Trade Setups & Market Themes I’m Watching Week of Jan 12-16

Last week in our option flow report we predicted SPY would grind higher as long as it holds the key 690 TGS (top gamma strike). This played out as expected with SPY gaining a whopping 1.09% on the week from the cash open to close.

5 min chart $SPY

We also mentioned in our 2026 market predictions that we think the Trump admin will move away from a rules based international order (think UN) vs applying executive action/orders in ways that will move supply chains away from the US. This manifested in Trump invading Venezuela and taking Maduro. We think this will lead to a) Latin America trusting us less while looking for supply chains outside the US, b) lead to a weakening of the USD, and c) be good for defense/military contractors.

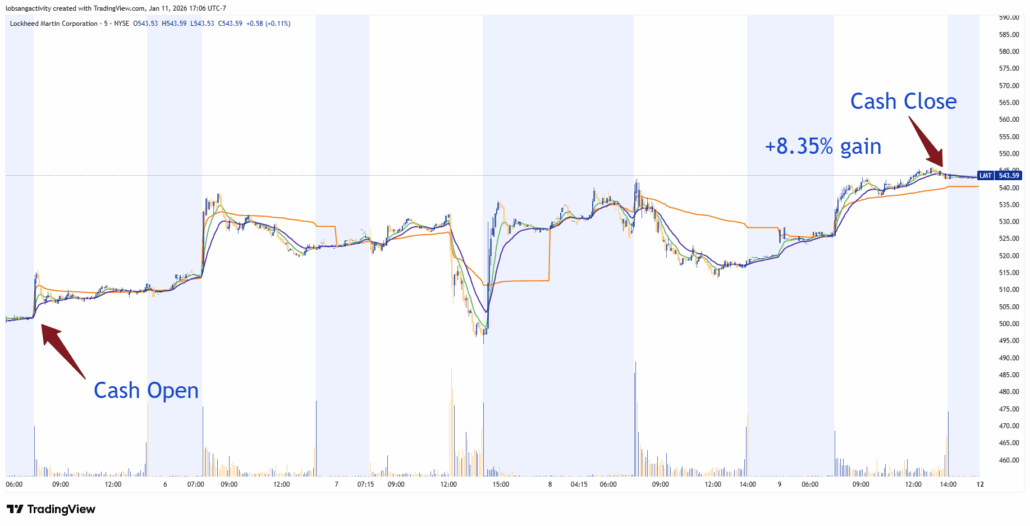

As you can see via the chart below, defense contractors did quite fine with $LMT (Lockheed Martin) gaining +8.35% on the week.

5 min chart $LMT

We think defense contractors will continue to shine in this environment, especially with the Trump admin wanting to increase the military budget by 50%.

Along these lines, we also are watching trade setups in metals and materials, not just for mining, but also rare earths as we think this will continue to see upside pressure in an environment increasing with geopolitical tensions.

Tickers we like watching are $REMX and $XME. We currently have long calls in $XME and are long shares in $REMX, but we’ll be looking to add if they continue to find more upside.

Lastly, circling back to $SPY and the week ahead, we have the Jan op-ex on Friday, earnings starting to heat up and CPI/PPI on the 13th and 14th. With open interest building at 700 for SPY, we can see this being a clear upside target, but we also lean towards this acting as strong resistance that likely won’t be broken without a heavy bullish catalyst. After this op-ex, due to the call heavy positioning, we think the market could be vulnerable to a pullback after the Jan op-ex.

Make sure to check in with our option flow report for TTM members on Monday before the market opens, along with our live trading webinar next week.