Matterport Is Reinventing The Real Estate Sector

For the first time in a long time, technology is reinventing the way we do things in the real estate sector, and Matterport, Inc. (Nasdaq: MTTR) is right at the heart of it.

Source: Patryk Kamenczak

Matterport allows potential property buyers to take virtual tours of the properties they intend to buy. And because no other company is currently doing what Matterport is, the company enjoys first mover’s advantages in a space with a $240 billion market opportunity!

Having just only gone public early this year, one thing Matterport completely nailed is its business model. It allows the Matterport app to be available for free on mobile and PC platforms to attract as many people as possible. However, homeowners or managers who intend to publish and share their properties may pay based on a subscription model that starts from as low as $10 monthly.

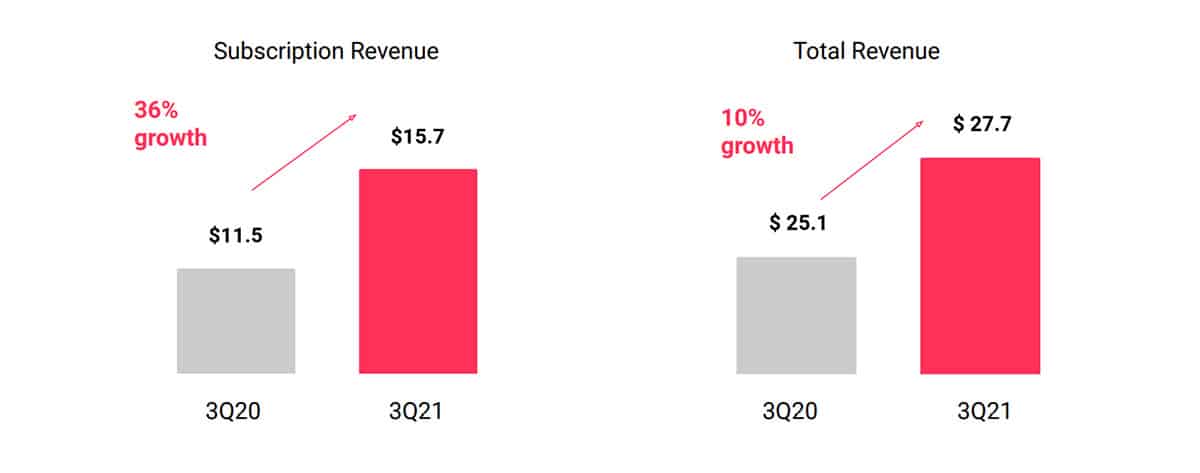

Thanks to this generous business model, the company boasts of a 116% growth in the number of subscribers with a 36% year-on-year increase in subscription revenue in Q3 FY 21. And this subscription model accounted for 57% of the total revenue gained at the same time. Other ways through which the company gathered revenue include products, services, and licenses.

Source: Matterport

Apart from the real estate, Matterport can also be used in other industries, including construction, travel, corporate, hospitality and retail.

Source: Matterport

By the way, another stock that went public within the past year and is currently doing well is Airbnb. If you had bought the stock when we recommended, you would be profitable by close to 40% by now.

Technical Analysis

It is safe to say we already missed most of the opportunity to “buy the dip” on MTTR. But who knows? Another opportunity may be presenting itself as we speak. The stock is 38% from its ATH of $38, having dipped by as much as 61% in May. The stock currently hangs under the $24.8 – $26.3 resistance level, and whatever happens here will determine what value investors should do.

If the stock falls to the lower $17.2 – $18.5 support level, it may become a more attractive buy. But if a breakout of the resistance level occurs, we may have another bullish run on our hands.

However, the strong fundamentals that back this stock up make us believe that even though we’re not buying cheap, we would still be getting in early on a potential 10X stock in the next decade.