How To Deal With A Counter Trend Signal to Our Trade

Recently I got a question from a newer student asking the following;

“Right now I’m short this pair. It’s in profit, but it just formed a pin bar against my trade before I hit my profit target. What should I do?”

This is a common question I get about what to do when you see a price action signal that is counter to your trade. The question by itself actually tells me a lot about the student and where they are at in their process (beginning, middle or more advanced).

My response was similar to the following;

“It is important to understand we are not pattern traders. We are price action traders. Being a pattern trader, as in trading pin bars, inside bars, engulfing bars, or fakey’s does not make us a price action trader.

Pin bars are not the death of trends. I can come up with about 50,000 examples of trends both intraday, or on the 4hr and daily time frames whereby the trends ran into a pin bar at a key level, then smashed right through it. I can also come up with thousands where they did the same and reversed.

‘Wait, but those were counter-trend pin bars, what about with trend pin bars?’

Same thing, I can come up with 50,000 of those that were with trend, and the market reversed the prevailing trend. I can also find you thousands that were with trend and worked out.

So what was the difference between the ones that did work out and ones that didn’t?

The key was the price action context around the pin bar. How the price action was leading up to the pin bar, and around it (the context of how the pin bar formed) is what will make that signals useful or not.”

This is why it is such a freshman idea and a complete fallacy to think all you need to trade successfully is 3 simple patterns (pin bars, engulfing bars, inside bars). All that + trading with trend at key levels and VOILA! You have your A+ setup and a profitable price action trade.

If it were only that simple (FYI – if it were, a lot more people would be profitable).

So how do you deal with a counter trend signal to your trade?

The answer is in reading the price action context around it. I will share four charts below to demonstrate the point clearly.

Exhibit A

Looking at the chart below, we can see towards the left a double touch off the level R1, then a break through it with a large breakout bar. The market falls heavily and you look to get long around A1 on the bottom right of the chart. Your trade is working out great, but you run into a pin bar + false break (A1) at the key resistance level R1.

Minions of the 50% retrace entry on the pin bar are salivating because they think this is a great chance to short as you have a pin bar + false break at a key level, and the 50% retrace is at the level.

Meanwhile, you being long back at A1 see this pin bar and are worried about the market reversing thinking the move is over, so you exit.

Turns out both of you were wrong (see chart below)

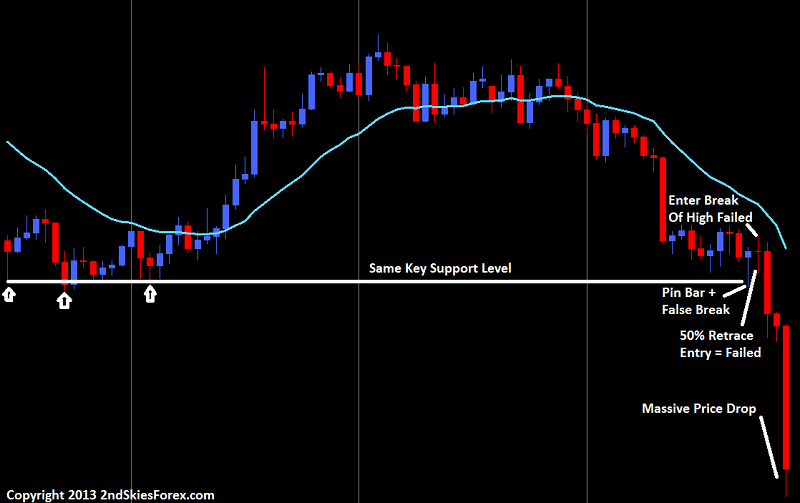

Exhibit B (later on in the same chart)

In this next chart below which is only a couple days later on the same pair, price eventually falls back to the same key level where we bought at A1 prior. It forms a consolidation just above it, then a pin bar + false break.

Great! Time to get in on the 50% retrace entry yes as its at a key level. Or, the other option touted is to get long on a break of the pin bar high yes? Either way, this is an A+ setup right since the pair is in a range and formed a pin bar at a key level right?

See the next chart below

Turns out both pin bar entries failed, even though it was at a key level while price action was in a range. Now imagine you were long around the top of this chart, and ran into this counter-trend pin bar signal at a key level. You probably would have taken profit.

But by not understanding the price action context around the level, you would have missed out on a ton of profit, almost double your profit leading up to that pin bar.

