The Problem With Trading Mentors & Trading Education Today

What You’ll Learn In Today’s Trading Article:

-Why most trading courses will fail to teach you how to make money trading

-Major problems in the trading mentor and education industry today

-How can we implement technology to help improve trading courses

Retail forex traders (along with stocks, futures, options, commodities and global index traders) have a problem, and it’s a problem the broker has as well. Most traders who open an account on January 1st of any year will not be profitable at the end of that year.

Think along the lines of 8-9 out of you traders will not be profitable at the end of the year.

Now when I started trading forex back in 2000/01, there were about 6 websites online about forex trading. Now there are millions of forex trading sites with thousands of online trading courses.

We’ve had a massive proliferation of online trading courses, trading mentors and educators, yet the needle of retail traders making money has barely moved. Hence you have to ask the question; why are so many retail traders losing money?

The answer really only has 3 possibilities:

1) There is a problem with the trader (you)

2) There is a problem with the trading education out there

3) All of the above

The answer to the above question is #3.

Without a doubt, there is a problem with you (the trader). This is implicitly obvious in the fact you are constantly studying, training, and taking trading courses. You’re doing this because you realize you need to make changes to your thinking, trading mindset, and price action skills to make money trading. Hence you implicitly recognize (consciously or unconsciously) there is something you need to fix, thus making #1 true.

On the other hand, there is a problem with the trading mentors and education today. Think about this probabilistically:

How can there be an enormous explosion + proliferation of trading courses and educators out there, yet profitability over the last 10-15 years barely move?

Even if the root of the problem to profitability is just with the trader (you), then isn’t it the responsibility of the trading mentors + educators today to recognize this, and then change their trading education and courses to help mitigate this problem?

Hence, the answer to the above question (as to what needs to change to make more retail traders profitable), comes down to you + the online training available today.

For trading mentors, our job is to train you in 3 main areas to help you make money trading:

1) building a successful trading mindset

2) acquiring trading skills that can give you a trading edge over time (i.e. technical, fundamental, sentiment, or flow based)

3) learn to properly understand, quantify and manage risk

And while I have written over 1200+ free trading articles to date, have been trading since 2001 and training retail traders since 2007, I am not immune to some of the problems in the trading industry I’m going to talk about today.

Since 2013, I’ve been thinking heavily on how to solve these problems in the industry. By 2015, after doing 2 years of research on this, I felt like I found several solutions to make more traders become profitable and change the trading education industry. From 2015, I’ve been quietly in the background working with developers to build a solution.

Since that year, I’ve spent close to $200,000USD building this solution to help change the trading education industry. And just a few months ago, I’ve been working with another trader in the industry who has the same focus, vision and commitment to changing the trading education industry forever.

We’re pretty close to announcing it’s launch soon, but for this article, I’d like to highlight why most trading courses today will fail to turn you into a profitable trader. Then I’d like to talk about how technology is a vehicle which can (and will) provide real world solutions to changing the way you think, trade and perform.

Let’s get into this controversial and (IMO) critical discussion to have about trading mentors, educators and online trading courses.

Problems With Most Trading Courses Today

If you’ve taken an online trading course, or looked to take one, you’ve probably found thousands of courses out there. The majority of all trading courses fall into the following categories:

Online trading courses (pdf’s, videos, books, text, webinars, live courses, etc)

Online Trading Rooms/Chat Rooms

Live in person training (seminars/workshops)

The first two are the most prolific because a) they’re more accessible, and b) the most cost effective.

Live training in person is the least prolific because they’re a) not easily accessible being location dependent, and b) expensive for the amount of time you get doing live training.

(Image: London Trading Seminar 2015 – twas an amazing trading seminar)

Regardless of which category of training you work with above, they all have two things in common;

- They’re all primarily ‘informational’ (this means they spend the majority of time giving you information)

- Their feedback loops are almost always voluntary, not consistent, not automatic, not ongoing, and not continually updating.

Let’s address the first point to start with.

Why Informational Courses Fail to Help You Become Profitable

With informational courses, the general sentiments is ‘If we give you the information you need to make money trading, you should be able to then go make money trading…eventually‘. The problem is, you have to assimilate that information into trading skills, with you doing the majority of the work.

Why do ‘informational’ courses not build your trading skills? And why is the feedback model with most trading courses so poor?

Information Does Not = Successful Trading Skills

How many trading articles, books and videos have you digested over the last several years? My guess is somewhere in the 100’s, perhaps 1000’s? Now if 8/9 out of 10 of you are not making money, then why hasn’t all the books, articles, and trading videos you’ve studied turned you into a successful profitable trader?

Do you really think reading books about golf will make you a good golfer by itself?

Do you really think watching 100’s of martial arts videos on youtube could turn you into Bruce Lee?

Can you become a good archer simply by reading books on archery?

No, of course not. That’s because information (by itself) does not make you a profitable trader.

