Setups, Price Action & Context

If you think this article is going to be about learning a price action setup, you’re wrong, but it will be about something more powerful. For your future, for your learning process, and for your sanity, keep reading this article if you are not consistently profitable.

Of all my articles, the most popular and commented ones are always on some specific setup or system.

Because almost all of you have been hunting for the one system, that edge which will turn your trading around. That edge which will print money into your account day after day, week after week without much effort. You’ve probably amassed dozens of patterns and systems, yet still aren’t making money.

Sound familiar?

If so, don’t worry – that was me 12 years ago.

But I think it points to a problem for those hunting through forums, websites and videos looking for your pot of gold. All of your focus and energy has been on finding a ‘system‘ or ‘price action setup‘ that makes money.

Sure, everyone wants their own ATM machine – who doesn’t? But what is also going on is you want the market de-mystified. You want trading to be simple and easy, i.e. thinking three simple setups will solve all your trading problems and help you understand the market.

Regardless, this underlies two things which will trip you up in trading;

1) The fallacy three simple price action setups will consistently make you money if you have good money management.

2) Being uncomfortable with uncertainty.

Today’s article will be focused on the first point, and the next article will be focused on the latter.

Three Simple Setups? Really?

To begin, it is a complete fallacy that if you learn what a pin bar, inside bar and a fakeout system is + good money management = making money…that you understand and can trade price action.

How convenient that a market which has brought traders to its knees, crying, jumping out of windows after losing fortunes, that three simple setups and good money management (plus a little psychology) is all you need to be a profitable trader.

If that was the case, why isn’t everyone doing it?

Why are banks spending thousands of dollars, and months, if not years on end, training their traders, when there is such a conveniently packaged solution available?

My programmer was recently at a algo conference with some of the top hedge funds. He told me they are spending hundreds of thousands of dollars re-programming their algos every 12-24 months to keep a competitive edge.

Why would they do this if they could just learn what a pin bar was, inside bar and fakeout setup is? Wouldn’t that be easier?

Newbie traders want to hear the market can be simplified into three price action setups, that trading with the trend and good money management is all you need. It perpetuates a dream which is actually a false reality.

This is why I have always talked about learning to read the price action in real time, that you cannot rely upon systems alone. Yes, a pin bar can be a highly effective method for trading various price action situations. But it always has to be taken in ‘Context‘.

Two Scenarios

To demonstrate this point, lets take two scenarios;

1) A bullish pin bar forms after a long trending move. This trending move ended with an exhaustive candle which then proceeded to form a double bottom off a key support level. The pin bar closed bullish and formed on the 2nd bottom also creating a 3 pip breakout below the lows. Am I going to buy that pin bar if I get a corrective pullback towards the double bottom?

Absolutely!

I see that – I’m going to buy that. The pin bar was a very good setup and price action cue for me. But remember, pin bars can be both cause and the result of order flow.

However, we have the other pin bar scenario….

2) Price action has dropped 1000pips in the last two days. Then in the middle of the Tokyo session forms a tiny pin bar on the 4hr time frame that closes bearish. Am I going to buy that pin bar expecting the price to reverse? NO!

Why???

Context!

You have to understand, there is nothing wrong with the pin bar by itself. It can be a highly effective signal, or it can lead to losses.

What is the difference?

It’s not money management, or trading with the trend, or your psychology.

It’s the context with which it forms. But to understand these differences, you have to learn to read price action in real time, and what it has done in the past around those levels. That is the context you have to learn how to read.

