Using the Ichimoku Cloud to discover Reversals

One of the amazing things about the Ichimoku Cloud trading strategy is the actual Cloud or ‘Kumo’ which is something unique wherein nothing like it was created before and nothing sense has come after. The Ichimoku Cloud or Kumo is designed to represent support or resistance but in a different form the western world has seen – to view support and resistance as evolving or dynamic and not static like pivot lines, Fibonacci lines, support lines or trend lines.

To the creator (Goichi Hosada), support and resistance was evolving and really based upon previous price action.Particularly, the highs and lows of previous price action was of great concern to Hosada (along with the opens and closes) which showed levels of rejection where the market would not accept price.The previous highs and lows would also give traders the range where the market was accepting price.

So the real question is ‘how’ does the Ichimoku Cloud or Kumo represent support and resistance?The answer lies in the construction of the Cloud or Kumo.

Kumo Composition

There are two main lines of the Kumo which are referred to as Senkou Span A and Senkou Span B. For the purposes of efficiency, we will refer to them as Span A and Span B. The space or value in between these two lines is what forms the Kumo.

Span A is formed by taking the Tenkan Line and adding it to the Kijun Line (white and red lines respectively from chart above), then dividing that value by 2 and plotting it 26 periods ahead. The formula is;

(Tenkan Line + Kijun Line) / 2 placed 26 periods ahead

Span B is formed by taking the highest high (over the last 52 periods), adding to it the lowest low (over the last 52 periods), dividing that by 2 and plotting that 26 time periods ahead. The formula is;

(Highest High + Lowest Low for the last 52 periods) / 2 and plotted 26 time periods ahead.

Now, before we fully get into the construction of the Kumo, we have to talk about what the Tenkan and Kijun lines are which help to form the ever changing Senkou Span A.

The Tenkan Line or Tenkan Sen (Sen means line in Japanese) is known as the conversion line or turning line is similar to a 9SMA but actually is quite different. Remember a SMA (simple moving average) will smooth out all the data and make it equal but the Tenkan Line will take the highest high and lowest low over the last 9 periods. The explanation for this is Hosada felt price action and its extremes were more important than smoothing any data because price action represented where buyers/sellers entered and directed the market, thus being more important than averaging or smoothing the data out. As you can see by the chart below, the Tenkan Line is quite different than a 9SMA. Because the TL (Tenkan Line) uses price instead of an averaging or the closing prices, it mirrors price better and is more representative of it. You can see this when the TL flattens in small portions to move with price and its moments of ranging.

The Kijun Line (or Kijun Sen) is known as the datum line, standard line or trend line designed to indicate the overall trend for the instrument or pair. The formula behind it is the same as the Tenkan line using price action and the highest high + lowest low with the only change being in the periods as it does it over the last 26 periods.

Why 26 periods? The answer to that is a matter of history. When the Ichimoku was first created, the Japanese markets were open 6 days a week on Saturdays. If the markets are open 6 days a week, this generally results in 26 trading days for the month – hence 26 periods for the Kijun. In essence, what it was meant to be was a measure of the highest high + lowest low for the last month of price action. If the Kijun has been climbing – it means price has been gaining ground for the last month. If it is flat, then it will be the midpoint of the range of price for the last month of price action (or representative of the price equilibrium).

Now that we have uncovered the composition of the Tenkan and the Kijun lines, lets talk about how they form the Senkou Span A.

Going back to its construction:

Span A is formed by taking the Tenkan Line and adding it to the Kijun Line (white and red lines respectively from chart above), then dividing that value by 2 and plotting it 26 periods ahead. The formula is;

(Tenkan Line + Kijun Line) / 2 placed 26 periods ahead

So the Tenkan line (which is the momentum line) and the Kijun line (which is the trend line) that are based upon price action are moving.Their valued added together, divided by 2 and sent 26periods ahead is what forms the Senkou Span A or Span A.So the first portion of the Ichimoku Cloud or Kumo is based upon evolving price action lines which are half momentum, half trend monitoring.When you put these two together, you get the Span A which is always changing based upon the acceleration or deceleration of price based upon how they effect the Tenkan/Kijun lines (and in turn, the Senkou Span A).

