Ichimoku Wave Theory – An Introduction

Now that I have outlined the major components to Ichimoku Time Theory (ichimoku numbers), I want to talk about the 2nd pillar of Ichimok which is the Wave Theory.

Remember, the main pillars of Ichimoku are not the Tenkan, Kijun, Chikou and Kumo. These are components of Ichimoku to help you read the main aspects of what is going on with the trend, support and resistance, and price action – all within a glance.

But…..these are NOT the pillars of Ichimoku. This led Hosada to state the following when he realized everyone was getting stuck believing the Tenkan, Kijun, Chikou and Kumo were all Ichimoku was about;

“Of the 10,000 or so people who are practicing and trading ichimoku, only about 10 really understand it.”

The 3 main pillars of Ichimoku are;

1) Ichimoku Time Theory

2) Ichimoku Wave Theory

3) Ichimoku Price Theory

I have discussed Ichimoku time theory which is the basis for all the other pillars and all of the ichimoku components you use when you look at any ichimoku chart. Now I would like to get into the 2nd pillar which is Ichimoku Wave Theory. I will get into the basic components or waves only as there are several types of waves (basic, mid-term, etc.) so to give an introduction without confusing anyone, I will write about the basic waves in today’s article.

3 Basic Waves

There are 3 basic waves which are the most important ones to learn because they are the basis of the ichimoku wave theory and will always be a part of your wave counts. They are;

1) I Wave

2) V Wave

3) N Wave

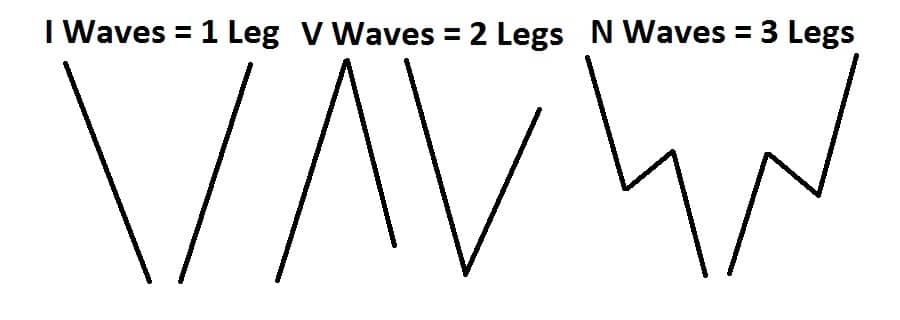

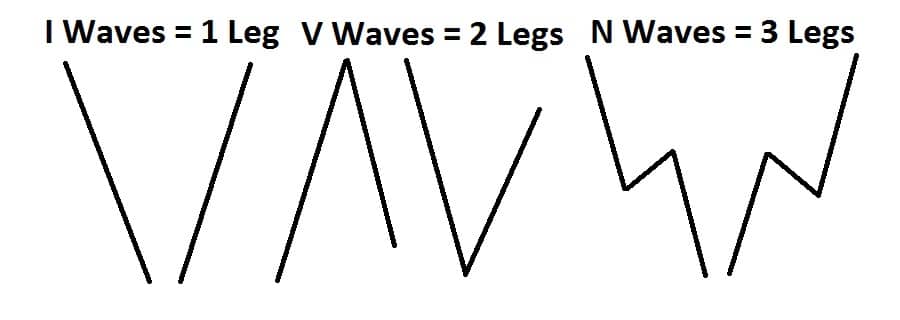

Ironically, an I Wave is 1 leg, a V Wave is 2 legs and a N Wave is 3 legs. Just like all the basic ichimoku numbers are building blocks for all the other numbers, it is the same with the waves. But let me show you a picture below to help give you a needed visual.

Looking at the image above, you can see how the one, two and three legs form the individual waves. I, V and N waves can all be up or down so that does not matter. Generally, I waves are impulsive price action moves, but they can be corrective. V waves are usually one impulsive and one corrective move, but can be two impulsive moves back to back. Whereas an N wave is usually an impulsive leg, followed by a corrective leg, and then another impulsive leg in the same direction as the original leg.

Being the most complex of the three, the N wave can have variations of this, but the first leg of the N wave should be impulsive with the other two having variations between them. Generally, most N waves will end with a higher high for an up wave, and a lower low on a down wave.

So the wave should end up lower or higher than where it started. If this is not the case, then it usually means a breakdown of the wave structure, but lets look at a few examples.

