In my previous article Developing A Successful Forex Mindset Pt. 1, I discussed how your trading mindset is essentially a product of three things;

1) Your Neuro-Physiological Wiring

2) Your Mindset of Level of Mindfulness

3) Your Psychological Conditioning

I focused specifically on how your Neuro-Physiological Wiring, specifically how your mind and brain are integrated and help in your development as a forex trader.

I also talked about the three main fundamental functions of your brain (regulation, learning, selection) and how these mental functions are critical for building a successful forex trader mindset.

Today I’ll focus on number two from above – how your level of mindfulness helps to build your trading mindset – gearing it towards success or failure.

Your Level Of Mindfulness

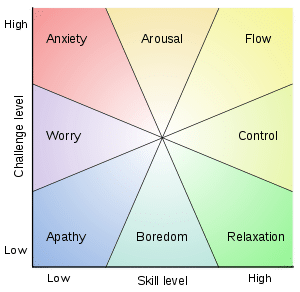

As a general definition of mindfulness in trading, your mindfulness equates to the degree of awareness and attention to both your inner and outer worlds. Although this is particularly critical during the trading process (including just before and after), it is also connected to your mental activity and thoughts separate from trading.

Why?

This is because there is no compartmentalized section of your brain just for forex trading. We didn’t evolve to be forex traders sitting in front of a computer for our survival, so we are using skills and neurons from all portions of your brain. Because the brain is an interconnected whole, our experiences in life around wealth, mindset of abundance, family, memory, fear, greed, confidence, and more, all effect our trading mindset, and thus – how we make trading decisions in the moment.

Particularly true for trading (but also in life), your brain learns primarily from what you attend to in the moment. In an ode to Star Wars fans, Qui-Gon Jinn once stated, ‘your focus determines your reality‘. Thus, since your mind essentially learns from what you focus on in the moment, your level of mindfulness is the gateway to taking in helpful information (and avoiding non-useful info). How you perceive information (internally and externally) via your level of mindfulness, is what facilitates your learning process and thus trading mindset.

30-80x a Second

I’m going to be sharing a few ways you can build your level of mindfulness to sharpen your mental faculties, but wanted to briefly mention the potency of mindfulness practice.

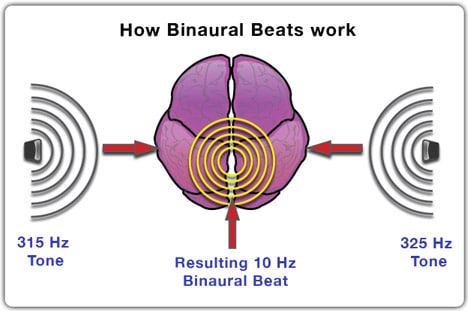

In a study in 2004 by Lutz et al., he examined various Tibetan meditators as they went deep into their meditation and he found something highly impressive. Lutz noticed these meditators produced an uncommonly level of powerful and pervasive brainwaves, whereby unusually large regions of neural connections were pulsing in a ballet like synchrony. These large regions of neural connections pulsed at 30-80x a second allowing them to unify large territories of the mind.

Part of Einstein’s incredible mental faculties were his ability to involve large regions of his brains to work together via the cerebral cortex. His level of activity and connection (or higher) has also been found in those meditators who have build up their level of mindfulness via a sitting meditation practice. So a genius level IQ or mental abilities, along with highly perceptive qualities are not reserved for people born with these gifts.

Like all things in the mind, they can be learned and developed, particularly through mindfulness practices.

Mindfulness & Wisdom in Trading

As a whole, trading wisdom and mindfulness is not your ability to spot price action patterns in the charts, or understand proper risk management. Trading wisdom and mindfulness comes from a few steps;

1) Understanding what hurts and helps your trading process

2) Based on this understanding and experience, letting go of those habits which hurt your trading process

3) And strengthening those that help move your trading forward

As a whole, mindfulness and wisdom in trading are supported by the three basic functions I mentioned in the last article (regulation, learning and selection). Your brain learns through forming new circuits, strengthening new ones and weakening others. It selects through experience what is valuable and what is not.

Mindfulness in turn leads to new (and accelerated) learning, since your attention shapes what neural circuits are built. Regulation is done through a combination of excitatory and inhibitory activity. Thus, by learning to improve these three processes, you will improve your neural functions, and thus improve your trading mindset.

Two Methods For Building Mindfulness

Although there are dozens of methods to help you build mindfulness which will flood into your trading, I will talk about the two that I have practiced for over 12 years now; Yoga & Meditation

Over a few thousand years old, Yoga has hundreds and hundreds of scientifically proven benefits, such as reducing fat, increasing muscle tone, improving digestion, enhancing your sex life, glandular function, and relaxing your central nervous system (or CNS).

Your CNS regulates an enormous amount of activity from motor to mental activity to breathing. Are you mouth breathing rapidly? If so, you are likely to be more excited, emotional and less relaxed/focused during trading. Yoga is a great practice to help build both a relaxed CNS, but also to build awareness, both physical and mental.

To really do yoga well, you have to maintain awareness of your entire body, and control your internal energy. Any inability to do this will manifest in your yoga practice. Don’t believe me, try and do a balancing pose (like tree pose) and see how long you can hold it? I’m willing to bet almost any experienced yoga instructor can hold it for much longer than you. How so? Through a greater ability to relax their body, mind while maintaining awareness.

Thus, Yoga is a fantastic option for building mindfulness as that is the root of all yoga practice.

Meditation is another alternative, particularly silent sitting, sometimes known as vipassana, shi-ne, zazen or many other names. More than likely there is a center around you that offers a silent sitting practice, but those who engage this practice fully not only notice mindfulness benefits, but greater clarity, happiness and without a doubt – better neural functioning.

The general goal of any silent sitting practice is to build your mindfulness and awareness in the moment.

Many people wonder how I became a successful trader being self-taught. I am unlikely smarter than many of those I teach. Nor did I take a single economics or business class in college. But one edge I had for sure, was my yoga and meditation practice over the last 12 years.

This helped accelerate my learning curve as I figured out much quicker what to focus on, what price action setups were high probability, how to build my trading skills and trading mindset to be successful. If there was one key edge between me and others, it would be this, and the benefits continue ad infinitum – probably the best investment and ROI I could have ever come across in my life.

Regardless, these are a few options for building a successful trading mindset and your mindfulness in trading.

In Closing

Your mindset, brain and mental activity is what forms your trading mindset, and thus – determines your level of success. Mindfulness in trading equates to the degree of awareness and attention to both your inner and outer worlds. This would mean your emotions, your level of relaxation or excitation, your ability to focus in the moment and detect the order flow in the market, along with how your mental activity is helping or hurting your trading decisions.

Mindfulness increases your learning process by focusing on what is beneficial and profitable for your trading process, while avoiding what sets you backward.

Two practices you can engage in to build your mindfulness are yoga and meditation, which will sharpen your focus and mental activity so you get more out of your brain and mind when trading.

This is part two of the three part series on Developing A Successful Trading Mindset, so stay tuned for the last edition soon. But I hope this gives you some ideas of looking beyond the strategy to what may be keeping profits and success in trading just out of reach.

Kind Regards,

Chris Capre