Is It Time To Buy This Chinese Tech Giant?

Owning the country’s largest search engine, the Chinese tech giant Baidu (Nasdaq: BIDU) put in a massive +166% bull run between November and February. However, despite posting Q1 numbers that exceeded analysts´ expectations, Baidu is currently trading -53% below it’s all-time highs from February.

Why is that? Well, the primary reason for this is the regulatory clampdown by China’s State Administration for Market Regulations trying to curb internet monopolies, which has hit Chinese tech company stocks hard across the board.

Whilst Baidu is mostly known to be the ‘Google’ of China, its search engine business has started to lose market shares and many analysts claim this will continue. That’s one reason the company is heavily pushing into the AI space which is to be expected to be the main focus and growth factor for Baidu going forward.

Overall, the fundamentals of the business are still sound with a net income of $3.2 billion in 2020. This, in combination with the fact that Baidu already is the AI leader in China by a wide margin and continues to push further into this field, makes it an interesting potential long-term investment opportunity that’s worth keeping on your radar.

Based on these two facts alone, it might be tempting to jump the gun, wanting to buy the stock at current levels. But for now, we simply do not know if there will be more repercussions because of regulations imposed by the Chinese government, which can further increase the bearish pressure on the stock. Therefore, we do think it’s best to stand aside until the full impacts become clearer.

Technical Analysis

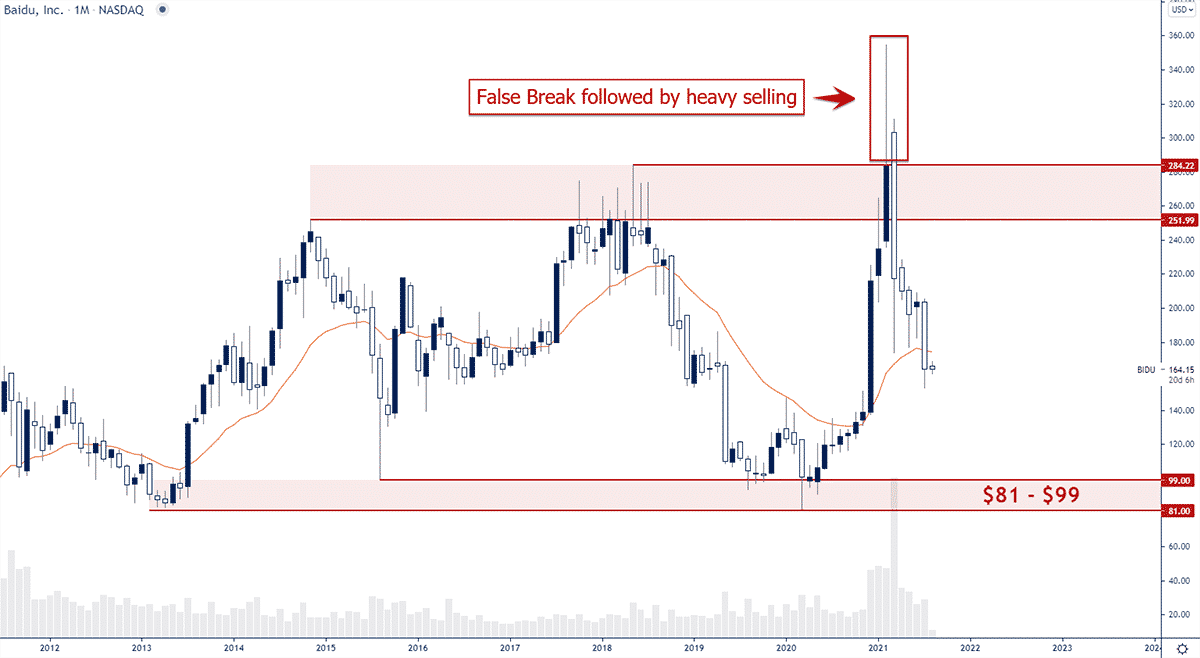

Following the strong bull run, price reversed sharply, creating a false break setup at a wide multi-year resistance zone. When you see strong false breaks like this, at the extremes of a larger range, followed by strong follow through into the direction of the false break, it’s very common for price to reverse all the way and re-test the opposite side of that range.

Looking at the monthly chart above, price action has been selling off 4 out of the last 5 months, clearly communicating that the order flow is heavily skewed towards the sell side. Based on this price action, unless we do see a sign of transition in the order flow, which currently isn’t the case, we do expect further downside in the next couple of months.

There is a minor area of support coming in at $146, but should price make it all the way down to the multi-year support zone between $81-$99 we do think that would be an ideal price range to start acquiring stocks of Baidu at a discount.

Option Positioning

Currently there are about 390K calls and 365K puts but the majority of the option trades aren’t expiring till September this year, so no short dated pressure on the stock up or down. We still look for overhead resistance around $175-180 hence will wait for lower levels.

In conclusion

We do not recommend buying the stock at current levels for the above-mentioned reasons unless price action clearly shows a strong transition from bearish to bullish. However, if price continues to sell off all the way to the bottom of the multi-year range, we do think Baidu is a good buy between $81-$99.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in BIDU. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.