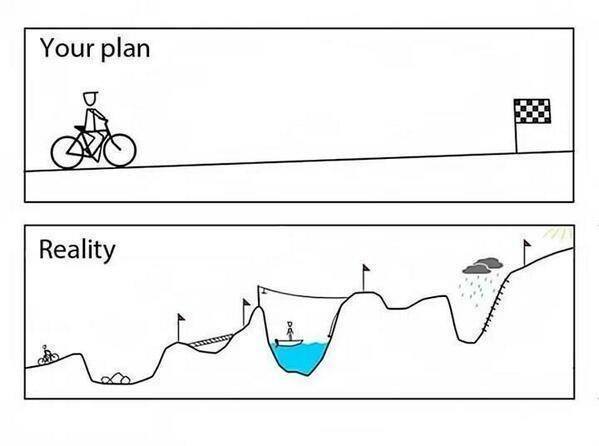

To trade profitably takes many things, all of which are borne of a successful trading mindset. You will never find a highly profitable trader without a successful mindset. You will need mental strength to complete this journey – but just like muscles, this mental strength can be built with proper training.

It is important to keep the perspective your journey and equity curve will not be a straight line. No success story was built without failures, speed bumps, or mountains to overcome. These failures and obstacles aren’t just part of every success story – they help to define them.

Here are five tips for building a successful mindset for trading and life.

#1 “I Can Do This”

A mind riddled with doubt and a lack of confidence will only make the situation more difficult. It will deplete available brain resources, and actually engage emotions which make it harder to succeed in trading.

We will all make mistakes and have losses in trading. To trade is to be married to both wins and losses. There is no way around it.

Trading is not going to kill you. Every obstacle you face in trading you can get through. You must have a mindset that ‘I Can Do This’. This will make those tougher moments becoming more workable.

A successful mindset is willing to keep trying till they get it right. Failures are not used as reasons to give up – but opportunities to grow stronger. By resolving in your mind to find a way, your intelligence, experience and resources will be directed in ways to overcome your obstacles.

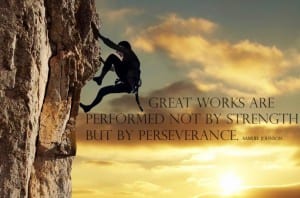

#2 Persevere and Stay Committed To Your Goals

The success and change you want will not happen overnight. Thus it is critical to have a mindset that stays committed – one that perseveres. You don’t lose 50 lbs of weight overnight. You will also not become a millionaire overnight with trading, nor be consistently profitable. It takes time, hard work and a focus on the process.

Staying committed keeps your attention, focus, time and effort on things that will bring you closer towards your goals. Build an inner perseverance understanding you will face challenges, losses and mountains to climb in trading. By staying committed to your goals, you will eventually find a way to overcome those challenges.

#3 Stop Worrying About Past Losses/Mistakes

This one is tough, because we are actually wired biologically to feel pain and losses more than gains. We placed emphasis on avoiding threats than on maximizing opportunities. This was simply to survive. But your goal in becoming successful isn’t just to survive – it’s to Thrive!

People who are mentally strong do not waste much time dwelling on the past or getting back their losses. You can wish every second for the rest of your life something you did in the past was different. You could become the wealthiest person in the world, and you still would not be able to change this. Why waste your time worrying about what you lost on a mistake or bad trade?

Far better to acknowledge your mistake and learn what to do differently. This is how you protect your mental capital.

#4 Patience Is Not About Waiting

People seem to think patience is some passive thing where you wait for things to come. Patience is an active process, whereby you understand little things done well build up a big result, but do not come overnight. While one result may take a lot of little actions to get there, you are actively moving forward – working on your growth.

Being patient means working hard for what you believe in taking those small steps each day.

Many times, it will be hard to see your progress. Your equity curve will have flattened and the results you want aren’t there. But that does not mean progress isn’t happening. It is very possible you are advancing. The space shuttle actually has to build up a lot of force and propulsion before it starts to climb. Often times your trading process will be the same.

Keep your focus on the process. That is where you build the momentum. That is where the fuel & propulsion to your success lies.

