Last week I talked about the importance of looking at the details and refining one’s trading game in Forex Trading, Ted Williams, & The Little Details Pt. 1 article. All highly skilled professionals realize paying attention to the details pays dividends, and often leads to the difference between being good and great. Today is the continuation of that article, where I will be sharing how making a small trading adjustment in my trading could lead to a six-figure change in profits per year.

But before I get into one small adjustment I need to make in my personal trading, I want to discuss a few amazing examples of how Ted Williams really paid attention to the details, and how these small things separated him from the rest.

Attention to Details

Ted was known to be obsessive about his hitting skills and had made several adjustments which allowed him to understand hitting better than most of his time. Here are some of the details below;

-He traditionally used a much lighter bat than most of the heavy hitters (sluggers) back in the day. To test how sensitive he was to the lightness of the bats, he was once presented with 4 bats, 3 weighing 34 ounces, and one weighing 33.5 ounces. Most people on the planet now could not tell the difference between 34 and 33.5 ounces, a .5 oz difference, or to put this in context, a 1.4% difference in the weight of the bat (.5oz / 34 = .014, or 1.4%).

Yet Ted was able to consistently tell the difference and identify the lighter bat each time.

-Ted used to warn his teammates to avoid leaving their bats on the ground. Since the bats were made of wood, this would cause them to absorb the moisture in the dirt or grass, and thus become heavier, which would slow their swing down. How would he have known this unless he was sensitive to all the details?

-After he retired, in a Sports Illustrated article, he was able to demonstrate how swinging at a pitch, just one baseball width outside the strike zone heavily affected his batting average, and he divided the strike zone into 77 baseballs, with each baseball being = to a particular batting average for each pitch in that location.

When reading the above examples of how Ted paid attention to the details, you can see why he was such a great hitter and baseball player. All of those small little details, while they may seem insignificant on their own, led to a huge difference between him and everyone else.

Paying Attention to Details in Trading

This is exactly the same for trading. Did you know using the risk of ruin tables, if you were 35% accurate, risking 2% per trade, and always taking profits at 2x your risk, you would have an 8.37% chance of blowing up your account?

But reduce your risk to 1% per trade, and the chance of you blowing up your account is only .7%, which is improving your chances of being profitable 119x?

That is quite a huge difference, all with one small detail.

SIDE NOTE: This is also the reason why we always measure risk in % terms, not in dollars terms. Professionals don’t measure risk in terms of dollars, they do it in terms of %’s, because this is where they can use the risk of ruin and math to guide them about trading performance as dollars are relative to you.

The One Details Which = A Six Figure Difference

I was reviewing my trading journal one day in March this year, and noticed a behavior continually repeating itself. I had been making sure to mark in my journal since 2012, every time I entered at market, but also noting if I was entering a bit early in relationship to the system entry. I marked it with the code EM (‘entered at market’) / HOP (‘hit original price’).

Several weeks ago, I noticed this happening several times in the same week, so I started to go back through my entire trading journal over the last 12 mos to see how many times this happened. The answer….

78% of all trades entered at market, would have executed at the original price the system gave the entry at. This occurred a total of 242x in the last 12 months.

3.6 Pips

I decided to compile a few more stats to really get into the details and see what kind of effect this was having on my trading.

The average entry was 3.6 pips less than my system entry price.

Now 3.6 pips may not seem like a lot, but it has a significant effect on your trading. To give an example, lets say you have the following trade setup with my system giving me the stop and take profit (limit) levels using the following data below;

Long EURUSD at 1.3003 (entered 3 pips early at market)

Target = 1.3103 (100 pips)

Stop = 1.2953 (50 pips)

Total reward to risk ratio is 2:1

But lets adjust this by just 3 pips, meaning I entered at 1.3000, still had the stop at the same level (1.2953) and target (1.3003) assuming they were my targets based on the original price action system numbers.

This translates into the stop being 47 pips, and the target being 103 pips, or a 6 pip difference. This also increases the reward to risk ratio from 2:1, to 2.2:1, or a 10% difference just in the R:R ratios.

This 3 pip earlier entry, was in reality a 6 pip difference, but for me, the number was 3.6 pips, so a total of 7.2 pips of difference in performance. Assuming a 50% win ratio, 7.2 pips x 242 EM/HOP (entered at market/hit original price) would result in a 1742.4 pips difference. Based on the average lot size, this would = ~200K USD. Even if we halve this performance, it would still be ~100K USD, which is a huge difference in performance, per year!

The Difference Between…

After getting over the initial shock of how much of a difference this small detail meant in my performance, I have come to a greater understanding of how important the small details are in trading and performance (in anything). Often times, these small details can be the difference between losing and winning, between breaking even and making money, between being just good or great.

Thus, make sure to apply a fine comb to your trading account performance and journal, to mine the little details which could be separating you from losing and winning, or making a little money to a lot. You cannot underestimate the power and difference a few small pips, or one small bad habit can have on your trading.

