Calls & Puts: The Most Basic Options

All option strategies are built using calls and puts. Once you fully understand how calls and puts work, you have the foundation to explore all options, strategies and setups going forward, whether they are more complex or not.

All options are calls and puts or variations and combinations of calls and puts, so your ability to get this down is super important, and it will allow you to start making your first option trades.

In this article, we’re going to simplify calls and puts, show you how they work, how you can trade them and why you’d want to trade call and put options.

Call Options

So starting off with calls, a call option can be simply defined as an option that gives the option holder the right, but not the obligation, to buy shares of a stock at an agreed upon price on or before a specific date.

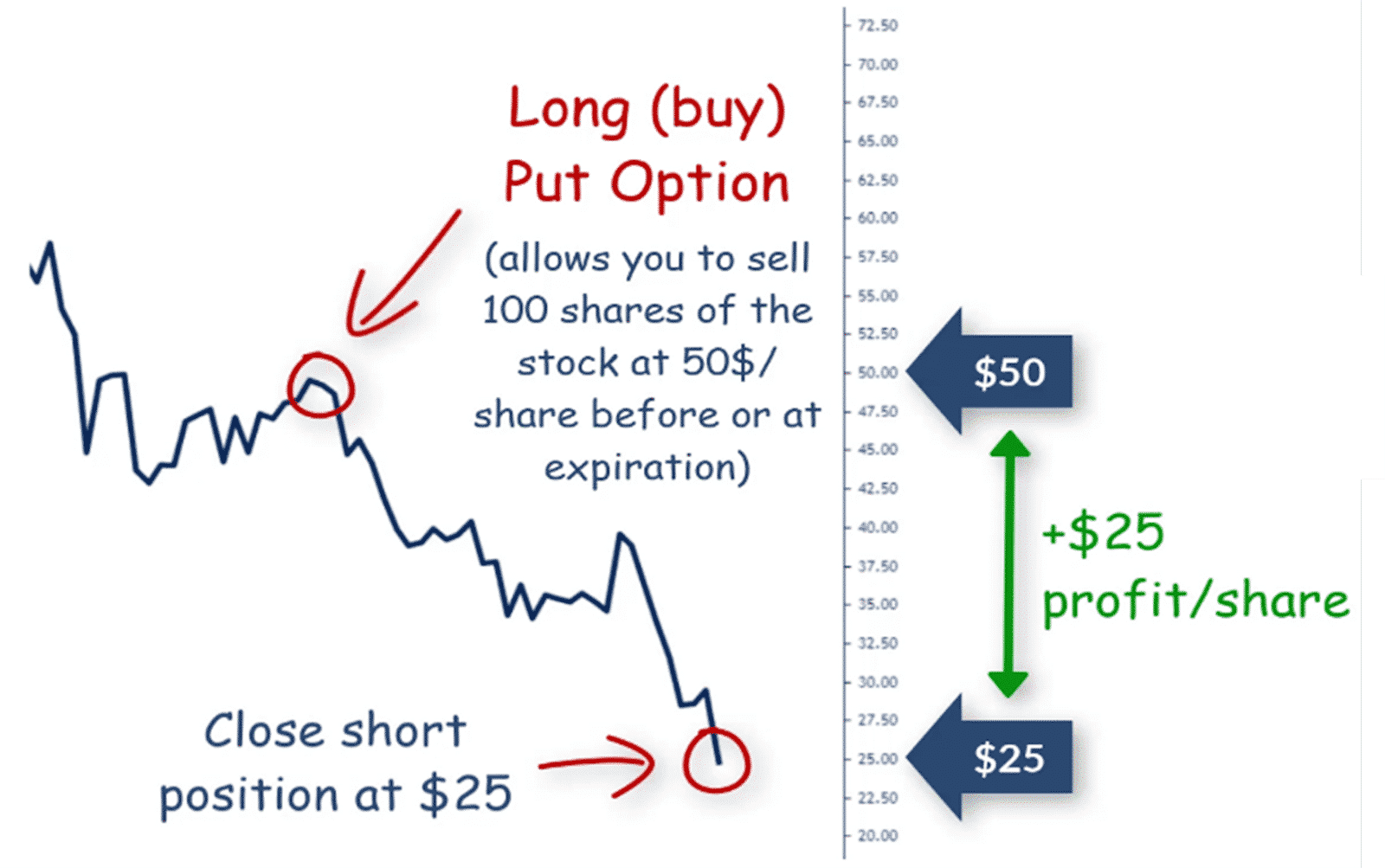

A put is simply the opposite of a call. It gives the option holder the right, but not the obligation, to sell shares of a stock at an agreed upon price on or before a specific date.

