Is The Stock Market Going To Crash From the Coronavirus?

Less than two weeks ago, a course member asked me the following question (click to enlarge):

Here was my response:

“You have to be prepared for bigger pullbacks & volatility than usual. You have to keep staying short till you see a broad base of instruments bottoming and showing a transition in the price action and order flow” – from my members coaching session Feb 14th.

This week, we got a taste of this volatility, and there is a decent chance the selling + volatility may just be starting. Hundreds of my clients and friends have been asking me, “Is the stock market about to crash?”

In this trading article, I’m going to discuss the coronavirus, the increase in volatility, what’s happening the financial markets, is the stock market going to crash and how I’m trading it.

So grab the popcorn and a good beer as we’re going to get into the thick and thin of it.

Coronavirus + Volatility = Panic!

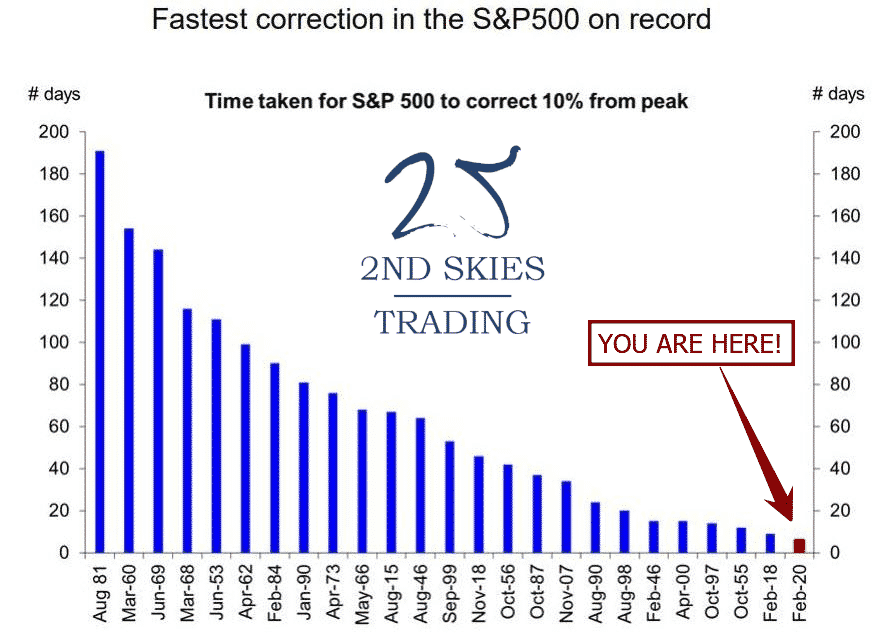

Let’s get into some stats around this week’s incredible sell off in the global markets. This week’s drop in the S&P 500 was the fastest 10%+ drop IN HISTORY!

Exhibit A: The Fastest Correction (10%) in History (S&P 500)

In the last 7 trading days starting with February 20 – 28 (from open to close) lost 440 points shedding 12.9% while global markets puked $5 trillion in market cap.

Translation: In the last 7 days, we lost the GDP of the UK & India combined! (source: investopedia)

Also of note, the fastest and second fastest 10% declines (from peak) have happened within this decade.

