Trading the Open and Close of the Candle

When trading price action or using price action triggers such as Pbars, Inside Bars, Shaved Bars, etc. it is important to always wait for the bar/candle to close more than anything else.

Many people have challenges trading any system because the signals are forming in real time and not necessarily when the candle closes so you have moving elements to the candle, trigger and price action which are still in play.

The way around all this is to wait for the candle to close. Once a candle has closed, it is final – it cannot ever be changed and it will always be that way.

If you are ever tentative about taking a trade, wait till the candle fully forms and closes. Once it does, it will always be like that forever and cannot be changed. This means the signal is clear and there are no changing components to it.

Also, one important thing about trading price action and waiting for the candle closes.

It is often the case (whether it’s the daily chart, 4H, hourly, etc) that price action will be dominant in one direction for the majority of the candle only to reverse strongly at the end of the candle. Institutional traders know retail traders are less disciplined than they are. They know a good trading candle pattern could be forming and will often trap traders into believing that candle is an engulfing candle or reversal candle and then quickly move price in the last minute or 5minutes of the candle only to change it drastically with traders stuck or trapped into a certain direction hoping for higher/lower prices.

It is also often the case the markets will reverse at the end of a session or major candle as traders are paring back positions before market close as they want to be flat going into the close. When they do this, if the market was moving heavily bullish for the day, you will often see price dip a bit in the last 30minutes or less of a session as the institutions are going flat into the close.

Furthermore, a lot of trading today is done via algorithms which will often as well exit their positions causing strong spikes in price going into market closes. You can often observe this in the US equities markets as traders eliminate risk by not holding positions overnight to avoid the risk. Another example is in the London close as you will often see a strong push at the end to only see if fade just before or even perhaps just after the market London close.

Such price action patterns are common and by waiting for the candle to close, you are trading off real price action triggers. If the trading candle pattern is still forming, unless your system is specifically tailored to getting in mid-candle, it is often recommended to wait for the candle to close because up till that point, anything can happen and the formation of the candle and price action signal can change drastically.

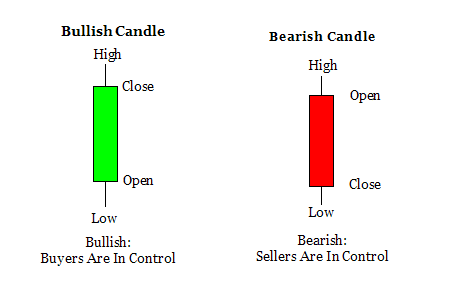

Lastly, if something is strong into the close, once the candle closes, it often displays the final intentions of the market in the current move. Closes towards the highs/lows of a candle often indicate there is little profit taking so if you are trading in the direction of such a move, this can be a good confirmation sign. However if you are in a long position and the candle closes with a strong rejection/wick on the topside, the closing of that candle could be indicating the markets intentions to reverse it as price failed for that candle to maintain a strong high and close.

Thus, its always important when trading price action to look at candle closes and entering on them as much as possible.

For those of you looking to learn how to trade pure price action with no indicators, make sure to check out our Trading Masterclass where you will learn rule-based systems for trading Price Action.

Thanks

Hello,

I am only interested in managing forex accounts under my current banner via White Knight Investments or Phoenix Global Management as I am already managing two platforms at the same time so if you are interested in coming aboard under these banners – then I’d be happy to work with you.

Chris Capre

hey chris,

can we use price action in low time frames …. like 15 min or 30 min??

Hello Dennis,

Sure, I use it all the time on lower time frames, like the 5m. Many of my students as well do it everyday.

When you can read and trade price action, time frame, instrument, or environment is irrelevant as the skill applies the same.

Kind Regards,

Chris Capre

hey chris,

really good to hear that…. :)… another question chris..

in price action system can we measure how much buy oder or sell order play in the fx market… or can we predict which direction to go market by only looking previous candle…???

Hello Dennis,

You will never be able to measure directly how many buy and sell orders since the fx market is decentralized, so there is no one exchange all the orders go through.

As to determining where the market will go next, with the right models and systems, this can be done with an accurate edge consistently once you learn the skills.

Kind Regards,

Chris Capre

hey chris,

superb answer thnx you… i`m new to forex trading…. i don`t like to use any indicator..with indicator i got worthless signal and with indicators chart is as like as fried rice.. 😀 😀

i like to learn trade only by candlestick reading and news…can i study about what i want in your price action and advance price action course??

are your your price action and advance price action course lessons all in videos?

thanks you again chris….

Hello Dennis,

In the course I teach how to read and trade price action in real time, for any instrument, time frame or environment.

And yes, all the lessons are on videos in the course members area, but there are also articles and posts for lessons. But 95% of it is all in videos.

Hope this helps.

Kind Regards,

Chris Capre

super answer chris… thanks you very much… (y)