Now, I’ve talked about on or before a specific date and I’ve talked about an agreed upon price. What are those? The strike price is the agreed upon price the stock can be bought or sold at. Also, all option contracts have an expiration date.

Unlike buying stock in and of itself, if you want to buy 100 shares of Apple, there’s no expiration date on that. As long as it doesn’t hit your stop loss or take profit, you can hold that position indefinitely. There’s no time that that trade will expire.

However, all options have an expiration date and that’s the specific date that option contracts expire. So these four definitions for calls, puts, strike and expiration date, those are the bare bones that are in every single option contract.

Let’s go through a very simple example of a call and a put.

Let’s say you are going to buy a call on a stock at $50 with what we call 30 DTA or 30 days to expiration. Owning this call option allows you to purchase a stock at $50 per share, which is the strike price, between today and the next 30 days, which is the expiration.

So if the stock goes from $50 to $75, your call option allows you to buy the stock at $50 regardless of the fact that it’s trading at $75 today. That means that you can exercise this call option on the stock, purchase the stock at $50 per share and thus profit $25 per share and you can do this with a lot less margin than buying the stock outright.

I’ll explain that in terms of margin and leverage and option shortly, but let’s go over a put option to kind of give you the same example. So we’re going to buy a put option on the same stock at the same strike price of $50 with 30 days to expiration.

Owning this put option allows you to sell the stock at the stock price of $50 per share between the time you buy the option and the expiration date or 30 days from now, regardless of where the stock is at.

So if the stock crashes from 50 to $25, then your put option allows you to sell the stock at $50 per share, which is your strike price, even though the stock is at $25 right now, which means you can profit $25 per share.

Now, the question must be coming into your mind, why would you buy a call or a put option versus trading the stock directly? This is a very good question, there are several reasons to buy calls and puts instead of trading the underlying directly, i.e. the stock.

For example, if you buy a stock at $50 per share and you buy 100 shares, you’re going to have to put up $5,000 in margin if you have a cash account. If you have a margin account, you’ll have to put up $2,500. And if you have a day trading account, which is any account above $25,000, then you can put up $1,250 a margin.

Now, owning this stock at $50 means the stock could technically go to zero, so technically you have $5,000 of risk if the stock goes to zero. This is where a put option comes in. Remember, if you buy a put option on the same stock with a $50 strike price, if the stock price goes down, the put option gains in value while your stock trade loses value.

Think of it like buying insurance on your stock position. The put option will protect your stock trade, even though your stock trade itself is losing value, your put option is gaining value. So it’s like getting insurance or hedging the risk on your long stock position.

Now, what about a call option? Well, you can just flip that scenario. Let’s say you want to sell a stock that you think is going down in price and it’s also currently priced at $50. If you sell 100 shares of that stock at $50, technically the stock can go to infinity, so your risk is unlimited on this short stock trade.

But if you buy a call option, you are hedging your short stock trade because your call option gains in value as the stock goes up. So again, you are buying insurance on this short stock trade. Hence, one of the main reasons to buy and sell options is to protect, hedge or buy insurance on your long or short stock positions.

Another reason to buy calls and puts is leverage. Options have more leverage than buying and selling stocks outright. For example, going back to our long stock trade at $50. If you go long the stock at $50 by buying 100 shares, you have to put up $5,000 in the cash account, $2,500 if you have a margin account and $1,250 if you have a day trading account.

However, with options, you can control 100 shares of the stock for much less. So let’s say a call option on this same stock at $50 with 30 days to expiration costs $2.50. Now, if you remember from earlier, each option contract represents or controls 100 shares of that stock.

So if you buy one option contract for $2.50, times 100 shares equals $250. So you can own a call option contract on the same stock for $250 versus having to put down $5,000 or $2,500 or $1,250 in margin.

That means you get a lot more leverage trading options and therefore you can use that capital to make other trades as well. This is another advantage to buying calls and puts.

Now, let’s talk with you through a couple examples of call and put options and how that works.