Passive vs. Active Learning

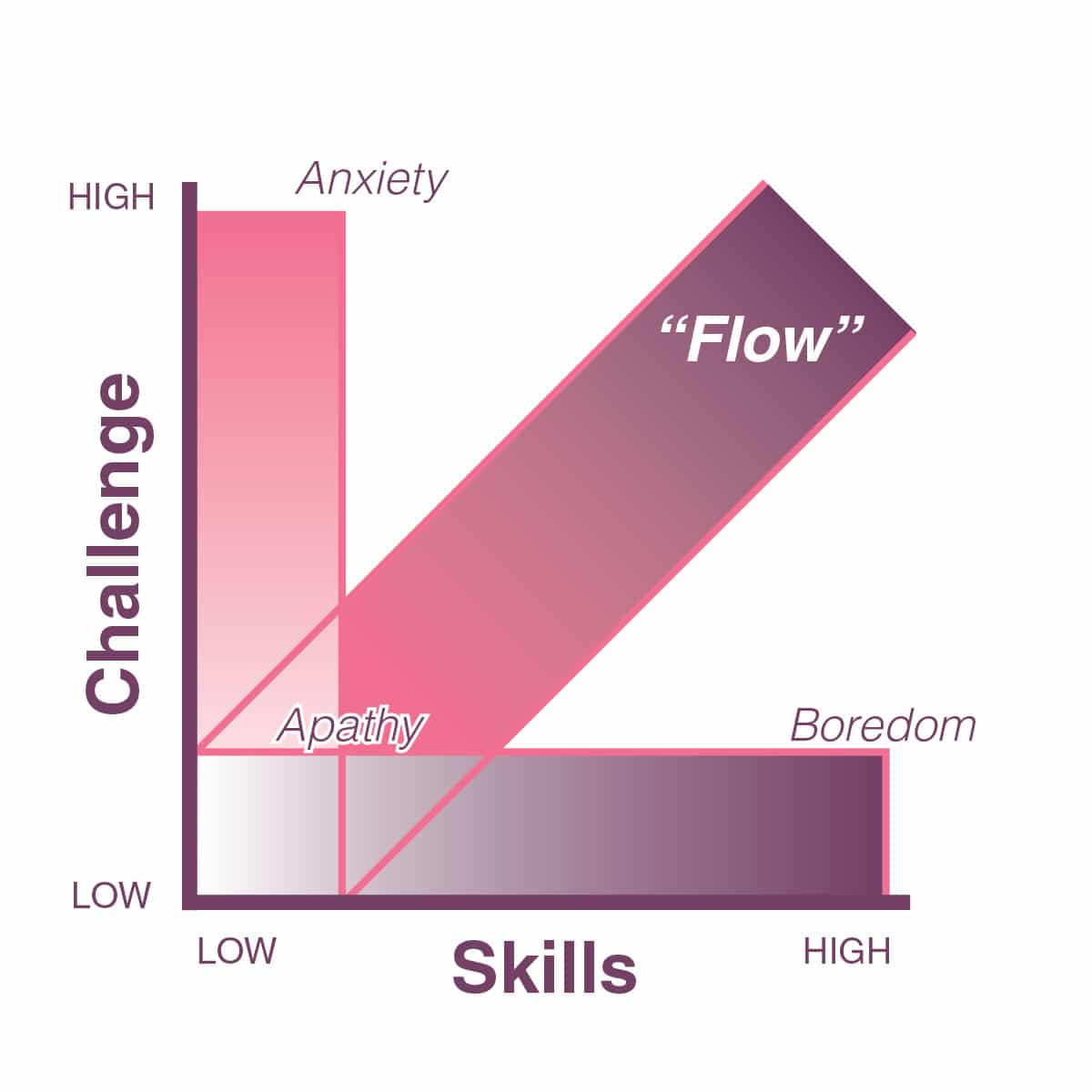

To be sitting there passively, waiting for days on end for your three simple price action setups is trading in passive mode and flat out boring. And boredom will actually interfere with your learning process.

If you can only find one setup a week, you’re not looking hard enough because there are plenty.

There is no active learning, and active learning is what you need. In active learning, you are engaging your resources, your current level of knowledge and applying it. In passive learning, you are not engaging any of your knowledge and seeing how it works in real time, learning from the feedback loop called the markets.

If you are sitting on the sidelines for days on end, just waiting for your three simple setups, you’re wasting your time. You could be learning, trying, studying, and participating in the market which is what facilitates learning.

I didn’t just learn what an inside bar was and then trade it based on what it should do. I spent dozens of hours studying 1000’s of inside bars and pin bars, to see what was different between them all, and how did price action form after each unique one.

I have pages of notes about pin bars, how each one forms, its size in relation to the prior bar, where it forms in relation to the prior bar, in the trend, near the 20ema, in relation to the surrounding price action, support/resistance levels, etc, etc, etc.

I don’t just trade pin bars like a robot. I trade them in context, and that is what gives me an edge, to be able to read the price action in real time, and what the market has done around current levels.

