“What does being a trader mean to me… it means the key to financial and personal freedom.” – From a former bank trader.

I actually find this quote above to be a dime a dozen statement. Anyone can parse out such a blatantly obvious and banal sentiment.

If offers no unique insights into trading, let alone an original perspective.

How about the ‘Get out of the 9-5 grind‘ – Cut and Paste. ‘Be your own boss‘ – Carbon Copy.

Any old (or young) bloke can write such waste.

Have I read/seen/heard any good ones? A few interesting reflections for sure. You can tell they’ve dug past the outermost crust, reached through the thick mantle & arrived at a rich core.

Coming from a buddhist, trader and 20 year student of neuroscience, here are 5 things I’ve learned from my 15 years of the markets.

#1: Money is Liquid

Most people work for a company (i.e. someone else). If that is you, you most likely get paid a fixed amount on fixed dates (neither are your choosing).

And it’s X amount of dollars on such fixed dates (barring an infrequent bonus). This causes us to relate to money in a very fixed & solid way.

Trading changes that completely. When each pip for or against you is $1000, your wealth is changing in real time constantly.

This forces you to see money in a completely different way.

Relating to money in a very fixed way doesn’t produce creativity, nor develop new neural networks in the brain. It doesn’t lead to challenging your ideas & looking at things from a different perspective.

It leads you to believe you are stuck and dis-empowered. Innovation and creativity do not arise in a fixed mindset, or a brain that isn’t growing.

When people start to trade for the first time and see how their money can grow, it changes something in your brain.

The limits are lifted and you start to see new possibilities (that money is liquid). This is a healthy thing for the growth and development of your brain and trading mindset.

#2: Novelty Helps the Brain Grow

Ever work in a warehouse? I did in high school.

It sucked. Great pay, but I would have preferred the Iron Maiden. Repeating the same motion every day 500x a day took me about…ohhh…2.5 days for me to say ‘F-THIS’.

Lamentably, most jobs keep you doing relatively the same things. Novelty in the workplace is not a commonality, but a rare commodity.

Trading changes that completely. No trading day is ever the same. The markets are in constant flux.

When I started in 2001, the market could move 100 pips on the first tick from an NFP announcement. Today…maybe 20-50 pips.

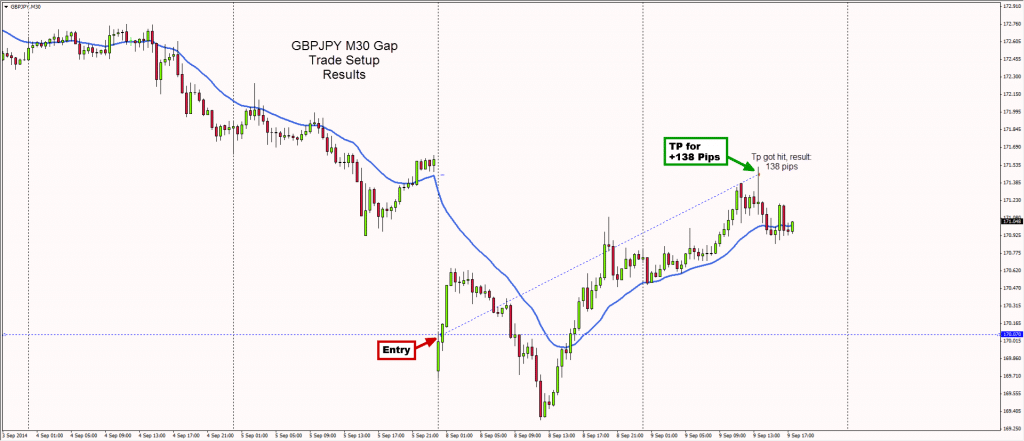

The GBPJPY (used to be called ‘the beast’) would move 250-450 pips a day on average. Now it boasts a whopping 109 pips on the daily ATR.

Markets present you with an ever flowing river of unpredictability and novelty.

How does this help your dome?

Novelty stimulates the brain. It helps excite dopamine production which is helpful for building new memories, learning, and creating new neural pathways.