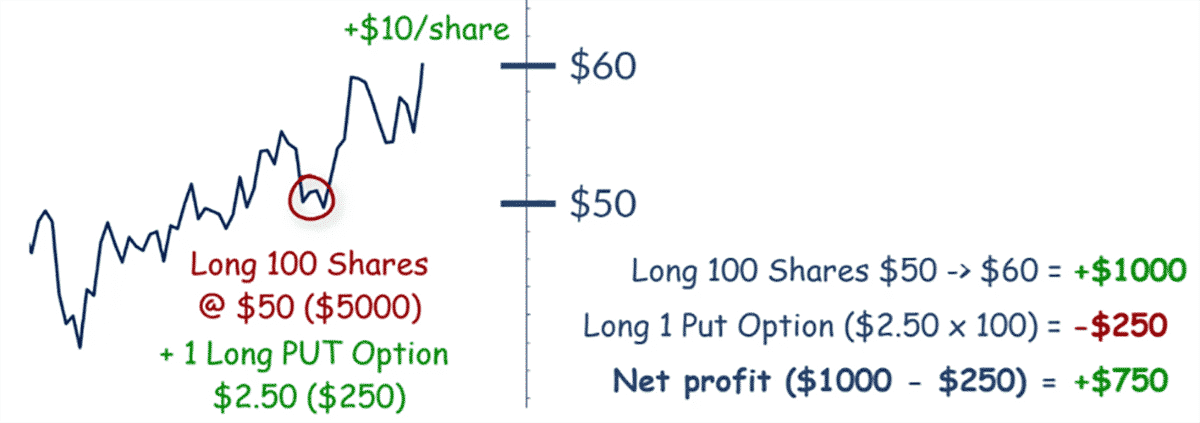

Let’s say you own 100 shares of a stock at $50 and you have a downside risk on that stock if it falls.

You decide to buy a put option on that stock for the same $50 strike price at $2.50 or $250 in margin to protect your long position.

If the stock climbs from $50 to $60, you gain $10 per share on your long stock position. This gives you $1,000 profit, which is $10 per share x 100 shares equals $1,000.

But you also bought insurance on this stock trade. You bought a put option, which costs you $250, so your net profit is $750 to protect your long stock position.

This is one example of how you can use options to protect or hedge your stock trades.

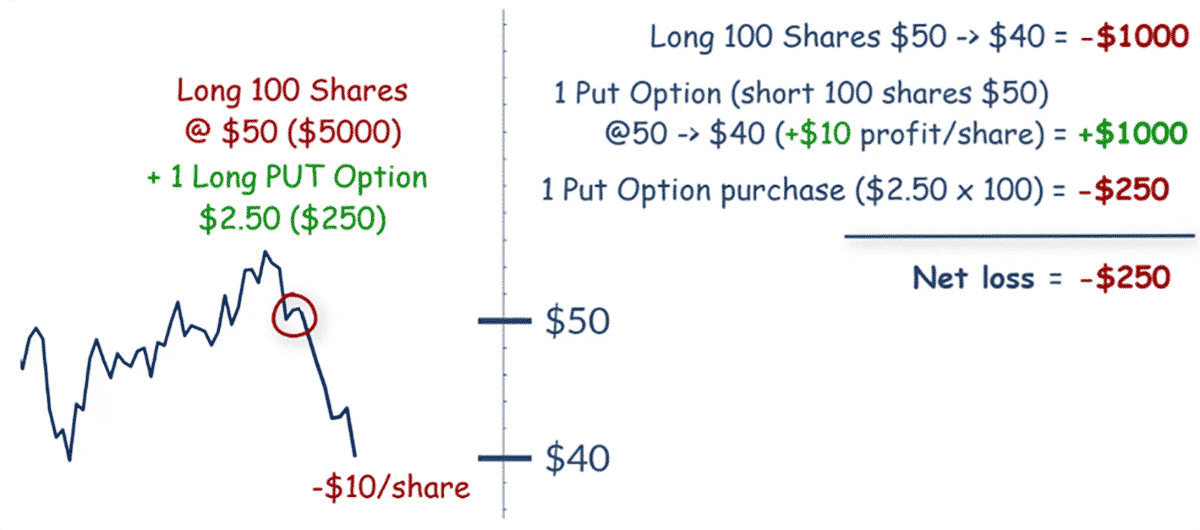

Now, let’s look at that same example with your stock price falling.