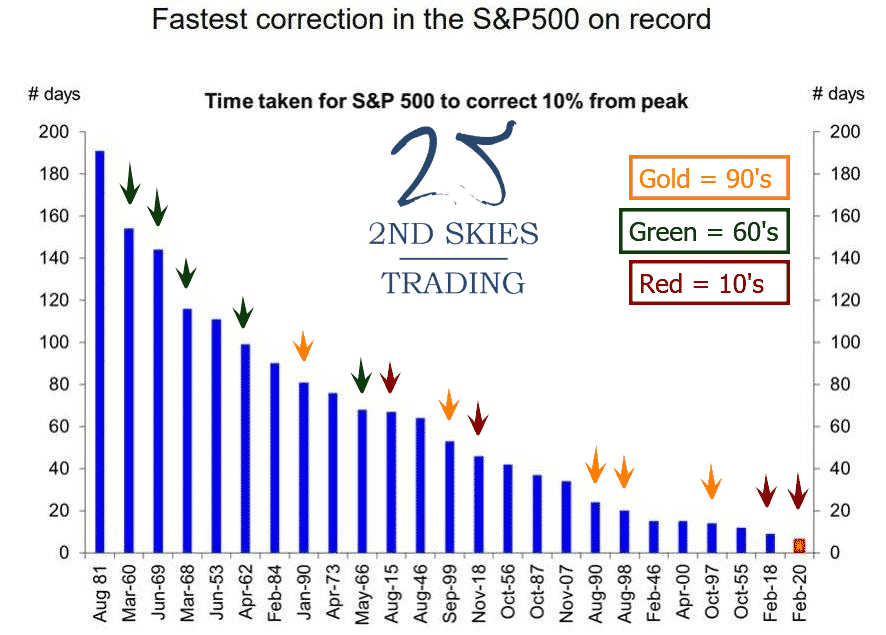

Of all the decades going back to the 40’s, the 60’s and 90’s had 5 of the fastest 10% corrections in history. This decade is in 2nd place with 4 of them (see below)

Also of note is 3 of the last 5 of these fast 10% corrections have happened in the last two decades and 7 out of 10 in the last 30 years.

Translation: these corrections are happening faster in more recent history than before.

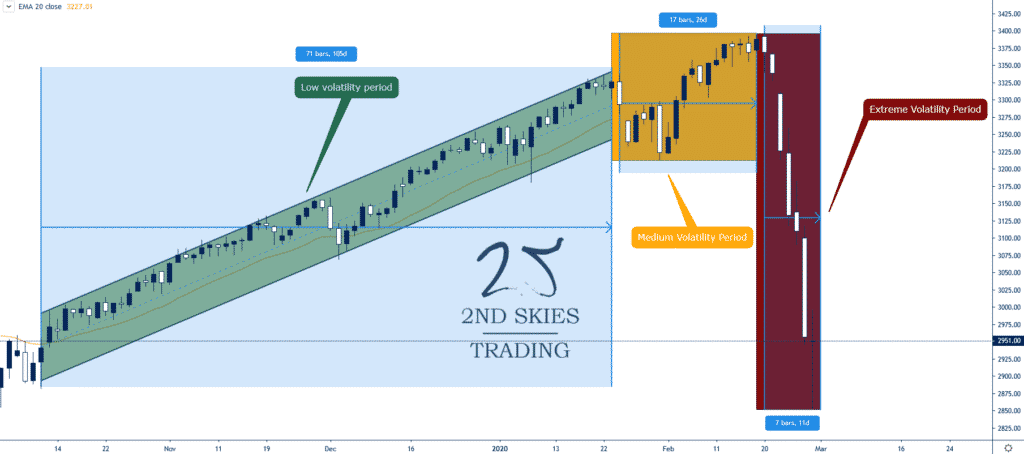

What is also important to note is how low volatility was in the S&P 500 until the corona virus started to become prevalent in the markets (see below).

We had 71 days of super low volatility and many 5 day stretches where the markets never dropped more than .5% (green box)

Then we had a period of 17 days with mildly increasing volatility when the coronavirus was becoming more of an issue.

This culminated in a 7 day explosion of volatility last week erasing months of gains in a flash.

This is one of the most important trading lessons I’ve learned over 20 years. That markets can and often do sell off faster than the run ups.

The reason why this can happen has to do with market psychology and behavioral finance.

In a long bull trend, the general emotions are complacency, confidence and greed. This has to do with simple biology.

We are wired as humans to react more rapidly to stimuli which threaten our existence. Slow non-volatile bull markets don’t threaten us, so we don’t often react with alacrity at a small sell off.

The emotions behind a bear market or extreme selloff is fear, worry and panic. Hence a sharp selloff and quick loss in our portfolio is threatening, thus leading to fast reactions (SELL & SELL EVERYTHING!).

This is why markets can sell off far more quickly then on the way up.

