The Pyramid of Trading

Earlier this week I was talking to a student who is starting his private forex mentoring with me. He was actually referred to me by a previous student I spent time mentoring two years ago. This former students name is Tony and had no prior experience in trading, nor a degree in business or finance. But he had a serious desire to learn how to trade successfully while putting in the work and study.

Occasionally he writes me an email to tell me he is still trading and doing well. He often asks me some advanced questions about the market, trading, but that is all.

What is interesting is when I talked to this newer student Ben I am starting to work with, I asked him how Tony was doing for 2011. He told me the following;

‘Tony is doing great. He is up 76% for the year and I’ve actually seen his trading report. He’s only had two losing months this year and has been getting asked to manage funds for clients.’

First off, I was nothing but proud and happy to hear this about Tony. I was not surprised he was managing money as he emailed me 6 months ago asking about the issues around such ventures which can be complex.

I asked my new student after talking with Tony, what he thought Tony’s greatest asset is. He responded with one word;

Discipline

Tony was taught a few of the exact same systems I teach all my students so he had no edge in regards to the system. Tony’s edge was his discipline. He simply had the mental fortitude to follow the system exactly as is. On top of it, he had the forex trading discipline to always stick to his risk management levels and never violated them.

So here was a student given the exact same tools as the hundreds of other students, and he was performing exceptionally well for the year – even outpacing most hedge funds (along with most traders on the planet).

He didn’t have some crazy algorithm or DaVinci Code system which sent Tom Hanks on a wild chase across the world to find it. He had a system which was obviously profitable, but even more so, the Discipline to execute it consistently and never violate his risk management profiles.

A trader without discipline will never experience consistency in their trading because they fail to use proper risk management and stick to their trading plan. This will likely result in them making a lot of really good trades, building up their equity, only to have a few losing trades (or one) knock them down the ladder. It is someone who kills long term success in the race by forgetting to tie their shoes and eventually tripping over them. Trading is not a sprint, it’s a marathon and requires conditioning over time.

Perhaps this sounds familiar about building up your account, only to have one or a handful of trades take out all your gains. If it does, then it’s a clear communication on what you have to work on (staying disciplined).

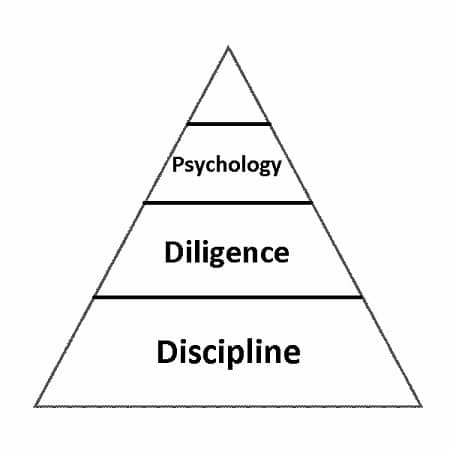

Developing traders often don’t understand, when you are asking to be a successful (or professional) trader, you are asking not just to build a pyramid, but to sit on top of it. What most forget is the base is the biggest part of the pyramid and the foundation for building higher levels.

As the pyramid continues to grow higher, it gets a little more complicated, but you have a base (foundation) and structures in place to carry the stones up to the higher levels.

But just like a pyramid, there are more stones at the base and this takes more time to build. Also like a pyramid, there are more traders at the base (not making money or breaking even) then there are at the top.

However, with structures and rhythm in place, the fruits of your labor will result in a steady conditioning of your muscles (discipline, diligence and psychology). This will allow you to take on greater and greater heights, challenges and climb the pyramid of trading. Having forex trading discipline, diligence and psychology will give you a sense of confidence and a feeling of mastery over the process.

This is the pyramid of trading and the attributes needed to climb to higher levels.

While most traders spend time trying to find profitable trades, or the next great system, make sure you take time out to build the attributes which develop your trading muscles (discipline, diligence and psychology). By yourself this can be a very difficult task so it helps to create mechanisms in your life to build these habits. Finding a mentor who can guide you along your path can be instrumental in developing yourself into a successful trader. But cultivating the habits needed to take your trading to the next level simply requires some work and time.

Kind Regards,

Chris Capre

2ndskiestrading.com

Twitter; 2ndSkiesForex

For those of you looking for a mentor, make sure to check out our highly successful Online Courses to help take your trading to the next level while getting direct access and mentoring from Chris Capre.

Thanks for the share!

Nancy.R

Its not so dificult to find the reason why we could not have great results. The hard and important decision is to improve and mantain the reason over time. Everybody has the capacity to decide to change, the key is to mantain this decision.

In some sense, I agree with you Jorge, but I would be willing to bet the reasons why people are not successful and do not have great results are not just one reason, but several, and are not all entirely obvious, while some are possibly quite subtle.

For example, do you know what is causing you to not have great results (if that is the case)?

But another thing to consider is for some people, being disciplined and maintaining their focus and efforts is not difficult. Many people who have been in the military, or competed professionally, semi-professionally, or at a high level have the training, understanding and experience to maintain their focus and efforts. Others, have not built this yet.

But, if maintaining the effort, focus and discipline is challenging for you, i’d suggest looking at the following two articles whereby I give techniques to help manage these things;

Building a Successful Trading Mentality

and

Awareness, Negative Habits and Concentration in Trading

Kind Regards,

Chris