Yesterday was my first day back at the range in a week. I had some problems with my shoulder so was resting it, but yesterday it felt better. Even though I’ve been shooting for over a year now and won two competitions, there is still a lot of work to do.

I was shooting decently consistent to start off yesterday…scoring a 10 (perfect), a 9 (in the gold center) and an 8 (red – one level off from the gold center) for every 3 shots (round) from 18m which = 60ft.

My pulling shoulder which used to be out of alignment (too high) was now at the proper level, but my back elbow was not totally inline with my front gripping hand. I started to make some adjustments but still the same result…10, 9, 8. I began to wonder what am I doing that is off?

Just then the instructor Diego pulls me aside and tells me next round we’ll go back to 3m target as he wants me to work on something. At first, it was discouraging to my ego being moved to the smaller target. But, I’m committed to learning the art of archery so instead of worrying about looking good shooting at the 18m, I was happy to go back and practice some basics.

Although most of my technique was correct, I was missing two things;

1) After my shot, I forgot the rhythm to close my eyes for 3 seconds while holding the bow

2) I had put too much of my energy on the target and not the process

The first one was relatively easy to change as it require a physical adjustment. However, the second one needed an internal adjustment, one that was more subtle and had no outer reference for me to gauge.

After three rounds, I was keeping my eyes closed and back in the rhythm, but far more importantly, my energy was focused where it needed to be – on the process and not the target.

I went back to 18m and started shooting. The whole time I was using my energy on the process and forgot about the target. After 3 arrows, I shot a 10, 9, 9. Even though the result was a slight improvement, there was something else going on. My awareness was where it needed to be. I was totally focused on the process and not the result, and thus doing all the things I needed to make a good shot.

How Does This Relate to Trading?

In trading more so than archery, there is a temptation which can distract you from the process. It is called money. Most people learning to trade do not have all the money they need so the temptation to be distracted is enormous. You look at your charts and see the EURUSD moving 150pips in the last few hours or the GBPUSD moving 400pips in the last two days, or all the flashing lights and what do you think?

‘Wow, I could have traded that and made $$$‘. Or you think, ‘Whoa, that pair is moving, I should get in that‘. Or, ‘Wow, if I had put 10 instead of 5 lots, I would have made double the money‘.

Sound familiar? If it does, your not alone and most traders go through this process. But herein lies the trick, which is the same in Archery.

It is easy to be more focused on the target and not the process (following your trade plan & rules, using proper risk management and being disciplined). It is more convenient to not follow your trading plan and make some quick pips then to follow it completely no matter what is going on in the markets.

Everyday I have tons of traders like yourself that come to me saying ‘I want to do this for a living‘ but when it comes down to it, many do not follow the system, or the risk management rules, or the trading plan. It is because they are so focused on the target and forget about the process.

Trading for a Bank

Speaking of trading for a living, do you know what it takes to trade for a bank?

4,000 trades. Yep, that is right – 4,000. Why? Because banks want to make sure their traders are trading their system as is, and the best way to do it is drill it over and over again. They have a lot of money on the line and they want to make sure before trading their money, you know what your doing to the point it is habit. This can only be done if you are focused on the process in the beginning.

Your Training as a Trader is not finding the best system out there, but in learning how to master the process. How do you do that? By being fully focused on what you are doing every time you make a trade. By doing this, your thinking or emotions never get a chance to interfere with your trading and decision making.

Have you ever had a great trade setup but didn’t take it out of fear (emotion)? Or have you ever got in a really good trending move, only to exit early before your system because you ‘thought’ it was going to turn around? Has this ever happened to you? If so, it is a direct communication where your focus is (on the target, not on the process).

As in Archery, so in Trading

When you are trading, ask yourself where is your focus? On the target and money to be made? Or on the process (using correct risk management, following your system, executing the technique). Keep your focus on the process until it is drilled inside your head so deeply, there is nothing left but the discipline and you executing according to plan. Skill is a drill and all highly successful traders have drilled their skills through the hammer of the training process.

