Ichimoku Price Theory | An Introduction

This is the third installment introducing details to subjects which are not really discussed or talked about when it comes to Ichimoku Trading, that of using Ichimoku Time Theory and Ichimoku Wave Theory. Remember, according to Goichi Hosada (the creator of the Ichimoku Cloud), the Ichimoku trading system is based upon three pillars, and they are;

1) Ichimoku Time Theory

2) Ichimoku Wave Theory

3) Ichimoku Price Theory

This Ichimoku trading system article will be focused on introducing the key principles to Ichimoku Price Theory. For those wanting a review of the other two, you can find those articles by clicking on the links above.

It should be noted to really understand and apply Ichimoku Price Theory, you will need an understanding of the prior two, particularly a good grasp of the Time Theory which is used quite extensively with the Price Theory.

The goal of this article will be to introduce the most basic components of the Price Theory, which may be considered the most complicated of the three. I will discuss the main price calculations, how to formulate them, give examples of each one and some helpful tips when applying the Price Theory to Ichimoku trading.

Introduction To Ichimoku Price Theory

First, it should be noted we do not want to see these price targets as absolutes. They are really guides to give us highly probable approximations as to where the market is likely headed during a particular wave or move. These methods take practice to learn how to use, so take your time with them, but never look at this as an absolute target.

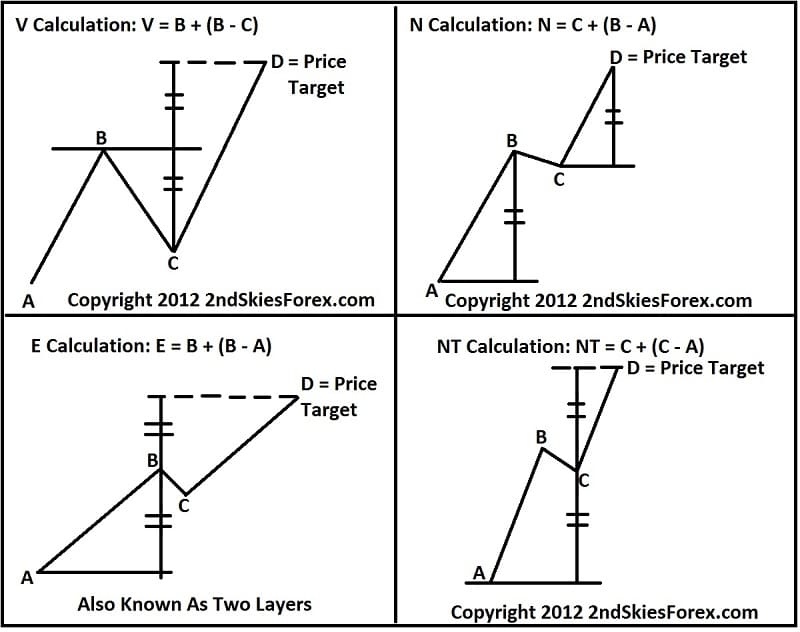

In reality, there are 4 basic price measurement methods according to the theory, however the 4th is generally regarded as a low probability event and takes a considerable amount of skill to spot and use. So for our purposes, we will only use the basic three which are the most common and critical to learn.

The three main price measurements are known as;

1) The V Calculation = B + (B – C)

2) The N Calculation = C + (B – A)

3) The E Calculation = B + (B – A)

The formulas for them are listed above, but I will show you a diagram to better understand them which is below.

Although I listed the NT Calculation, for now just spend time understanding and practicing the first three price measurements.

The V Calculation

Looking at this general structure, we have a bullish move from A – B – C. You will notice the depth of the retracement of C in relationship to the A – B move, which is about a 61.8% retracement. If we were using Ichimoku Wave Theory, this would correlate to an N Wave.

The way to use this as a price measurement method is when price breaks the horizontal line at B for that is only when the V Calculation and pattern would be active. Of course we can make the calculation ahead of time, and that is the point of the price measurement methods (or ichimoku price theory in general). But the calculation actually does not become ‘active’ till the line at B is broken.