A Student

One of my students wrote just yesterday on this subject:

“I am at that point where I know I want to be a full time trader. I absolutely believe that the strategies, models and methods we are taught in this course can lead to profitability, because I’m using them everyday and they lead to good profitable trades.

However, I have moved away from just seeing a pin bar or some other signal and just pulling the trigger, because I have moved toward understanding price action the way Chris talks about in his lessons, like he has done on breakouts, the aussie price action, the USDX, etc.

I believe that as traders we can trade these strategies and make some money, but we will not evolve as traders if we don’t begin to read and understand the price action that is occurring around these different setups.“

When I read this, I was nothing but smiles as the light went on. This student gets it, and gets what I have been teaching. He understands that pin bars, inside bars, and all the other methods have a purpose – but they are not the road and vehicle towards profitable trading.

Although they are highly informative about what the order flow is behind the price action, he understands they are both cause and result. This means he understands sometimes they are the cause of order flow, and other times, they are the ‘result’ of order flow. They are not simply just one or the other.

It also means he is spending his time learning to read the price action in real time, to understand what kinds of order flow would create such price action. He is not passively waiting for setups, and then pulling the trigger like an automaton. He understands that these setups have to be taken in context.

In Summary

Don’t waste your days on end in waiting mode for your simple three setups to occur. Understand three simple setups will not lead you to profitable trading, nor understanding price action. If it did, everyone would be doing it and that is all they would be teaching at banks and hedge funds.

Understand trading price action means learning to read price action in real time. It means being an active and deliberate learner.

Understand that price action setups are highly valuable tools – but they have to be taken in context. You have to learn to read what kind of order flow would create such price action, and how to trade this flow.

I hope this helps and that it changes the way you look at price action and your learning process.

Please make sure to leave your comment, like and share this post.

Kind Regards,

Chris

Fantastic read. Puts it in to context for those of us who are still on our way.

We are all thankful for the time you’ve put in!

Thanks Kyle,

Glad it helps to put things in to perspective on such a misunderstood topic.

Kind Regards,

Chris

Hi Chris

Really good article.

yes we have the tools.

we see a block of wood . we can make a beautiful carving out of it.

Thanks a lot for being there

prem

Great read n agree with what you shared. Everything has to be in context. 🙂

PLEASE I WILL WANT YOU TO SEND ME AN ARTICLE THAT EXPLIANS THE MEANING OF ORDER FLOW INA SIMPLE WAY I NEED TO UNDERSTAND WHAT ORDER FLOW IS..

THANKS IN ADVANCE

Hello Taiwo,

Here is a video explaining some of the key concepts about learning to read order flow.

https://gammalevelcorp.wpengine.com/forex-videos/understanding-price-action/

Hope this helps.

Kind Regards,

Chris

i like using the daily time frame when trading because its convenient for me. i average about 6 – 4 trades a month. do you think to learn price action better i will need to lower the timeframe so that i will be in more trading conditions. i have been trading for 2 month and just profitable

thanks

Hello Jere,

If you are comfortable trading the daily time frame, then I suggest sticking with it. I don’t think you need to learn to trade off the lower time frames. But, I think you need to be more active than 4-6x a month. Putting it this way;

-will you learn a foreign language practicing only 4-6x a month? NO!

-will you become a professional archer only practicing 4-6x a month? NO!

-will you become highly skilled or a professional at anything doing it 4-6x a month? NO!

So hopefully that demonstrates my point.

I think the solution is learn to find more setups. There are plenty more than 4-6x a month while still being able to maintain accuracy, so I think that would be the solution. If you can only find 4-6 setups a month, then you just need to train your eyes to see the other high quality setups that are there.

Hopefully this helps give some perspective.

Kind Regards,

Chris

Hi Chris,

Glad you answered Jere’s question the way you did, because my initial reaction also was to think “does he mean we need to move down from Daily charts?” However, your answer clarifies this well.Personally, l am happier on the Dailies than the 4 hour and while l continue to study/watch and learn PA l am finding “less is more”, and learning a lot about self-discipline and patience to boot!

Finally,there is an argument that Swing Trading is the one area that many traders can find their edge, as in most other areas self-directed traders are at a disadvantage in terms of manpower/resources/research/info etc etc. Obviously it depends on the trader, and some do seem to thrive scalping and intra-day, but do you think there is a strong argument for considering Swing Trading on the Dailies?