Lastly, if something is not going right with your trading, do not feel it is a setback to go trade smaller lot sizes or go back to demo. I often have to go back to the 3m distance to work on various aspects of my technique. Once they are back in sync, I go back to the 18m. You can do the same with trading by going back to demo for a month or so, and once the results improve, go back to live trading. Quit thinking about the money you have to make right now and focus on the process. When you do, you will find you are hitting the target with more consistency then ever.

If you liked this article, then please make sure to ‘tweet’ and ‘like’ them via the buttons below. Your comments are also welcome so please make sure to share.

For a really good article on Discipline and the mental aspects of trading, check out this great article on Trading Lessons from Jesse Livermore – the World’s Greatest Trader.

And for those looking to take their trading to the next level and work with me as your mentor, make sure to check out our Online Courses where you will learn the same systems I use daily along with having a chance to communicate directly with me to help you build your own trading plan.

Earlier this week I was talking to a student who is starting his private forex mentoring with me. He was actually referred to me by a previous student I spent time mentoring two years ago. This former students name is Tony and had no prior experience in trading, nor a degree in business or finance. But he had a serious desire to learn how to trade successfully while putting in the work and study.

Occasionally he writes me an email to tell me he is still trading and doing well. He often asks me some advanced questions about the market, trading, but that is all.

What is interesting is when I talked to this newer student Ben I am starting to work with, I asked him how Tony was doing for 2011. He told me the following;

‘Tony is doing great. He is up 76% for the year and I’ve actually seen his trading report. He’s only had two losing months this year and has been getting asked to manage funds for clients.’

First off, I was nothing but proud and happy to hear this about Tony. I was not surprised he was managing money as he emailed me 6 months ago asking about the issues around such ventures which can be complex.

I asked my new student after talking with Tony, what he thought Tony’s greatest asset is. He responded with one word;

Discipline

Tony was taught a few of the exact same systems I teach all my students so he had no edge in regards to the system. Tony’s edge was his discipline. He simply had the mental fortitude to follow the system exactly as is. On top of it, he had the forex trading discipline to always stick to his risk management levels and never violated them.

So here was a student given the exact same tools as the hundreds of other students, and he was performing exceptionally well for the year – even outpacing most hedge funds (along with most traders on the planet).

He didn’t have some crazy algorithm or DaVinci Code system which sent Tom Hanks on a wild chase across the world to find it. He had a system which was obviously profitable, but even more so, the Discipline to execute it consistently and never violate his risk management profiles.

A trader without discipline will never experience consistency in their trading because they fail to use proper risk management and stick to their trading plan. This will likely result in them making a lot of really good trades, building up their equity, only to have a few losing trades (or one) knock them down the ladder. It is someone who kills long term success in the race by forgetting to tie their shoes and eventually tripping over them. Trading is not a sprint, it’s a marathon and requires conditioning over time.

Perhaps this sounds familiar about building up your account, only to have one or a handful of trades take out all your gains. If it does, then it’s a clear communication on what you have to work on (staying disciplined).

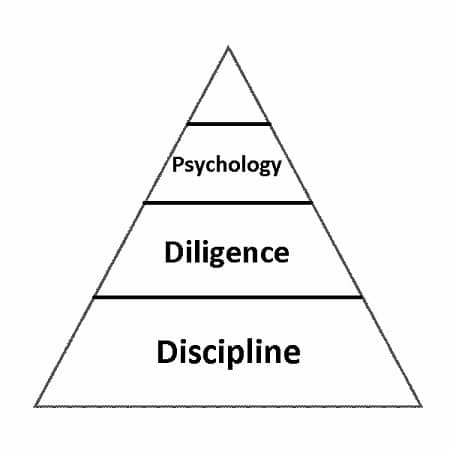

Developing traders often don’t understand, when you are asking to be a successful (or professional) trader, you are asking not just to build a pyramid, but to sit on top of it. What most forget is the base is the biggest part of the pyramid and the foundation for building higher levels.

As the pyramid continues to grow higher, it gets a little more complicated, but you have a base (foundation) and structures in place to carry the stones up to the higher levels.

But just like a pyramid, there are more stones at the base and this takes more time to build. Also like a pyramid, there are more traders at the base (not making money or breaking even) then there are at the top.