Once this does, we can expect an upside price target of D to be achieved (within a handful of pips) based on the V Calculation. An example is below.

V Calculation Using the NZDUSD 4hr Chart

So using this chart and running through the math of the V Calculation, we take .8202 + (.8202 – .8110 = 92), or .8202 + 92 pips = .8294. As you can see, this matches up nicely with a current swing high and natural target for an upside continuation in the Kiwi (should it continue). This is a basic example of how you can use the V Calculation to gauge a potential target for the pair. An ichimoku trader using this calculation along with the swing high would only bolster their confidence in the upside target being hit.

Keep in mind this is a live chart and I have no idea how this will play out, but wanted to show it as an example.

Lets run through examples of the N and E calculations so you can see how they operate.

N Calculation = C + (B – A) Using the Dow Jones Index 4hr Chart

Now using this chart above and the numbers for the N Calculation, C (12698) + (12794 – 12463 = 331), or 12698 + 331 = 13029. So we would have a general target of 13029. Now if you remember, these numbers are not meant to be absolutes, only highly probably approximations of upside or downside targets. Considering the major role reversal level was at 13003, we can consider this to be a good target for D using the N calculation.

E Calculation = B + (B – A) Using GBPJPY 4hr Chart

Using this chart above on the GBPJPY and the E Calculation, B (12897) + (12897 – 12566 = 331), so 12897 + 331 = 132.28. In this case, the market actually only got one pip higher than the D price measurement or target, showing a fine example of how the E calculation and price measurement theory can work.

Some Additional Notes

As I said before, ichimoku price theory should be combined with ichimoku time theory as they work in tandem. But the scope of this is for another article and far too large for an introduction to ichimoku price theory.

Another note in terms of deciding which price measurement to use is based on the price action of the actual moves you want to measure. You will notice all of the calculations have certain levels of impulsivity and correctiveness to the A, B and C moves. On a basic level, what you are doing is gauging the level of the retracement from B – C, along with the correctiveness of the pullback from B-C to determine which calculation you will use. Thus in essence, you need the A, B and C components to really apply any calculation at all. But how you read these moves and waves will determine which calculation you use.

A critical note as well, is when measuring bull or bear runs. The calculations you see in the first diagram are for bullish runs. For bearish runs, you will substitute the + for a – between the first variable and the set. Thus, using the V Calculation, instead of it being V = B + (B-C), it would be V = B – (B – C).

In Summary

This was an introduction into Ichimoku Price Theory which is by far the most complex and intricate of the three pillars of The Ichimoku trading system. The three basic calculations are critical and the foundation of the entire price theory, thus the most important formulas for you to learn. Eventually you will combine price theory with time theory, but for now, just practice the basics here. These price measurements are not to be considered absolute values, and Ichimoku was always meant to be used in combination with price action. In fact, many aspects of ichimoku and the formulas are interpretations and patterns often found within price action, so the two are really intertwined.

For a more in depth study and training on Ichimoku Price, Time, Wave Theory, and Ichimoku Trading, make sure to visit my Advanced Ichimoku Course where we explore these methods in great depth, along with giving rule based systems to trade ichimoku both intraday and a trending/momentum basis.

confusing but am sure the course will explain in dept. nice one Chris

Hello Ricky,

I cover this in the Ichimoku Course and will post a video on it shortly.

This one takes time though so patience on this as its a bit complex.

Kind Regards,

Chris

That’s a great article Chris!

One of the measurements which I noticed by myself I’m using for 3p HLR system to get the best target.

Didn’t know about these theories till now…

Does Ichimoku has more stuff like this related to price action??

Kind Regards

Mantas

Hello Mantas,

Yes, ichimoku price theory, and ichimoku theory in general, has a lot more related to price action which we will unpack

in the course as time goes on. But glad you liked the article.

Kind Regards,

Chris

Hi Mr. Chris,

I just want to ask if these calculation are only for bullish setups? all of its price target are set on longs. What if there is a downward V? ichimoku doesn’t cover that?..

Kind Regards,

Nad

Hello Nad,

If you go back through the article, I talk about the calculation for the bearish setups which is in there.

Kind Regards,

Chris Capre