The second line is the Senkou Span B which is a little different.Its based solely upon price action, particularly the last 52 candles of whatever time period you are on.If you are working with a daily chart, we are talking about the last 52 days, for a 1hr chart, the last 52 hours of price action.After taking the high and low for the last 52 candle range, it takes their values, divides them in half, and shoots them 26 time periods ahead.

The shading in between is called the Cloud or Kumo.

Why 26 periods?

The answer to that is a question of history.Originally, when the Ichimoku Cloud was built, Hosada was mostly using it off of daily charts.The Japanese were trading 6 days a week so 26 days would represent a full month of trading.Hence 26 time periods to see where future support and resistance would be one month out.

This is where we can use the Ichimoku Cloud for reversals.

If the Ichimoku Cloud or Kumo represents support and resistance, then the thicker the Cloud, the thicker the S/R it offers.If price is below the Kumo, it will act as resistance, if price is above the Kumo, it will act as support.The Cloud can take many forms and shapes (virtually infinite) which is what makes it tricky but thick Kumo’s often will reject price and the longer the time frame (4hr, Daily, Weekly), the more powerful the Kumo will act as support or resistance.

Take a look at some Ichimoku cloud trading strategy examples below.

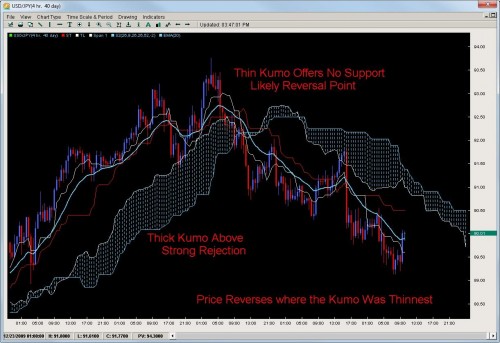

USDJPY 4hr Charts

Notice how the pair rejects off the really thick Cloud but when it reverses is where the Cloud was the weakest or most thin.

USDCAD 4HR Charts

Taking a look at another example, the USDCAD after its initial fall, rejected off a really thick Kumo twice telling us a reversal was less likely.However the Kumo starts to thin out giving us a window to break through the Kumo and likely reversal point.

So the key tactic in both is to look for thinner Cloud formations which offer a window or glimpse into an upcoming reversal.Remember the Kumo is sent 26time periods ahead so you have plenty of warning when the window is opening.If you are in the current trend, the window in the Kumo could be a warning to take some profits or if you are looking for a reversal, then the Cloud offers you a good location and method to time a reversal which is one of the hardest things to do in trading.

Another clue hidden in the Cloud can be the flipping of the Senkou Span A and B which can indicate a reversal but do not always.The other main point is price does not always reject off a thick Kumo so its important to watch price action as well but the Ichimoku Cloud is excellent at spotting and timing reversals.

To learn more about Ichimoku Cloud trading strategies, or proprietary quantitative based strategies on the Ichimoku Cloud, check out the Advanced Ichimoku Course.

Chris, another great post!

I haven’t traded the cloud for sometime now but used it with good effect with market profile when trading emini’s on the back of the FX correlations.

Regards

Pav

Hi Chris,

Just went through this article. I have few questions in regards to Kumo. Kumo according to the theory is drawn 26 days ahead. So if i understand this correctly if the price passes the thin Kumo does that mean that past price was losing direction? Because technically when the price penetrates the Kumo it means that previous 78 days(senkou B 52 +26days) and Senkou A was losing momentum hence the contraction in Kumo? Does this make sense? Is this the reason why the price has a better chance of penetrating the price? Because when the kumo is thick that means that past 78 days had good momentum in the direction? Hope this makes sense.