However, with structures and rhythm in place, the fruits of your labor will result in a steady conditioning of your muscles (discipline, diligence and psychology). This will allow you to take on greater and greater heights, challenges and climb the pyramid of trading. Having forex trading discipline, diligence and psychology will give you a sense of confidence and a feeling of mastery over the process.

This is the pyramid of trading and the attributes needed to climb to higher levels.

While most traders spend time trying to find profitable trades, or the next great system, make sure you take time out to build the attributes which develop your trading muscles (discipline, diligence and psychology). By yourself this can be a very difficult task so it helps to create mechanisms in your life to build these habits. Finding a mentor who can guide you along your path can be instrumental in developing yourself into a successful trader. But cultivating the habits needed to take your trading to the next level simply requires some work and time.

Kind Regards,

Chris Capre

2ndskiestrading.com

Twitter; 2ndSkiesForex

For those of you looking for a mentor, make sure to check out our highly successful Online Courses to help take your trading to the next level while getting direct access and mentoring from Chris Capre.

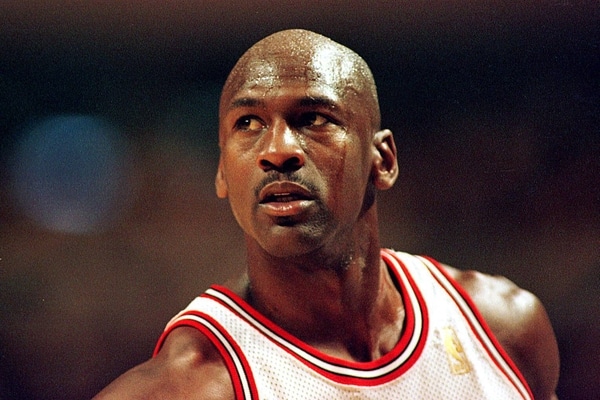

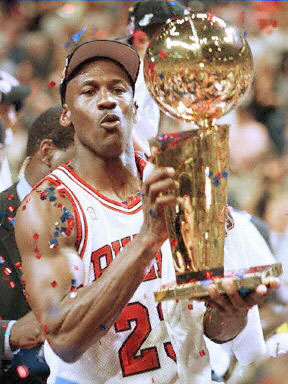

For the record, I have no idea if Michael Jordan trades. I have no idea if he even knows about the Forex market or is actively involved in his investments. Nevertheless, he helps me with my trading.

I have read over 9 books on the man, have his DVD (Michael Jordan to the Max), seen pretty much every game and am constantly reading his quotes. Why? Simply put, he embodied greatness.

Many people think he was born with some magical talent to play basketball and nothing could be farther from the truth. The first time he played, he could barely dribble the ball. He couldn’t make shots and had none of the moves or skills he was famous for.

Many people only know him when by the time he was already great with the Bulls, or a standout player at UNC – Chapel Hill where he won the National Championship as a freshman. But few know the journey of how he got there, how he struggled, how hard his work ethic was, what challenges he faced, how he overcame his weaknesses, how focused he was and how he had to make his greatness through effort, discipline, and will.

His Early Years

Michael came from a family of ‘sharecroppers’ – people who rented the land and shared the crops they produced. His grandparents were born sharecroppers and worked extremely hard. They had food on the table but were still poor. His parents had this hard work ethic built into them and it was a hallmark of their character. With four children to raise, James (Michael’s father) built his own house on a plot of land (working on weekends) they saved up for years to buy. While building this house, Michael, the youngest of four, got to see the results of hard work first hand.

Even though his mom had four children, she also worked a full time job.

When the father later started playing basketball with his sons, he never made it easy for them. They had to earn their wins. Michael being the youngest of 4 had to play even hard since he was physically smaller than his older brother Larry who he played against all the time. Larry also never eased up on Michael and they played for hours until dark. From the very beginning, Michael had to earn all his wins.

Later they both joined a youth team where Larry was the star and Michael was just another player. Although he had athletic skills, nobody thought of him as anything special in any sport he did. Hard working yes, but not special.