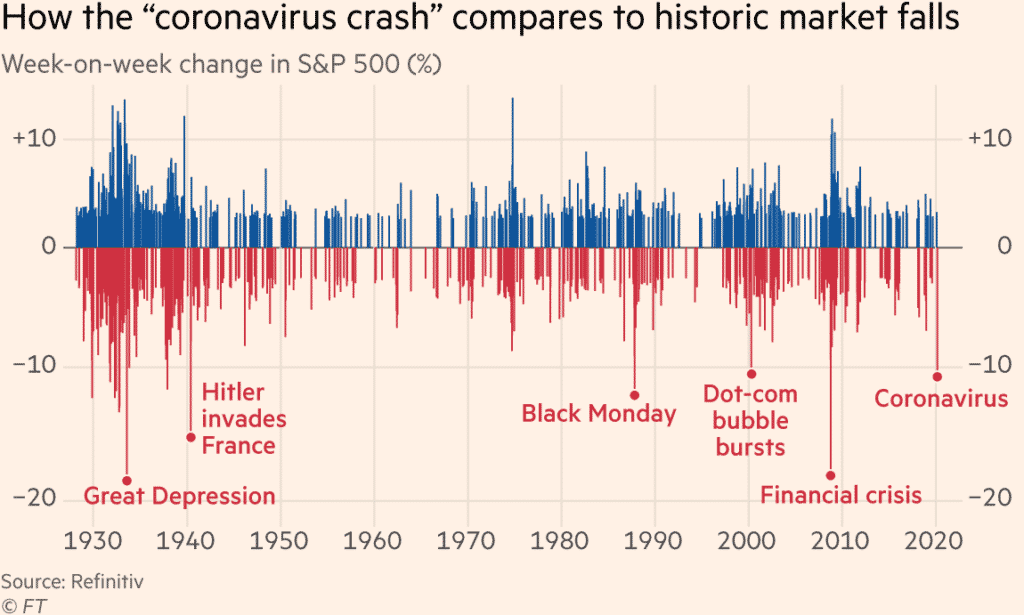

There is a reason why the fastest week-on-week changes in the S&P 500 (%) are during crashes vs bull runs (see below).

The big moves to the downside (week-on-week %) are simply larger and more frequent.

This also means big week-on-week changes create a feedback loop for panic selling to continue.

What this means for investors and traders is we make quicker trading decisions during bear vs bull markets.

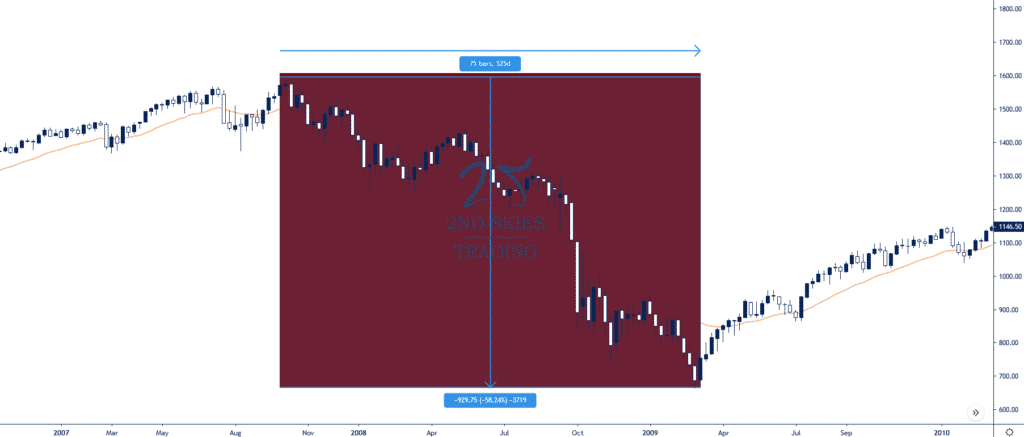

Now in comparison to the 2008 financial crisis, the S&P 500 lost 58% from Oct 07’ – Mar of 09’ over a period of 525 days peak to trough (image below).

We’ve already lost 12.9% (about one-fifth of the 08’ drop) in just 7 days!!!

