Forex Trading, Ted Williams, & the Little Details Pt. 1

With liquidity dying down heading into the Easter holiday coming this Sunday, instead of writing my evening price action market commentary article, I wanted to write a little two part series today and tomorrow about some of the overlooked aspects of trading – the little details.

Wasn’t Ted Williams a baseball player?

Yes he was – and a great one at that.

This lesson actually centers around a great story about Ted, although not during his trading career, but well after it had ended.

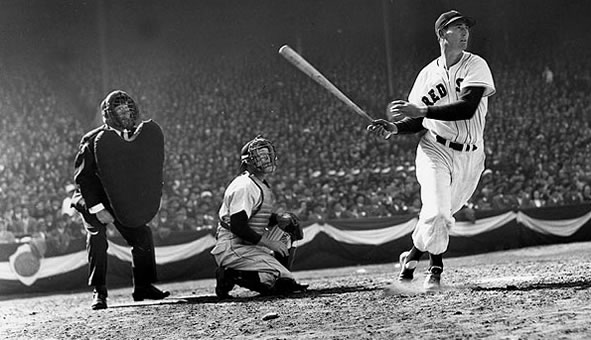

Several years ago, the Ted Williams museum was collecting several items from Ted’s great career to be stored in the museum for all to appreciate. For those that don’t know much about Ted, he is considered to be one of the greatest hitters of all time, and in 1941, he hit a .406 average – which makes him the last person in over 70 years to finish a season above .400.

Williams was known to pay attention to the details of everything he did when it came to baseball, especially hitting. His famous bat during the 1941 season was suspected to have been bought initially by a collector for over $20,000. When the museum had bought the bat, they had asked Ted to come to the museum and verify if it was his bat.

He saw the bat, closed his eyes, and put his hands firmly around the handle just as he held the bat to hit a baseball.

After a short pause, he said the following;

“Yep, this is one of my bats for sure.”

One of the members at the museum had asked him how he had known it was his bat.

He responded;

“Back in the years 1940 and 1941, I had cut a groove in the handle of my bats to rest my right index finger in. I can still feel the groove in this bat here.”

You will find amongst some of the greatest concert pianists, guitarists, athletes, and anyone highly skilled in their craft, they pay attention to the details and the smallest aspects of their game. Often times, these small details and steps will lead to a large result, often times separating success from failure, breaking even to profitability, and from just good to great.

Ted Williams realized that if he could rest his index finger more naturally into the bat, it would influence his swing. That is attention to detail.

Jimmy Hendrix would adjust and oversee every guitar he ever used. Anytime he got a new guitar, he would bend the ‘tremolo‘ (whammy bar) by hand for hours at a time.

Why?

By bending it and getting it closer to the body, he could tap the strings while raising and lowering the pitch, sometimes down three steps instead of one.

That is attention to detail, and just one in the dozens he did when adjusting his guitar.

All highly skilled professionals look towards the details as a way to refine their game. And this is something you have to do in your forex trading. You have have to constantly refine your trading to greater and greater levels of precision, detail and performance. Maybe you have to adjust your equity threshold, or maybe you have to adjust your engulfing bar entry, as the vanilla one is quite inefficient.

As Michael Jordan once said;

” Take small steps. Don’t let anything trip you up in reaching your goal. All of those small steps are like little pieces of a puzzle. Eventually they come together to form a picture of greatness. But doing things step by step – I cannot see any other way of accomplishing anything.”

So take some time to think of all the little details where you could refine your trading. We all have them, regardless of our level, profitability, or account size. I’m willing to bet that if you look at the numbers, and run the data on your performance, perhaps even adjusting your risk of ruin, if you just changed one little detail, you would be completely amazed at how it would affect your performance.

This can make the difference between being profitable and losing money, between barely breaking even and consistently profiting, or the difference between being good or great. Ask yourself where you are on that spectrum, and where you’d like to be. Then get to work.

Keep in mind, I’ve never met a single profitable trader who cut shortcuts, who tried the easy way out, who wanted something for free, or was willing to steal to get there. Food for thought…but without having the mindset of abundance, how can you expect to be a professional trader who works with bigger and bigger amounts of money?

Tomorrow before the weekend, I’ll write the second part of this article, where I share one piece of data I’ve recently discovered in my personal trading, that would be the difference between my current performance, and a six-figure car…per year…without compounding.

See you then…

Nice, and I like the smiley face : )

Its interesting how some of the greats do things to make those things “their own.”

Hello Gabe,

Yes, many of the greats do things that make them their own, but you also see a pattern amongst them.

Kind Regards,

Chris Capre

Have to admit l’m going to like any article that references the great Jimi H, especially one with such a great photo too! l was at his last concert, he woke me up at about 1am as l slept on Devastation Hill (at the end of Desolation Row!)..he was cursing as he hadn’t liked the first part of his set and he just started over again! (Got a bad entry,scratched and re-entered on a later pullback??!!).It was at the Isle of Wight Festival – 600,000 hippies and not a “Franchise Outlet” for miles and miles…happy days!

Ha – how does one not like Jimi? Amazing on so many levels.

really great article, and very practical, thanks so much,

looking forward to part 2

tony

Hello Anthony,

Glad you liked it – did you find part 2?

Kind Regards,

Chris Capre

thanks chris – god bless you