Understanding Price Action Context

Want to Increase Your Profitability? Try this powerful approach

If you want to find high probability trades, and skip those with a low probability of working out, you’ll need to develop a core skill. Does this sound interesting? Then keep on reading. What is this skill you ask?

I am talking about trading with price action context.

Good Trading Decisions Are Based Upon Context

First, let’s define the word ‘context’. Context = understanding and approaching a situation based upon the ‘context’ (or environmental variables) around it.

In price action, the ‘context’ is a way of describing the overall environment, and using that to help you trade with the underlying order flow. We have 3 filters to understand the price action context in our Trading Masterclass Course. For the purposes of this article, we’ll talk about impulsive and corrective moves.

Impulsive and Corrective Moves

Now I’ve already done many videos and articles on impulsive and corrective moves. For a more in-depth study, you can watch this video on impulsive and corrective price action, or this article on impulsive and corrective moves. But to sum them up briefly:

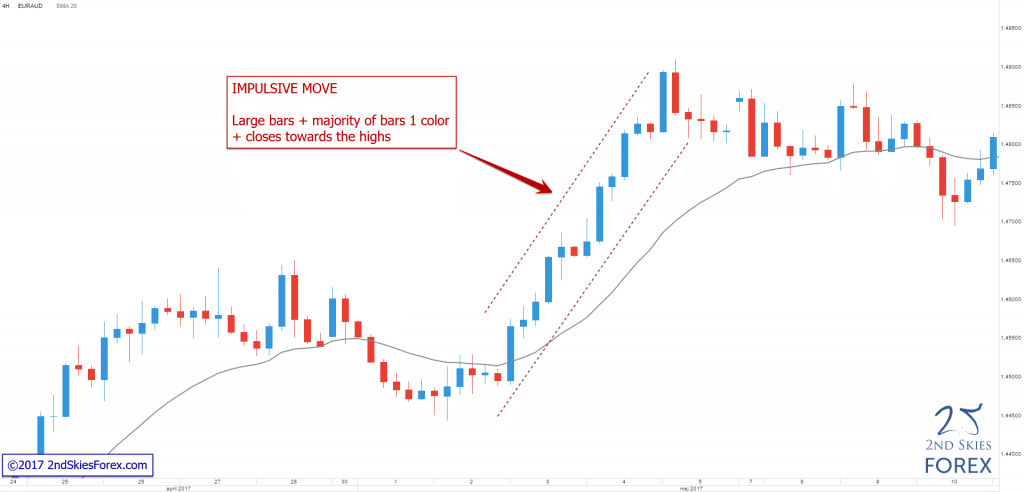

Impulsive moves = large bars + majority of bars 1 color + closes towards the highs/lows

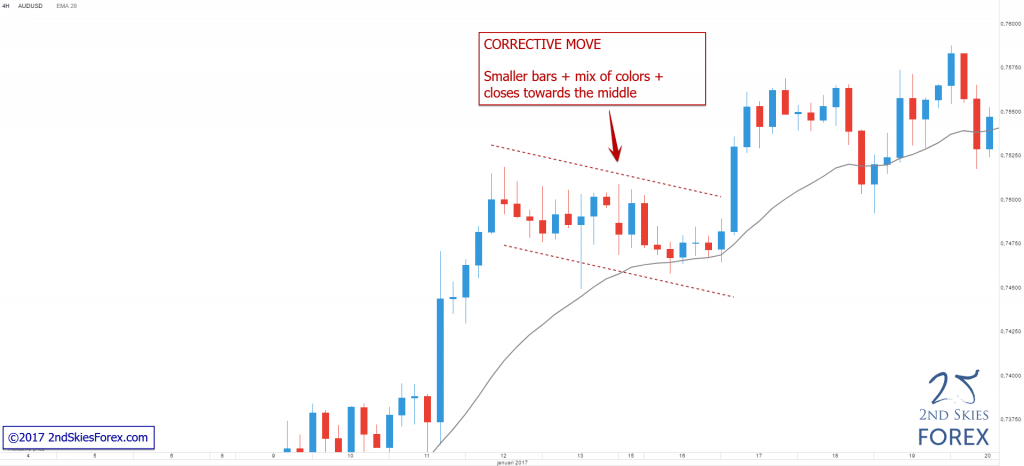

Corrective moves = smaller bars + mix of colors + closes towards the middle

An example of an impulsive move is below:

And an example of a corrective move is below:

As a whole, impulsive and corrective moves communicate a lot about the price action context, such as the underlying order flow behind it.

During impulsive moves, the order flow is relatively ‘imbalanced’, meaning it’s dominant towards one side (buying/selling) which causes strong directional moves.

During corrective moves, the order flow is relatively ‘balanced’, meaning there is no strong winner between the buyers/sellers, hence the market goes mostly sideways.

Using Impulsive and Corrective Moves to Discover the Price Action Context

Now that we understand the basics of impulsive and corrective moves, we can use them to discover the price action context of the market.