And if we happen to get another 58% decline, we’ll be looking at an S&P 500 around 1400 by the time this is over.

Translation: this selloff has the potential to be one of the most rapid declines in history. And the speed at which we’ve lost so much so fast last week could create more selling from investors globally.

Going from a low volatility environment to a high one this quickly will create stronger biological reactions, hence the formula Coronavirus + Volatility = Panic!

Is The Stock Market Going to Crash?

Short answer: I don’t know. I don’t think we’re there yet.

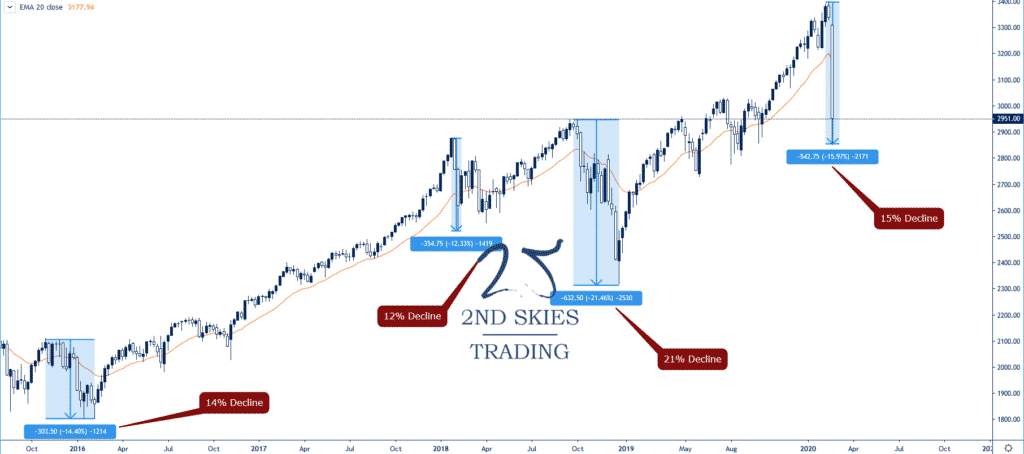

We’ve had many 12+% declines in recent history (4 total) since 2016 with a 12.33% decline (Jan 18’) being the smallest and a 21.46% decline the largest (Nov 18’).

I think once we start seeing a 25% drop or larger, investors along with major institutions (Fed, Trump Admin) will start to really panic.

Combine this with the fact we’re in an election year and the last thing Trump wants is a stock market collapse.

In some sense, it’s even a bigger issue for Trump as he campaigned on his business skills, and has proudly taken credit many times about this being the “Greatest Economy Ever” pretty much anytime we’ve posted all time highs over the last few years.

Should we get a strong selloff next week and start reaching the -20% levels, expect a govt stimulus to come which (depending upon how its setup) could create a short term strong bounce.

But here’s the kicker…

Let’s say the coronavirus continues to spread from country to country with more and more population centers becoming infected.

Is a Fed rate cut going to inspire you to travel? No.

Will a Fed rate cut give you the confidence to go out in public and risk getting infected with a potentially deadly disease? No.

And this is how this threat to the markets is different than the 2008 great financial crisis.

The 08’ crisis was an economic one (over-leveraged exposure to housing) which was able to spread globally.

The coronavirus isn’t an economic issue, it’s a biological and containment issue.

Economic policies will be more effective (like in 08’) simply because it was more of a 1-1 relationship (economic problem & an economic solution).

However, economic stimulus isn’t going to change a biological health scare because the relationship isn’t a 1-1 match.

My sense tells me economic stimulus packages will be far less effective vs the actual biological and crisis management of the issue.

That is where IMO traders and investors globally should be looking for signs of a turnaround should this selloff get worse.

We haven’t gotten to the ‘Oh-Sh!t’ levels yet. Once we start to get into a 20-25% decline, then I think you’ll start to see real panic in the markets.

How to Trade & Protect Your Long Term Investments During This Time?

I wouldn’t think of buying anything till at least we see the market open this week.

How the Asian markets open will likely give a strong tell as to how the week will go.

