The A+ Setups, The Trades That ‘Kick You In The Chin’

There is one mistake I see beginning traders constantly making. They wait on the sidelines for days, waiting for A+ setups, waiting for setups that ‘kick them in the chin‘, or ‘knock them over the head‘.

If you need to get kicked in the chin or knocked over the head to act, perhaps you should consider MMA, not trading. If you need this to actually do something – you really are missing the most basic thing of being a successful trader.

Your job is not to sit there like Johnny Bench waiting for the delivery of the perfect pitch. Your job is to think in probabilities, to think in numbers and expectancy. This is one advantage for becoming a better trader by learning how to play poker.

Positive Expectancy

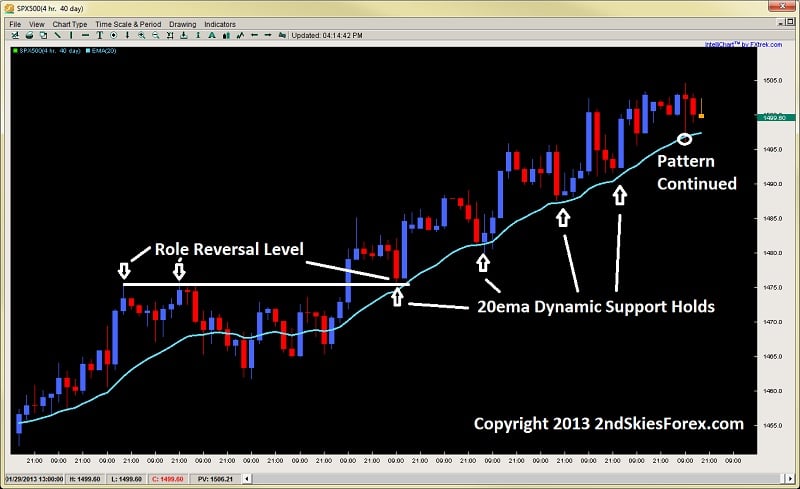

In poker, they have this rule about positive expectancy. It basically involves not waiting for your power hands to arrive before you play. You should [pay your medium strength hands in the right environment because they have positive expectancy.

Sure, you can wait for AA or AK suited before you get involved in the pot, but you are passing up many hands that make money in the long term. You are passing up hands that have positive expectancy. This doctrine about waiting for A+ setups is a fallacy espoused by people who really do not understand trading. It is important to remember trading is not a fashion contest.

Trading is thinking in probabilities and finding setups that make money over 100, 1,000 or 10,000x.

You have to understand, that you may not make money on the trade right now, or even the next one, but if it makes money over the long run (has positive expectancy) then you need to pull the trigger.

Beginning Traders vs. Professional Traders

Beginning traders make the mistake of waiting for setups which have 60 or 70+% accuracy, trading at 1:1 or 2:1 reward to risk ratios. Sure…mathematically these will make money, but guess what – did you know you could have a system which is 35% accurate which still makes money (and a lot of it) over time?

Although losing 65 trades out of 100 may seem daunting, a professional trader doesn’t skip these trades – because they know they make money. This is the difference between a beginning trader and a professional – they think in probabilities. They are comfortable with uncertainty, because they trust the process.

Breaking It Down

To look at it mathematically, if you take 100 trades at 35% accuracy, you win 35 and lose 65. Now if you always target 3x your risk (meaning if you risk 50 pips, you target 150 pips each time), this system will make money. Although you may lose the next 6-7 trades, all you need to do is win 3 or more, and you’ll make money over those 10 trades.

This is the difference between a professional & beginning trader. They understand the risk of ruin principle, and are not worried whether they will win the next trade. Beginning traders rationalize losing the next 6-7 trades as being bad for their overall trading, when mathematically you can still make money.

What Separates Beginning Traders from Professional Traders

Professional traders are not worried about the next trade winning or losing. What they care about is making money long term and over time. They want to maximize their profits by playing the mathematics – by thinking in probabilities.

Although beginning traders hang their entire psychology, confidence and performance on the next trade – you have to look at the next one as just one free throw in the thousands you will make over time.

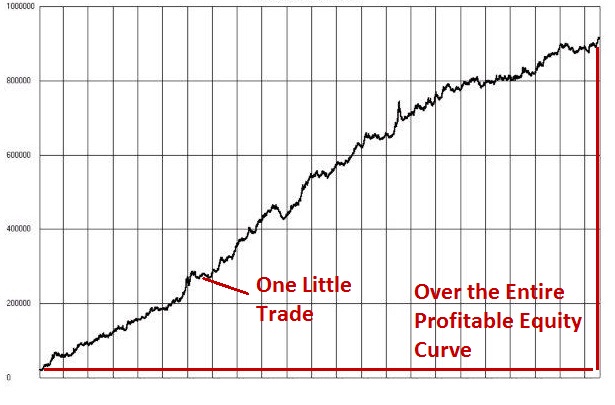

A Single Grain of Sand & Your Positive Sloping Equity Curve

One way to relate to an individual trade is to see how really unimportant one trade is in the grand scheme of things. A good visual for this is – if you are currently holding a hand full of sand you picked up from the beach – that each trade is like a single grain of sand.

If you are using proper risk management and thinking in probabilities, that one grain of sand is really insignificant. Put them all together, and it adds up to something more substantial, but by itself, it really means very little.

Now imagine your positive upward sloping equity curve over the next few years, with hundreds of trades per year under your belt. That one grain of sand really means nothing in the entire equity curve of profitability. It’s just a tiny data point in a very large set.

If you can really grasp this, I guarantee after you have a long trading history with hundreds (if not thousands) of trades under your belt, one little trade will not mean anything to you. But what will matter, is if you pass up trades that have positive expectancy with lesser accuracy, you may lose massive profits over time.

Thus make sure to let go of whether the next trade will be a winner or a loser. Try not to invest too much energy in this. Start to think like a professional, and pull the trigger whether your next setup has high or low accuracy. If your price action strategy has positive expectancy, then that is what you need to know. When you do, you’ll realize a huge piece of the missing puzzle as you’ve started to think like a professional, and started to think in probabilities.