Thanks,

Michael.

thanks great advice

Glad you liked it Jere

Hello Chris,

Your excellent article fully reflects my thoughts and beliefs. To master a number of non-discretional strategies based on specific set-ups, trade, take profit and stop loss points entries may require good memory and a lot of practice. BUT, to read effectively and efficiently price action and its context with the forex market requires, in my view, very advanced skills and practice is only part of the package. I strongly believe that above all it requires a dedicated and sincere guru, a true MENTOR, who will spend time with you and patiently teach you the secrets and coach you on a daily basis. Im afraid that there are not too many true mentors out there and, in case you find one, like yourself, it may be not feasible to have this service due to various constraints (lack of time from the side of the mentor, lack of adequate financial means from the side of the student, etc.).

NEVERTHELESS, being a student in your Price Action course and a studier of your thoughtful articles I feel that I am progressing slowly but steadily in forex trading.

Kind regards,

Tasos

Hi Chris…..this is such a timely article. It’s really weird because I have been thinking about these two topics for the last few days. Anyhow, I was going to write some about context, but mostly about uncertainty, and let you know what a major and immediate impact it’s having on my trading. It’s like somebody turned the light switch on and now I see. Since you’re going to be writing another article on uncertainty I’ll wait for that article to come out to comment anymore. Thanks a ton for the words of wisdom….

Cal

Thanks for this great article which is really helpful for my trading. I have been following you for some time and your articles have helped my trading – I will be signing up for your course very soon.

a great article….in short keep on learning

Hi Chris, I will like to have more information on your price action course, please contact me.

Thank you for these bunch of articles they are all really helpfull!

Reading PA is essential even if you have a “setup” Not every setup that presents itself is an automatic entry into the markets. I am a student in the advanced price action course – Chris has mentioned this concept in previous articles, you need a METHOD – this will help you understand the context of the market, you need a MENTOR – a mentor is someone who knows what you want to lean, and is achieving the success you desire, you need MASTERY – this takes time. This is not – learn a setup in 2 weeks and bang your making money. Mastery is a process that comes one way and only one way – time, lots of time, lots of practice, lots of study – but when you master the process your trading account will consistently grow and reflect your mastery.If you are “stuck” in your trading journey, I recommend you read every article Chris has published, watch the videos, read the forums where his students give feedback about the courses he offers and make a decision to invest in yourself and your trading knowledge.

Guilty! that’s exactly what I was missing! I spent hours, for years perfecting the ideal system without seeing the global price action, took few pips, a slap, more pips, more slaps then moved to perfecting another system and so on… My friends call me “the machine” as I wanted a system to avoid any emotions, just Entry, Target, SL … I’m lucky that even after years I never wiped out my portfolio entirely thanks to adapted money management.

I don’t know how long I could have done this, thinking I was going to be a pro trader with a so short view of the price’s life.

I’m ready Chris, thanks for opening my brain

Hello Bob,

Its understandable – there is this fairytale going on there that all you need is the trend, key levels, and these three patterns to trade successfully. That must be why banks pay thousands to train their traders, over years…

Joking aside, most don’t know how to read or see the price action context in real time – and this is only exacerbated by focusing too much energy on the 1-2 bar patterns themselves.

But glad you are understanding this now.

Kind Regards,

Chris

HELLO SIR,

IT IS GOOD OR BAD TO PLACE AN ORDER DURING EUROPE,LONDON,US MARKET OPENING AND CLOSETING TIME.

DURING THAT TIME ANY FLUCTUATION CHANCE IS THERE TO HAVE OR TO FACE.SIR CAN YOU EXPLAIN ABOUT IT.

Read this twice..really good article.

I was always thinking that reading charts in real time is important and that you are teaching us to wait for days for a perfect setup, but this article changed my mind. Thank you for confirming what I thought before…this really motivates me to spend more time looking at the charts and understanding why does the price change.

I am torn between taking your price action course first or your course on Ichimoku system; is there a preferred sequence ?

Hola Dave,

Without a doubt – the Price Action Course. Why? Because it teaches you the most important base skill – that of learning to read and trade price action in real time.

It is also the only course with my private member webinars, trade setup commentary and trader quizzes to test your knowledge.

Hopefully this answers your questions.

Thoughts?

Kind Regards,

Chris