What is interesting to note is his father and brothers were not that tall, some just barely over 5’6″. But something happened to Michael. He never stopped growing like the others did when he was as tall as them. Many people in his family think he willed himself to grow.

Nevertheless, when high school came around, as a sophomore, he tried out but didn’t make the varsity team. He was hurt and his confidence was shaken. Being placed on the junior varsity team, after digesting his hurt feelings, he determined to become better. He worked hard at practice, so much so eventually the other players could not keep up with him. Even after having a great season with the JV team, when the varsity team was entering the state tournament, Michael was not selected to the group. So what did he do? After hearing the team’s manager was ill, he decided to fill in for him. He wanted to be there so bad, he would get there any way he could, even if that meant carrying towels and gym equipment for the players.

When the season ended, did you find him swimming at the pool or playing games with his friends? No. He was practicing every day on the basketball court hours on end. In the next year, he made the varsity team. Did he start off having great success? No. He actually struggled, made lots of turnovers, had wild shots and made all kinds of mistakes. He actually was a disappointment to his team and his coach.

Going into a holiday tournament, his team made the finals. Although he was playing all right, the game was close. His team needed someone to stand out in that moment. This is where Michael came in. With only a few minutes to play, something happened in Michael. He got really focused and had an intensity about him. He just started making plays and shots and steals that it was bringing his team back in the game. All the hours of practice over the years was starting to kick in. But there were only seconds left and his team was still down. Trailing by a point, his team gave Michael the ball. The team started to collapse on him so he pulled away for a shot. The ball was in the air while the buzzer sounding. Michael made the game winner! There was no fear of losing or of looking like a fool. There was just the concentration of the moment and what he had to do. Interestingly enough, Michael made the teams last 15 points of the game.

That summer he was the first student from his school to receive an invitation to the 5-star camp, a collection of the best coaches and players from the country receiving instruction and competing against the top players. Michael could not believe he was invited and wasn’t sure he belonged. So what did he do? Practice harder than anyone in the camp. He outplayed everyone there not through skill, but through having an unmatched intensity. He received more trophies from the camp than any other player.

Returning home from camp, did he rest on his accolades? No. He became possessed. Starting his senior year, he would go to the gym while it was still dark out and practice. After school was over, he would practice even more – again till dark. When the season started, even though he was on the Varsity team, he also practiced with the JV team to get in more time. After returning home from practice at school with both teams, would he rest? No. He would practice some more. When he started the season, he was a marked man, often finding 2 or 3 people guarding him. Did he balk or fade under the challenges? No. He averaged more points in his senior year than the one before even though he was guarded more intensely.

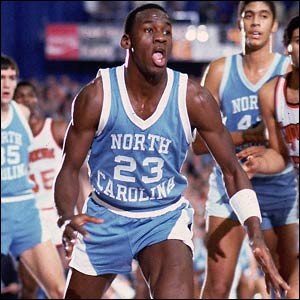

He then went to UNC as a freshman trying out for the team. Only 3 freshman before him ever started on the team. Did that stop him? No. He worked harder than ever. In the first game of the year, he got the nod, even through having a bad ankle. How did his first shot go in front of 11,000 fans and a regionally televised game? He missed and it clanked off the rim. Did that stop him? No. He got over his nervousness, stopped worrying about being careful and played. He let go of his fears and started playing using everything he had. And he got better.

UNC eventually made it to the championship game in the NCAA tournament and were playing against another freshman (Patrick Ewing) thought to be the best player in the league. It was played before 61,000 fans and nationally televised. Imagine the nerves in being a freshman playing for a game like this. With UNC down by 1pt at the end of the game, instead of giving the ball to their top player James Worthy, the coach decided to give the last play to Michael, a freshman. With Worthy and Sam Perkins covered by Georgetown, Michael was perfectly open and took the last shot. He flung a high-arched shot that seemed to hang in the air forever. It snapped right through and he made the game winner as a freshman. Michael Jordan just made the game winner in a national championship. And this was someone who 4 years ago did not even make his varsity team.