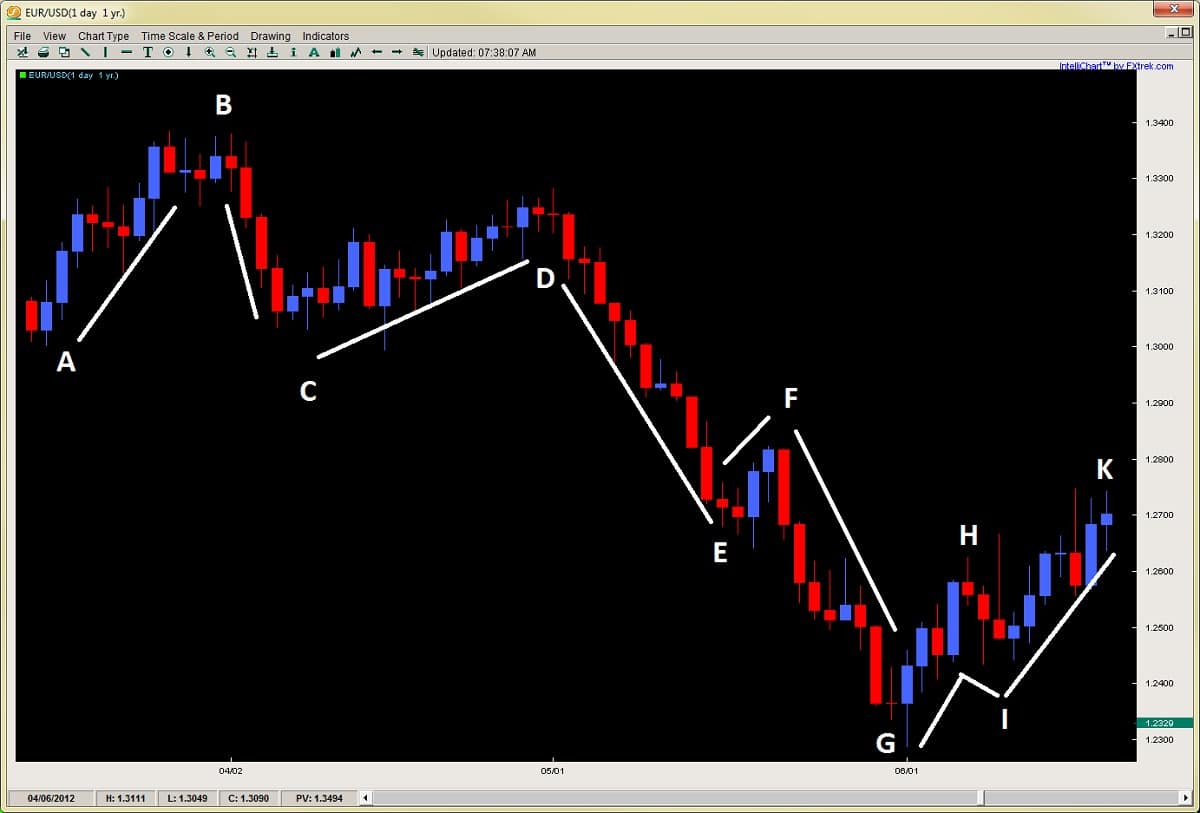

Using the chart above, I have labeled several lines, all of which individually are I Waves. As I said before, they all are components of each other, so a V Wave is really two I Waves put together, while an N Wave is either three I Waves, or one V Wave and one I Wave. But lets break this down in the chart above.

Starting at the top left of the chart, the first movement from A-B is an I Wave. Now by that token, the move from A-B-C is a downward V Wave. A-B-C-D would be therefore an N Wave, but also composed of two V waves (one up and one down). As a general rule, it’s better to look at the wave structure from a macro perspective then a micro one, so breaking say four N Waves up into 16 I waves is unnecessary. Look for the larger macro structure (gestalt) of the wave structure and you got the trick.

Now, as I stated, even though A-B-C-D is an N Wave, it doesn’t end with D being higher than B. When this happens, it generally means a range bound market at a minimum or a breakdown into a downward N wave, but rarely ever do these end up with higher prices above B, especially if C is breached.

Since this did happen, we actually have an downward N Wave starting at B-C-D-E. We can also count a downward N Wave from D-E-F-G. This brings me to the point that N Waves generally continue in their original direction until the ideal structure of the waves gets broken or disrupted. It also means N Waves can continue and parts or legs (ends) of them can start new N Waves in the same direction.