Novelty also increases the activity in the pre-frontal cortex (PFC), which helps you build greater insight, empathy, and self-control.

The novelty of the markets is simply good for your brain.

#3: Markets Are A Giant Mirror To Your Mind

Perhaps you’ve realized it, but the markets are a place for self-discovery. Regardless of the market you trade or where you are trading from, it is always one giant mirror to your mind and trading mindset.

Every action and thought you have affects your performance.

“The markets completely reflect back your mind to you, making it painfully obvious what your psychological strengths and weaknesses are.”

If you are disciplined in trading or not in the face of uncertainty, the markets will let you know.

It is completely unbiased and untainted how it reflects these things back to you.

The market does not judge you, and will mirror something back whether you are George Soros, a middle aged bank trader, or a young 20-something just starting out.

Any flaws you have will be brought to the surface and available to see whether you want to or not.

What person do you know that can so accurately reflect such things back to you without judgment, bias or an agenda?

What entity do you know out there, that every moment you engage it is constantly reminding you to observe your own mental, emotional and physical condition?

The markets are a giant mirror for your mind and mindset, and a fantastic place for self-discovery and growth.

#4: Understanding Risk vs. Reward

Recently my partner and I started looking at new homes. We met with a Sotheby’s agent as they had a few good listings in our area.

After talking with them about the numbers, my trading brain started to go off.

The law here requires non-permanent residents to put a minimum of 35% down on the house. Assuming a house value of $1 million, that comes out to $350K.

As soon as I started to hear the numbers, my trading brain went to work. Last year the market here gained about 4.5%.

Assuming a similar return, I’m putting down $350K to gain $45K on the overall property value (4.5% on $1M).

Now is that the most efficient use of my capital? I could put $350K into the markets and confidently get a 20% return. That would = a $70K return vs. my $45K on the house.

Considering I am not far away from my permanent residence status, when evaluating the risk vs. reward of the situation, it is actually more expensive and less profitable for me to put this money into a down payment.

Most people would never go through this line of thinking. Most wouldn’t do the math, or particularly evaluate situations from a risk vs. reward perspective.

This is a highly valuable skill in life beyond the numbers.

We will always encounter situations in life that will require us to understand, evaluate and assess the risk vs. the reward.

Simply put – the things we learn in trading are valuable for us in life.

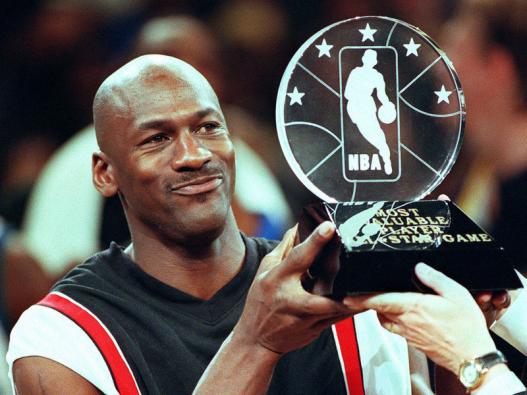

#5: Learning How & When to Take Risks

Speaking of risk, one thing you’ll get intimately familiar and comfortable with via trading is taking risks.

Whether we want to acknowledge it or not, in life you have to take risks. It is not only good for your brain, but is a governing factor behind what you achieve.

Those who don’t take risks never get ahead. They live the same run of the mill life & never leave their comfort zone.

Yet leaving our comfort zone is often where the most growth is. It is where most successful traders and people spend their time.

By and large,

“successful traders & people in all fields have taken risks, oftentimes large ones for big payoffs that last them a lifetime.”

That is one thing you’ll get an instinctual feel for when trading, because it’s a part of your every day work and passion.

Learning how and when to take risks is a highly valuable skill which can pay dividends well beyond the charts.

It can literally define the direction you take and the trend of your life. Hence what you learn from trading can enrich your mind and life in ways most jobs never will.

Did you find this lesson useful? Please make sure to like, share and tweet it below.

Also I’d love to hear what ‘aha‘ moments you had by sharing your comments and thoughts below.