Only two days after making the game winning basket and becoming one of the best known players in the country, did you find him relaxing with his friends, drinking at parties or playing games? No. He was back at the gym practicing and getting ready for next season.

I could go on an on about Michael’s accomplishments and many people are aware of his professional career. But few understood all he went through to get there, and what actually made him great.

How Does Micheal Help My Trading?

I can think of no other person who inspires me more to become better at what I do. Here was someone who wasn’t born great, but made himself that way. He worked harder than anyone else. He was more focused than anyone else. He was more determined than his peers and never let obstacles or losses overcome his mind. He used his will to make himself great at what he did. He faced his fears, doubts, and nervousness, yet he never stopped working on getting better.

Anytime I am tired, or think I have trading figured out, or don’t want to study, practice, work, or get better at trading, I think of Michael. Its the same reason on a saturday morning at 8am, while others at the university were recovering from their nights of drinking, I was in the library studying for the next 6hrs. I didn’t graduate a Golden Key National Honor Student because I was smarter than others. Shoot I barely graduated high school. I just worked harder than them. I sat down and continued to study, even when I wanted to get up, or was tired, or didn’t feel well. When I was playing soccer for a nationally ranked college team and had set three records the prior year, did I relax and sit on my accolades? No. Anytime we did our ‘flagpole run‘ from the field to the pole and back (a 3/4mile sprint), I always came in first every single time for the entire year. Its why I played 330 days a year.

When I lost $50,000 in 30mins of trading, did I give up, stop, quit or say I’d never do this again? No. I vowed to never make that mistake again and started learning more, practicing more, figuring out where I went wrong and correcting my mistakes. Anytime I ran into a challenge or faced a major loss in trading (which I had many times over the years), I thought of Michael and never gave up. I wasn’t born understanding markets or how to trade. Nobody in my family traded and I did not take one business class in college. I was a yoga teacher prior to trading and had absolutely no experience in the field.

When I applied for a job on Wall Street, did I let that stop me? No. After my first interview, one month later I was being flown out to Wall Street to learn the Forex markets from the market maker. After intense training sessions, did I rest and have a beer at the bar like the others? No. I organized after training sessions with the other trainees so we could study the markets.

When I went to the San Francisco office, I started with a group of 5 others who were all more experienced than I, some with masters degrees in finance or economics. Did I let that stop me? No. Although after one day of being 6mins late to work, my boss came on the company chat and asked me a simple question, ‘what time you supposed to be here?‘ I replied, ‘10‘. He then asked, ‘what time is it now?‘ I quickly typed, ‘10.06‘. What did he say? ‘Don’t ever be late again‘. And I never was. In fact, from that day on, I was always early, sometimes up to 2hrs and stayed always past after I was to go home. I came in on my days off and sometimes worked 7 days a week. I worked so hard that after a year, the same intimidating boss I had was about to ask me to take a vacation when I took my first. Even though I had 2 weeks vacation time, I took 4 days.

When I think of any degree of success I have earned in this field, I think of Michael Jordan and how greatness is earned and rarely ever given. It takes hard work to be great at anything. It takes never-ending focus and dedication, even after failures. Its the same reason on a sunny Sunday while I can see others out with their family and friends having fun, I am sitting in front of my charts, studying quantitative data, patterns, doing trading exercises to improve my analytic or pattern recognition skills, and continually working on my weaknesses. Its the same reason when im training in olympic archery, I am thinking of how it will improve my trading and what I can learn from it.

I actually met Michael once, when he was playing for the Bulls in 1992. After a home game, I was downtown and was still in the city an hour and half after the game. I pulled into a gas station as I needed to fill up. When paying for the gas, I noticed the attendant was distracted. I asked him what he was looking at, and he pointed to a black Mercedes with the license plates (MJJ JVJ – him and his wife’s initials) and said, ‘that’s Michael Jordan’. I went over to the car where he was talking to others. I told him amazing game and how thankful I was for watching him play. And then I did something a little out there. Knowing his competitive spirit, I asked him if he wanted to race. I had an older looking Chevy El Camino which had a hidden monster under the hood. He looked at it and said, ‘that? you want to race me with that?’ I calmly replied, ‘yes’.

