Diversify Your Portfolio With This High Dividend-Paying Stock

Not everything is about growth stocks. It is always smart to diversify your portfolio with the relatively safe dividend-paying stocks. And Rio Tinto Plc (NYSE: RIO) rightly fits into this category.

Source: Tom Fisk

Since it was founded in 1873, Rio Tinto Groups has made its daily income from exploring, mining, and processing of mineral resources. Some minerals it sells are gold, copper, aluminum, and iron ore.

Here’s why we think it’s a dividend stock worth watching:

Rio Tinto Group has a history of at least 5% dividend yield in the 5 last years. Although it slightly dipped below that earlier this year, it has recovered and has even risen to as far as 10.99%. We don’t expect RIO to sustain this high dividend yield. But if the dividend yield falls, we expect it to return to its 5% base level, which still makes a relatively high dividend yield.

Source: Rio Tinto

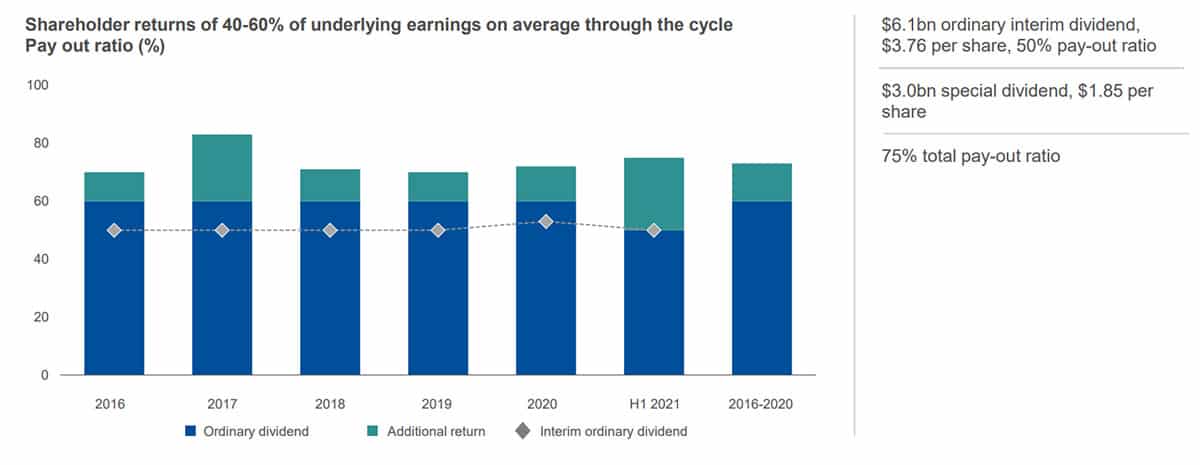

The consistently high shareholder returns of 40 – 60% of its underlying earnings is another reason to consider adding RIO to your portfolio. If up to 60% of the company’s profit if going into shareholders pockets as dividends, you might as well say that RIO exists for the dividend pockets of its shareholders.

Other financial metrics that are looking up for Rio Tinto in its H1 FY 2021 report include sales revenue, which was up by 71% to 33.1 billion year on year, and free cash flow (up by 262% year on year to $10.2 billion).

The only potential risk is the company’s over-reliance on iron ore. Revenue gained from iron ore made up about 64% of its total revenue in H1 FY 2021. If iron ore prices keep dipping, as they have in the past months, it may hurt RIO.

Technical Analysis

There isn’t much going on in the RIO chart apart from a majorly ranging market that has lasted for about a decade.

It broke out of the resilient $62 – $65 resistance level late in 2020 to reach the highest price levels in 13 years. The only other time it broke out of the range in the last 5 years was when it formed a bear trap in March 2020. But now it looks to be taking a dip back below the same resistance (now support) level.

If the price, however, bounces back from the support level, you may buy and set your target at $85. Otherwise, the price may return to the lower $44.5 – $47 support level.

But ultimately, it’s its reasonably high dividend yield history that makes the RIO stock attractive to us.

Option Positioning

$RIO has about 92K calls and 32K put options, so a heavy call bias. About 26% of those options are rolling off this Friday so we may see a pullback from this rollout.

Option positioning is suggesting there is solid open interest between the high 40’s and low 50’s.

FULL DISCLOSURE: Chris Capre currently has no orders in $RIO. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.

Or you can get access to Chris Capre’s entire trading portfolio by becoming a subscriber to Benji Factory.