Small-Cap, Huge Potentials. The Stock You Should Hold For The Next Decade

One of the industries that most benefited from the pandemic was the gig industry. A lot of companies laid off their employees to stay afloat. But these employees had mouths to feed and bills they couldn’t lay off, unfortunately. So what did they do? They went freelance!

Of the many freelance platforms that welcomed the troves of job seekers, Fiverr International Limited (Nasdaq: FVRR) was one of those with the lion’s share.

(Source: Photo by Andrea Piacquadio from Pexels)

Fiverr is a freelancing platform where freelancers (or sellers, as the company calls them) package their services as products (Fiverr calls them gigs) for clients (or buyers) to buy.

The pandemic couldn’t have come at a better time for Fiverr, which had just had its IPO in 2019. Thanks to the influx of new users, Fiverr stock grew by over 1000% with a total revenue of $185.9 million at the end of FY2020.

This growth rate wasn’t sustainable, however. No surprises there. The effects of the coronavirus eased across the board and people returned to their 9 – 5 jobs. But the pandemic didn’t end without exposing us to the opportunities that abound in the gig economy.

Let’s view the company’s reports under a magnifying glass.

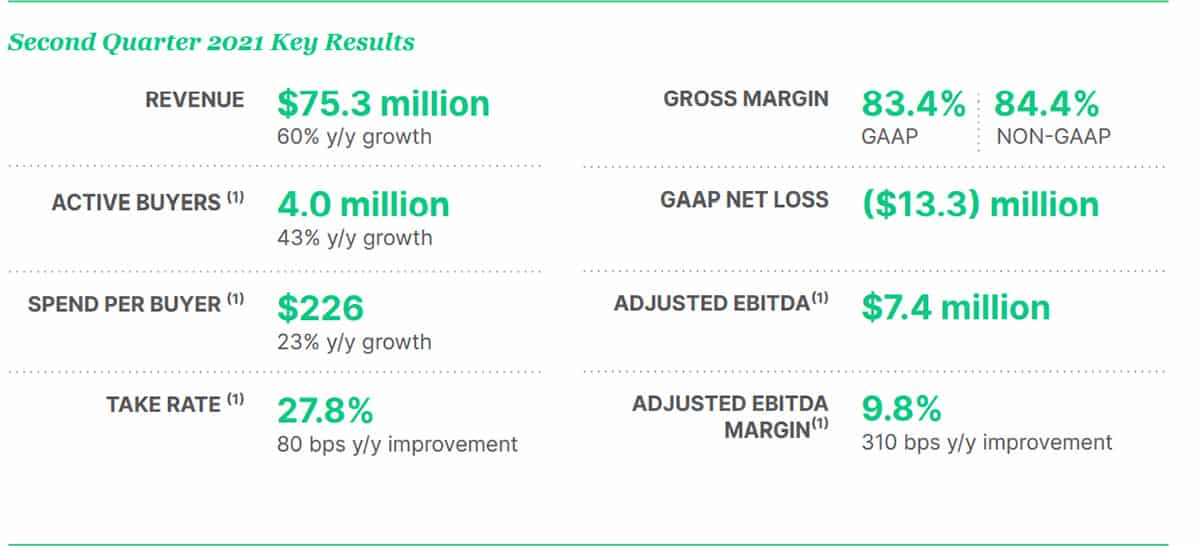

Fiverr reaped a revenue growth of 60% year on year in Q2 FY 2021 with the figures rising from $47.1 million to $75.3 million. In addition, every other key growth metric increased from pre-Covid times. For instance, the freelance platform increased its active buyers by 43% year on year. The average spend per buyer (SPB) also grew by 23% in the same period.

(Source: Fiverr)

We expect that the gig economy will only get stronger. Statista backs this up, as it estimates that the gig economy will grow to take up about 50% of the US workforce by 2027.

Technical Analysis

With the Fiverr stock being relatively new, there isn’t much to say on the technicals yet. But you’ll see that the price is currently approaching the $128.65 – $145.68 support level. We expect this support level to reflect the price to the upside. But if the support breaks, there’s no other established support level available. This could force the price to a free fall until a new support level is established.

Another thing you may notice is that the stock looks to have formed a typical bullish wedge pattern. And you may see this as another signifier of the bullish sentiment of the stock.

Option Positioning

While not a huge option stock by volume, currently there are about 35K calls and 28K puts. What is interesting is about 41% of those options are rolling off this Friday, so some potential tailwinds going into the weekend.

We see option positioning providing support between $145 and $160.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in FVRR. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.