This is why its important to graduate beyond the freshman concepts of trading pin bars, inside bars, engulfing bars, fakey’s, or whatever price action patterns. If trading were that easy, as in trading with the trend + key levels + price action signal = profitable trading, then a lot more people would be making money.

The difference between knowing when to take those signals is in learning to read the context and order flow behind the price action. Pin bars are not the death of trends. Nor are the other patterns. In isolation, or even with trend analysis + key level analysis does not make it a good trade.

Thus my answer to this students question about what to do when you see a counter trend price action signal to your trade – my response is to understand the order flow and price action context around that signal. When you begin to do this, your trading will start to turn. You will find yourself winning more trades, and holding onto trades longer. And while others are buying this last pin bar – you are selling it, and you’ll understand why.

Those are great examples of why knowing Market structure will help!

Hello Anil,

What you would call market structure, I would call price action and order flow. If someone can learn to read them in real time, then other techniques are not needed imo.

Kind Regards,

Chris Capre

Indeed Informative.

Glad you liked it Nomi

Hello Chris, I think your charts are not daily as you mentioned. I guess it must be hourly or lower (i guess it’s 5 min chart), so the pin bar often fail on it. The second pinbar you mentioned did not make a false beak, as I see

However, I absolutely agree with you that understanding price action and order flow is more important than price pattern.

Kind Regards.

Hello Tima,

This is a misunderstanding of price action. First off, regardless of whether its daily charts, 1hr charts or lower, you never trade a pin bar because its a pin bar. This doesn’t matter whether its the daily time frame or not. You never just trade a pin bar in isolation. You always trade pin bars based on the surrounding context (trend/counter-trend, at key level or not, etc). This goes for any time frame. So it doesn’t matter whether any old pin bar fails on the 5m or daily chart, because we aren’t trading solely pin bars in isolation. We are trading them based on surrounding factors regardless of the time frame.

Pin bars fail on the daily chart (many of them). They also do so on the 5m chart or 1hr chart. So when you say they ‘often fail on’ the lower time frames, by themselves they also fail on the higher TF’s. So it doesn’t matter because the trading is the same, whether its the 5m, 1hr, or daily – because you always trade them with supporting factors regardless of the time frame.

So its a meaningless statement to say pin bars fail more on lower time frames because there is no pre-qualifier or supporting aspects to include in it.

Lastly, I never mention in the article the charts are daily charts. I never say what they are, and it doesn’t matter because it misses the point of the article.

Hopefully that clarifies it a bit.

Kind Regards,

Chris Capre

Hey Chris

Nice article it kind of reminds me when I go hunting, I may not see the beast at times but i can see its footprint and the direction its travelling

I would have been a wonderful article if you’d have done an explanation why the “freshman” analysis failed and why price went on the opposite of the expected direction. Based solely on the charts of the article how could you tell the price would go after the pin bar?

Hello Keen246 (is that your real name?),

The models we use explain quite clearly why price would go on after the pin bars.

But instead of me answering and doing all the work for you, perhaps you could give some thought on it, then share your ideas as to what you think would be the reasons.

If you do, I’ll make comment on them and give some feedback. This is far better for your learning process, because it forces you to think, test your knowledge, and understanding of price action as to why the ‘freshman’ methods would have failed. Your answers will tell me what you understand, what you are missing, and how to respond.

So give it a go.

Kind Regards,

Chris Capre

I’d say the main moves are impulsive and the sideways moves in which the pin bar appears early in the first two charts are consolidation moves as opposed to corrective. However, I don’t know that from one pin bar early in the sideways move, at least not in the first or second chart anyway and if I was long or not in a trade at all I might have closed out or gone short. I guess you can argue that there is not enough profit taking to make price move lower because buyers come back in and that’s “order flow” at work.

In the later charts (the down move) the pin bars appear part way through what turns out to be a consolidation. Since the consolidation forms a range of sorts, I’d like to think I’d wait for a break above the range or a break of the support line.

Some interesting statements here. I’ll respond in the course with more detail.

Kind Regards,

Chris Capre

hello Chris

thanks for your Enlightened article.

you are one of the best in your job.

yours

The article is really good, but i must be honest i did not quite understand why it broke out afterwards? It has a strong price move right before the pin bar at the level, but the consolidation AFTER the pin bar and then the breakout i don’t understand how to read? I just bought your course and i’m half way tru it, but as a “former” pattern trader there is a lot of key things to be learned. Your skill to read the market is insane.

Great price action info Chris.

You rarely here those others talking about counter trend trading, but I am confident the big players trade both sides.

Thank you professor. Cannot wait to join your price action course.

Ilin