Hence before you go rushing into what you think might be ‘cheap’ prices compared to recent history, wait to see how the market opens.

We’ve only had a few instances of the markets selling off for 3 weeks in a row since Dec 15’ (5 total) and none of them shed this much value.

For now, there are various ways you can protect your long term long term plays if you think there is more downside:

Trading Options

1) collect premium by selling calls on stocks you are holding long term

2) bear put spreads

3) buy outright puts on your long stock positions

Trading Forex

The currencies which have most benefited from this 7 day decline are JPY, CHF, EUR & USD while EM currencies suffered heavily (MXN, RUB, ZAR).

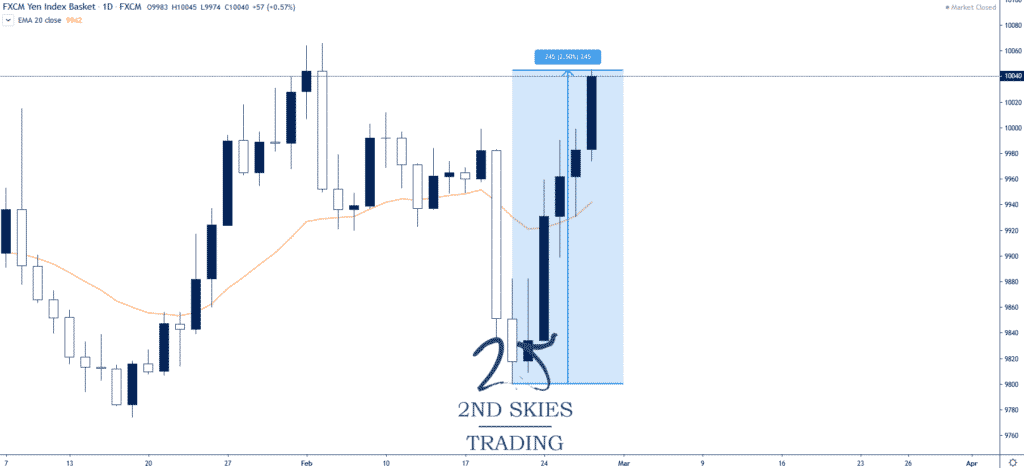

The JPY basket (JPY vs USD, EUR, GBP, CAD & AUD) gained 2.5% last week (image below).

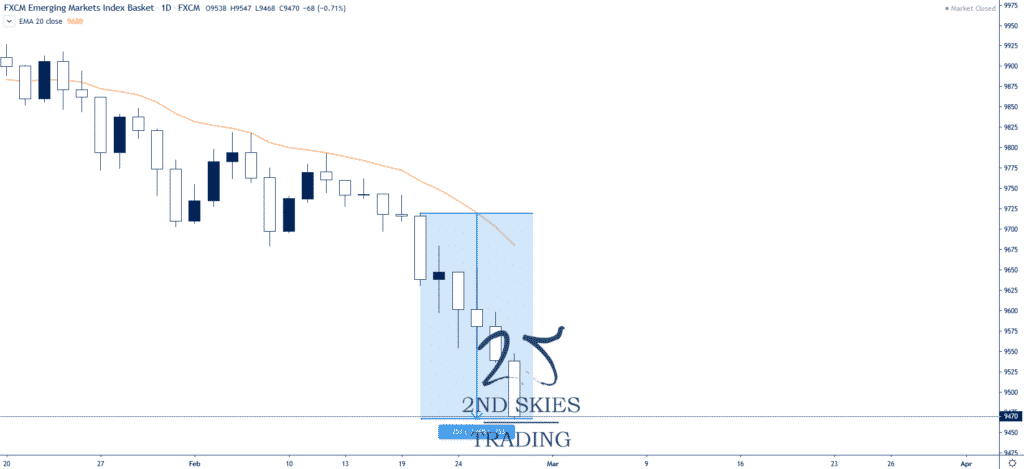

Meanwhile the EM basket (USD vs CNH, MXN, ZAR & TRY) lost 2.6% over the same period (image below).

