Live Price Action Trade Setups | Oct 15th

This week I want to share a few price action trade setups from one of my students, along with some of my personal live trades. Although I had several trades that were highly profitable, my student actually had some really impressive trades, so he’ll get the top nod for the week.

Here they are below, including one I just completed less than a few hours ago.

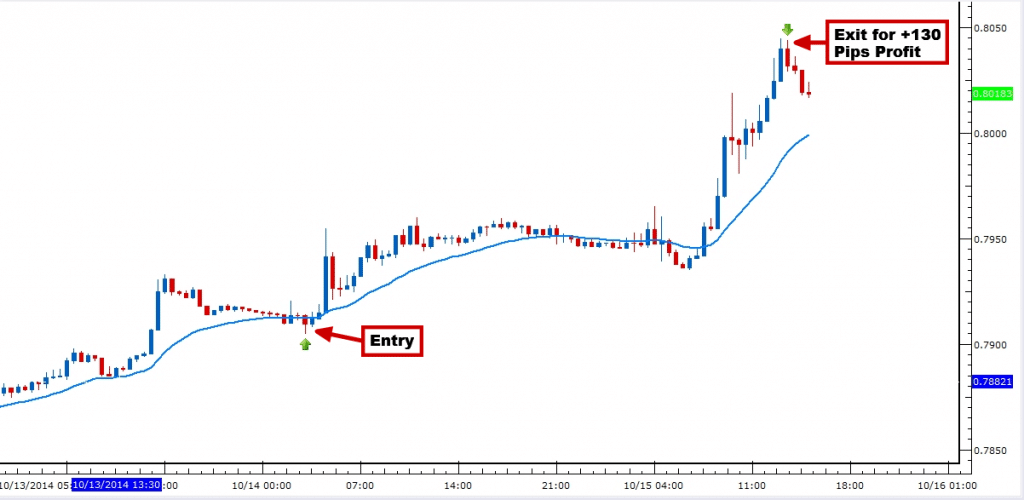

Live Trade Setup #1: EURGBP +130 Pips

This is one of my personal live price action trades on the EURGBP. On October 13th, in the private member trade setups commentary, I told the members that I was flipping from short to long on the EURGBP, and suggested looking for a pullback between 7908 and 7890.

The pair pulled back to 7908, and as you can see from the chart above, this was an excellent trade location as the trade literally never went negative.

My entry was based on corrective pullback anticipating the trend would continue (not a price action signal or pattern), with me entering mid candle as price hit my limit order.

Literally just a couple hours ago, I took profit, and this seems like the prudent move as the pair has since sold off from the highs.

Total profit was +130 pips with a 28 pip stop, for a +4.65R profit in less than 1.5 days.

Live Trade Setup #2: Dax Trade Profits +3.5R

This trade comes from a student, who probably like you, has been struggling with their trading. Right away, he got to work, training hard with our course strategies and lessons.

The result is his performance now taking a seriously good turn as of late.

In this trade above, you can see his trade entry, stop loss and take profit. He was viewing the corrective pullback + double top as a great opportunity to trade with the trend.

He targeted the bottom of the range, which was a prudent move as the index bounced heavily, grabbing +3.5R in less than 2 hours.

NOTE: We’ll discuss his other highly profitable trade shortly, which he made just a few hours earlier.

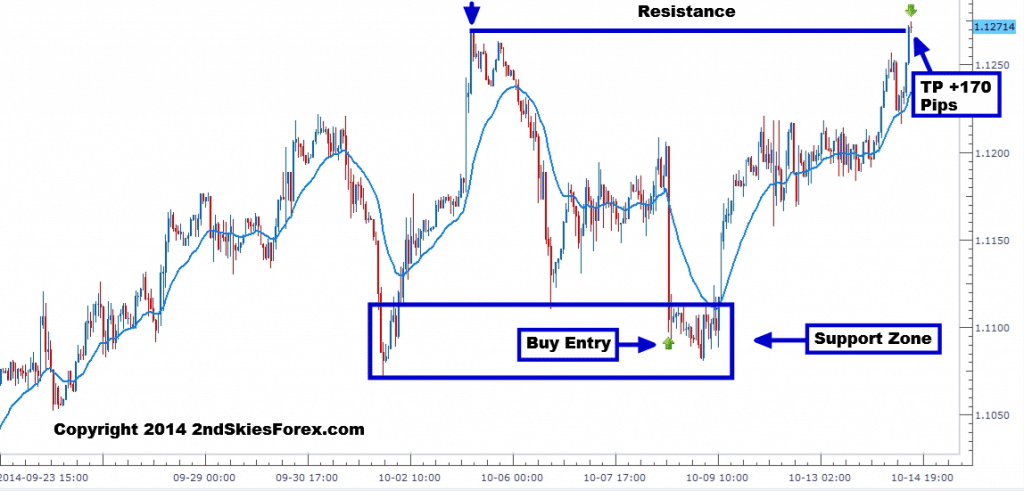

Live Trade Setup #3: $CAD +170 Pips & +3.77R

On October 7th in our daily member trade setups commentary, we suggested looking to buy the USDCAD between 1.1120 and 1.1070 to get long and trade with the trend.

Looking at the chart above, we traded this play, buying at 1.1100 with a stop at 1.1051 and a targeting the prior resistance at 1.1270 for +170 pips and +3.77R.

Had you been looking for a price action setup, you would have missed this trade completely. Food for thought.

Live Trade Setup #4: 2nd Dax Trade for +8R!

Remember that student who had the +3.5R trade on the Dax we showed earlier? Well this is the trade that came just hours before.

Trading off the 5 minute intra-day chart, this student spotted a good with trend trade following a corrective pullback.

Selling just below 8957, he literally called the top of the day (within a few points), grabbing +140 points on a 17 point stop for an amazing +8R in 2 hours!

Hence between those two trades, he put +11.5R of profits in his account within 4.5 hours, all using the 5 minute chart.

In Closing

As you can see, we don’t just give vague trade recommendations about what the market ‘might do from here‘, or occasional trade ideas 3-4x per month. We actively trade the markets, sharing many of our live price action setups (and give more in-depth commentary to our private members).

Also by now, you should clearly see the power of learning to trade price action beyond your ordinary price action signals (which would have missed all these trades).

If you’d like to learn more about becoming a member and making profitable trades just like the above, click here.