Invest In The Future of Retail With MercadoLibre

If it isn’t already obvious to you, eCommerce is the future of retail. With what were merely science fiction fantasies about the metaverse gradually getting closer to reality, physical retailing is only going to dip. And eCommerce companies like MercadoLibre, Inc. (Nasdaq: MELI) would likely have bigger and bigger stakes in our retailing experience going forward.

Source: Los Muertos Crew

Often tagged “the Amazon of Latin America,” MercadoLibre has dominated the eCommerce space in the Latin America retail space. Not only has it dominated the space through eCommerce, but the company also offers other services that give it a strong and diversified root in the region. Some departments in its ecosystem include a logistics service, a payment platform called Mercado Pago, and, of course, the eCommerce department.

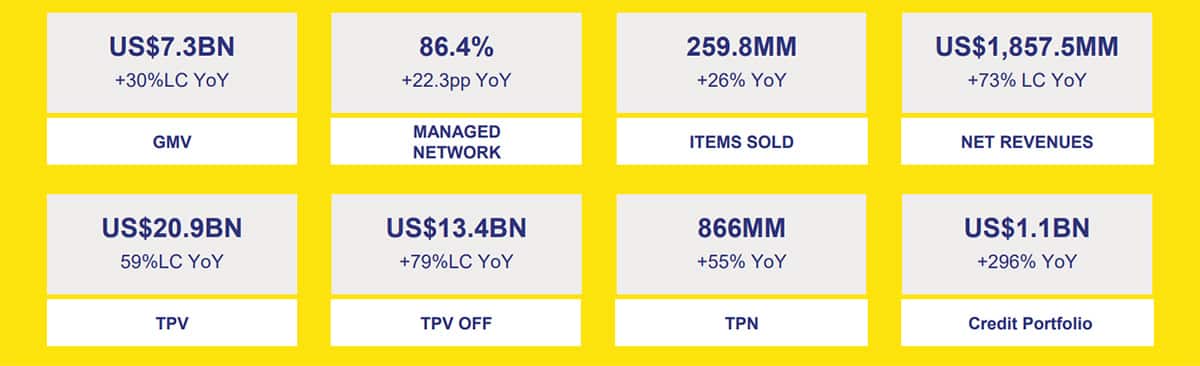

MercadoLibre has momentum on its side, as it has reported consistently impressive results in its last three quarters. This recently concluded third quarter in FY21 saw the company’s net revenue increase by 73% year-on-year to $1.8 billion. The net profit from its Fintech department, MercadoLibre Pago, was $630 million. eCommerce accounted for most of what was left.

Source: MercadoLibre

Taking a look at the growth opportunity ahead of MercadoLibre, we believe the eCommerce and online payment platform company still has a huge runway. According to pre-pandemic statistics, online buyers are only 29% of the total population in Brazil. And in Mexico, Colombia, and Argentina, the percentage of the banked adult population is less than 50% in each country. With MercadoLibre being one of the major companies servicing these niches in the region, we believe there’s more room to grow for the company.

Technical Analysis

We’re going to get this out of the way first. MELI looks bearish in the short term as it approaches the $1250 – $1325 support level. It hit this level once before and it looks like it might do the same again. And having soared by over 300% to new highs, thanks to the propellent from the pandemic, this correction is long overdue. So, it’s possible that the price even breaks the support level to somewhere below.

For investors in it who are in for the growth, however, this is the best time to buy the stock at a discount and hold on to it for the future.