What happened after is a story for my grand-kids.

Observations of Beginning Traders

I think many times, when talking to other beginning traders they want to take the easy way out. They ask others for trade signals or if their trade will work out. They would rather have someone else think for them instead of learning how to trade the market themselves.

Nobody ever became great by having someone else do the work for them. They listen to their minds, have no patience for a trade and want instant gratification. If their own minds knew how to trade successfully, they’d already be there. Yet they still do what they want to, not what their training has taught them to do. Some of them don’t even go through any real organized training or online classes.

They don’t want to fill out their trade journals, or performance sheets, or study their past work. They just want to make money and they want it fast. Never in Michael’s mind was instant success or gratification. If it was, he would have never made it. He did everything he needed to become better at what he did and he never rested, nor asked others to think or work for him. He faced his fears of losing, of being a fool or wrong and went forward anyway. I think the reason why so many traders cannot wait for a trade to play itself out is fear – fear of the uncertainty. This is why they go for shorter trades or close it out because then its certain they know the outcome. They would rather be controlled by their fears than confront and digest them. I think newer traders worry about being careful or making a mistake thinking it means something about them, their intelligence or ability. If you have a long trading career, you will make thousands of mistakes. Stop trying to not to make any mistakes or losses and start trading.

In closing, I’d like to share one quote of Michael’s that I am constantly haunted and inspired by, one that I will never forget which he said at his Hall of Fame speech.

“One day you might look up, and see me playing the game at 50….oh don’t laugh (and here’s the part I will never forget), because limits, like fears, are often just an illusion.”

I hope this has been helpful to you and your trading process, and hope that Michael’s life, story, and example of what hard work can do, will also be an inspiration for you as it always will be for me.

Chris Capre

2ndskiestrading.com

Twitter; 2ndskiesforex

A Brief History

At the age of 14, Jesse Livermore began his trading career, although not as a trader. He was one of the young boys who would stand on a wooden plank in front of a chalkboard posting the quotes of prices for speculators. This was at the Paine Webber brokerage in Boston.

After about a year of this watching stock prices, noticing patterns, having hunches and checking to see how they did, he decided to make a move. Keep in mind he had no education in economics, business or finance. He came from a farming family and left at 14 to make a new life for himself.

He took his $5 in savings and made his first trade which he won. After trading for several months, at the age of 15 he had made $1,000 in winnings (about 20k today). By the age of 21, he went to New York with everything he had – $2,500. Keep in mind, just before this he was actually up about $10,000 so lost 75% of his stake just before heading to the Big Apple. How did he do in his first few hours of trading? Lost almost half his $2,500, in about 2hrs. He proceeded to lose the rest in a matter of days. He actually had to borrow money at that point to continue.

And continue he did, actually leaving Wall-Street to go make money where he knew he could, the bucketshops – places built specifically to help speculators lose money. He gained enough money to come back to Wall-Street, only to lose it again. He did this three times.

During the 1907 crash, he built up his wealth to $3million. He had done so shorting the market until a plea from a man named J.P. Morgan asked him to stop shorting the market as it may threaten the financial stability of the country.

He lost virtually all of this (90%) on a blown cotton trade and had to start over. He continued to lose money after this during the flat markets of 1908-1912, hitting a low of $1million in debt forcing him to declare bankruptcy. Remember this cotton trade as we will write about it in a later post.

Moving on to 1929, after slowly building up his stake again (after several losing periods as well), he made another big win shorting the market going into the crash. How big? To the tune of $100million dollars which would be worth billions in today’s value.

5 years later, FDR had created the SEC which caused the markets to take on a completely different character, something never before seen in the markets. How did this effect Jesse’s trading? He subsequently lost all of his $100million dollars. When he died a few years later in 1940, including all his trusts and assets, he had a net worth of about $5million ($95million less from his all time highs).

The Lessons

Now that you’ve had a brief history of one of the most amazing traders and stories of speculators across time, what were some of his crucial lessons he learned from trading?