So you bought 100 shares of XYZ stock at $50 and you also bought the $50 put option with 30 days to expiration at $2.50, which is $250 of your capital.

Let’s say the stock falls from $50 to $40 per share.

On your long stock trade, you’re losing $10 per share x 100 shares, that’s $1,000 loss. However, you have a long put option that gains in value if the stock falls and that put option allows you to short the stock at $50.

Thus, you can exercise that put or your put option insurance and get $10 per share on that put option, so you lose $1,000 on your short stock trade, but you gain $1,000 on your long put option, which is a net zero loss.

You did pay $250 for this put option and insurance, so instead of losing $1,000 on this trade, you only lose $250, which is much better than taking the full $1,000 loss.

For every single loss you had on all your trades this year, instead of losing the full amount, the full loss that you took, what if you took anywhere between 25 and 75% less than your full losing position? How much would that help your account?

This is one of the benefits of trading options. It gives you a natural way to protect your trades by giving you that insurance. Now, what if you don’t want to buy insurance on your stock trades or what if you want to trade the stock prices without actually owning the stocks? That is the benefit of trading options.

Now, let’s say you don’t own any shares of a stock, but you want to own shares in the stock or profit from the stock price’s movement. You’re bullish on it, however, the stock is too expensive, say at $300 per share. This is where call options and then option leverage comes in.

Call options, as you recall, gain in value if the stock goes up and they give you better leverage than owning the stock outright.

So to buy 100 shares of a $300 stock, requires $30,000 of margin if you have a cash account. If you have a margin account, you have to put in $15,000 in margin. And if you have a day trading account, you have to put $7,500 down in margin.

But let’s say you don’t have that $7,500 in margin to buy the stock, this is where option leverage comes in. This is where call options come in. You can buy a call option at the $300 strike price with 30 days to expiration. That gives you the right, but not the obligation, to buy 100 shares of that stock at $300 per share anytime between now and the next 30 days.

Now, let’s say this call option costs you $5. That means you have to pay $5 x 100 shares, that’s $500. That’s much better than putting the $7,500 minimum just to own 100 shares of that $300 stock.

Now, let’s examine two scenarios using options. One where the price goes up and another where the price goes down.

In the first example, the stock goes from $300 to $325. You own a 300 call option for $500 or $5. The stock appreciated $25. At 100 shares per option contract, you can now exercise that call option, which means you can buy that stock at $300, even though it’s now at $25 a share. That’s a $2,500 profit. The math is $25 a share x 100 shares, so a profit of $2,500.

However, you did buy the call option for $500, so your net profit on this call option trade is $2,000. If you had bought the stock outright, you would have a $2,500 profit, but you would also have to put up that $7,500 in margin.

And if you didn’t have the margin to buy the stock, you wouldn’t be able to profit from the stock’s bullish move. That’s where options can allow you to profit from stocks while not having to put up for as much margin.

That’s pretty cool.

Now, in the second scenario, you bought that same call option at the $300 strike price for $5 or $500 in margin. Let’s say the stock price falls to $275. Well, that call option gives you the right, but not the obligation, to buy the stock, so you don’t have to exercise that option and there’s no point in exercising that option, that call option, if the stock price falls.

So if you were long 100 shares of that stock at $300 and it falls to $275, you lose $2,500. However, by buying that call option for $500, you only lost that $500. Hence, options can allow you to buy stocks with greater leverage and also reduce your risk. This is the power of trading options. You can put out much less capital, have less risk, all for the exchange of a small premium. The same goes for put options.

So, to recap, call options are options that allow you to buy a stock at a set price, which is called the strike price, within a specific timeframe, which is the expiration date, on or before that date.

Put options are the opposite. They allow you to sell a stock at a set price, a strike, within a specific timeframe, the expiration date, on or before that date. To buy a call or put option, you get greater leverage, you have less risk, but you do have to pay a premium.

Now, as we also mentioned, you can use those calls or puts to buy insurance on your long or short stock trades. This gives you the option to hedge or reduce your risk on those same long and short stock trades.

It’s important to understand that even if you think the stock is going up or down, there are certain times where you should buy calls and puts and there are certain times you should not buy those calls and puts.

In closing, calls and puts are the basic building blocks of all options. If you get this down, you understand options and how the basic building blocks of options work.