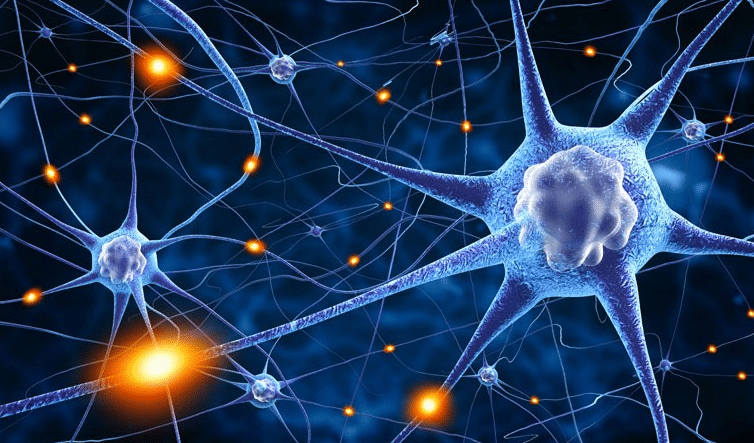

Trading is a ‘skill-based’ endeavor, meaning you have to wire specific trading skills into your brain to make money trading. Luckily, you have an amazing neurological feature called neuroplasticity, which means your neurological circuits can re-wire themselves (through training and repetition) to make money trading.

This is a real thing.

Now there are 7 characteristics (or rules) behind neuroplasticity. They are:

Intention

Mindfulness

Belief

Emotion

Focus

Repetition

Choices

Notice the word ‘information’ is not in the list above. So jamming as much information to your brain as possible (by itself) will not make you a good trader. Just think back to your college/university days, and try to think about how much of the actual information you digested you can still recall today?

Bottom line is information does not = making money trading.

Now there are 4 of the 7 rules above which are super powerful for impacting and increasing neuroplasticity in your brain, but the one that is most fundamental is #6 (repetition). Simply put, you cannot build new neural structures without repetition.

Hence, since trading is a skill based endeavor that requires ‘repetition’ of a specific action (i.e. proper trading preparation, analysis, execution, risk mgmt, etc.), to make money trading, you’ll have to wire those skills into your brain.

Reading books or watching videos over and over again simply won’t cut it. You’ll need to continually practice those critical skills till they become professional.

Why This Matters

If most trading courses today are ‘informational’, then isn’t there a problem with the trading education and courses today? Doesn’t this mean the majority of trading courses out there are not going to help you make money trading?

While you’re at it, when you think about your struggling performance you’re experiencing right now, recall how many trading courses you’ve taken and ask yourself; how many of these trading courses were ‘informational’ vs focused on ‘building skills’?

Most Trading Courses Have Poor Feedback Models

The second problem with most trading courses today is they have poor feedback models.

The best way to understand this is, reflect upon what gives you ‘feedback’ when learning to trade or taking an online trading course?

-the market (wins/losses/timing/trading location/accuracy/instruments/performance, etc)

-your emotions

-your self-talk

-your perceptions/attitudes about your trading performance

-your experiences

-environment

-the course content

-the skills your course teaches you to build

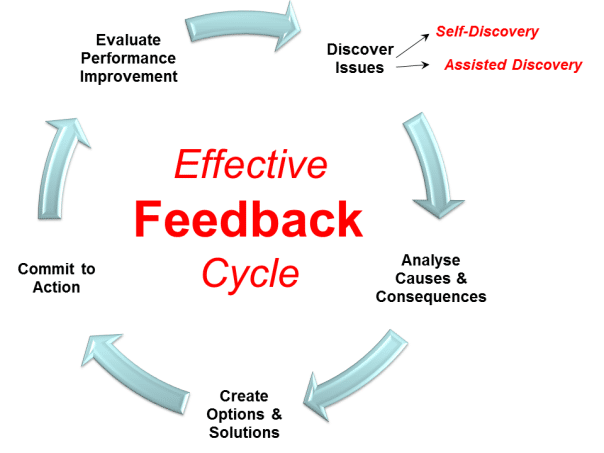

Now there are several types of feedback you can get, but all peak performers in trading, sports, etc have the following characteristics:

The feedback model is quantified

The feedback model is automatic

The feedback model is ongoing

The feedback model is responsive

The feedback model is continually updating

For a feedback model to be quantified, there has to be fixed metrics you’re measuring through the course that are minimally sufficient to give you quantified data on what you’re specifically performing well with, and what you specifically need to change.

For a feedback model to be automatic, it has to be one where the feedback and data collected is automatic.

For a feedback model to be ongoing, it has to be feedback you’re consistently getting over time.

For a feedback model to be responsive, it has to be able to analyze what training/feedback/execution variables are improving your performance, and which are not.

For a feedback model to be continually updating, it has to be collecting your performance data and continually updating it based upon new data coming in and how the bulk of your performance is changing over time.

Now of the above 5 models for feedback, how many of them does your current course provide? My guess is 1, maybe 2 max. It needs to be said, while my 2ndSkiesForex trading courses offer quantified feedback (our Trading Analytics sessions), which is ongoing, responsive and continually updating, it’s not automatic (not yet at least ;-).

If you’re missing 2-3 feedback models above in your current online trading course, then you’re likely getting insufficient feedback and clarity on how to improve your trading performance. And that can mean the difference between making money trading, and losing money trading.

You’ll have to decide which side of that equation you want to be.

Final Thoughts

I believe the trading education industry needs to change. I think we have to improve our feedback models, along with stop producing ‘informational’ courses, and start building more skill-based trading courses.

This means not just teaching systems and how to enter/exit a trade, but how to build the most important base skills of trading. This has to be done in the same vein as professional basketball players continually work on their dribbling, passing, footwork, and shooting skills day in – day out.

I also believe the trading education industry is going to change, and it’s going to do so with the help of technology. I feel the technology is in place to produce the best training tools available, so you can become a peak performing trader who makes money trading.

Now Your Turn

Do you feel the trading education industry needs to change? How do you think online trading courses can be improved? How do you see technology helping with this process.

Make sure to share your thoughts and leave a comment below as I’m very passionate about this topic and changing the trading education industry.