The Covered Call Strategy

In this article we’re going to teach you a strategy that you can use to generate income on your stock trading portfolio, called the “covered call strategy“.

The covered call strategy is a strategy you can use to give you a second income on your stock trades, improve your profit potential and generate monthly income.

This simple strategy consists of two components. It’s a combination of a long stock trade and a short call trade.

How the covered call strategy works

Let’s say you are long 100 shares of Apple stock at 100 per share, with the price of Apple let’s say being at $125. You are long-term bullish on Apple. However, you feel the tech sector might be weak for the next few months, and Apple might pull into a range, not appreciate much or perhaps even drift a bit lower.

You don’t want to get rid of your long stock position on Apple, but you think you may not make any money on your stock position for the next few months.

Enter the covered call strategy.

When you buy a call option on a stock, you are bullish on the stock and have the right, but not the obligation, to be long Apple stock at your strike price before the expiration date.

However, when you sell calls, as you do in the cover call strategy, you do collect a premium for selling that option.

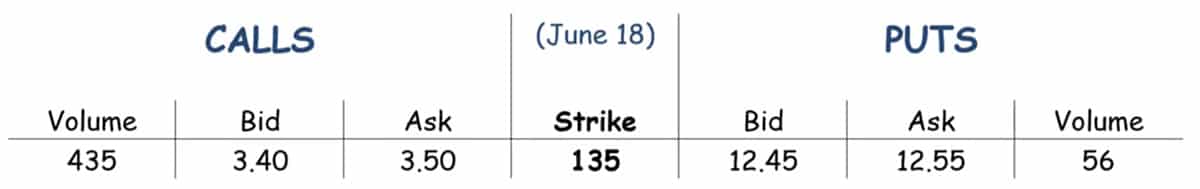

Let’s look at a theoretical option chain on Apple for options expiring in 30 days, on June 18th in this example. Looking at the option chain below, you can see the 135 calls are selling for $3.50.

With the cover call strategy, since you own at least 100 shares of apple stock already, you can sell calls against those 100 shares. With the $135 calls selling at $3.50, you can collect $350 in premium for each call that you sell.

Since each option contract represents 100 shares of a stock, you can sell one call of Apple for every 100 shares that you own and for each call option that you sell on Apple for $3.50, you collect $350 in premium.

For example, let’s say you own 100 shares of Apple which you bought at $100 with the current stock price of Apple being at $125. You think that Apple is not going to get above $135 before June 18th and you sell the $135 calls with 30 days until expiration, i.e. June 18th.

Let’s go through four different scenarios to see how this strategy plays out.

Scenario 1

In scenario one, Apple goes from $125 to your strike price of $135, exactly on the day of expiration (June 18th).

The $135 call we sold is now at the money. Since the price did not go above the strike price at $135, i.e. that means the option is at the money but not in the money. In extension, this means the option has no value and is worthless to the option buyer and we get to keep the full premium that we received for selling the option which is $350 ($3.50 x 100).

Looking at the profit on this trade, you are still long 100 shares of Apple at $100 and the stock is now trading at $135. That means a profit of $35 per share or $3500 on your long stock trade. On top of this, you also made a second income on this trade by selling the $135 calls.

So you made an additional $350 on that call you sold. This puts your total profit at $3850.

$3500 on the long stock trade ($35 profit/share x 100 shares) plus $350 in premium that you received from selling the call option.

Had you not sold the $135 call option you would have only walked away with $3500, so by selling this call option, you improved your profit on this trade by an extra 10%.

Imagine if you could increase the profit on every profitable stock trade you took by an additional 10%. How much could this boost your trading performance and trading account on a yearly basis?

Scenario 2

Now let’s look at scenario two, whereby the stock price of Apple rises to $140 by June 18th when our $135 call option expires.

Looking at your profit and loss in this trade, your long stock trade is $40 in profit since you bought the stock at $100 and you also collected $350 in premium for selling the $135 call option.

However, since you sold the call at $135 and the price of the stock now is at $140, the option buyer you sold the call option to has the right to exercise that call option and be long the stock from $135.

That means you made $40 dollars per share on your long stock trade, you collected $350 premium for selling the call option ($3.50 x 100 shares), but you also lost $500 on that short call you sold because the price exceeded your strike price by $5 ($5 x 100 shares).

Hence, your net profit is $3500 from your long stock position + $350 in premium from selling the call option minus $500 because the stock price went past your strike price of $135 by $5. So your net profit is still $3850, the exact same as if Apple closed at $135.

Hence, when you sell covered calls, you collect the premium from selling those calls, but you also max out your profit at the strike price, in this case $135. Regardless if Apple closes at $140, $145 or $150 at the time of your option expiration date, your profit is still capped at $3850.

This is because while your long stock trade keeps making money, your short calls start losing money above your strike price, in this case $135, and it evens out.

Scenario 3

Now, let’s look at scenario three where the price of apple falls from $127 to $115 by the june 18th expiry and you sold those $135 calls for $3.50 ($350 in premium).

On your long stock trade you made $15 per share or $1500. You also made $350 via the premium you collected for selling the $3.50 call option.. Those calls are now worthless to the buyer because the stock price did not close above $135 at expiration.

So your net profit now is $1500 on your long stock position + $350 in premium from selling the call option, for a total of $1850. If you hadn’t sold the $135 call option, you would only have made $1500 in profit. So selling that covered call improved your profit potential by an additional 23%.

Again, imagine if on your stock trades, you could collect an extra 23% of your profit. How much would that help your performance?

Now you should start to understand the power of the cover call strategy. Now let’s go through one more scenario to show you the power of this strategy.

Scenario 4

In this scenario, you’re still long 100 shares of Apple at $100 and you sell the $135 call option. But Apple has a big miss on earnings and the stock goes in the pisser, dropping to $98 on June 18th.

This is how your profit and loss works out in this scenario. You lose $2 per share on your long stock position which is a -$200 loss since you own 100 shares. However, since you sold the $135 call option and collected $350 in premium, your net profit on this trade combination is $150.

Had you not sold the call option you would have banked a -$200 loss, but since you collected $350 in premium for selling the option, you end up with a net profit of $150 instead.

Imagine if on your small losing trades, you actually came out with a net profit. What would that do for your long-term performance over a series of 100 or a 1000 trades?

Conclusion

By now, you should be able to fully understand the power of the covered call strategy. This is one of the many benefits of trading covered calls, because you reduce your risk by collecting that extra premium. If you’d like to learn more on when and when not to use this strategy, check out our Options Bootcamp.