So if we were counting a new N Wave from F-G-H-I, since the wave structure is being disrupted, we would expect a likely reversal, and this is supported by the upward N Wave starting at G-H-I-K. This may seem like a lot, but this should give you some starting ideas of how to use these basic waves when reading an ichimoku cloud chart and will get easier with practice.

Usage in Trading

There are many ichimoku trading strategies we can use with these basic waves in trading, and if you were paying attention, I already gave away one idea. One example is how the wave structure generally performs (particularly N Waves). If the structure breaks down from its ideal formation, then watch for trend change – minimally a consolidation, but definitely not a trend continuation.

Another way this can be useful is if the number count (using ichimoku numbers) in a particular move is getting long, such as a two section, one period or a combined-6 move. These common turning points, combined with wave structure changes often bring a confluence of signals together which can mark major turning points in a move.

For example, in the chart above, the move from D-G is actually 1 day short of a one period move (a common turning point).

Additionally, you can combine forex price action strategies with these moves, especially reversal setups, so when you see (for example) pin bar setup happening at a major resistance, along with an N Wave structural change, this can increase the probability of a reversal.

Other ways to do this is if the V Wave is not a traditional impulsive move followed by a corrective move. For example, if it is an impulsive move followed by another one counter-direction, this could also be suggesting trend change or a range bound market, depending upon how it started the V Wave.

As you can see, there are many ways, too many to discuss here, but hopefully this gives you something to work with.

In Summary

Although there are other waves that we have not discussed, this is a good introduction and start to understanding Ichimoku Wave Theory and gives you the foundational theory to start practicing with the basic waves. But it is important to understand this is one of the key pillars underlying all of Ichimoku Kinko Hyo theory, so understanding the basic waves is a gate towards understanding ichimoku trading strategy as a whole.

Best is to practice forex wave theory by itself so you learn it as an individual component. Then after building some experience, combining it with ichimoku time theory. But hopefully for now, this gives you a nice introduction to Ichimoku Wave Theory as there is very little information about it available, nor discussed openly.

For those wanting to learn how to trade the Ichimoku Cloud, time, wave and price theory, along with lifetime access to the Ichimoku traders forum, discussing ichimoku setups using rule-based systems, make sure to visit my Advanced Ichimoku Course.

Thank you Chris, for opening our eyes and shedding some light on such a deep, intriguing and unexplored topic here in the West. Having studied the Ichimoku strategies within your course, these theories can seem very confusing at first glance.

The question I have for you, as “green” of me as it may seem, is simply this:

Will the onset of all these “new” theories render the rules that we have learned to date within the Advanced Ichimoku Course obsolete?

Thank you for all your professional expertise!

Sincere Regards,

GF-

Hello Gary,

Glad you are enjoying this material.

Of course they will not render the strategies obsolete. They are meant to enhance them and help you amplify the strength of the setup.

The systems have been performing because they work so obviously nothing would make them obsolete, but feel free to start using them

to amplify your understanding and trading of ichimoku.

BTW – feel free to share this article to others via facebook or posting in any of your favorite forums as this material is generally not talked about.

Kind Regards,

Chris

Hi chris,

Great article as usual. Is there an ichimoku book you recomend that talks about all these theories and some usdful strategies?

Thanx

Bader

Hello Bader,

Unless you can read japanese, unfortunately – no, there isn’t any book talking about ichimoku time, wave and price theory.

This is why I’m bringing this information out as I have the original text along with the other main ones all written in Japanese.

I go into further detail in my Advanced Ichimoku Course, so hopefully this gives you an idea for now.

Kind Regards,

Chris

Hello, Chris, I am a fresh new student of the Ichimoku Course. I would very much like to become one of the 10 (of 10.000). Can you hep me?

Thank you for the articles, too. Pavel

Hello Pavel,

Yes, that is the goal of the course and all the new lessons I am posting. I’ll be doing a new video soon on Ichimoku Price Theory which will help to build your knowledge on this.

But good to be working with you on the course.

Kind Regards,

Chris

Perfect, thank you, I am very much looking forward to it! Have a nice weekend! Pavel

hi chris

thanks , very useful

do you have any information about kihon suchi (japanes pattern) ?

if yes , would you please share some info about it

thanks