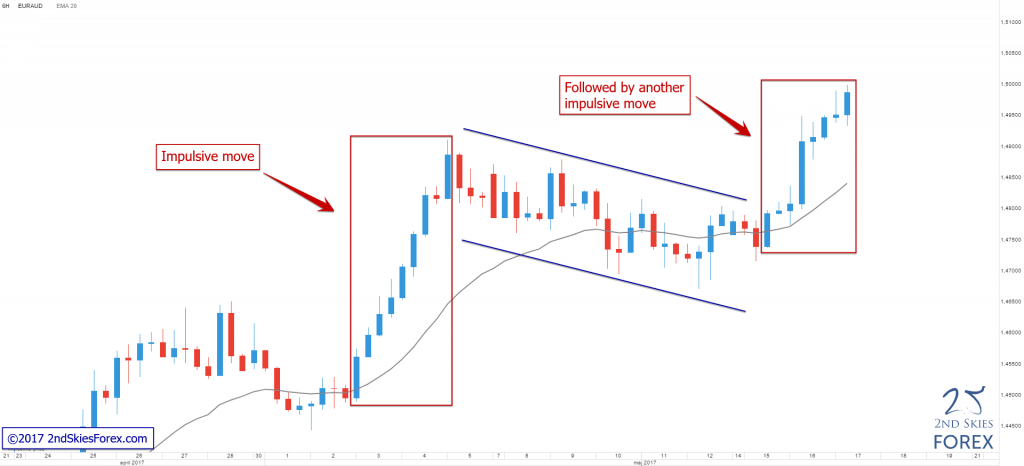

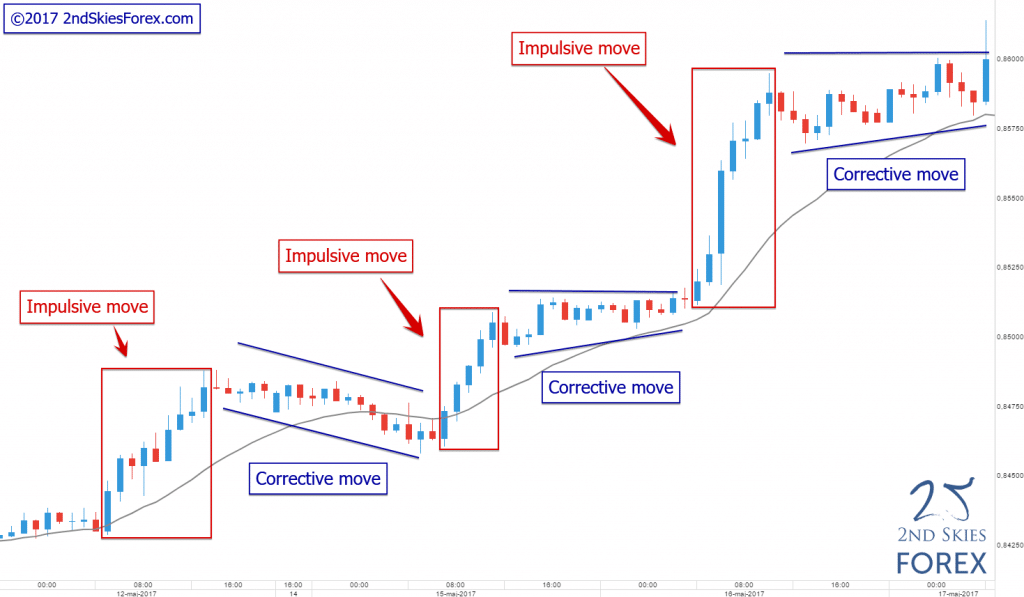

As a general rule, an impulsive move (the majority of the time) is followed by a corrective move. If the impulsive move is with trend, then the next move after the corrective move will more often be an impulsive move in the same direction.

Two good examples of this are below:

Example 1: Impulsive and Corrective Moves

Example 2: Impulsive and Corrective Moves

Now what do impulsive and corrective moves teach us about price action context?

They give us an underlying sense of what the dominant order flow is. If you see a potential trend in place, along with a good series of impulsive and corrective moves, then you can feel confident the overall price action context is bullish, and thus you should be looking to buy more often than sell.

Now instead of waiting for a pin bar, fakey or some other 1-2 bar confirmation price action signal, look at the impulsive and corrective moves for trade opportunities as they will often offer you many.

You don’t need a 1-2 bar candlestick pattern to know if the market is bullish – just determine the overall ‘context’, and trade with the impulsive and corrective structure as much as possible.

NOTE: If you want to learn how to find high probability trade setups using impulsive and corrective moves, check out our Trading Masterclass course.

The bottom line is – many of those 1-2 bar candlestick patterns (pin bars, fakey’s, inside bars, etc) don’t form that often. Yet if there is a strong trend in place, why are you waiting for a pattern that may never materialize, when the overall order flow is already bullish?

Get into that trend and make some money. Just make sure the price action context is in your favor. A great way to determine this is to make sure you can read the impulsive and corrective moves.

The most favorable situation is when you are trading in the direction of the impulsive moves (not against them) because you’re trading with the dominant order flow in the market. It also means you can make money faster because impulsive moves travel farther and faster than corrective moves.

Hopefully you can now see how price action context, particularly spotting the impulsive and corrective moves, can give help you find better trade setups.

Want To Learn More About Price Action Context?

While impulsive and corrective moves are a crucial part to determining price action context, they are not the whole. We have two other key factors to determining price action context and what the dominant order flow is in the market.

To learn more about these two, check out our Trading Masterclass Course where we teach you higher, lower and multiple time frame context with clear rules to understanding them. In fact, our entire 1st section of lessons is dedicated specifically towards understanding price action context.

To get access to these lessons within minutes, click here. Inside the course, you’ll also learn how to read other critical (or more advanced) price action structures and find more trade setups.

Keep in mind, trading with price action context is a skill that works on any instrument, time frame or environment. If you’re learning a price action strategy or approach that only works on specific time frames, then it’s a limited strategy that doesn’t really understand price action or PA context.

Until then – I look forward to your comments and feedback.