#5 ‘A Smooth Sea Never Made a Skillful Sailor’

Obstacles, pain & challenges come in two types: 1) Those that hurt or stop you, and 2) those that change you (for the better). Learning from them brings change, growth and confidence. A sailor will never become highly skilled by taking on easy voyages. The best learn from the rough waters they have to traverse. This is no different from trading.

You want to be a successful trader, so accept the fact you’ll have to overcome obstacles and rough seas to get to the other shore.

Strength and confidence doesn’t come from what you can do easily. Overcoming is the currency of confidence.

Successful traders and people often do things differently than the rest of the crowd. But what they do is not magical or something unavailable to you. A successful trader mindset is always behind these people, and this is something you can build. There is very little about trading that is easy, and often times I hear of traders applying the wrong mindset to the challenges they face. Here are 9 simple things successful traders (& people) do, which you can adopt to change your compass towards success.

1. Have a Passion For the Process

Around the age of 5, Earl Woods brought his son on to a TV show to demonstrate how good his son’s golf swing was. After the young Tiger showed a glimpse of what he was to become, his dad was asked the following question;

“How many hours do you make him practice every day?”

Earl quickly responded, “Make him…I cannot get him to stop.”

You have to have a passion for trading and the process. Your passion cannot be ‘outcome dependent‘, meaning if you make x dollars in y months, then I’ll remain motivated to do the work. You must be willing to do the work, particularly in the moments when things are not working your way. It is easy to do the work when all is going well.

2. You Must Accept a Tedium of Work in Your Learning Process

There will be moments in your learning process which will seem boring, tedious, and difficult. You will often have to work on things you like the least – perhaps money management, filling out your trading journal or reviewing your trades. It is unlikely you will enjoy everything you do equally. In all great things built, there was always a tedium of work in the process – the moments where you sweat, tire and become exhausted. You must accept this tedium of work, and understand those little things build up skills and wire your brain to trade successfully.

3. Frustration Often Times is a Sign of Progress

When the brain gets to something it doesn’t understand, it often gets frustrated not having the answer. Being frustrated by something in your trading process is a communique you are dealing with things more complex than you understand, or can do efficiently now. This is a good thing. It means you are now heading into territory you are not skilled in, but need to be to become a successful trader. Be grateful those things are being pointed out – for when you work on them, growth happens.

4. You and Your Environment Imprint Upon You

The things you say to yourself before, during and after each trade have an impact. They imprint upon you, particularly the emotional quality of them. The same goes for your environment (parents, friends, co-workers). Make sure what is imprinted upon you is positive and directs you towards being successful. Learn to protect your mental capital.

5. Do Not Expect Immediate Results

Nobody who is a successful trader (or successful at anything) got there in a matter of months and expected immediate results. In a great commercial ‘Maybe It’s My Fault‘, amongst saying many brilliant things, Michael Jordan shares the following;

“Maybe I led you to believe that basketball was a god given gift, and not something I worked for – every single day of my life.“

It’s easy for us to see the success of such people. But we often fail to see all the hard work behind it. Michael had to work at his game for years, often filled with failures before he started to notice results. Real change in your trading does not come easily or quickly.

6. Do Not Look For an Easy Way Out

I have never met a successful trader or person who looked for the easy way out. You can pirate all the systems you want, but you will not have the mindset of abundance to be successful. You can try all the robots out there – none will become the ATM machine you think they will.

Do you really think Tom Brady or Peyton Manning got to being elite quarterbacks by not doing the work? Do you really think they skipped steps?

Remember, 84% of all people who win the lottery are broke inside three years. Now ask yourself who you’d rather be;

Person A – who makes $1 million in a lottery

or

Person B – who built up a business over three years and made $1 million?

Who will be able to repeat that success, use their skills, experience, and be most likely to do it again? Obviously Person B, while Person A by contrast has no skills, information or experience working for them. Food 4 thought, but do not look for an easy way out. There is none.

7. In The Future, I will…

I cannot tell you how many students tell me, or my partner Aruna who does the ERT training program, that they will feel confident, relaxed, or happy when they become a successful trader. Why put your happiness on hold? Why make your mindset held captive to some unknown future? Why not feel confident, relaxed and happy now?

