One Social Media Stock to Buy in 2021

The social-shopping platform Pinterest (NYES: PINS) with its virtual pinboards has grown rapidly in recent years, enjoying its first-mover advantage and is one of the leading social networks on the market right now.

As you might already know, Pinterest is different from other social media platforms as it effectively combines many things social media users enjoy, such as sharing creations, hunting for inspiration and market/sell products, which is a very powerful combination.

The platform is also highly attractive to advertisers because it a) doesn’t have political content (which can scare away advertisers), b) has a highly targeted user base ready to buy products and c) the company/platform actually benefits from ads because its users actively seek out ads for inspiration.

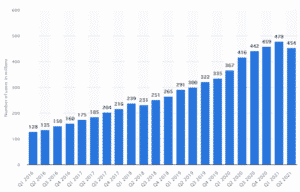

From a performance perspective, the stock has taken a beating lately, likely because the company in Q2, for the first time in 3 years, saw a decline in their monthly active users (MAU).

Short-term, this drop seems to have made investors wonder if Pinterest is hitting a wall in terms of growth, but since the mobile-user side still is growing, this drop might just be a temporary bump in the road.

(Source: Statista)

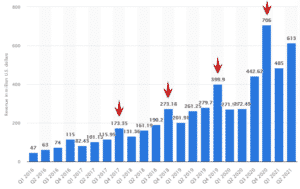

Despite the drop of active users in Q2, Pinterest was able to leverage their shopping-interested users to its fullest. By doing so, the company managed to sharply increase Q2 revenue and from an quarterly and annual perspective, revenue growth looks very strong across the board as you can see in the graph below.

You should also notice that the company’s revenue is affected by seasonality with the Christmas-month December being strong in terms of revenue every year.

(Source: Statista)

Overall, we believe Pinterest offers a unique service with a first-mover advantage and that the recent drop in the stock, especially if it continues short-term, creates a great investment opportunity.

Technical Analysis

Since it’s all-time-high in February, the stock has given back a decent chunk (roughly 40%) of the Q4/Q1 bull run. However, the pullback overall looks corrective which is a positive sign that we’re likely looking at a long-term pause in the overall bullish price-action picture.

For investors wanting to get involved in this stock, this pullback is good news. If bulls can continue to push the stock lower, we think that the price range would be a great buying location for this stock. For now, price action is suggesting that further downside is likely, at least short-term.

Option Positioning

Currently there are 393K calls and 377K puts with about 23% of the options rolling off this Friday. This rolling off should create a headwind for prices going into Friday, so resistance around $55 should hold upside gains. Option positioning looks like it could start to offer support around $52.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in PINS. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.