Hello Traders,

Often times I share my own personal trades that I use from my price action course strategies, but today I wanted to share some from a student who has banked over 1640+ pips in just the last two days, using our strategies. This student (we’ll call him Stan) had joined our course only a few weeks ago, and has already paid for it several times over. How Stan came to me is quite interesting and worth noting.

He took another course from someone else on price action just this last January and had the following to say;

“I started a course from him in January, and I do not want to waste any more time on his course. I like your forex videos, but moreso wanted to learn from your unique perspective on trading and life, so I’m going to join your course.”

He joined on March 10th of this year.

For the next two weeks, he did nothing but study and ask questions, really digging himself into the material and constantly getting feedback. He without a doubt has the passion and drive, and is using these to fuel his growth without a doubt.

After a few weeks of study, questions, practice and feedback, he emailed me on April 4th with the following;

“I have been watching the videos on the price action course, and today I nailed 3/3 trades which I’m still in at the moment. I just want to thank you for being such a good teacher and gifted instructor. Thank you for passing on the knowledge.”

Making a good chunk of money to have the time and freedom to do what you want is one thing – but having an impact on another person’s life is a completely different thing. This is what I strive for, as making money is not difficult, but being able to impact a person’s life like this student – is as rewarding as it gets.

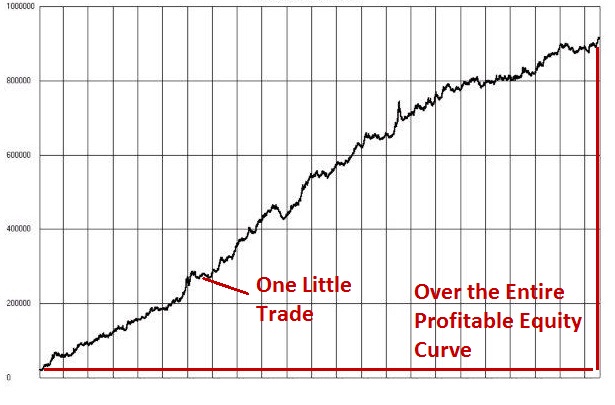

Stan made these trades the day before NFP, and was up over +1060 pips heading into the big announcement.

After a few back and forth discussions on how he should handle the positions, Stan stayed in them through NFP, and has profited even more – currently up +1640 pips on just those three positions.

Here are the trades below from the screenshots he sent me on Thursday:

CHFJPY 1hr Chart

USDJPY 1hr Chart

GBPJPY 1hr Chart

As you can see, Stan got pretty darn good entries on the positions considering the JPY volatility – but has also held his nerve as they developed, which has allowed him to make several multiples of R (reward) per trade, with some over 10:1 reward to risk plays.

As of Friday just after the NFP report came out, Stan sent me another screenshot of him holding the positions, and even adding onto it using one of our price action setups.

As you can see buy the date and time on his broker platform, Stan was still in the position heading into NFP and added more. If you include the new position he added, he’s up another 221 pips, so a total of +1861 pips in the last two days, and each trade is no less than a 7:1 reward to risk play, with one being over 10:1.

Keep in mind, Stan only joined the course a few weeks ago, and has learned tools and methods to take advantage of these huge moves in the market. The irony of it is, he was not the top performing trader in the course this week, who banked over +6300 pips this week from trading Gold and Silver!

Perhaps you have not been profiting lately in the markets, and having trouble catching these great price action setups and large moves. But seeing the above, I hope you realize how you can profit from trading the market, with the right education, study and practice.

Making money in the markets is a real thing, and its not just something that I do, but my students do as well, and continue to do. My belief has always been – if they can do it, then there is no reason why you cannot as well.

My job is to give you the strategies, training and mindset to be successful, but you must meet me on the path. I can only do so much, and my job is really to do 50% of the work for you (although it ends up being like 75%). But for those that meet me along the way, and do their part, the rewards are there, just like they were for Stan in his excellent trading above.

Hopefully, you will be next.

Kind Regards,

Chris Capre