The EM currencies which suffered the most losses last week were MXN vs EUR (-9%), RUB vs EUR (-8.8%), RUB vs JPY (-9.5%), MXN vs JPY (-9.6%), CHF vs MXN (9.5%), & the CHF vs RUB (8.8%).

If the virus continues to spread, expect further capital to move into these safe haven currencies vs EM betas.

It’s important to note many of these currencies ran into some key support & resistance levels, rebounding a bit to end the week.

Forex currencies tend to overshoot key levels during major crisis, so if we see them blow past many of the current key support & resistance levels, we could be reaching all time highs or lows (EURZAR, USDRUB, USDMXN) on the quick.

I’ve been trading many of these pairs on the 5 minute charts trading intraday breakout setups with two positions.

I’d suggest using the first position to hit a medium term target while letting the second one run and capture as much alpha as possible till momentum changes manifest in the short term price action.

But this is only recommended if you are doing day trading.

Trading Stocks

If you feel an uncontrollable urge to buy stocks, I suggest the following plays:

Watch the market leaders who exhibited strength heading into the selloff and performed well on Friday. If they continue to exhibit strength, there may be a potential buy, but watch the price action:

1) Microsoft (MSFT) which gained 7.7% on Friday

2) Facebook (FB) which climbed 6% on Friday

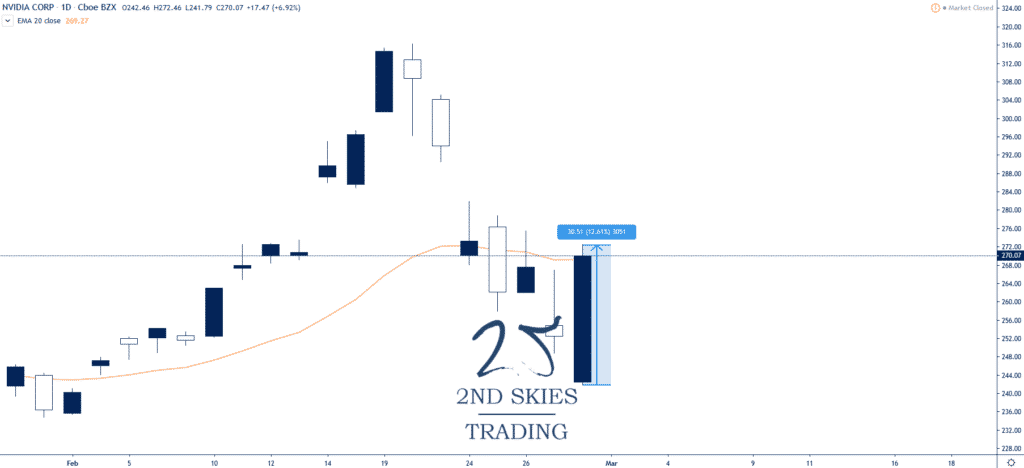

3) Nvidia (NVDA) grabbing a 12.6% gain to end last week

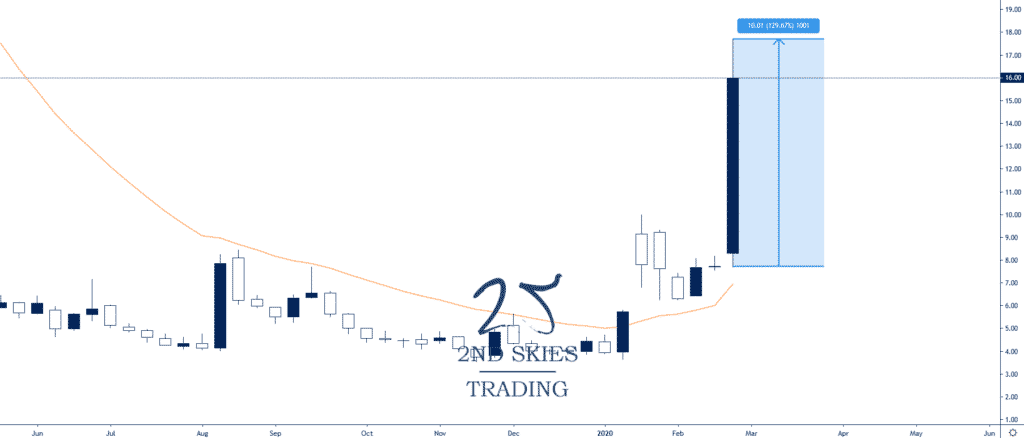

4) If you don’t mind trading nano, micro and small caps, take a look at pharma stocks which have done well recently: NVAX +129% low to high last week, MRNA +96%, and for the truly brave micro cap trader CODX +591% last week low to high (big cajones required 😉)

Novavax (NVAX) chart below:

1) Sell Airlines (who wants to fly to another country when there’s an outbreak?) – source: bloomberg

NOTE: A more targeted method would be going after airlines in countries where travel bans or warnings are issued.