A good friend of mine recently shared this great quote and post which said the following;

Ego says “Once everything falls into place, I will find peace.” Spirit says, “Find Peace and everything will fall into place.”

8. Take Responsibility for Your Behavior

Would you expect to be capable of finishing a marathon without running, stretching, training, proper hydration and diet? Would you expect to build strength and muscles sitting in a chair all day? Of course not. What makes you think trading is different?

Don’t fill out your journal, evaluate your trades, train properly, build your trading skill set, or a successful trading mindset – then do not expect to become a successful trader. Be honest with yourself and take responsibility for your behavior.

9. Failure is a Part of All Successful Ventures

Failure is a part of the process – an element you have to befriend. If you make it mean something about you, then it will consume you and create negative trading habits. However if you learn from failures, you will grow from them. You have overcome challenges like this in the past. When those challenges were happening, at one point you didn’t think you could get around them. This situation is no different.

Remind yourself of the challenges you have overcome to get here, and what strengths you have. They will aid you in difficult times. Peter Vesterbacka – the creator of Angry Birds, had produced 51 games prior to creating Angry Birds, and virtually ended up in bankruptcy. It has done over $6B in sales over the last few years. Failure is a part of all successful ventures. Real confidence comes in overcoming obstacles, failures and challenges.

In 99% of the cases, when hearing about ‘protecting your capital’, what’s being discussed is your financial capital, or money in the account. But when do you hear about protecting your mental capital?

Unfortunately there is very little discussion about protecting your mental capital. And yet, it can often be more important than protecting your actual capital (i.e. money).

What is Mental Capital?

Your mental capital is very much like an account balance reflecting the strength (or weakness) in your self-image and trading mindset. A good example is confidence, or lack thereof. Some other ingredients which affect/are part of your mental capital are;

Doubts

Fears

Beliefs (positive, limiting or negative)

Impatience

Self-esteem

Laziness

Discipline

Focus

Awareness (both self, and in the moment)

Beating oneself up

Negative or Positive Language

Mental Toughness

Your mental capital is something (just like your risk capital) that has to be protected and built up brick by brick. However, there are no mathematical formulas to help you with this. The two things that affect your mental capital the most are 1) You and 2) Your environment.

Ways to Protect Your Mental Capital

There are many ways to protect your mental capital, of which, I’ll share a few simple techniques here;

1) When in a trading slump, go for smaller, more achievable goals

We’ve all gone through losing periods, but the longer they go, the more potential they have to affect our mindset. Sometimes you just need to get a few winners to build your confidence back. If getting 2R on a trade just seems out of reach, try going for 1.5R, or 1R. Just nailing a few wins can do magic for your confidence and beliefs. Its an external confirmation to your mindset you can make good trades. When this belief comes back, you start to find yourself making better trades.

2) Avoid beating yourself up

This takes awareness in the moment, so anytime you catch yourself doing this, you have to stop the negative self-talk. Instead, think about things you do really well. Think about something which you’ve overcome in your life. By recognizing your strengths, you start to engage them more, while replacing the negative self-talk. It’s a more constructive thought process to engage in and helps to strengthen your trading mindset.

3) Take on less

Maybe you are trading 3-4 systems across several time frames and instruments. If you cannot perform consistently at this level, reduce what you take on. Trade less systems, instruments and time frames. Try doing a few things, or even just one system really well. When you start to perform well with that one system, winning more trades and making money, you start to create a positive belief you can do this. This leads to a confidence which you can then use taking on just a bit more, very much like lifting weights.

In Conclusion

These are just three simple ways to protect your mental capital, and there are many more developed methods, techniques and ways to do this. One example is ERT training, which helps to re-wire your brain and remove those limiting beliefs.

Not protecting your mental capital will only lead to negative emotions, beliefs and habits. But protecting your mental capital will help you build constructive and positive trading habits that ultimately lead to better trades. There is nothing more powerful than someone who believes in themselves. All great performers have this. Your goal should be to become that person.