All highly skilled professionals pay attention to these small details, as they can truly create a world of difference in performance. Jimmy Hendrix realized this when adjusting his guitars. Ted Williams also realized this when it came to baseball and batting.

The question then remains, will you take the time to find the little details which could be holding you back? How much is it worth to you, to take a few hours away from the screen time, the beach, or the bars drinking, so you can increase your performance by a huge amount? The benefits could last you a lifetime, and it’s possible this could be one of the best reward-to-risk plays you ever embark on.

Tag Archive for: ted williams

With liquidity dying down heading into the Easter holiday coming this Sunday, instead of writing my evening price action market commentary article, I wanted to write a little two part series today and tomorrow about some of the overlooked aspects of trading – the little details.

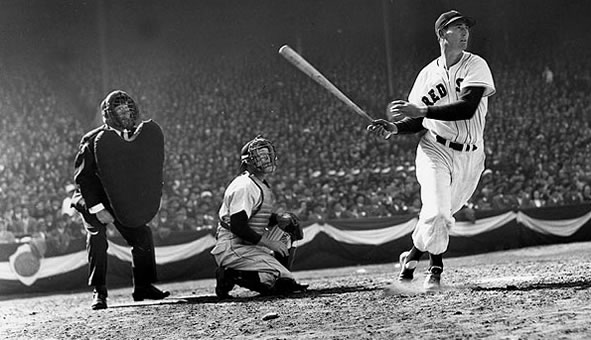

Wasn’t Ted Williams a baseball player?

Yes he was – and a great one at that.

This lesson actually centers around a great story about Ted, although not during his trading career, but well after it had ended.

Several years ago, the Ted Williams museum was collecting several items from Ted’s great career to be stored in the museum for all to appreciate. For those that don’t know much about Ted, he is considered to be one of the greatest hitters of all time, and in 1941, he hit a .406 average – which makes him the last person in over 70 years to finish a season above .400.

Williams was known to pay attention to the details of everything he did when it came to baseball, especially hitting. His famous bat during the 1941 season was suspected to have been bought initially by a collector for over $20,000. When the museum had bought the bat, they had asked Ted to come to the museum and verify if it was his bat.

He saw the bat, closed his eyes, and put his hands firmly around the handle just as he held the bat to hit a baseball.

After a short pause, he said the following;

“Yep, this is one of my bats for sure.”

One of the members at the museum had asked him how he had known it was his bat.

He responded;

“Back in the years 1940 and 1941, I had cut a groove in the handle of my bats to rest my right index finger in. I can still feel the groove in this bat here.”

You will find amongst some of the greatest concert pianists, guitarists, athletes, and anyone highly skilled in their craft, they pay attention to the details and the smallest aspects of their game. Often times, these small details and steps will lead to a large result, often times separating success from failure, breaking even to profitability, and from just good to great.

Ted Williams realized that if he could rest his index finger more naturally into the bat, it would influence his swing. That is attention to detail.

Jimmy Hendrix would adjust and oversee every guitar he ever used. Anytime he got a new guitar, he would bend the ‘tremolo‘ (whammy bar) by hand for hours at a time.

Why?

By bending it and getting it closer to the body, he could tap the strings while raising and lowering the pitch, sometimes down three steps instead of one.

That is attention to detail, and just one in the dozens he did when adjusting his guitar.

All highly skilled professionals look towards the details as a way to refine their game. And this is something you have to do in your forex trading. You have have to constantly refine your trading to greater and greater levels of precision, detail and performance. Maybe you have to adjust your equity threshold, or maybe you have to adjust your engulfing bar entry, as the vanilla one is quite inefficient.

As Michael Jordan once said;

” Take small steps. Don’t let anything trip you up in reaching your goal. All of those small steps are like little pieces of a puzzle. Eventually they come together to form a picture of greatness. But doing things step by step – I cannot see any other way of accomplishing anything.”

So take some time to think of all the little details where you could refine your trading. We all have them, regardless of our level, profitability, or account size. I’m willing to bet that if you look at the numbers, and run the data on your performance, perhaps even adjusting your risk of ruin, if you just changed one little detail, you would be completely amazed at how it would affect your performance.

This can make the difference between being profitable and losing money, between barely breaking even and consistently profiting, or the difference between being good or great. Ask yourself where you are on that spectrum, and where you’d like to be. Then get to work.

Keep in mind, I’ve never met a single profitable trader who cut shortcuts, who tried the easy way out, who wanted something for free, or was willing to steal to get there. Food for thought…but without having the mindset of abundance, how can you expect to be a professional trader who works with bigger and bigger amounts of money?

Tomorrow before the weekend, I’ll write the second part of this article, where I share one piece of data I’ve recently discovered in my personal trading, that would be the difference between my current performance, and a six-figure car…per year…without compounding.

See you then…