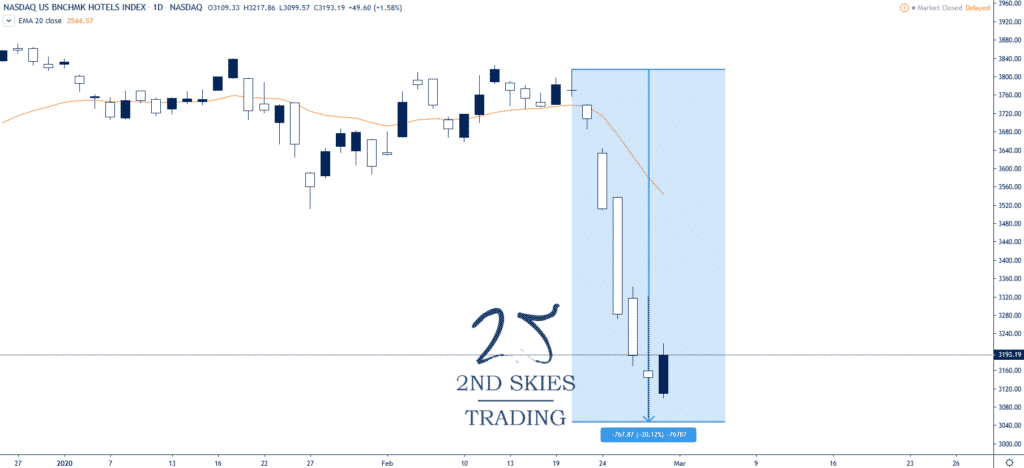

2) Sell Hotels/Entertainment which is down 20% on the week (same reasons as above)

There’s been a lot of profit taking in commodities, so I’d wait for a change in the short term price action context before getting long (gold and silver in particular).

Wrapping It All Up

Now is not the time to be listening to CNBC analysts, most of whom are not trading. Last week many were all calling stocks ‘cheap’ and in the process getting their a$$’s handed to them.

This is a time to be alert and nimble, using good risk management as the volatility moves on these instruments can wipe out weeks or months of gains if you’re not careful.

Hence trade smaller positions than your usual risk % per trade. Try more ‘proof of concept‘ trades where you put small feeler trades out, and if it progresses, then add on size.

I don’t think the stock market is at its ‘OH SH!T‘ moment yet, but we could get there fast.

I’ve traded now for 20 years and went through 2 major financial crisis (2001 dot.com bust & the 2008 great financial crisis).

The first one I didn’t know what I was doing and performed poorly.

The second one I learned my lesson and killed it.

Traders can make a lot of money if you’re smart and agile, defensive when you need to be and aggressive with precision.

But you’ll need mental toughness to manage your emotions and mindset during these periods.

Do that and you can make a killing. You may not see another time like this for years as its been over 12 since the GFC of 08′.

Hence, avail yourself of the opportunity, be patient, allow for more space in your stop losses due to the increased volatility, and trade with the most impulsive moves till you see changes in the price action and order flow across a broad base of instruments.

******

This was a monster article that took hours upon hours to write and publish. Please make sure to pay it forward by sharing it with others on social media and leaving your feedback below.

Until then, good luck trading and I’ll see you out there in the field.