1) Learning how to read price was a critical aspect of his trading, learning how to spot opportunities, notice price behavior for an underlying instrument, find opportune times to get in, etc. He spent the early days of his first year not trading, but watching, learning, observing and remembering price moves. No indicators, no computers, no charts. Nothing but pure price data and price action. He could spot key levels where the market was going to bounce, or break out, or start a trend or crash through a key level. But again, he learned this from hours and hours of observation of price behavior and price action.

He did not expect to get rich quick or cut corners. He worked and studied hard to develop his skills. One of his more famous quotes on the subject, “The game of speculation is the most fascinating game in the world. But it is not a game for the the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor.” from his book, ‘How to Trade Stocks‘

You would not believe how many people I run into asking me how they can make money fast, or 10% per month for the next year (when they cannot even be profitable now), or say they want to be a ‘professional trader’. Yet, they don’t fill out their trade journal, or do performance analysis on their systems or trading, or follow their trade plan, or work on their mental game, or spend time just studying the markets.

Jesse Livermore constantly filled in his trading journals and studied them endlessly, along with price movements and price action. When he went to Wall Street and failed the first time, he spent the next several years analyzing his system. It took him three times before he could return and be successful there. He also worked exceptionally hard at his risk management and did not expect to do 10% per month every month for the next year. He had no dreams or illusions about making fortunes. He simply looked for the best opportunities and traded them. And when he did, the money came.

2) Resiliency. If you were to put 100,000 traders through the wins and losses and all the experiences Jesse went through, probably less than a few % would see it through the end. He went through several divorces, actually asked his first wife to borrow money to keep trading which divided them forever. He traded in ‘bucketshops’ designed to take people’s money with no regulatory bodies in place to protect anyone. He had the poorest execution for the longest time and lost his entire stake over a dozen times.

Yet he always came back. He studied harder, refined his system further, made less mistakes & learned from his big losses. By eliminating most of his mistakes, getting more disciplined after each setback, sticking to his trading plan and constantly studying the markets, he came back with more vigor each time and greater successes, even after losing all his prior gains. It takes resiliency to trade the markets, mental, physical, spiritual (if you will), that in the face of losses, humiliation, being undisciplined and being flat out wrong, to pick up and try again. The best of all careers (and not just in trading) are marinated with characters of resiliency.

3) Getting ‘The Big Moves‘ or ‘Best Opportunities‘ Jesse Livermore was one of the few people to make money in both the 1907 and 1929 crashes. While tens of thousands were losing fortunes, he was making money and becoming exceptionally wealthy in the process. He was not married to any bias or view of the market (bullish or bearish). He read the price action and found the best opportunities when they came. He did not over-trade or expect to find exceptional trades every day. He was patient, sometimes not trading for an entire year until conditions were ripe. He noticed how people would get lured into markets that were not prime for making money and how often people lost during those times. His discipline and patience allowed him further to get him into the ‘Big Moves’ being short the markets going into the 1907 and 1929 crashes.

Imagine you are short the strongest stocks to date before the market makes a big move, and then starts to fall and your profits are increasing by multiples of 2, 3, 5, 10, 20 or 50x. Are you watching your profits in the ‘account balance’ window of your platform wondering when its going to reversethinking ‘I should just take my profits now‘? Or are you watching the two things you should be, the markets and your system, waiting for your exit signal.

By always keeping his eye on the markets and waiting for his signal telling him to exit, he was able to stay in the biggest moves of the decade and hold them until he got his signal (or was asked to stop selling the market so the financial system would collapse). Nothing was more important to him than keeping his eye on the target and the markets.

Dozens More…

These are just some of the most important lessons from his career and I could write about dozens more which I will share in later articles about one of the greatest traders of all time. Jesse Livermore and his trading career is someone I can read about time and time again and continually learn from (whether trading is good or challenging).

Perhaps you are profiting from these volatile times, or perhaps you are finding challenges in trading this unique environment. Hopefully you will benefit from these timeless lessons of Jesse Livermore’s career.

-May all good things for you increase.

Chris Capre

2ndskiestrading.com

Twitter; 2ndskiesforex

*For another great article on Trading Psychology, make sure to check out ‘The Pyramid of Trading‘